For today, we decided to present you with an update asset structure analysis of Croatian UCITS funds.

Since the asset managers play a very significant role in the Croatian capital market, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. Given that the global financial markets observed a partial recovery in April, it is worth seeing how Croatian UCITS funds performed during that period.

According to the report, NAV of all funds in April 2020 experienced a slight increase of 1.4% MoM (or HRK 225m), amounting to HRK 15.87bn. This also represents a decrease of 17.8% YoY and a decrease of 29.7% YTD.

As a reminder, in late February until late March UCITS funds recorded the majority of the yearly decrease in their NAV . HANFA noted earlier this year that since 21 February until 24 March, 86.1% of the decrease could be attributed to withdrawals from the funds, while the rest 13.9% can be attributed to a change in value of assets in which the funds invest. As turmoil on financial market subsided withdrawals from funds were halted, but the value of most financial instruments has not yet returned to pre-crisis levels.

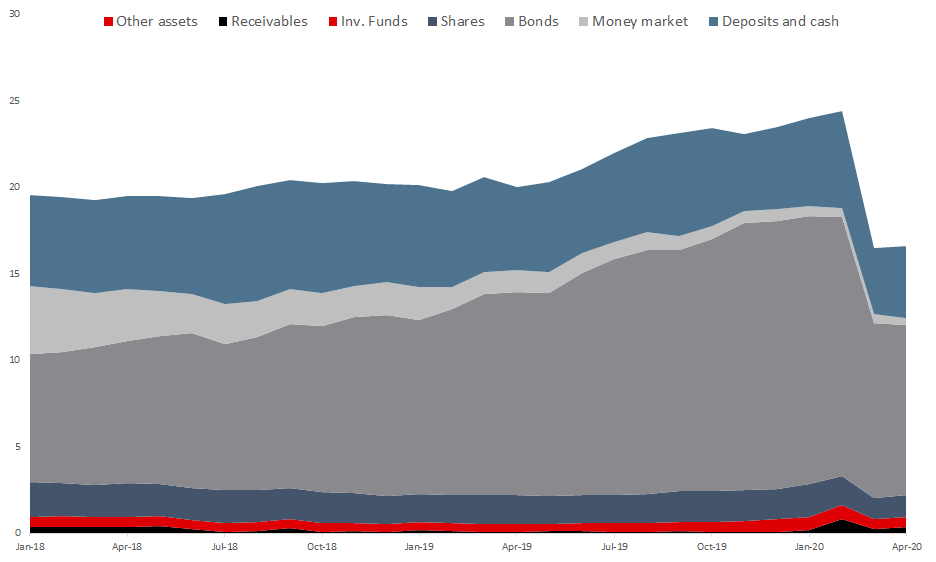

Asset Structure of UCITS funds (April 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to 59% in the April of 2020. Such a decrease could be attributed to withdrawals from funds which (predominantly) invest in the mentioned asset class, but also to decrease in value of bonds compared to the end of 2019.

Money market funds and shares which currently account for 2.5% and 7.7% of the total asset structure of UCITS funds, remained relatively flat both on MoM and YoY basis.

Total Assets of All Croatian UCITS Funds (2018 – April 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

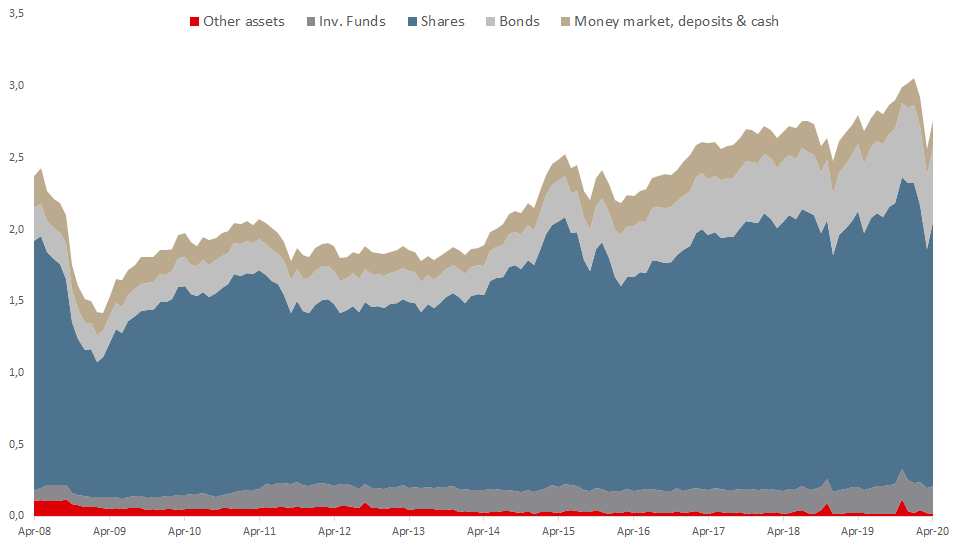

As of April 2020, Slovenian mutual funds manage EUR 2.76bn, representing a decrease of 1.31% YoY.

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

As of April 2020, shares account for 66.9% of the total assets structure of mutual funds, which is slightly above the historic minimum of 65.6% in the observed period. Note that the equity holdings of Slovenian mutual funds reached their peak in September 2007, when they accounted for 76.4% of the total asset structure.

Next come bonds, which make up for 18.7% of the total asset structure, and which is a slight decline from all-time high of 20.0% that happened in March 2020. Investment funds share in AUM amounts to 7% of total assets. Money market, deposits & cash, follow, making up 6.8% of total AUM.

As of April 2020, Slovenian mutual funds manage EUR 2.76bn, observing a slight decline of 1.31% YoY . It is worth noting that mutual funds are experiencing slight recovery after a considerable loss in March 2020 due to crisis caused by the Covid-19 pandemic, as AUM of Slovenian mutual funds increased 7.82% MoM. Meanwhile, on a YTD basis, AUM is 8.6% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak.

Source: Securities Market Agency, InterCapital Research