With less than 2 months remaining in 2022, we decided to take a look at how the global shipping industry performed, as well as how that reflected on the largest domestic shipping companies and their results.

The shipping industry has been on a rollercoaster of a ride since 2020. Travel restrictions, sudden drops in demand, the decrease in commodity prices, as well as the dozens of ships waiting for days or even longer to offload their cargo, something that usually needed hours or at most, a day. 2021 followed by a surge in demand for commodities and leading to an increase in the prices of these commodities. Subsequently, the increase in the demand for shipping was also recorded, which had a profound effect on the pricing.

In 2022, the supply chains finally started to recover, albeit there were still some hiccups like the continued zero COVID-19 policy in China, the world’s manufacturing hub, and the largest export/import market. Of course, the start of the war in Ukraine only made the situation worse, as the supply of commodities such as oil, gas, wheat, and rare earth metals, among others, became increasingly limited. In this environment, and also taking into account the strong inflationary pressures across the world, we decided to look at how the shipping industry is doing, especially the largest domestic shipping companies.

First of all, let’s look at the data.

Baltic Dry Index (2015 – present, points)

Source: Bloomberg, InterCapital Research

The Baltic Dry Index (BDI) is a shipping freight cost index that is issued daily by the London-based Baltic Exchange. The BDI is a composite of the Capesize (app. 170k Dry Weight in Tons, DWT), Panamax (app. 82.5k DWT), and Supramax (58.3k DWT) of Timecharter Averages. Divided by those categories, Capesize makes up 40%, Panamax makes up 30%, and Supramax makes up the remaining 30% of the BDI index. Overall, the BDI index is used as a proxy for dry bulk shipping costs around the world, and as such can be an indicator of future economic activity, as the ship costs that the index tracks directly correlate to the demand for those ships. Due to their size and costs, these ships are employed only when needed by countries and large companies, implying the aforementioned activity demand. Since the beginning of the year, it decreased by 38%, while compared to the level it was at the end of December 2019 before the pandemic, it is up 26%. What this can tell us is despite the drop in 2022, the supply chains have yet to return to their pre-pandemic level of efficiency, and as such, prices are still higher. Furthermore, the prices of commodities are also higher, and as such, the price of shipping that is used to transport them should also be higher, as this data can tell us.

Baltic Dirty Tanker Index (2015 – present, points)

Source: Bloomberg, InterCapital Research

Next up, we have the Baltic Dirty Tanker Index (BDTI), which is an important price index for the global shipping of oil on standard routes. It is an index that tracks 17 major shipping routes and it tracks the costs for some of the largest categories of ships. The demand for oil and thus the freight rates of the tankers that this index tracks are under the influence of the following factors: GDP growth in countries, structural changes in the economy, technological progress, as well as the development of the oil prices. Besides the changes in available cargo space (which determines the price of the remaining available vessels), the price of the index is also influenced by port capacities, fluctuations in demand, and new demand from growing economies such as China and India. With the war in Ukraine also influencing the demand for Russian oil (across Europe primarily), the increased demand for oil, with lower supply due to the lower amount of Russian oil available in the market, means that the index can indirectly show us how these fluctuations are affecting the price. Furthermore, following OPEC+’s recent decision to reduce oil production by 2m barrels/day, in order to stabilize the price that was falling after further announcements on sanctions to Russia, the price is still quite volatile, as is the whole situation.

The BDTI index has increased by 130% since the beginning of the year, indicating two things. On the one hand, oil supplies from Russia have been reduced. As Russia is one of the world’s largest exporters, this means that replacement for that oil has to be found, and in the short term, this leads to higher oil prices. On the other hand, just because there is less oil available on the market that does not mean that countries will require less of it. With the lower amount of supply from Russia, the demand for oil from other countries increased, driving up prices. In fact, the price of oil (Brent contracts) increased by 21.4% YTD. Compared to the pre-pandemic level, however, the BDTI index is only 13% higher, indicating that even at the beginning of 2022, the world was yet to recover all of its demand for transporting oil, and by extension, the oil itself. It should also be noted that China, the largest importer of oil in the world, is operating well below its normal capacity due to the zero COVID-19 policy still in force in the country. Looking at the prices of oil compared to the pre-pandemic levels, it is 43% higher. However, it should be noted that if we look at the correlation between the changes in the BDTI and oil prices, it amounts to 0.15, indicating a very low correlation between them. This can tell us that despite the fact that oil price is a factor in determining the prices of tankers, it is by far not as significant as one might imagine. A lot of other factors are also playing a crucial role, such as the available global tanker capacity, and the congestion in ports, among others.

