Since March 2020 when PEPP program was announced, ECB bought EUR 571bn worth of eligible bonds with 90% of them being public sector’s securities driving sovereign spreads in eurozone close or even below levels from pre-corona period. In this article we are looking at the details of the most recent PSPP data and what could we expect in the following months.

In the midst of coronavirus crisis (March 2020), Ms. Lagarde introduced ECB’s pandemic emergency purchase programPEPP “…to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the coronavirus outbreak”. The PEPP envelope was initially worth EUR 750bn but the amount was subsequently increased to EUR 1.350bn. Besides expanding their toolkit, PEPP program provided ECB with more flexibility then existing APP. ECB could now also buy securities issued by Greek government (not eligible under APP) and greater flexibility was implied considering capital keys. This allowed the ECB to buy more periphery bonds in the beginning and to “close the spreads”.

Recent data reveals that in August and September ECB bought EUR 126.8bn worth of securities (raising the cumulative net purchases to EUR 511bn). That was significantly lower compared to the March-May and June-July period when ECB bought EUR 186bn worth of papers every two months, obviously due to larger volatility on the markets in the beginning of the crisis. Interestingly, latest data also show that most purchases in the last two months were made closer to capital keys leaving the ECB with more firepower in case spreads start to widen once again.

Talking about capital keys, in the latest data Italian papers weighted 18.03% of total sovereign purchases in August-September period compared to 21% in the period March – July (its capital key stands at 17.0%). On the other side, France benefited in the last months as it was significantly underbought considering capital key before. German papers’ weight stood around 26.0% which is very close to its capital key for the whole period since PEPP started. ECB obviously decelerated its QE during slow summer months but also since market calmed and spreads tightened significantly. In case ECB decides to spend the whole PEPP envelope until June 2021 (as was previously announced by Ms. Lagarde), it will have to increase its purchases once again. However, we do not expect ECB to forcefully spend the remaining amount ceteris paribus but rather to extend the period in which is possible to use it.

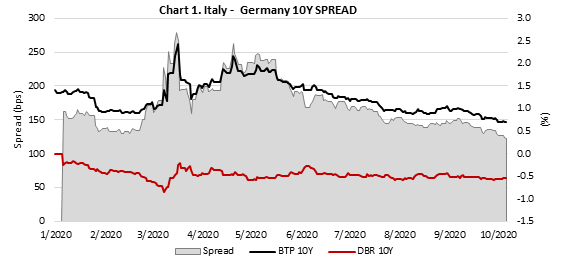

Moving to the topic of yield spreads. Just look at Italian 10Y spread versus German Bund which now stands at the lowest level year-to-date (128bps) while being only 15bps above lowest level ever recorded. To put things into perspective, 6 months ago the yield on Italian 10Y paper stood at almost 3.0% while at the time Bund was almost 90bps in the negative territory. Italian 10Y paper now trades below 80bps. Another thing worth mentioning is that Greek 10Y bond is once again trading below 1.0% which looked quite impossible only half a year ago when there was no bid for the paper and yields were skyrocketing over 4.0%.

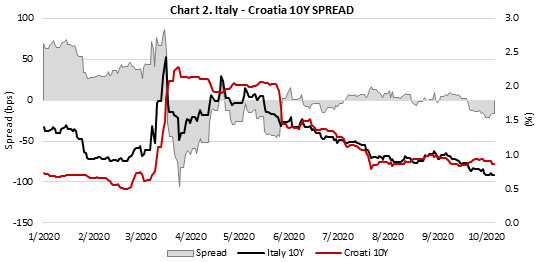

Spreads continue to tighten while QE is being decelerated. Does this mean we are out of the woods yet? Well, not really which is best seen with sovereigns which are not under the ECB umbrella. Namely, Croatian and Hungarian 10Y EUR denominated Eurobonds are still more than 50bps wider compared to pre-corona levels and that could be one of the benchmarks for risk-on and real money buyers. Although one number can’t ever be enough to rely on, once Croatian 10Y is traded again at 80bps spread against Bund, I think it would be fair to say that we are out of the woods, at least concerning the financial markets.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital

For today we decided to look at EBITDA and profit margins of Romanian Companies.

For this we used H1 2020 results. Note that financials were excluded from the analysis.

It is important to note once again that comparing the margins across the selected companies is not necessarily the best way to do the comparison as many companies operate in different industries. Since both EBITDA and profit margin reflect to a great extent the industry in which the company operates in, we advise to compare it to the peer average or median. Nevertheless, it is still worth seeing which Romanian companies are more profitable and therefore have more “room” to potentially reduce the prices of their goods or services if needed, while still remaining a higher level of profitability.

EBITDA margin (trailing 12m)

As visible from the graph, all of the 11 observed companies have a double-digit EBITDA margin, with Romgaz leading the list (52.15%), followed by Nuclearelectrica (51.5%). Next comes Digi Communications with 38.5%. Such results are expected given that the industries in which these companies operate tend to have a relatively high EBITDA margin. However, the Digi operates with a negative (trailing 12m) profit margin, due to a high net loss of EUR 56m recorded in Q1 2020. As a reminder, the company reported a high net financial loss of EUR 98.1m in Q1. On the flip side, and MedLife operate with the lowest EBITDA margin of 11.26%.

When looking at the profit margins, 6 companies operate with a double-digit margin, while Nuclearelectrica operates with the highest margin of 25%. Next comes Transgaz with 24.6%. The difference between the company’s EBITDA and profit margin is rather small, which could be explained with the company’s H1 results being further boosted by FX gains as well as the fact that the company operates with relatively little debt. On the contrary, MedLife has the lowest (positive) profit margin of 0.3%. Next comes Sphera Franchise Group with 1.89%, as the company’s bottom line was severely hit by the pandemic (the most of all observed companies). To be specific, the company had to struggle with measures taken to prevent the spread of the Covid-19 virus which led to the closure of their restaurants. In 2019, Sphera’s profit margin stood at 5.8%.

To recap on H1 top line and bottom line performance of Romanian companies click here.

Profit margin (trailing 12m)