Today, we bring you an overview of the 2023 dividend payments in Croatia, Slovenia, and Romania.

2023 thus far has proven to be quite challenging for companies, with the continued environment of high-interest rates and inflation. This of course, also had an influence on the companies’ decision to pay out the dividends, and the amounts paid. Below, we bring you the breakdown of all the data related to the dividends this year. Do note that the dividend yields are based on the share prices before the initial dividend proposals.

Croatia

Starting off with Croatia, this year has seen an improvement in dividend payments, with some Croatian blue chips proposing dividend payments that are higher than what is usual in the region.

Croatian blue chips dividend information in 2023

Source: Companies’ data, InterCapital Research

*Latest counterproposal

Out of the blue chips observed, the highest dividend yield (if approved at the GSM) would be Atlantska Plovidba, with a dividend of EUR 5 per share, or a DY of 9.3%. Following them, we have Ericsson NT, currently the only one with a pending counterproposal in Croatia. If accepted, this would imply a EUR 12 DPS, and at the share price before the proposal, a DY of 5.5%. Following them, we have Valamar Riviera, with a DY of 4.5%, Hrvatski Telekom, with 4.3%, and Adris (pref.) with 4.1%. Compared to the previous year, all of the blue chips have decided to pay out the dividend. Of course, this is more due to regulations (for example, the tourism companies last year could not pay out dividends until after August, due to receiving COVID-19-related government support). Thus far, except for Ericsson NT (and Arena Hospitality Group, which was not approved and thus isn’t included here) no dividend counterproposals have been made, and the majority of dividends have either already been approved or will be approved by the end of June. A similar situation is present in terms of the ex-dates, as the majority of them are pretty close to the approval dates, and as such, a surge in returns from these companies can be expected for investors in May/June/July.

In terms of the overall CROBEX10 index, the dividend yield that can be received in Croatia if all the proposals are accepted amounts to 3.47%, which is certainly welcome in the current environment. Furthermore, investing in ETFs such as the 7CRO (which tracks the movements of the CROBEX10tr index) would mean that investors can buy an index fund that has low cost due to it being passively managed, can avoid the dividend tax as this is a total return index in which the dividends are reinvested, and can overall expect solid returns. One also has to take into account the impact of the share buybacks, as this also creates further value for investors, and the current regulatory environment favors this type of decision for Croatian companies.

Slovenia

Moving on to Slovenia, the story is a little bit more varied, with several counterproposals being made, and the regulatory environment also affecting the companies’ dividend proposals. It should be noted that the dividends and thus dividend yields for the companies which received counterproposals are based on said counterproposals, and as such after the General Shareholder Meetings of those companies, dividends might end up being different than shown below.

Slovenian blue chips dividend information in 2023

Source: Companies’ data, InterCapital Research

*Latest counterproposal

**First dividend tranche

*** Dividend payment delayed until 2024

Starting off with the highest-yielding company, we have Cinkarna Celje, with a DY of 12.5%. Here we see the first effect of the counterproposals, as this is based on the 2nd counterproposal for the Company. In fact, Cinkarna Celje initially proposed no dividend payment in 2022, as the Company received government-related energy cost support, and they would have to repay the funds received, in this case in the amount of EUR 5m – EUR 7m. If you want to read the full story, click here. In general however, due to this aid, the Company decided not to pay out a dividend in the year, and afterward, they received two counterproposals; the initial one for EUR 3 DPS, and the 2nd one for EUR 3.2 DPS (the currently presented DY of 12.5%). Next, we have Luka Koper, with a DY of 9.5% (EUR 2.5 DPS), and given the fact that Luka Koper recorded one of its best years on record in 2022, this was to be expected. Next up, we have Telekom Slovenije, with a DY of 9%, which is also based on a counterproposal. Following them, we actually have NLB, but to understand this, one has to take into account the Company’s dividend payment policy. Currently, NLB proposed a dividend payment of EUR 2.75 DPS, DY of 3.85%. In their guidance however, and as pointed out many times by the Company, they plan on paying out dividends in two tranches during the year, the first to be approved in June, and the latter in autumn. From that guidance, we already know that the dividend payment should amount to EUR 110m in total (EUR 5.5 DPS), which at the price before the initial proposal, would amount to a DY of 7.7%, placing NLB in this position in terms of the DY size.

Following them, we have Sava Re, Triglav, Petrol, and Krka, at 6.4%, 6.3%, 6.3%, and 6.2% DY, respectively. The payments from the insurance companies and Krka are expected. On the other hand, Petrol’s dividend story stands out. As we know, Petrol was hit extremely hard on its profitability in 2022, due to the fact that the energy commodity (oil&gas) prices were extremely high, while Petrol’s margins (as a distributor) were capped. As such, there were periods of time when the Company was making losses on sales in 2022, which meant that the 2023 dividend payment was uncertain. What’s even more interesting, is when the Company initially proposed the dividend payment, they proposed EUR 0.7 DPS (DY of 3%). No counterproposals were made until the GSM, during which a counterproposal of EUR 1.5 DPS (DY of 6.3%) was made, and accepted. As such, despite being in one of the most challenging business environments among the Slovenian blue chips, Petrol still decided to pay out a sizable dividend.

In terms of the SBITOP index, the total DY at the current dividend proposals amounts to 6.33%. Furthermore, investments into ETFs such as 7SLO (the same principle as 7CRO), would mean that passively, strong returns can be expected from Slovenia.