Freightos Baltic Index ( October 2016 – present, USD)

Source: Bloomberg, InterCapital Research

The Freightos Baltic Index, also known as Freightos Baltic Global Container Index, is a daily container index issued by the Baltic Exchange and Freightos. The index measures global container freight rates, by calculating spot prices for 40-foot (12.19 meters) containers, the standard size containers on most transport ships, for 12 global trade lanes. As such, the index is used around the world as a proxy for shipping stocks, as well as the general shipping market’s health. Like with the remainder of the shipping industry, it is under the influence of the supply and demand of the goods which are transported, the macroeconomic situation, as well as the currently available number of ships. Since the beginning of the year, the index has declined by 64.6%, and it currently amounts to USD 3,340 per container. Compared to the pre-pandemic period, it is up by 131%. Again, this implies a similar thing as the other two indices; the supply chains have yet to recover since the beginning of the pandemic, leading to a lot higher costs compared to that period. At the same time, the YTD drop is also the trend we can see with the BDI index, which could imply that there is an expected reduction in future economic activity, both in the terms of commodities required, but also in terms of the transportation of finished goods.

So in this environment, how are the Croatian shipping companies performing? To see this, we looked at the largest listed Croatian shipping companies on the ZSE, i.e. Atlantska Plovidba, Tankerska Next Generation, and Jadroplov. How did they perform during the 9M 2022?

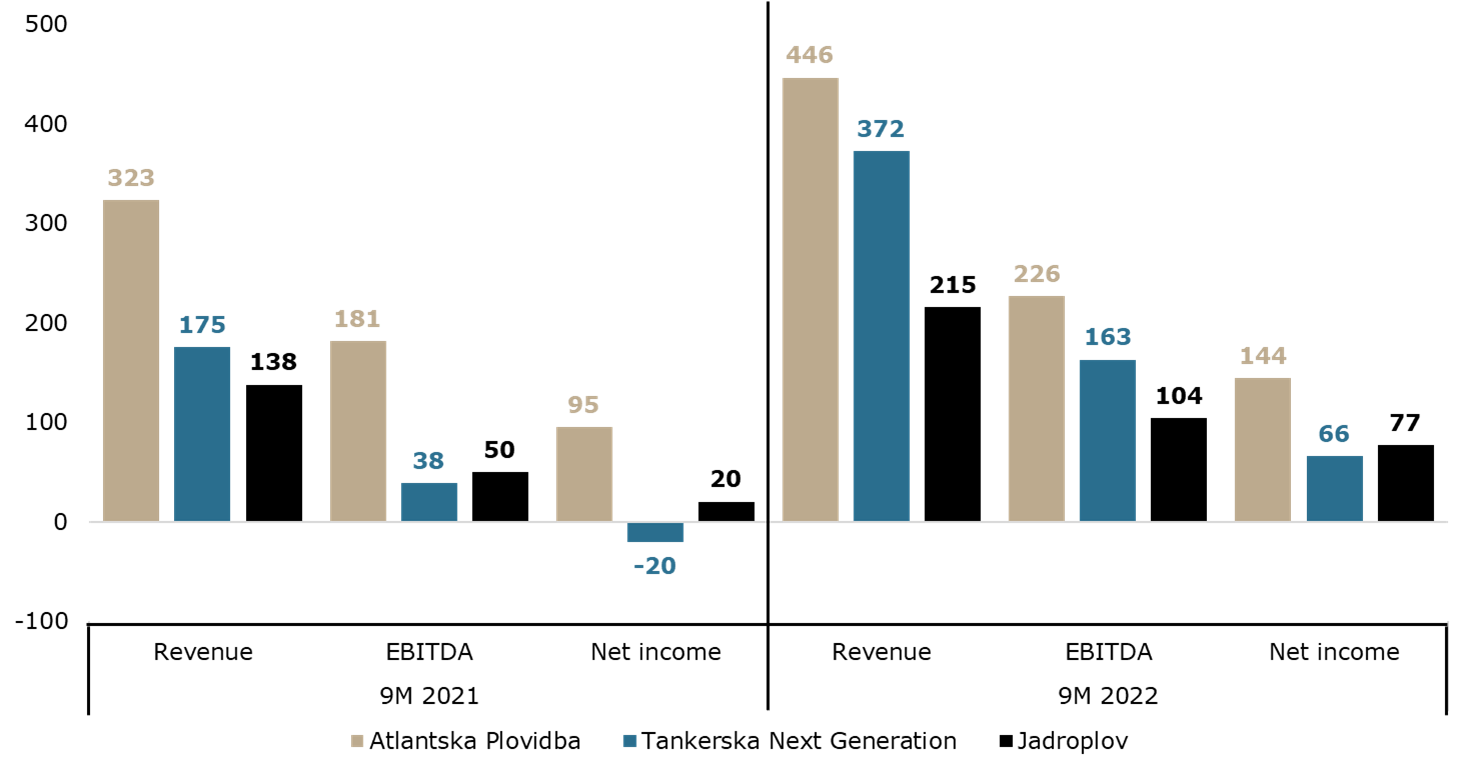

Key Financials of ATPL, TPNG and JDPL (9M 2022 vs. 9M 2021, HRKm)

Source: Atlantska Plovidba, Tankerska Next Generation, Jadroplov, InterCapital Research

