At the current share price, dividend yield is 3.7%.

Ericsson Nikola Tesla published an announcement stating that the Supervisory Board and Managing Director made a joint proposal to shareholders at the General Meeting to adopt a dividend payment of HRK 49 per share. This translates into a dividend yield of 3.7%. Such a dividend per share is 31% lower than the one paid in the previous year.

As a reminder, in mid-May the Management and Supervisory Board of the company proposed HRK 95.51m to be allocated to retained earnings. The dividend proposal is subject to approval at the Extraordinary General Meeting, which will be held on 9 December 2020. Note that ex-date was not yet stated.

In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (2013 – 2020) (HRK)

Dividend Yield (2013 – 2020) (%)

Provided the approval of ZSE, HT would become the 6th company in the prime market.

Yesterday, Zagreb Stock Exchange received an application of HT regarding transition of their shares from the Official to the Prime Market.

Prime Market is the most demanding market segment of the ZSE with regard to the requirements set before the issuer, especially in relation to transparency.

Some of the requirements before the issuer are the following:

- The issuer must have an investor relations function in place

- Free float min. 35%

- At least 1,000 shareholders

- Market cap. of minimum HRK 500m

- The issuer of shares shall enter into a market making contact with at least one market maker

- The supervisory board of the issuer must have at least one independent member

- At least one member of the audit committee shall be independent of the issuer

- Developed and disclosed dividend policy to the public

The Exchange shall decide on the received application and inform the investment public about the resolution. Provided the approval of ZSE, HT would become the 6th company in the prime market joining the company of AD Plastik, Arena Hospitality Group, Atlantic Grupa, Podravka and Valamar Riviera.

We support such an application of HT, which is already one of the most transparent companies on the market. Therefore, the addition of the company would be a step forward on making CROBEXprime a potentially better peer for Croatia than current CROBEX. The reason behind is that CROBEX consists of a large number of shares which many fund managers would not even include in their investment universe (due to extremely low liquidity, poor corporate governance), while CROBEXprime consists of less constituents, however the ones which are the most transparent and liquid.

The company is investing HRK 200m in digitalization and the development of new products.

This week Croatia osiguranje announced that they have launched LAQO – Croatia’s first digital vehicle insurance.

The company states that LAQO offers contracting of compulsory and casco vehicle insurance completely digitally, in a simple, fast and smart way. Arranging vehicle insurance is possible in just a few clicks on the website, without having to physically go to the branch, while the whole process takes less than a minute. Additionally, the company offers extra options such as towing, hail insurance, animal damage (collision with an animal) insurance, etc.

With this, Croatia osiguranje is covering digitally a solid portion of the Croatian insurance market as vehicle insurance (casco policy) accounts for 12.12%, while civil liability in respect of the use of motor vehicles is the single largest GWP item in Croatia taking up 23.7% of the insurance segment (as of August 2020). These segments have in the first 8 months of 2020 performed quite well despite the pandemic as civil liability in respect of the use of motor vehicles grew by HRK 152.6m, while vehicle insurance (casco policy) grew by HRK 20m. To read more about the latest GWP development in Croatia click here.

Croatia osiguranje is the market leader in Croatia with a market share of 27% as of August 2020. The company added that they are currently investing HRK 200m in digitalization and the development of new products.

As a reminder, even though the insurance segment has felt the impact of the pandemic measures a lot less than other segments of Adris group, the fall in Croatia osiguranje’s net earned premium was accelerated in the Q2 to -7.3% vs. -1.6% in Q1, so H1 decrease was -4.6%. Total GWPs in Q1 2020 have decreased by 5.8% YoY driven by improvement in non-life segment (+0.5%), while in life segment the company is witnessing double digit premium decrease as more maturities of life insurance contracts coupled with early termination of life insurances (trend on the market triggered by Covid-19 pandemic).

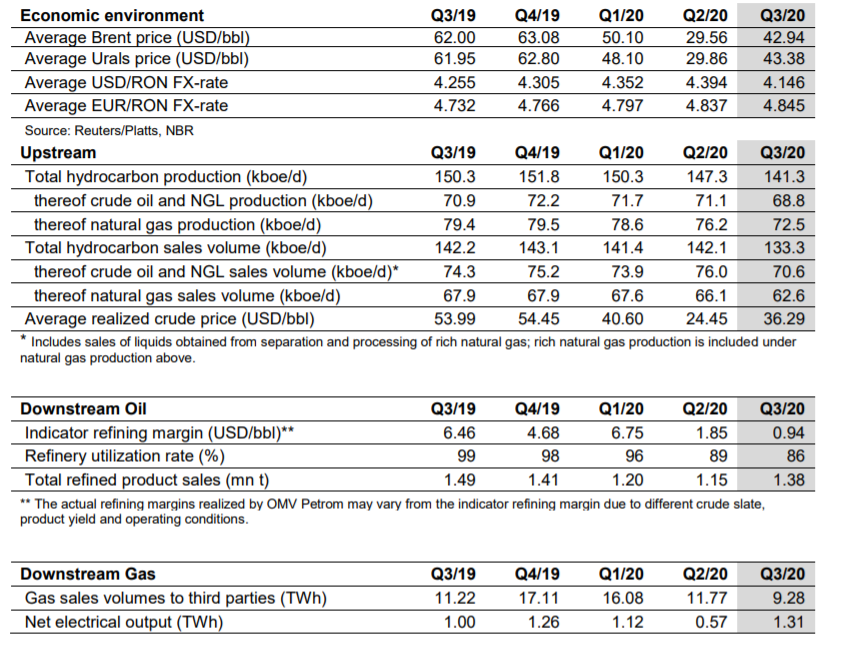

In Q3 retail fuel sales dropped by 7.4% YoY while the refinery utilization rate was at 86%.

Yesterday, OMV Petrom published their trading update which provides basic provisional information on the economic environment as well as OMV

Petrom Group’s key performance indicators for Q3 2020. The Group will publish their Q3 results on 29 October 2020. The company notes that information contained in this trading update may be subject to change and may differ from the final numbers of the quarterly report. The current figures show that in Q3 retail fuel sales dropped by 7.4% YoY while the refinery utilization rate was at 86%.

Source: OMV Petrom