2019 could be characterized as an eventful year for the Croatian capital market, in which we witnessed a solid share price increase of all blue chips, a sharp increase in turnover on the ZSE, a couple of takeover bids etc. Consequently, for the first blog of 2020, we decided to bring you a recap of the most significant events in the previous year.

2019 was definitely an eventful year for the Croatian equity market, in which we witnessed a solid increase in share price of most the blue chips coupled with a sharp increase in turnover on the ZSE. In 2019, CROBEX observed a 15.4% increase, which is the second highest yearly increase in the past decade. It is also worth noting that in October, the index breached 2,000 points, which was the fist time it reached that level since the end of March 2017. In 2019 average daily turnover recorded a high increase of 27.8% YoY, amounting to EUR 1.47m. Such an increase could mainly be attributed to the Kraš takeover, which is covered further in the article.

Performance of CROBEX in 2019

Average Daily Turnover on ZSE (EUR m)

When observing individual CROBEX constituents, 12 out of 15 ended the year in green. Of that, one company recorded a triple-digit increase, while 7 companies witnessed a double-digit increase. Optima Telekom by far leads the list of top gainers, with a share price increase of 370%. On the flip side, Đuro Đaković ended the year with a decrease of 59% YoY.

Share Price Performance of Crobex Constituents in 2019

THE KRAŠ SAGA

Arguably, the most significant event on the Croatian capital market was the takeover of Kraš which resulted in a spike in turnover in 2019 of HRK 478.8m. Its worth noting that such a high turnover accounts for roughly 18% of the total equity turnover on the Zagreb Stock Exchange.

In early September, the majority shareholder of Kraš, Mesna Industrija Braća Pivac published an announcement that they are acting in concert with KRAŠ-ESOP (the company’s second largest shareholder).

In parallel to this event, Kappa Star Limited started buying large volumes of Kraš’ share, which eventually led to a 173% increase in the share price (compared to the beginning of September). By the end of the year, Kappa Star Limited owned 28.03% of the share of Kraš, making them the second largest shareholder, after Mesna Industrija Braća Pivac.

In late September, Kraš ESOP voted against the proposal of acting in concert with MI Braća Pivac, regarding the mentioned takeover bid. However, MI Braća Pivac stated prior that in case if the two parties do not reach a joint decision, they will publish independently a voluntary takeover bid. This did occur in late October, when MI Braća Pivac published a takeover bid at HRK 430 per share, which puts the bid at P/E 12 and EV/EBITDA of 7. It is important to note that at the time the share was traded at HRK 1050 per share, which would put the bid at a discount to market price of 41%.

A few days later, the management board issued its opinion on the mentioned takeover bid. The management considered that it is undeniable that the synergistic effects of negotiating the procurement of goods and services from the Group’s perspective could have a positive effect on cost reduction and, therefore, its competitiveness. They therefore reason that the bid by Mesna Industrija Braća Pivac would have a positive effect on the future operations of Kraš. However, they considered the takeover bid as too low.

The whole saga ended a few days after the bid expired, when MI Braća Pivac signed a Sale and Transfer Agreement with Kraš ESOP, through which they acquired an additional 18.45% stake in Kraš. The mentioned amount refers to all shares of Kraš ESOP which were acquired for HRK 238.1m or HRK 861.2 per share. Such an indicative price per share equals to the volume weighted average of all prices realized on the stock exchange in the past 3 months and in the same time more than double what MI Pivac offered in their takeover bid. With this acquisition, MI Pivac had a 49.16% stake in Kraš and 51.8 % of voting rights (5.1% of shares are in treasury).

The following trading day, the market reacted to such news, resulting in a share price decrease of 31.43%, with it closing at HRK 720 per share. Such a decrease could have been expected since after the mentioned acquisition MI Pivac obtained a majority voting stake in the company. The drop occurred as the large shareholding supposedly reduced the interest of other buyers to aggressively bid on the market. Namely, it appears that Kappa Star Limited (which has been acquiring large volumes of Kraš for quite some time), removed their bid from the market, or at least at levels we have seen in the previous weeks.