As we can see, the Croatian shipping companies recorded significant growth in their finances, both on the top line and the bottom line. In 9M 2022, Atlantska Plovidba recorded an increase in revenue of 38% YoY, an EBITDA growth of 25%, and a net income increase of 52% YoY. Jadroplov recorded revenue growth of 56% YoY, an EBITDA increase of 109%, and net income growth of 279% YoY. Finally, Tankerska Next Generation recorded an astounding 113% increase in revenue, an EBITDA growth of 324%, and a net income of HRK 66.8m (9M 2021: HRK -20.2m), an improvement of more than HRK 86m YoY. Even though these companies operate in the shipping industry, they do operate in different segments, from dry bulk to oil transportation, from smaller-sized ships to truly massive behemoths. This is the cause for the difference in results, but overall, 2022 proved to be one of the best years for the shipping sector.

How did these results translate into the companies’ share prices?

ATPL, TPNG, and JDPL share price change (2016 – present, %)

Source: Bloomberg, InterCapital Research

Since the beginning of the year, Atlantska Plovidba share price increased by 3.2%, Jadroplov’s share increased by 28.1%, and TPNG’s share increased by 84.2%. Compared to their pre-pandemic levels, Atlantska Plovidba’s share increased by 2.4%, TPNG’s share increased by 63%, and finally, Jadroplov’s share increased by an astounding 5.6x! However, it should be noted that besides solid results, the prices were also under the influence of other factors; for example, TPNG’s share price was also under the influence of its majority shareholder, Tankerska Plovidba’s decision to buy out to over 91.4% of the Company’s shares, and to launch a voluntary takeover bid for the remainder of the shares.

In summary, it could be said that despite the expectations of an economic downturn present since the beginning of the year, but growing ever stronger as time passed, the demand for shipping is still strong. This is quite a paradox in a way. If there is an expectation of a slowdown in economic activity, there should be a reduction in industrial production and general output. But this has not yet proven to be the case. There are several reasons for this. First of all, the economic slowdown is supply-driven, with the prices of commodities increasing more due to the lower supply (due to, for example, lower supply of certain commodities from Russia and Ukraine), and as such, new sources of these commodities have to be found. This has led to increased demand for commodities from other countries, which keeps the shipping industry busy despite the macroeconomic turmoil and high inflation rates. As such, the shipping industry has performed admirably this year. However, if the supply issues do get fixed, and the demand continues to decrease due to the threat of recession increasing, this will surely hit the shipping industry as well, sooner or later.

In October 2022, SBITOP increased by 5.6%, ending the month at 1,016.87.90 points.

The total equity turnover on the Ljubljana Stock Exchange amounted to EUR 25.9m, which represents a decrease of 8.4% MoM and an increase of 15.5% YoY. This would also mean that during the month, the average daily turnover amounted to EUR 1.18m.

We note that there were two block transactions during October2022 of Krka, amounting to EUR 1.04m and Petrol of EUR 899k.

Looking at the top 5 most traded stocks, they had a turnover of EUR 23.4m, which would account for 90.4% of the total turnover which is not surprising for the Slovenian market. Breaking this down further, Slovenia’s heavyweight Krka had the highest turnover, at EUR 11.7m (or 45% of the total equity turnover), followed by NLB with 4.6m (or 17.9%), Petrol with 3.6m (or 13.9%), Zavarovalnica Triglav with 1.8m (or 7%), and Cinkarna Celje with 1.7m (or 6.6%).

When it comes to prices, Slovenia’s main index SBITOP increased by 5.6% during the month and ended above the 1,000 level at 1,016.87 points. At the same time, SBITOP TR also increased by 5.6% and ended the month at 1,272.72 points.

Looking deeper at the SBITOP constituents’ performance during the month, most of the constituents have recovered in price during October, as they were hit more significantly during the month before. Petrol recovered part of its capitalization with a 16.5% increase in share price in October, followed by Sava Re with a 8.4% gain, Luka Koper with 6.3% and Triglav with 5.4%. The only company that recorded a decrease in share price was Cinkarna Celje, with a loss of only 2.5%, while NLB and Telekom Slovenije remained flat.

Performance of SBITOP constituents (October 2022, MoM, %)

When it comes to YTD performance, SBITOP has reported a high decline of 19.2%. Looking deeper at the Slovenian SBITOP index on a YTD basis, the picture stays pretty much the same. Each of the constituents has recorded a decrease in share price since the beginning of the year. The biggest winner (or smallest loser in this care) was Luka Koper, with a loss of “only” 2.9%, followed by Triglav and Cinkarna Celje with a 10.1% and 11.2% decline in price, respectively. Unior follows with a 13.2% decline and Telekom Slovenije with 14.2%. The biggest losses were recorded by NLB with a 29.7% decline, followed by Krka and Sava Re, decreasing by 24.2% and 21.1%, respectively. Petrol follows with a 15.2% decline

Performance of SBITOP constituents (October 2022, YTD, %)