Today, we bring you an overview of the Croatian, Slovenian, and Romanian blue-chips’ dividends as well as all of the most important dates. If you invested in the indices which include these companies, we’ll look at how much would your yield be just based on dividends.

Before we start, it should be noted that all the dividends as well as their dividend yields are in the gross amount, so depending on the country, the tax on them has to be paid. To avoid paying this tax, one has to invest in total return indices, which immediately upon payment reinvest all the dividends into the index. Examples of these indexes are CROBEX10tr and SBITOPtr. On the Zagreb Stock Exchange, two Exchange Traded Funds are listed – 7CRO, and 7SLO. They are managed by InterCapital Assets Management (link) and they track these total return indices. Considering they are passively managed, the fees are lower compared to actively managed investment funds. So there are more benefits in investing in funds directly rather than buying specific stock.

Also, to provide a better overview, we’ll focus on comparing the companies’ dividend yields, as it doesn’t make sense to compare a company that pays out HRK 8 DPS and HRK 50 DPS, due to their share prices being different. With that out of the way, let’s take a look at the dividends in the region.

Croatia

Starting off with Croatia, most of the Croatian blue-chip companies have already announced their dividend proposals, excluding AD Plastik (which is under significant pressure due to the Russian invasion of Ukraine), and Atlantska Plovidba, which does not pay out dividends. It should also be noted that a subsidiary of Končar, Končar D&ST also paid out a dividend in 2021, and as they are a part of Končar, we’ll include them here. Furthermore, Hrvatski Telekom is currently the only Croatian blue chip that has already approved and paid out its 2022 dividend (on 4 May 2022), and even though we’ll include them in our comparison, we’ll also provide DY excluding them.

Overview of the Croatian blue chips dividend yields (%) in 2022

As can be seen from the graph, the largest DY is evidenced in Hrvatski Telekom, with 4.3% (but considering they already paid out their 2022 dividend (for the 2021 result). If you were to buy their stock or the index which includes them now, you would not receive this dividend. Following them, we have Adris with 3.64% DY, Ericsson NT with 3.4%, and Atlantic Grupa, with 3.14%. On the flip side, the smallest dividend yield is made by Končar, which has a DY of 1.4%. However, if you also bought their subsidiary, Končar D&ST, you would get a slightly higher dividend yield of 2.8%. It should be noted that Arena Hospitality Group and Valamar Riviera transferred the net profits for 2021 into retained earnings, as they are still blocked from paying out dividends until at least August 2022, due to them receiving COVID-19 related govt. support. However, after August, there is a chance these companies will pay out dividends, but that of course depends on their business results and the macroeconomic situation. We also included one of the newest additions (and one of the most traded) companies on the ZSE, Span, which even though they aren’t part of the CROBEX10 index, their high turnover and recent addition to the CROBEX index deserves a place here. In 2022, their dividend yield amounted to 2.27%.

In total, if you invested in CROBEX10 since the beginning of the year, you would receive a 2.44% return in the form of gross dividends. If you invested in a total return index/fund, like the 7CRO ETF, then the whole 2.44% would be reinvested. If you were to invest now, after HT’s dividend payment, your DY would be 1.62%. Also below, we provide you with the table of all the important dates (date of the proposal, date of the General Meeting of Shareholders when the dividend is approved, or in HT’s case, has been approved, and finally, the ex-dividend and payment dates).

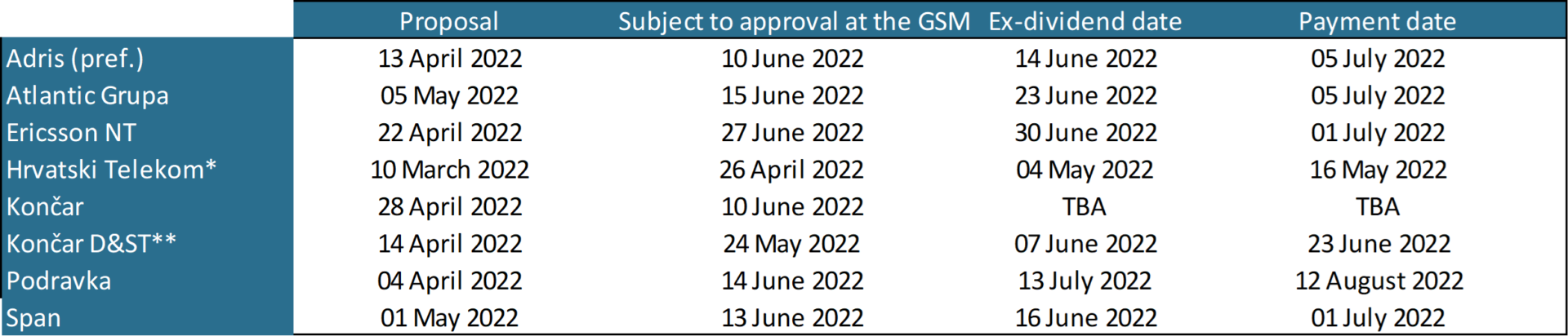

Croatian blue chips dividend proposal, approval, ex-dividend, and payment dates in 2022

