S&P Global Ratings will be reviewing Croatian credit rating this afternoon and domestic investors believe that by Monday morning Croatia might be at A- with a neutral outlook. To quote a popular song from The Cure – “Friday never hesitates“. Nevertheless, we think it’s a coin toss decision. But we know one thing – have Croatian bond prices already priced this upgrade? Is CROATI€ already in the closet A-? Read in this brief research piece.

S&P Global Ratings is scheduled to review the Croatian credit rating this afternoon and the domestic investment community is broadly aligned with rating being lifted from BBB+ (positive outlook) to A- (neutral outlook). Last rating review took place on September 15th, 2023 and staff stated that credit rating could be revised upwards in the following 12 months if „economic resilience is sustained, supported by the country’s deepening integration with Europe, and facilitated institutional improvements, for example within the judiciary, education, and broader business environment“. Let’s take it step by step.

Speaking about economic resilience, the rating agency expected real GDP growth to reach +2.5% (2023), +2.3% (2024), +2.8% (2025) and +2.7% (2026). The 2023 and 2024 figures are slightly below the forecasts put forward by the European Commission, which expects +2.6% in both 2023 and 2024. The rating agency also expects general government gross debt to be reduced to 60% GDP by 2026, but notice that Croatian public debt ended 2023 at 64% GDP and it’s quite likely that it will drop quite close to 60% GDP by the end of 2024. Additionally, EU fund withdrawals, excellent tourist seasons and strong government consumption spell real GDP growth rates above +2.5% in the near future, so the possibility of outperformance is quite evident. Moreover, the Croatian Ministry of Finance is issuing more and more retail instruments, increasing the share of domestic investors.

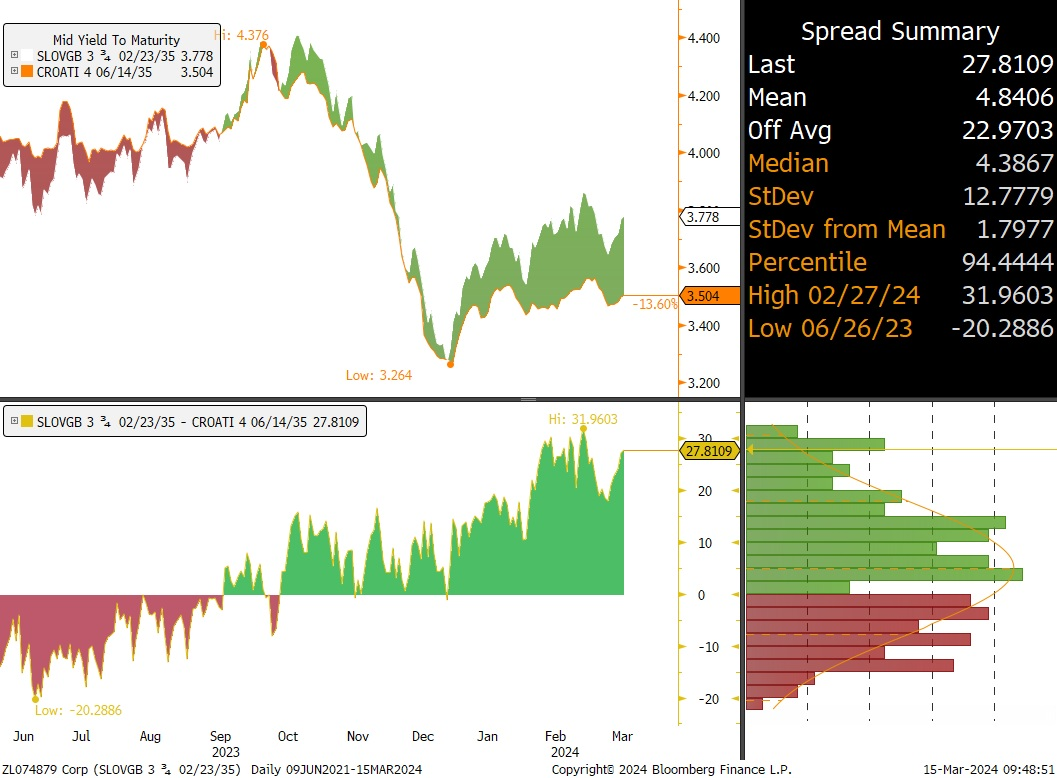

There are downside factors to the review as well, such as the assessment of judiciary independence, however, we do believe that the positive factors offset the negative ones. Needless to say, Croatian bonds have been behaving in a way that suggests that a rating upgrade might be in the cards this year. If you doubt that, just take a look at the spread between SLOVGB 3.75 02/23/2035€ (A+/A-/A2) and CROATI 4 06/15/2035€ (BBB+/BBB+/Baa2; notice that all three rating agencies hold a positive outlook). Slovakian bonds are traded at +27bps in terms of YTM compared to CROATI€ and it’s easy to know why. Markets are really expecting that rating upgrade, but the real question wee need to ask ourselves is – are the prices already reflecting A-? Is Croatia already “in the closet” A- country?

There are pros and cons for this story. If you believe liquidity on Croatian international bonds resembles SLOVGB€, you are right, the consequential spread tightening has been priced in and a hypothetical rating upgrade will be a non-event. On the other hand, take a look at SPGB 1.85 07/30/2035€ trading around 3.30% YTM (A/A-/Aa1). Spanish bonds are a lot more liquid compared to Croatian and the spread between the two is 20bps. Now here’s the kicker – Croatian yields are poised halfway between Spain and Slovakia. Markets tell it all – the liquidity is slightly better than Slovakia, but slightly worse than Spain, so it’s priced halfway in between. Notice that this has nothing to do with creditworthiness, but rather with the width of bid-ask spreads and the easiness of executing bigger orders.

The last thing you have to keep in mind are the subsequent rating decision dates: Fitch (05th April), S&P again on 13th September and Fitch again on 20th September.