On the last day of October Croatian government presented draft budget for 2020 and sent it to the parliament for vote. HDZ-led government expects consolidated budget to end 2019 with deficit of 0.1% GDP (ESA 2010 methodology) while presented document envisages surplus of 0.2% and 0.4% GDP in 2020 and 2021, respectively. In this article we are analyzing drafted budget and its consequences for the capital markets.

Croatian budget for 2020 was based on relatively optimistic macroeconomic scenario. Namely, government expects GDP to grow by 2.8% YoY in 2019 and then to deteriorate only modestly to 2.5% and 2.4% in 2021 and 2022. They expect personal consumption to be on the front seat for the next three years while growth of investments should decelerate from 8.5% YoY in 2019 to 6.1% in 2020 and to 5.2% in 2022. However, government expects growth of exports to increase to 3.0% in 2022 (2.3% in 2019) driven by acceleration of exports of goods which could be questioned in case of prolonged economic slowdown or even recession among Croatian main trading partners. On the other side, government expects imports of goods and services to grow at slower pace which Finance Minister stated as one of the goals for the future. Also, worth mentioning is that unemployment is expected to fall further, from 8.4% in 2018 to 6.3% in 2022 while average salary is expected to rise by 3.5% in average in period 2019-2022. Just to put things into perspective, most CEE countries are most likely to see stronger deceleration in the following years due to slowdown of core EU countries and several geopolitical risks. However, one should mention that most of them rose at higher pace compared to Croatia so looking at relative change, modest slowdown of Croatian economy could still be in cards in case no major deterioration takes place in developed world.

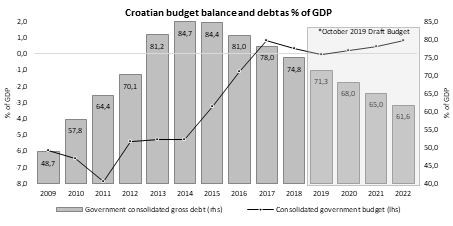

After two years of posting consolidated budget surpluses, Croatia is expected once again to see deficit, although in rather small amount of HRK 582m, i.e. 0.1% of GDP. However, in 2020 Mr Maric expects budget to be in surplus of 0.2% of GDP and 0.4% and 0.8% in subsequent years. Eventually, with above mentioned GDP growth, that should force debt/GDP more South, i.e. to 61.6% in the end of 2022, according to Ministry of Finance.

Source: Ministry of Finance, InterCapital Research

So, what’s in the budget for 2020 and what changes it includes? First, Ministry of Finance expects revenues to increase up to HRK 145,1bn or 5.4% YoY down from 6.4% that we’ll most likely see in 2019. Although government expects tax revenues to increase by 3.1% YoY in 2020, strongest driver of next year’s increase should be EU funds that are expected to increase by 23.2% YoY due to slower withdrawal in 2019 (first plan for 2019 was HRK 17,45bn however only HRK 15,23bn is now expected to be withdrawn). As said above, tax revenues should increase slightly above GDP growth despite 4th round of tax reform that will include decreased income tax for young workers, several tax deductions such as food and housing allowance for workers, higher limit of net income to be taxed at lower corporate income tax and so on. As wages are expected to grow around 3.5% in 2020, social security contributions are also expected to rise, by 3.9% YoY and accelerate to 4.6% and 4.5% in 2021 and 2022.

On the other side, expenditures are expected to rise by 5.0% YoY in 2020 (HRK 147,29bn) and 1.2% in both 2021 and 2022, reflecting slightly optimistic stance of the government, bearing in mind that 2020 is election year. As most likely wages are set to rise further in the following years, wage expenditures are expected to increase by 7.2% in 2020 compared to 3.4% in 2019. It’s worth noting at this moment that proposed budget has already calculated wage increase of 6.12% for all public workers. Although we are still to see how government plans to finance maturing bonds in November, the most obvious cut in expenditure is coming from lower debt burden. Namely, interest costs stood at HRK 9.71bn in 2019 and will decrease sharply to HRK 8.06bn and 7.39bn in 2020 and 2021, resulting in savings of almost HRK 4bn in just two years that we should thank to economic cycle and ex-ECB governor Mr Mario Draghi.

If you were focused on numbers above close enough, you realized that central government is expected to end 2020 with deficit of HRK 2,15bn. However, when consolidated with local government, SOEs and other adjustments consolidated budget should post plus.

And last, looking at Croatian bond market, in case government’s plans go through it seems like both local and Eurobonds could become even more illiquid as government’s financing needs are decreasing meaning that government will just roll existing bonds or decrease its debt stock while Croatian financial industry is becoming bigger and bigger meaning that current situation where Croatian HRK 10Y bond yields 10bps less compared to its EUR denominated Eurobond peer could stay with us for a while.

