Croatian Ministry of Finance yesterday issued a new EUR 1.25bn 10-year Eurobond at a yield of 2.975% while in the beginning of February it issued 8Y EUR denominated paper at 1.39%, reflecting the sharp rise of both yields and spreads. In this article, we are looking into more details on the yesterday’s deal and what to expect further.

Immediately after the first local bond issuance that took place in February 2022 Finance Minister Maric said that Croatia is preparing to issue a new Eurobond to finance EUR 1.25bn worth of CROATI 2022 paper that matures in the end of May. Yields were marching higher back then and issuance was most likely postponed for some better times. However, yields around the world continued shooting higher and Ministry of Finance decided that it should issue bonds this week to move out this challenge from their schedule. On Monday, joint bookrunners Citi, Erste, JPM, and MS organized a global investor call on which Finance Minister Mr Maric presented the current fiscal situation stating that the Croatian deficit was below 3.0% of GDP in 2021 and that debt to GDP could be below 80%, although official numbers should be published soon (April 22nd). On the call, it was stated that book building could follow on the day after (Tuesday), however, in the morning we were informed that due to the market backdrop books will be opened on Wednesday or later.

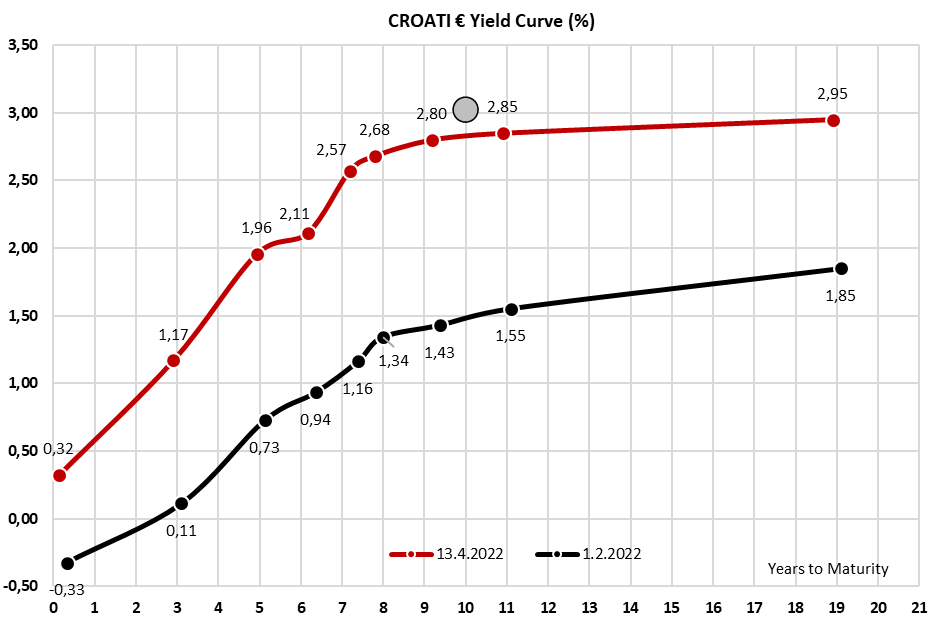

Auction for the new 10y Eurobond officially started on Wednesday as stated and IPT was set at MS+175bps area i.e., 3.30%. Looking at the two neighboring papers’ (CROATI 2031 and CROATI 2033) bid prices in the morning that stood at 2.78% and 2.84%, yield looked quite rich. However, the long-end yield curve went up by 10bps after the announcement resulting in yields of 2.88% and 2.95%, respectively. With IPT at 3.30%, something was still a bit mispriced. At 1 pm investors were informed that the book was above EUR 2.3bn with an expected size of EUR 1bn and that targeted yield was decreased to MS+160 which was around 3.10% at the exact moment. Final terms were sent an hour and a half later saying that a new eurobond will be issued at MS+150bps i.e., 2.975% in total notional of EUR 1.25bn. Coupon was set at 2.875% with a reoffer price of 99.146. Books stood above EUR 3bn, reflecting a bid to cover of 2.4 meaning that Croatian 10Y paper had a stronger bid to cover compared to 5y BTPs issued a few hours before. In the end, books were a bit decreased to EUR 2.65bn, reflecting decreased NIP that took away some of the investors. Looking at the spread, one should look at risk-off due to Russian aggression or the corona risk-off to find spread of Croatian longer bonds being above 200bps compared to benchmark as CROATI 2032 was issued 220bps above German bund. However, in both times bund yield was close to or even below zero while yesterday’s yield was around 0.80%, level last time seen in 2015. In any case, Croatia was the first CEE country to break the ice for government auction after the dramatic rise in yields, and in the following weeks, we could see Romania, Poland, and others coming to markets for fresh financing.

With this auction, Croatian Ministry of Finance secured funds for CROATI 2022 and could pause now until summer when will have to finance local paper RHMF-O-227E while we cannot exclude one more auction after to finance deficit for this year. Yield of 2.975% is much more compared to 1.39% that Ministry issued RHMF-O-302E, but it is important to note that CROATI 2022 has a coupon of 3.875% meaning that Croatian cost of debt is still on the downward path. Talking about costs of debt, the average yield of all bonds currently outstanding is 2.74%, with CROATI 2032 being excluded.

What to expect from the newly issued bond on the secondary market? First grey indications were positive as dealers and brokers were showing positive bids compared to reoffer price while bund yields were marginally lower. One could say that Croatian 10Y at 3.0% is a steal but bearing in mind what was happening for the last 3 months on bond markets we leave this theme for another article.

Source: Bloomberg, InterCapital