Global GDP growth rate seem to be slowing down amid trade tensions, tight labour markets, Brexit uncertainty,… The usual stuff. In the most recent Spring Economic Forecast the EC downgraded GDP forecasts for most of the countries, the highest changes happening to Italy and Romania. For a more detailed description, browse through this brief research piece.

The recently published “Spring 2019 Economic Forecast”, compiled by the European Commission, disclosed more weakness in the European economy. Back in autumn 2018 the Commission expected EU27 (EU28 – UK) to report a real growth rate in size of +2.0% YoY in 2019; by winter 2019 the growth rate was already down to +1.5% YoY and finally this spring the rate was cut by 10 more basis points to +1.4% YoY. Next year looks a bit more optimistic with EU27 gross domestic product expected to expand by +1.7% YoY, but that too was cut by 20bps compared to autumn 2018. The growth rates are slowing down, no question about that, but the Commission doesn’t see a recession on the horizon; instead, the slowdown is attributed mainly to slowing world trade and tightening of global financial conditions, meaning that the reasons for the deceleration lie overseas. Speaking about the euro area, the growth rate is expected to reach +1.2% YoY (the Commission expected 1.9% YoY back in autumn) and by looking at the more detailed decomposition of growth rates at page 188 we can easily spot the laggard: Italian GDP growth rate has been downgraded from +1.2% YoY (autumn 2018) to +0.1% YoY (spring 2019).

This is not where the story ends with Italy – although the Commission acknowledged that a muted recovery fueled by recovering external demand and higher social transfers might be under way, the Italian version of Friedman’s helicopter money (basic income or “reddito di cittadinanza”) means that public deficit will reach 2.5% GDP (2019) and 3.5% YoY (2020). As a reference point, the Commission was expecting 2.9% YoY in 2019 and 3.1% YoY (2020). The deterioration caused quite a commotion in the control room of the Italian government: first the sovereignist Deputy Prime Minister Matteo Salvini criticized the Commission of never getting any of the forecasts right and claimed that he’s not even thinking about lifting the VAT rate (on of the measures proposed to curb spending); even more curiously Primie Minister Giuseppe Conte sacked Armando Siri, advisor proposed by Salvini’s Lega Nord. Conte’s decision came amid corruption probe and is one more testament to the disharmony of coalition partners since the decision was supported by the junior partner in the coalition, Luigi di Maio’s Movimento Cinque Stelle. In almost a knee-jerk reaction the spreads widened and currently BTPS 3.0 08/01/29 paper is traded @ 2.64% YTM (Bund+281bps), the highest in at least a month.

Speaking about Croatia, the Commission’s 2019 GDP growth forecast was cut by 20bps compared to autumn 2018 and currently stands at +2.6% YoY, meaning that the correction was quite moderate. Growth is fueled by domestic demand and VAT cuts are keeping inflation subdued. It’s interesting that the Commission expects budget surpluses to keep on rolling in 2019 and 2020 (0.1% GDP and 0.5% GDP, respectively), meaning that multiple forces would be at play for the public debt to keep on falling as a share of GDP. As a matter of fact, by end-2020 the Commission expects that public debt might drop down to 67.6% GDP. It’s worth mentioning that late in 2020 Croatia will go through a regular parliamentary election and before that no major shift in fiscal policy is expected.

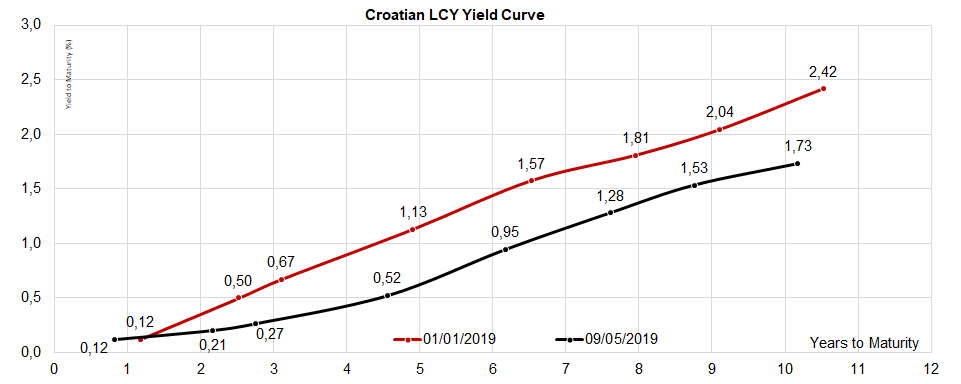

Speaking about Croatian local bonds, the tight supply of paper and persistent liquidity surplus (nearing 9.0% of 2018 nominal GDP) doesn’t seem to go away. The chart submitted below depicts how much the HRK yield curve bull steepened since the beginning of the year. It’s curious to note that the short term yields aren’t dipping closer to zero, meaning that the financial institutions still have venues to place the liquidity at above zero rates. Speaking about the shape of the curve, the largest yield drop happened on H297A, while currently the curve is steepest between H23BA (0.95% YTM) and H257A (1.28% YTM).

At the current share price, dividend yield is 2.8%. Ex-dividend date is 3 July 2019.

Atlantic Group held sessions of the Management Board in which they proposed dividend in the amount of HRK 106.6m to be paid out as dividend to their shareholders. This would translate into a dividend of HRK 32 per share, which would be paid out from the part of retained earnings of the company realized in business years 2003, 2004, 2015, 2017 and from the 2018 company’s net income. The proposed divident amount compared to consolidated 2018 net income of HRK 244m translates into a payout ratio of 44%. The dividend of HRK 32 per share represents an increase of 60% YoY.

At the curret share price, the dividend yield is 2.8%. Note that the ex dividend date is 3 July 2019.

In the graphs below, we are bringing you the company’s historical dividend per share and dividend yield. As visible in the graph, the proposed dividend would have the highest dividend yield in the observed period.

Dividend per Share (2013 – 2019) (HRK)

Dividend Yield (2013 – 2019) (%)*

*compared to the share price day before the dividend announcement

A joint-venture company will be formed to develop the project, in which 51% will owned by CGN and 49% by Nuclearelectrica.

According to Romanian media, Nuclearelectrica, China General Nuclear Power Corporation and CGN Central and Eastern Europe Investment signed a preliminary investors’ agreement for the construction of two nuclear reactors in Cernavoda.

The nuclear power plant in Cernavoda currently operates two 700-megawatt reactors, covering around 20% of the country’s energy consumption.

A joint-venture company will be formed to develop the project, in which 51% will owned by CGN and 49% by Nuclearelectrica. The mentioned joint-venture should be set up within 60 days of the signing of the preliminary agreement.

Romania has been talking about developing two more nuclear reactor units at its plant in Cernavoda since 2003. Units 3 and 4 have been in conservation since 1992.