Kraš Share Price Performance in 2019 (HRK)

OPTIMA TELEKOM TAKEOVER SPECULATION

Another significant event on the Croatian equity market was the speculation regarding Optima Telekom takeover. On 31st May, the media has covered that the Swedish Tele2 AB announced on the sale of their Croatian subsidiary Tele2 Hrvatska. The sale of the Croatian segment was concluded with United Group for the value of EUR 220m (at 7.2x T12 EBITDA). This was particularly interesting as Optima Telekom, which is currently consolidated and managed by HT will be subject to sale. As a reminder, HT should dispose of their 17.4% stake in Optima Telekom until 10 July 2021.

It was speculated by the media that United Group might be interested in acquiring Optima Telekom, as the company’s business is majority related to fixed broadband, which is a segment TELE2 Hrvatska does not operate in. Such an acquisition would lead to a consolidation of all majority telecom segments on the Croatian market by the United Group.

As a result of the above mentioned, many investors have flocked to the share, which initially resulted in a share price increase of 56% (a week after the mentioned news).

Meanwhile, in 2019, Optima Telekom’s share observed a significant increase of 370%, making it the best performing share of the CROBEX constituents.

Optima Telekom Share Price Performance in 2019 (HRK)

CROATIA UPGRADED INTO INVESTMENT GRADE

In the first half of 2019, Croatia received credit rating upgrades by both S&P (in March) and Fitch (in June), which takes it to the investment grade territory. The upgrades came as a result of the country’s efforts in lowering public debt, balancing the budget, and improving economic growth. The upgrades add additional tailwind, as it might attract a new pool of investors who are seeking investments only into countries with investment grade credit rating by two or more credit rating agencies.

Also, the upgrades provided for additional comfort regarding the future outlook and risk premia of the country. There is no doubt in our view that the credit rating upgrade should be a positive signal to the local capital market as we believe certain new investors will now place Croatia on their investment map which should bring new and needed liquidity.

The mentioned credit rating upgrades directly influenced Croatia’s equity risk premium (ERP), which according to Damodaran, decreased from 10.13% in the beginning of 2019, to 9.06% in July 2019. It is worth noting that the decrease could be also be partially be attributed to the ERP for developed markets observing a decrease in the same period by 0.29 p.p. By the end of 2019 (December), Croatia’s ERP further decreased to 8.64%, as the implied ERP for developed markets further decreased.

Of course, all other things held constant, lower ERP would lead to lower cost of capital and therefore, higher company valuations. To read our blog on Croatia’s ERP development click here.

FAR FROM A POOR PERFORMING TOURIST SEASON, ONCE AGAIN

Despite what can now be considered traditional skepticism by the media, Croatia’s tourism recorded another successful year of growth. In the first 11 months of 2019 (December figures are not yet publicly available), Croatia observed 107.8m tourist overnights, representing a 2.4% YoY increase. Accommodation wise, hotels account for 23.46%, while camps account for 17.44%. Meanwhile, tourist arrivals breached 20m for the first time (20.31m to be exact), representing a 4.9% increase.

For the past couple of years Croatian tourism has been benefiting from the unfavorable security conditions seen in competitive Mediterranean countries. As a result, the domestic hospitality industry saw double digit growth in arrivals and overnight stays which pushed prices up significantly. Now Croatian companies will once again have to work in order to attract and retain customers in the country’s most important industry which accounts for roughly 20% of the country’s GDP.

It has become clear that the strong organic growth seen in the past has come to an end, and if Croatian tourists want to secure future growth CAPEX will have to be at the center of their attention. Many companies have already started or published their investment programs, so for example, Adris announced roughly HRK 3bn of investments in the tourism segment. To read more about it click here.

Arena Hospitality Group announced an investment plan of roughly HRK 500m, which they deem to be the driver of growth in the coming period. To read more about it click here. Meanwhile, the total approved investments of the Valamar Group for 2020, including Imperial Riviera, amount to HRK 826.2m and represent a continuation of the investment strategy in repositioning and upgrading the portfolio.

