In his Ode on a Grecian Urne, English poet John Keats said his immortal words that “beauty is in the eye of the beholder“, meaning in a nutshell that it’s not so important what the writer said, but rather what the reader understood. With this in mind, we turn to apparently ambiguous statements made this week by FED Chairman Jerome Powell, stating that his words were not ambiguous, but rather misunderstood. How come? You’ll just have to read the article to find out.

Jerome Powell’s two-day congressional testimony left the financial markets with mixed feelings since it seems that Wednesday’s dovish statements (in the House of Representatives) pushed back against the hawkish remarks made on Tuesday in the Senate. Does it mean that Chairman Powell compromised his integrity by giving different statements to different committees? Not at all. First of all, Powell was grilled by the Senate’s Banking Committee on Tuesday over the question of whether monetary policy tightening would really bring inflation closer to the target 2.0% in the medium term against the backdrop of strong hard data – and by hard data, we mean labour market and PMIs. Powell did answer that “the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely higher than previously expected”. To interpret this statement, remember that the upcoming FOMC’s March 22nd meeting is expected to bring about a new set of dots and that December 2022 median dot for 2023 came at 5.125%. “Latest data” Powell is talking about is the hard data published since December, underscoring the strong labour market in general and resilient wage growth in particular. We believe Powell is telling us that it’s quite likely the median dot might move higher in two weeks’ time, however, we’re not sure which dot is it going to be – 2023 or 2024 dot (or maybe both?). Naturally, dots reflect individual FOMC members’ estimates of the FED funds rate at the end of each year, meaning that Powell cannot directly influence the median dot, but he knows the economic fundamentals and expectations upon which these dots are built on. And he senses that the ground on which rate expectations are stationed has moved. We will have to wait for March 22nd to see if we are correct about the hypothesis that Powell’s hawkish rhetoric was actually aimed at the changing dots. In other words, Powell and the markets were referring to different time frames – FED Chairman looking at the months that have passed since the last dots report, while the rates traders were looking at the developments in the last few trading sessions.

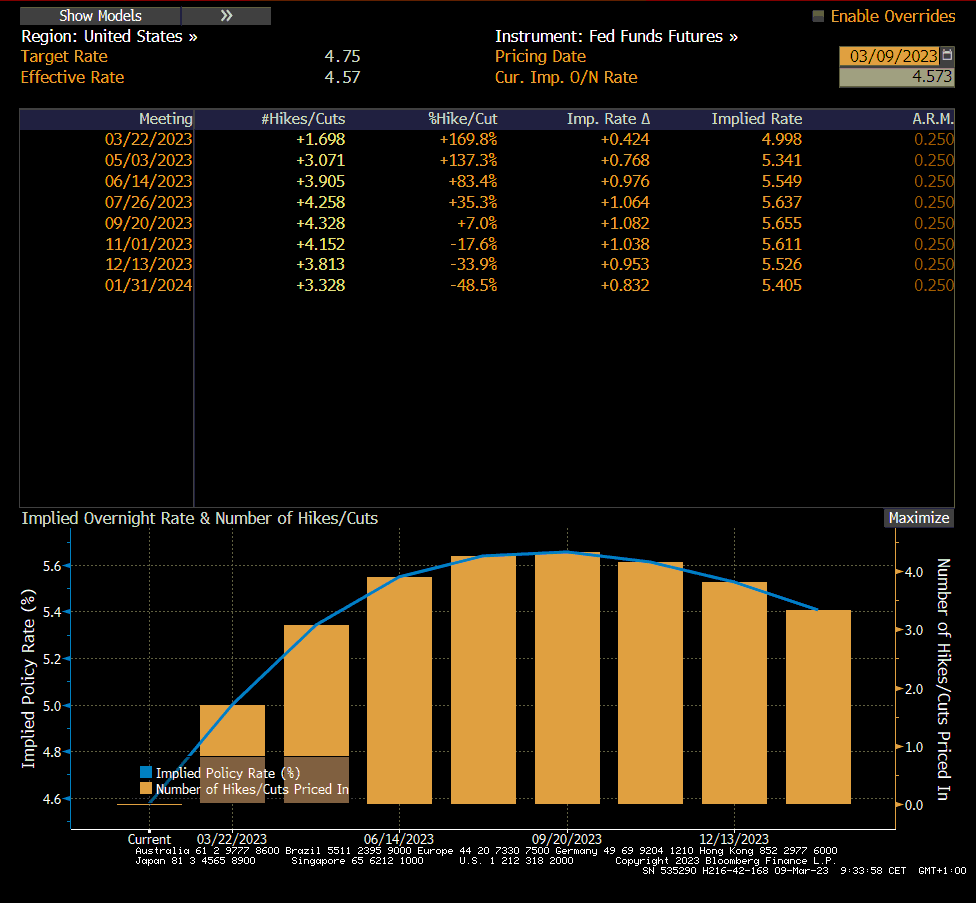

In the meantime, we will have to satisfy our hunger for data with market expectations. SOFR futures are already pricing a 70% probability of a 50bps hike on the March 22nd FOMC meeting, pushing the target range at 5.00%-5.25%. Here is the Bloomberg WIRP US function highlighting the pace of future releases:

