This week we have seen yields in the euro area reaching multi-year highs on the narrative that ECB could accelerate their rate hikes and that was just into for today’s policy meeting. We expect Ms Lagarde to announce the end of APP and to present plans for rate hikes. In this brief article, we are looking into the details of the latest increase in rates and what to expect further.

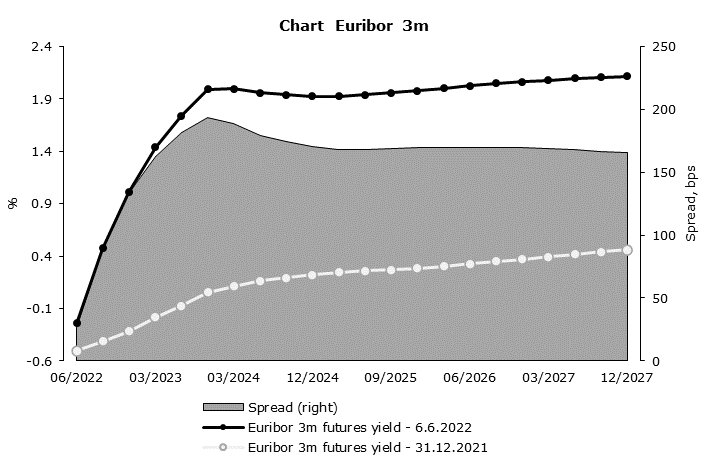

In 2022 we witnessed a significant rise in yields around the globe but also saw several mini cycles. First, we saw strong growth in yields due to inflation reports and central banks becoming more hawkish than expected. Then equity markets dropped due to lower valuations, with some worrying economic data which pushes one or two central bankers to announce a pause in rate hikes in the future. However, then inflation reports surprised the markets once again, driving hawkish central bankers to become louder, pushing rates even higher and repeating the process. In the last two weeks, we have seen another leg higher in EUR rate markets as inflation in euro area came higher than expected i.e., at 8.1% vs 7.8% expected, while core inflation stood at 3.8% YoY. Yields shoot up with bund yield overjumping 1.30%, while 5Y German paper was above 1.0%, a level last time seen in 2014. Furthermore, Euribor futures reveal that market expects 3 hikes until September which would mean that ECB must hike rates already today if they want to go with 25bps steps or will have to lift by 50bps in July or September. Well, some of the uncertainties should be solved today with the long awaited monetary policy meeting.

Several ECB officials could vote for the rate hike already today, although that would be contrary to what Ms Lagarde was saying at the last meeting. Namely, Ms Lagarde insisted on the gradualism, saying that rates will be lifted sometime after exiting from APP (“could be days, weeks”). Nevertheless, inflation is creeping higher and central banks around the world are hiking almost every day with RBA being the last, lifting rates by 50bps versus 25bps expected. Also, that would not be the first time that ECB changed its opinion rather quickly (remember Lagarde in December 2021 saying that rate hikes are unlikely in 2022). So, in respect of rate hikes, we would not be surprised in case ECB decides to lift rates today to come ahead of the curve. Furthermore, it will be important to see what tools is ECB planning to use to signal that fragmentation will not be allowed. Just to bear in mind, the Italian 10Y spread jumped to 215bps last week and then decreased towards 200bps once again as FT sources said that ECB will support a new bond-buying program to close the spreads.

Talking about yield spreads, in the last few weeks, we have seen a solid tightening of the spread between USD and EUR benchmarks. Namely, US 2Y is still off their highs, currently at 2.75% while German Schatz sky-rocketed to 0.70%, resulting in a spread coming close to 200bps versus 250bps in mid-May 2022. Furthermore, 10Y papers tightened from above 200bps to below 170bps today. This reflects renewed hawkishness in the euro area on one side and fear of recession in the US on the other side. Nevertheless, data from the US are still mixed and some of them are showing that consumer spending is still strong in US while inflation still did not decelerate, and we will not have to wait for long to see new data. Tomorrow, we have another blockbuster event, namely, US May’s inflation data which is expected to land at 8.2% YoY and 0.7% in MoM terms.

Source: Bloomberg, InterCapital

At the end of April 2022, the total deposits in Croatia equaled HRK 366.7bn, representing an increase of 0.6% MoM, 9.4% YoY.

The Croatian National Bank (HNB) has published its monthly consolidated statement of financial positions of the monetary financial institutions. According to HNB, at the end of April 2022, the total deposits in Croatia amounted to HRK 366.7bn, which would mean that on an MoM basis, they grew by 0.6%, while on a YoY basis, they grew by 9.4%. With the current geopolitical situation, the increase in inflation across the EU, prompting the ECB to finally start increasing interest rates going forward in 2022 (something that the Fed has done months ago), this leads to a decrease in investments into financial assets (stocks directly and debt indirectly through various funds), and an increase in deposits as the most liquid type of asset. It should also be noted that traditionally, Croatian households retain higher than average (compared to the EU) deposit levels.

Looking at the deposits by their components, on a YoY basis, demand deposits grew by 16.8% YoY and amounted to HRK 154.5bn, while saving deposits grew by 4.6% YoY, amounting to HRK 212.1bn. This increase was also recorded on the MoM basis, as both demand and saving deposits grew, by 0.7% and 0.4%, respectively.

Looking at the saving deposits by themselves, we can see one other trend continuing. Based on the currency, saving deposits in HRK decreased by -12.6% YoY, -2.6% MoM, and amounted to HRK 28.1bn. This would also mean they amounted to 13.3% of the total saving deposits, a decrease of -2.6 p.p. YoY, 0.42 p.p. MoM. On the other hand, saving deposits in foreign currency increased by 7.8% YoY, 0.9% MoM, and amounted to HRK 183.9bn. This would mean that in April, they amounted to the remaining 86.7%. Considering that Croatia is expected to enter the Eurozone in January 2023, and the dual pricing model is to be implemented in September, the switch towards foreign currency is expected and should accelerate as the date of the ascension closes.

Finally, taking a look at the household deposits alone, they increase by 9.2% YoY, 0.6% MoM, ending the month at HRK 250.2bn. This also means that 68.23% of all deposits held were household deposits, representing a decrease of -0.14 p.p. YoY, but an increase of 0.04 p.p. MoM.

Croatian deposits breakdown (November 2012 – April 2022, HRK bn)