In 9M 2019, the group recorded an increase in net interest income of 9.7% YoY, increase in net fee an commission income of 2.1% and an increase in net profit of 7.4%.

As BRD published their 9M 2019 report, we are brining you key takes from it. According to the report, net interest income amounted to RON 1.6bn, representing a strong growth of +9.7% YoY. Such an increase came on the back of volumes growth on all segments and favorable structure shifts, while still benefiting of rising RON interest rates. Meanwhile, net fee and commission income observed a growth of 2.1% YoY, which could be attributed to the dynamic cards business. As a result, Group’s net banking income witnessed an increase of +6.9%, amounting to RON 2.45bn.

Operating expense were 7.4% higher, amounting to RON 1.18bn, which can mostly be attributed to a rise in staff costs (+6.9% YoY), and regulatory costs (RON 72m vs RON 35m in 2018). Consequently, CIR stood at 48.5%, showing a slight increase of 0.24 p.p. YoY.

The quality of the loan portfolio further improved, which can we seen by the continued decline in NPL ratio to 4.0%, a decrease of 1.8 p.p. and a solid level of coverage ratio of 74.1%.

Risk costs remained once again positive, amounting to RON 207m, as a result of a strong recovery performance and the exceptional insurance indemnities, within a favorable economic environment.

As a result of all the above, BRD Group observed a solid performance of the bottom line, with net profit amounting to RON 1.23bn (+7.4%).

BRD Group Performance (9M 2018 vs 9M 2019) (RON bn)

Turning our attention to the balance sheet, total assets recorded an increase of 2.7%, amounting to RON 55.98bn. Of that, net loans and advances to customers recorded a growth of 3.3% YoY and currently account for 54.1% of the total assets. The mentioned growth was mostly driven by growth of loans to individuals and large corporate customers. On the liabilities side, deposits from customers, amounted to RON 43.9bn (+0.9% YoY). The slight increase was backed by higher inflows from individuals, small and medium business customers, still mostly driven by sight deposits. As a result, L/D ratio stood at 67.2% (+1.6 p.p. YoY), showing room for further potential loan growth.

On the bank level, the CAR stood at 20.9% (+1.5 p.p. YoY), indicating that the bank is well capitalized. Of that, the capital adequacy ratio consists solely of Tier 1, which stood at 20.9%.

Trading statistics for October 2019 show an average daily turnover of EUR 6.96m (-18.8% YoY).

The Bucharest Stock Exchange published their trading statistics for October 2019, showing an average daily turnover of EUR 6.96m, representing a decrease of 18.8% YoY.

When observing the top traded shares, one can notice that Romgaz recorded the highest turnover of RON 203.45m. Banca Transilvania follows with a turnover of RON 130.6m. Next comes Purcari with RON 100m. As a reminder, in early October, Lormier Ventures Limited, sold 4,539,223 shares, representing 22.7% of Purcari’s share capital, which made them (as of 31 December 2018) the second largest shareholder, behind Amboselt Universal which owns 25.03%. The mentioned sale occurred at RON 20 per share. To read more about it, click here.

Of the BET index components, DIGI observed the highest share price increase in October of 13.04%. Nuclearelectrica follows with an increase of 7.5%. On the flip side, Purcari observed a share price decrease of 6.4%.

Turning our attention to the main index of the BVB, in October, BET observed a decrease of 0.58%, amounting to 9,518.89 points.

Average Daily Turnover (Jan – Oct 2019) (EUR m)

In October, the Belgrade Stock Exchange observed an average daily turnover of EUR 0.3m (+18.7% YoY).

The Belgrade Stock Exchange reported a turnover of EUR 6.89m in October 2019 (when observing solely equity), which represents an increase of 18.7% YoY. This would translate to an average daily turnover of EUR 0.3m (+18.7% YoY).

In October, the most traded share (excluding block transactions) were two banks – Komercijalna Banka and Jumbes banka, with a turnover of EUR 1.51m and EUR 0.97m, respectively. NIS follows with a turnover of EUR 0.54m. VP Dunav comes next with EUR 0.18m.

When observing gainers of the BELEX 15 index, AERO recorded the highest increase of 3.84%, followed by Messer Tehnogas with a 2.42% increase.

On the flip side, Komercijalna Banka recorded the sharp decrease of 11.54%. As a reminder, in September, Komercijalna Banka received 4 non-binding bids regarding its privatization. According to the Serbian media, NLB gave the best bid among 3 other banks for the sale of Komercijalna Banka. Allegedly, NLB offered EUR 450m for 83.2% of the total shares, which are owned by the Republic of Serbia. The binding bids should be received by early December.

Turning our attention to BELEX15, the index observed a slight decrease of 0.16%, ending at 749.88 points. Note that this is the sixth time this year that the index ends the month in red.