Core bond yields dropped by some 40bps in the last 40 days. An early Thanksgiving gift for the buy side? Or is it just a technical rally that’s going to be killed off by central bank hawkish rhetoric? Read in this brief research piece.

Without looking at the Bloomberg terminal and just from the top of your head, would you be able to tell where the 10Y German yield stood at the beginning of the year? It was at roughly 2.55%. This morning the figure opened at 2.63%, or merely 8bps higher. On a year-to-date basis, the 10Y yield barely moved, but why is that so important? Well, to understand that, take a look at what markets were expecting on the last day of December for the current year based on €STR swaps:

Notice that financial markets were expecting rate hikes to be continued in 2023, raising the €STR rate from 2.00% to around 3.50% by end-July. What actually happened was that the ECB got to 3.50% in June and delivered one more 50bps hike in September to end gradually higher than the markets were expecting. These additional 50bps are not expected to stay here for longer, at least according to the most recent WIRP reading:

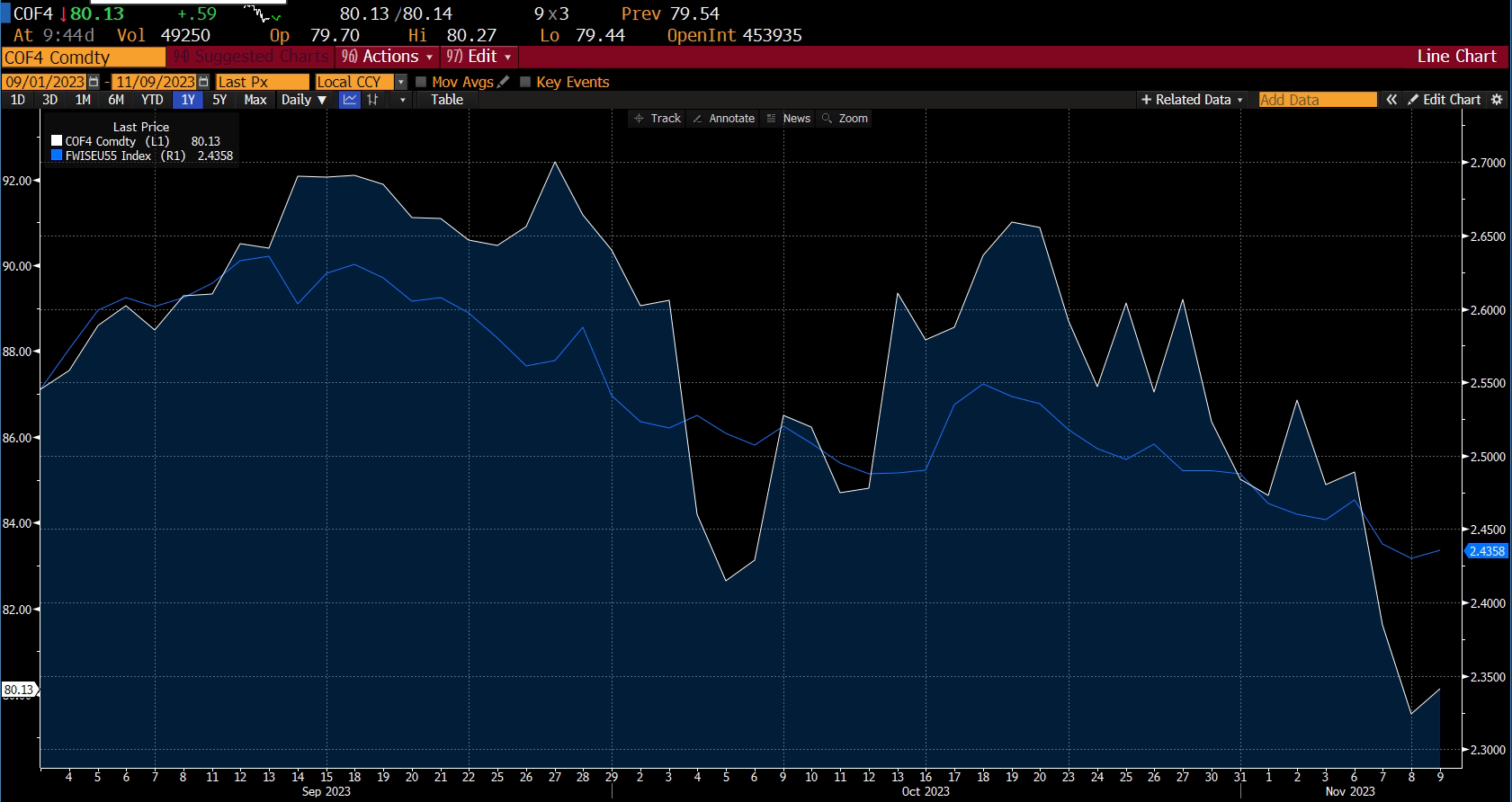

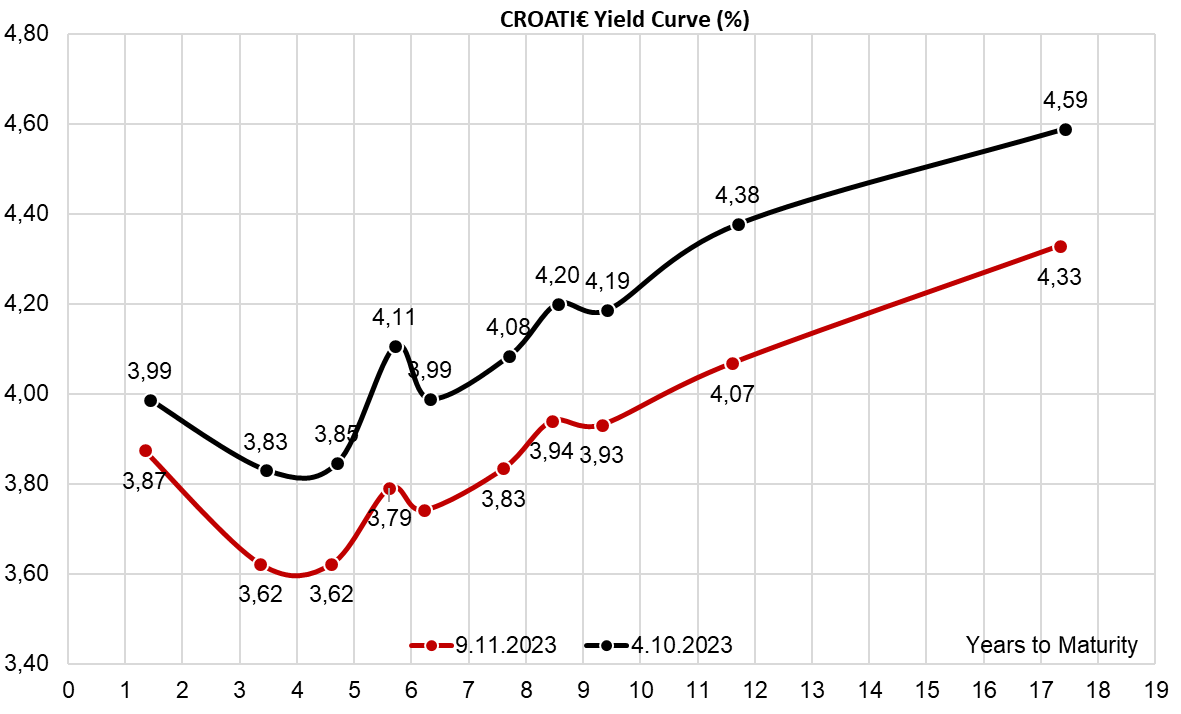

Now here’s where things get really interesting. Seasoned fixed income traders know that 10Y German yields came down by roughly 40bps (from 3.03% on October 04th to the current 2.634%), but very few understand the drivers of these yields. We opt for the most obvious solution, which is that the drop in oil prices caused European 5Y5Y inflation swaps to reprice lower, dragging long-term yields lower in the process:

However that is not the whole story because it’s obvious that inflation swaps came down by merely 10bps.

