There are many words history books will use to describe the events which occurred in 2020, but the one that seems to be the most popular is – unprecedented. 2020 was definitely a challenging year for everyone including the participants of the Croatian capital market. For the first blog of 2021, we decided to look back at some of the most significant events on the Croatian equity market.

Outbreak of Covid-19

In 2020, Croatian equity market observed an increase in liquidity, which was mostly caused by the selloff in late February and March coupled with increased trading in April. To be specific, total equity turnover amounted to HRK 2.85bn (EUR 378.5m). This translates into an average daily turnover of EUR 1.45m (+3% YoY). Although we did notice an increase caused by the selloff, we note that the following months mostly experienced lower liquidity.

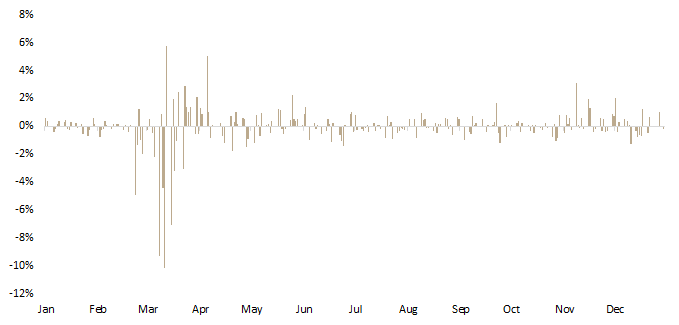

As visible from the graph, CROBEX recorded a sharp decrease of 13.74%, ending the year at 1,739.29 points. It is worth noting that such performance is lower compared to other regional markets (Slovenia, Romania, Serbia), however this can be explained by a high weight of tourism related companies in the main index which underperformed in 2020.

In late February and beginning of March, the market plummeted as investors realized that the outbreak of the pandemic became inevitable. This resulted in some of the best and worst performances of the index in its history. On 12 March CROBEX plummeted, recording a daily decrease of 10.18%. Consequently, after roughly 15 minutes in the trading day, Croatian Financial Services Supervisory Agency (HANFA) temporarily suspended trading on the ZSE until the end of the trading day. Note that the index observed such a sharp daily decrease only once in October of 2008 when CROBEX dropped by 10.2%.

We note that on 24 March, CROBEX reached its bottom with 1,366.36 points (-32.23% since the beginning of 2020).

Daily changes of CROBEX in 2020 (%)

Buying the Dip Proved to be Lucrative

What followed in end March/ beginning of April was almost an uninterrupted positive sentiment on both Croatian and other global equity markets, which was supported by an unprecedented monetary and fiscal stimulus. In the graph below, you can see the share price performance of CROBEX constituents since their respective bottom. As visible from the graph, buying the dip ended up being a very lucrative strategy as 4 index constituents observed a triple-digit increase by the end of the year. Meanwhile, all other constituents observed a double-digit increase. Of the blue chips, Arena Hospitality Group leads the list with an increase of 78.84%, followed by AD Plastik and Valamar Riviera with an increase of 60.6% and 59.1%. Although most shares have not bounced back to their beginning 2020 values, the year still offered more than enough interesting opportunities on the market.

Performance of CROBEX constituents since their respective bottom in 2020 (%)

Poor Tourist Season, However Better than Expected

As the Croatian economy is heavily dependent on Tourism (c 20% of GDP), the global lockdown meant significantly lower inflow of tourists in 2020 and therefore a hit to GDP. The immediate worry behind the aforementioned was reflected by the depreciation of HRK to EUR as a market reaction to potential loss of summer season and inflow of foreign currency. However in the meantime the local currency depreciation trend subsided to a certain extent.

In 2020, Croatia witnessed 7.76m arrivals (-62.51%) and a decrease in tourist nights realized by 50%. Although this is a substantial decrease compared to 2019, we note that the result is better than its Mediterranean peers and is better than early estimates.

As a result of the above mentioned, all tourism blue chips recorded a sales decrease of 59% or higher in 9M of 2020. A visible trend among tourism companies was a higher share of revenues from their camping segment which led to somewhat lower ADR’s.

To read about 9M results of all Croatian blue chips click here. (FY results not published yet).

Vaccine Development in November

In November, both Moderna and Pfizer announced a very high effectiveness of their Covid-19 vaccine which led to a surge in equities across Europe. To read more about vaccine development and its initial effect on Croatian equities click here.

The aforementioned news led to the highest monthly increase of CROBEX 2020, by as much as 8.1%. We note such an increase was the highest in almost 8 years. To be specific, such a high monthly increase of the index was last time observed in January of 2013 when CROBEX increased by 8.5%.

Croatia Remained/Returned in/to Investment Grade Territory

Despite a challenging year for the Croatian government, Croatia remained in investment grade territory at the end of the year, according to Fitch and S&P.

More specifically, in September S&P affirmed its BBB-/A-3 long- and short-term sovereign credit ratings on Croatia, with the stable outlook. Soon, Fitch affirmed Croatia at BBB-, outlook stable. We note that Moody’s was the only credit rating agency not to put Croatia in investment grade territory as they upgraded Croatia to Ba1, one step below investment grade.

There are a few key reasons behind such ratings. What seemed to be a consensus between credit rating agencies as positive news is the recent entry into Europe’s Exchange Rate Mechanism II (ERM II), the so-called waiting room for euro adoption. To read more about it click here. Besides that, the agencies pointed out the importance of EUR 2bn currency swap line which Croatia obtained with the ECB. To read more about it click here. Furthermore, the agencies believe that net inflows from the EU budget, under various envelopes including Next Generation EU, will meaningfully contribute to Croatia’s economic recovery in 2021-2023.

First ETFs on ZSE

Mid – November marked what can arguably be considered the most significant event on the ZSE this year, which was the first listing of ETF’s in Croatia. To be specific, InterCapital Asset Management listed two ETF’s – InterCapital CROBEX10tr UCITS ETF (ticker: 7CRO) which replicates CROBEX10tr index, while InterCapital SBI TOP ETF (ticker: 7SLO) replicates SBITOP index. Both mentioned ETF’s are total return ETF’s.

The listings were welcomed with a very solid interest on the market as their turnover amounted to HRK 21.9m. To put things into a perspective, both ETFs have turned over almost their entire market cap in roughly a month and a half. Besides that, for more than two third of trading days, at least one of the ETF’s was among 10 most traded shares.

We note that both ETF’s have ended the year in “green”, while 7SLO observed an increase of as much as 7.2%. To read our serial on ETFS click here.