Powell’s second day of congressional testimony before the Financial Services Committee (House of the Representatives) was perceived as a pushback against the hawkish remarks made a day earlier (FED Chairman reiterated that the decision is not already made and that it would be data-dependent once it’s been made), but actually, he was trying to put the Tuesday’s statement into the correct context. It’s quite interesting that at the same time, Powell was fighting for the correct interpretation of his own remarks, in the euro area we were monitoring an “all gloves are off” brawl between two members of ECB’s GC. On Tuesday Robert Holzmann (Head of ÖNB) came forward to the German business daily Das Handelsblatt with a statement that in his view the ECB should raise rates by 50bps on all four of the coming meetings. Holzmann really dropped the bomb this time, but his statement was just a day later rebuked by Ignazio Viscos (Bank of Italy) stating that he does not appreciate his ECB colleagues breaking the rank and coming forward with expectations of their own. Ignazio Visco and Fabio Panetta, both from Italy, are stating that hawkish members of the ECB GC are using elevated inflation data to ramp up support for their own agenda and Visco also pushed forward with a statement that with unpredictable geopolitical conditions, it’s difficult, if not impossible, to commit to any course of actions.

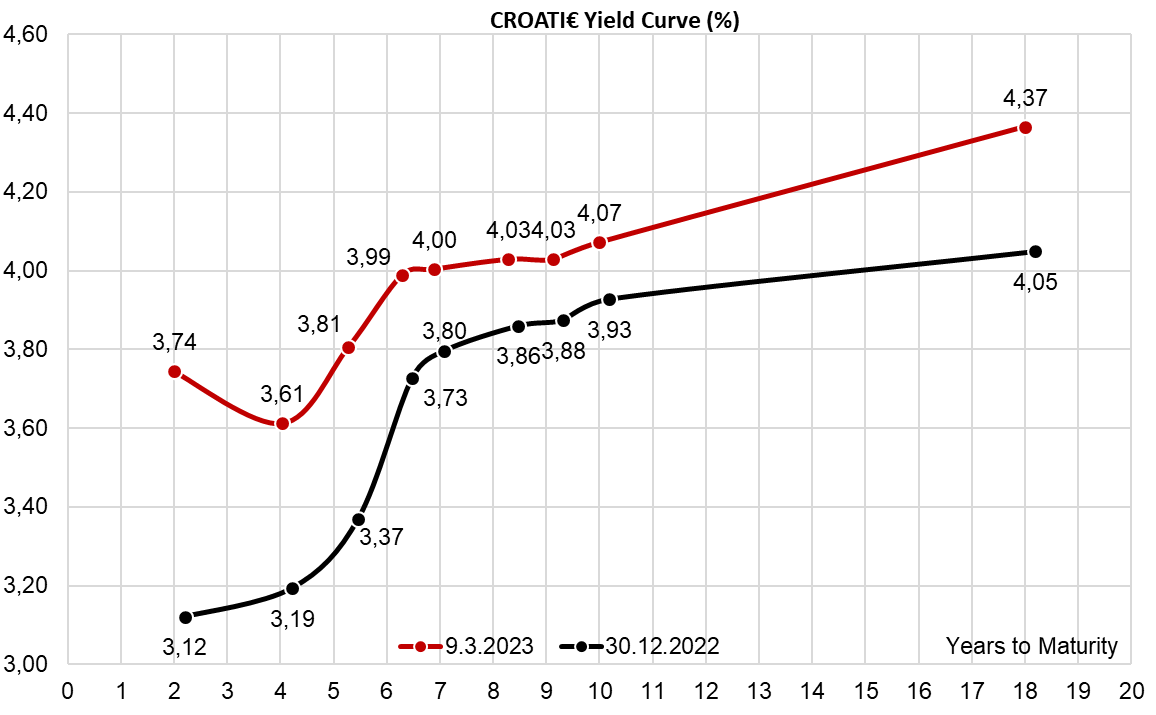

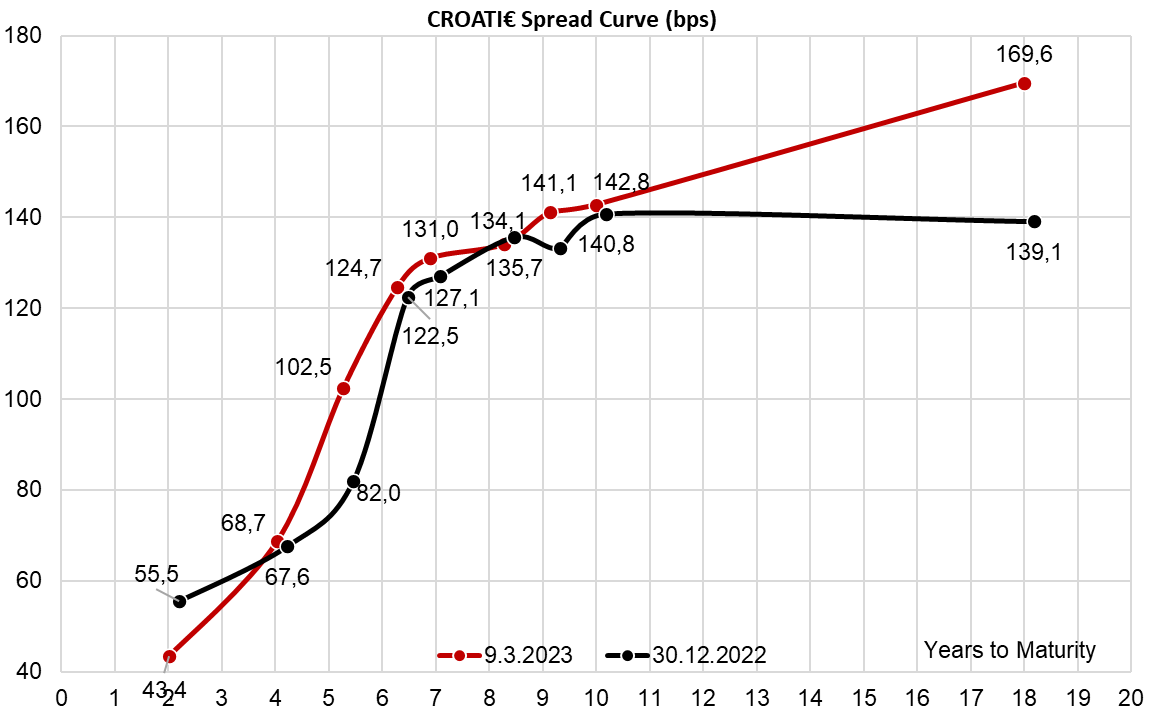

What does all of this mean for Croatian international bonds? Longer part of the curve is better offered, however, no fire sale took place in the wake of this week’s FED+ECB speech. We attribute this to the fact that CROATI€ is now held less by UCITS funds (prosaic institutional investors with shaky hands) and more by investors with stable balance sheets that can endure periods of volatility (insurances+pension funds). Nevertheless, yesterday we have seen trading in CROATI 2.75 01/27/2030€ around 92.65 levels (4.0% YTM, B+131bps at the time of execution), as well as CROATI 1.5 04/17/2031€ at levels slightly above 4.0% YTM. By looking at the two charts we regularly supply with our blogs (Croatian yield curve and Croatian spread curve), one can ask if is it possible that the placement of the new retail bond is the sole reason for the modest yield curve inversion on the front end? Notice that on the red curve of the upper chart (CROATI€ yield curve) CROATI 3 03/11/2025€ is traded at 3.74% YTM, while CROATI 3 3/20/2027€ is traded at 3.61% YTM, so there is a 13bps inversion. We would suggest looking at the spread curve instead and noticing that CROATI 3 03/11/2025€ is traded at B+43.4bps, while CROATI 3 03/20/2027€ is traded at B+68.7bps – so no inversion there. Instead, German 2Y4Y spread currently stands at some 40bps (i.e. 2Y is 40bpbs above the 4Y in terms of yields), causing the Croatia yield curve to invert as well because spread steepness is not high enough to provide a buffer.