Romania

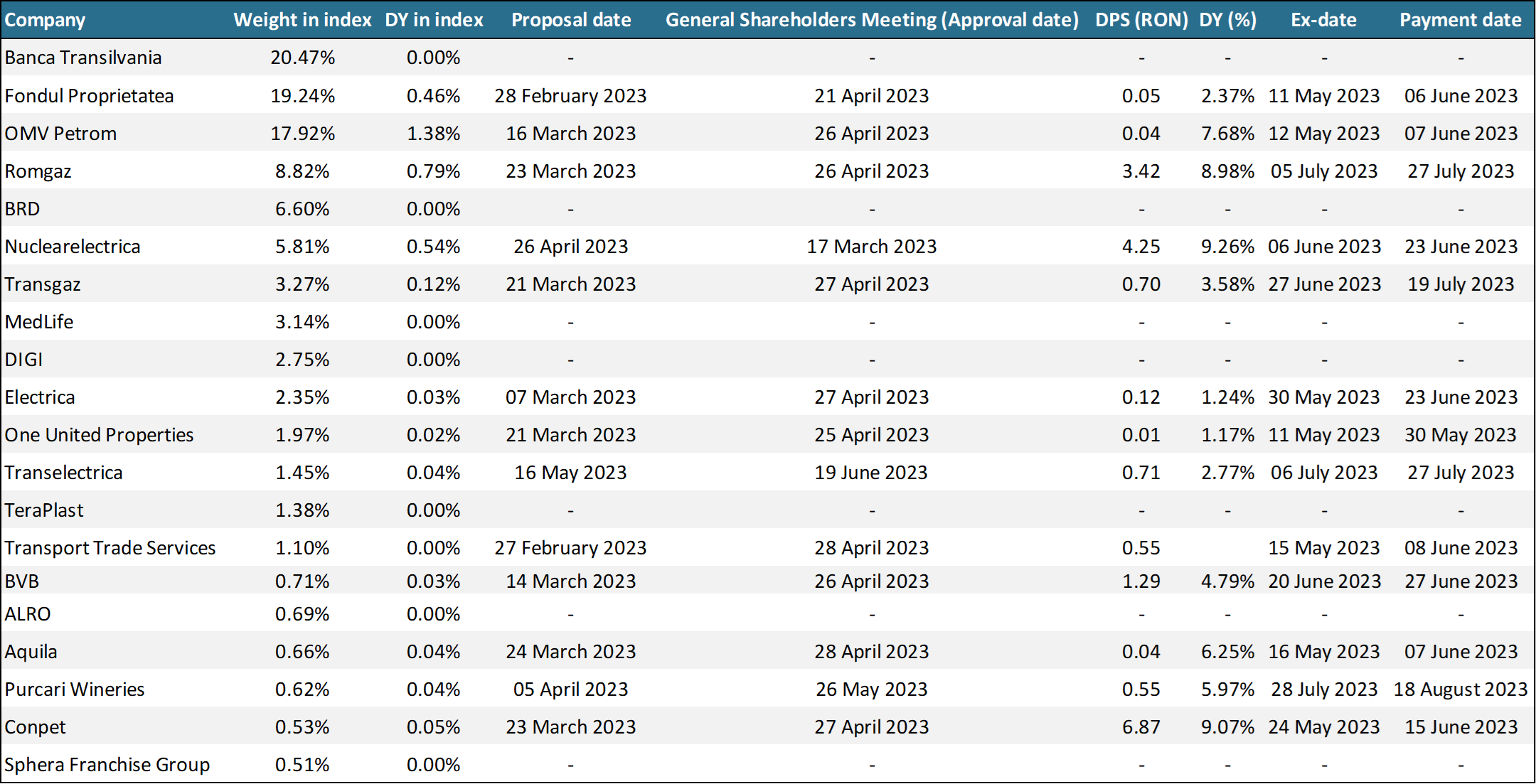

Finally, moving on to Romania, out of the 20 companies present in the index, 7 haven’t proposed dividend payments yet, which certainly affected the DY and overall returns. Furthermore, the Romanian banks present in the index (Banca Transilvania, BRD Group) decided not to propose the dividend payments thus far, and considering that Banca Transilvania has the highest weight in the index at 20.47%, this, in particular, had a sizable impact on the dividend yield of the index.

Romanian blue chips dividend information in 2023

Source: Companies’ data, InterCapital Research

In terms of the companies that did propose the dividend payments, the highest dividend yield can be seen from Nuclearelectrica at 9.26% (RON 4.25 DPS), followed by Conpet at 9.07% (RON 6.87 DPS). Next up, we have Romgaz at 8.98% (RON 3.42 DPS), and OMV Petrom, at 7.68% (RON 0.0375 DPS). As we can see here, the energy companies which comprise app. one-third of the BET index, are giving solid returns to their shareholders. This is a quite positive development, especially if we take into account the size of the windfall tax in Romania, basically meaning that despite the macroeconomic environment which saw huge improvements in the top-line of all the energy-producing companies, their margins roughly stayed the same or improved only by a little.

Moving on, we have Purcari with a DY of 6.25% (RON 0.04077 DPS), and Conpet, with a DY of 5.97% (RON 0.55 DPS). Overall, BET index DY at these dividend numbers for 2023 would amount to 3.5%, which is certainly a reduction from the previous year during which we saw a DY of 5.82%. Lastly, it should be noted that 7BET, an ETF tracking the movements of the BET-TR similar to 7CRO and 7SLO will launch on 31 May 2023 on the Zagreb Stock Exchange. This will allow investors to invest in the entire BET-TR index, receive the same benefits as with the other already mentioned ETFs, and directly invest in Romania. As such, and despite the challenging macroeconomic environment, investors have even more options to diversify their portfolios, which is certainly a positive development for the overall capital market.