The story began in late September, when MSCI opened a consultation on whether Digital Asset Treasury companies (DATs) should remain inside its equity indices. The timing was notable: the discussion surfaced just before the sharp selloff across crypto and crypto-linked equities. Weeks later, Bitcoin was under 100k again, MSTR had fallen more than 60% from its highs, and premiums on DATs collapsed. What might initially look like a simple classification issue quickly became a major driver of market repricing.

What DATs Actually Are

DATs are companies whose balance sheets are overwhelmingly exposed to digital assets, mainly Bitcoin. MicroStrategy (MSTR) is the most well-known example. Once a traditional enterprise software business, it spent the last several years deploying nearly all excess cash, including raised capital through convertible debt to accumulate Bitcoin.

The software business still exists, but its role has become marginal. By 2025, almost all of the company’s economic exposure and market behavior was tied directly to Bitcoin. MSTR’s share price moved less like that of an operating software company and more like a leveraged Bitcoin vehicle.

MSCI’s Reasoning

MSCI’s decision makes sense when viewed through the lens of index construction. Equity indices are intended to track operating companies with business driven financial performance. Vehicles whose value depends predominantly on the price of a single asset; funds, commodity pools, closed-end products are generally excluded.

MicroStrategy and similar firms increasingly fit that second category. Their earnings profiles reflect Bitcoin’s volatility, not business fundamentals. Their balance sheets resemble the structure of investment funds rather than corporations. The use of convertible debt issuance and volatility harvesting strategies only reinforces that comparison. MSCI simply acknowledged the economic reality: these companies no longer align with the purpose of broad equity indices.

The final decision arrives on January 15, 2026, and index changes will be implemented shortly after. Funds tracking MSCI indices will have a limited window, roughly a few weeks to adjust exposures, which implies mechanical outflows for companies deemed ineligible. A big part of the current sell-off is the market front running this.

Market Impact and Forced Repricing

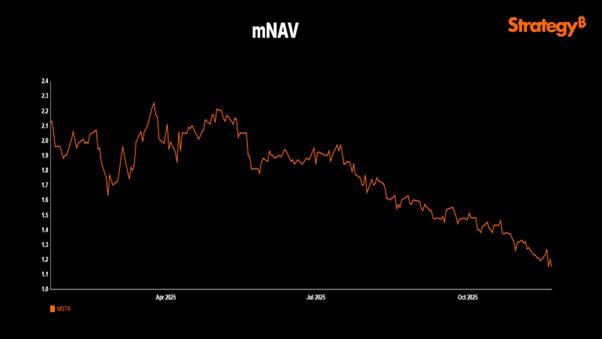

Premiums that DATs had traded at relative to their net asset values began to decline. MicroStrategy, which had often traded far above the value of its underlying Bitcoin holdings, saw that premium compress to near 1x.

Strategy ($MSTR) mNAV

Source: Strategy, InterCapital

This premium existed for years because MSTR offered access to Bitcoin at a time when most investors could not buy it directly. There were no spot Bitcoin ETFs, crypto adoption was limited, and many retirement accounts prohibited direct crypto purchases. Owning MSTR was one of the few ways for institutions and individuals to gain exposure.

But with spot Bitcoin ETFs now widely available, the structural demand that once supported DAT valuations has faded. MSCI’s decision accelerated that shift. Analysts estimate potential outflows of $2.8 billion for MicroStrategy and as much as $8.8 billion if additional index providers adopt the same classification approach.

As the market priced in these flows, the decline in DATs fed back into crypto markets themselves. When DAT share prices fall, their ability to raise capital for additional Bitcoin purchases weakens. Some investors also hedge DAT positions by shorting Bitcoin directly, adding another layer of sell pressure. The result was a synchronized drop in both MSTR and Bitcoin.

A Turning Point for Bitcoin Balance Sheet Strategies

This episode marks a critical moment for companies that positioned themselves as corporate Bitcoin holding vehicles. The market dynamics that once supported them have changed. The regulatory environment now offers direct, regulated Bitcoin investment products, reducing the need for equity proxies. And index providers are reevaluating whether these companies belong in traditional benchmarks at all.

Strategy may continue its „strategy“, and other firms may follow similar paths, but the environment is unlikely to resemble the one that enabled their earlier premium-driven rise. The combination of MSCI’s decision, increased ETF accessibility, and reduced structural demand signals a new phase for DATs.