Yesterday, Croatian Regulatory Authority for Network Industries (HAKOM) announced that the public auction for the spectrum allocation has ended. The total amount of fees for the use of spectrums amounts to EUR 339m at the national level, compared to the initial price of EUR 154.8m. Permits are issued for 15 years for all allocation areas with the possibility of extension for a maximum of five years, as determined by EU-level rules.

Yesterday, Croatian Regulatory Authority for Network Industries (HAKOM) announced that the 6-week public auction for the spectrum allocation has ended. The total amount of fees for the use of spectrums amounts to EUR 339m at the national level, compared to the initial price of EUR 154.8m. Permits are issued for 15 years for all allocation areas. Further, according to the EU-level rules., there is a possibility of extension for a maximum of five years. Finally, we note the biggest total amount spent per frequency band amounted to EUR 120.4m for 2100 MHz, which should not come as a surprise, as this frequency band is used for 5G. Also, each of the three telecoms spent the most for this frequency band, individually, compared to all other categories.

Below we present you the total amount of fees spent per company for all spectrums bided, compared to the initial price for the use of spectrums.

Total amount spent by telecoms for all spectrums vs. initial price

Source: HAKOM, InterCapital Research

At the share before the announcement, the dividend yield amounted to 1.3%. The ex-date is set for 30 May 2023.

Electrica published an OGSM and EGSM call on the Bucharest Stock Exchange, in which the proposal by the Company’s Board of Directors for the distribution of profit was included. According to the press release, they proposed the distribution of the 2022 profit in the amount of RON 39.9m, which in per-share terms, would imply a dividend of RON 0.1178. At the share price before the announcement, this would imply a DY of 1.3%.

The ex-date for the payment is set for 30 May 2023, while the payment date is set for 23 June 2023. The proposal is subject to approval by the GSM, which will be held on 27 April 2023. Below we provide you with the historical dividends per share, and dividend yields of the Company.

Electrica dividend per share (RON) and dividend yield (%) (2015-2023)

Source: Electrica, InterCapital Research