Where are the remaining three quarters? On Tuesday BoE’s chief economist Huw Pill stated that market expectations for rate cuts next summer are not unreasonable. As a result 10-year gilt yields dropped by 11bps and have still not retraced the Pill they swallowed, holding to the gains in gilt futures. Yesterday Mario Draghi expressed his expectations about the euro area entering a recession by year’s end. Finally, yesterday’s 40bn USD heavy 10Y UST auction went by with a really small tail (4.519% versus 4.511%), while indirect bidders took 69.7%. This was not a flop. Additionally, any bond you might have purchased on primary placement this week, regardless of whether it’S BGARIA€, MAEXIM€ or something else, it’s up compared to reoffer price.

Our explanation about the sharp drop in yields is based on narratives circling around, however, JP Morgan’s Nikolaos Panigirtzoglou has a different angle to it. Analyzing CTA flows, it seems that momentum traders were caught off guard by the beginning of this month and about half of the extreme short positions recorded on October 25th were unwound in about a week. That’s nice, but the yields have been sliding since the beginning of October, so there might be more than one explanation for the current chain of events.

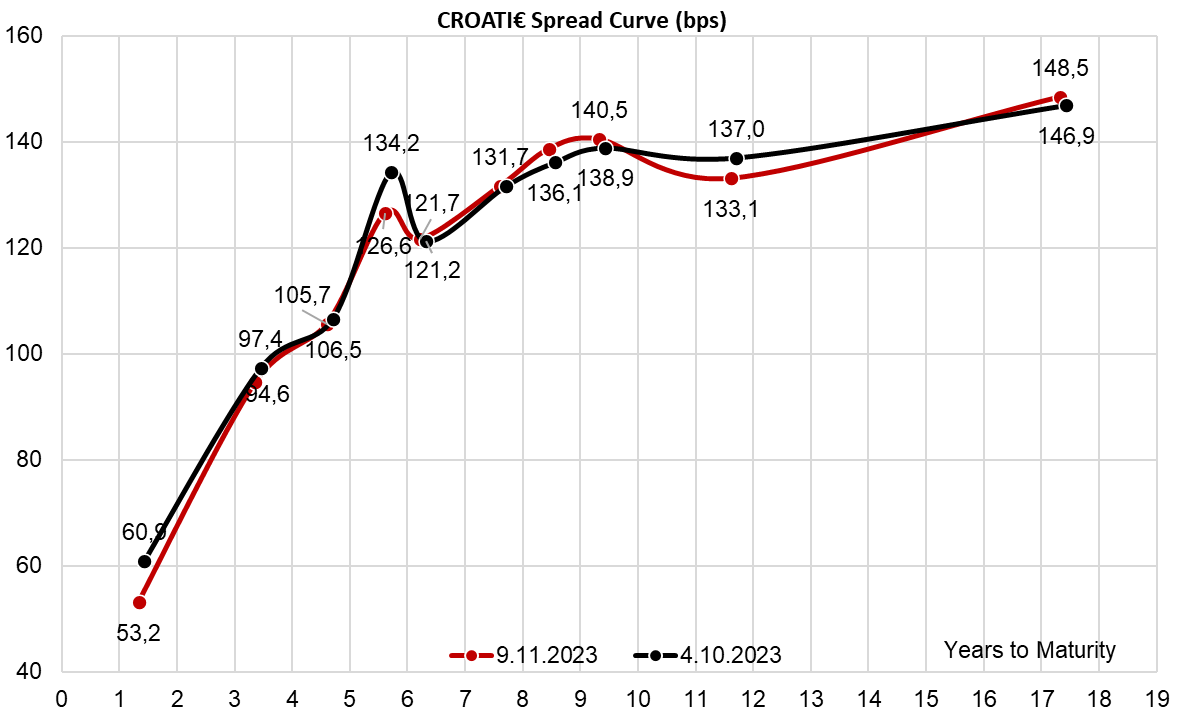

What do we make of Croatian international bonds? Obviously, CROATI€ prices went up with the bulk of demand being concentrated on CROATI 4 06/14/2035€. What we find really interesting is that the spreads to the German curve remained completely unchanged, strengthening the claim that Croatian paper is traded with a higher positive correlation to core countries. The time series is still too short to make a definite conclusion. Going forward we expect the attention of fixed income investors to be concentrated on the upcoming local bond auction taking place in the last full week of November. With 1.5bn EUR of CROATE 1.75 11/27/2023€, it’s still difficult to say which duration MinFin would pick for the new local paper, but based on the demand we see, some sort of RHMF-O-31BA might be in play. Time will tell.