*HT already paid out the dividend

** Končar D&ST is a subsidiary of Končar

TBA – To be announced

Slovenia

In Slovenia, all the SBITOP constituents except Unior have published their dividend proposals, with approvals coming from Petrol and Salus, and Salus already paying out the dividend at the beginning of May. Looking at the companies themselves, the largest dividend yield comes from Triglav with 9.5%, followed by Cinkarna Celje with 7.2%, Petrol with 5.98%, Krka with 5.85%, and Telekom Slovenije, with 5.8%. On the flip side, the lowest dividend yield comes from Luka Koper, with 2.95%. It should also be noted that NLB paid out EUR 2.5 DPS, amounting to 3.8% DY. This is important because according to the Company’s announcement on their web page (link), they are on track to follow the guidance that they outlined in their FY 2021 report. According to it, app. EUR 100m would be paid out as dividends in 2022, so one could expect a 2nd dividend payment by NLB in H2 2022. Slovenian equity is quite known for its larger dividend payment, so investing in these companies based on their dividend payments is quite attractive. In total, if you invested in SBITOP at the beginning of 2022, your dividend yield would be 5.79%. If you invested today, your yield would be 5.59% (excl. Salus dividend).

Overview of the Slovenian blue chips dividend yields (%) in 2022

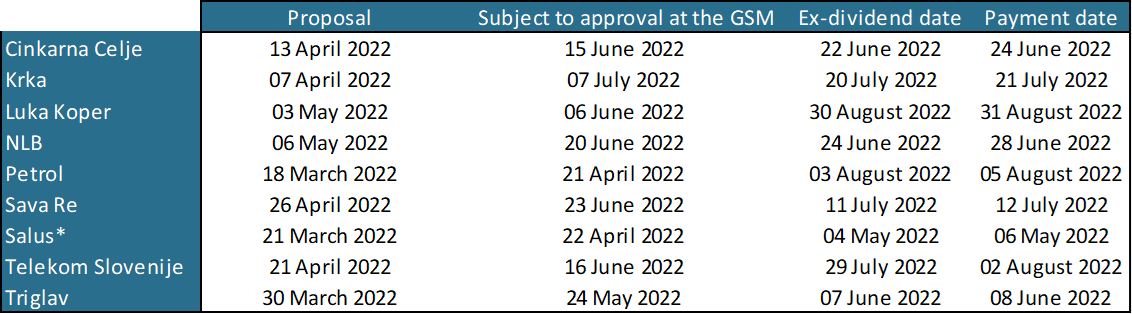

Below we provide you with the table of the most important dates (date of proposal, date of the General Meeting of Shareholders, and finally the ex-dividend and payment dates). It should be noted that most Slovenian companies are yet to announce their ex-dividend and payment dates.

Slovenian blue chips dividend proposal, approval, ex-dividend, and payment dates in 2022

*Salus already paid out the dividend

Romania

Finally, we took a quick look at the Romanian blue chips. Out of the 20 companies which make up the BET index, 15 have announced their dividends. Of those 15, all of them have already approved their dividend payments, so we’ll exclude the dividend proposal dates. With that out of the way, the largest dividend yield of all Romanian blue chips comes from Conpet, with a DY of 9.4%, followed by Romgaz with 8.9%, OMV Petrom with 7.7%, and BRD Group, with 7.2%. On the other hand, One United Properties and Teraplast have the lowest dividend yields, with 1.2% and 2%, respectively. In total, if you invested in a BET index since the beginning of the year, your dividend yield would be 5.82%. If you invested today, it would amount to 4.58%, as OMV Petrom, as well as One United Properties’ ex-dividend dates, were due last week.

Overview of the Romanian blue chips dividend yields (%) in 2022

Below, we provide you with all the most important dates for the Romanian blue chips, i.e. the date of approval, as well as ex-dividend and payment dates.

Romanian blue chips dividend approval, ex-dividend, and payment dates in 2022