Tourist Arrivals (11m 2018 vs 11m 2019)

Tourist Nights (11m 2018 vs 11m 2019)

FOOD SECTOR SHOWED STRONG RESULTS

The Croatian food companies, Atlantic Grupa and Podravka have once again shown strong performances, which was reflected in their share price increase of 12.1% and 29.1%, respectively.

Improvements came mostly on the back of organic growth as both companies shifted their strategy to focus more on core activities and familiar markets, rather than expanding into new segments and exotic markets. This combined with the positive macroeconomic development in the region resulted in growth on all lines for both companies.

Let us now turn our attention to the individual performance of both companies. During 2019, Atlantic Grupa continued their strategy of divesting non-core assets. As a result, the company sold Fidifarm, owner of Croatia’s leading food supplements brand – Dietpharm and Bionatura, a company that distributes water bidons. However, note that Atlantic will maintain the business connected with the brand Kala. In the 9M period of 2019, Atlantic Grupa recorded sales of HRK 4bn (+3.2% YoY). The revenue growth follows excellent sales results of the SBU Savoury Spreads (+9.3% YoY) and the SBU Beverages (+4.8% YoY), and almost all distribution units. EBITDA amounted of HRK 634.4m, or HRK 567.6m without the effect of the IFRS 16 standard, (+8.3% YoY). Below the operating line the net financial loss is down by 24% YoY to HRK -23.8m, primary due to lower interest expense, following the continuous deleveraging of the company. As a result of the above mentioned the bottom line went up 11% YoY to HRK 354.2m.

Meanwhile, in the 9M 2019 period Podravka’s sales went up by 5.3% YoY to HRK 3.2bn. The growth was fueled both by the food and pharma segment which grew 4.6% and 7.7%, respectively. The Group’s 9M EBITDA amounted to HRK 413.2m, (+8.9% YoY). However, if one would to exclude the estimated HRK 27.6m benefit from lower lease expense due to the adoption of the IFRS 16 standard, EBITDA would be up 2% YoY. Below the operating line Podravka’s net financial result deteriorated with the company posting a net financial loss of HRK -9.2m (+31.4% YoY). However, note that this was due to the influence a positive oneoff recorded in H1 2018 when the company benefited from a FX gain on loans in the amount of HRK 12.8m. Finally, net profit amounted to HRK 197.7m (+4.1% YoY).

INTRODUCTION OF CROBEXprime & ADRIAprime INDICES

2019 also brought the introduction of 2 new indices on the Zagreb Stock Exchange – CROBEXprime and ADRIAprime.

CROBEXprime was launched on 18 February as a free float market capitalization weighted total return index (meaning that it takes dividends into account). The new index includes all shares listed in the Prime Market of the Zagreb Stock Exchange, while the weight of each constituent share is capped to 30%. At the introduction, the index consisted of 4 companies: AD Plastik, Atlantic Group, Arena Hospitality Group and Podravka, while Valamar joined at the end of April as the latest introduction to the index.

The current main index of ZSE, CROBEX, consists of many shares which many fund managers would not even include in their investment universe (due to extremely low liquidity, poor corporate governance, going in and out of pre-bankruptcy procedures etc). These issues made the issuers prone to large price changes. As a result, one could have easily been misled on how the Croatian market has been actually performing. Therefore, we are happy to see an index focusing on less constituents, but the right ones. There is still work to be done (adding more companies to the Prime Market) but we believe CROBEXprime will ultimately become a better peer for Croatia than the current CROBEX index.

Furthermore, on 19 June, Zagreb and Ljubljana Stock Exchanges launched a new joint equity index called ADRIAprime, which is a free float market capitalization weighted total return index. The mentioned index includes shares listed on the Prime Markets of the Zagreb and Ljubljana Stock Exchanges, whose selection will depend on the decision of each stock market. The weight of each constituent share is capped at 15%. Note that the base level was set at 1,000.00 points on 30 April 2019 and is calculated in Euros.

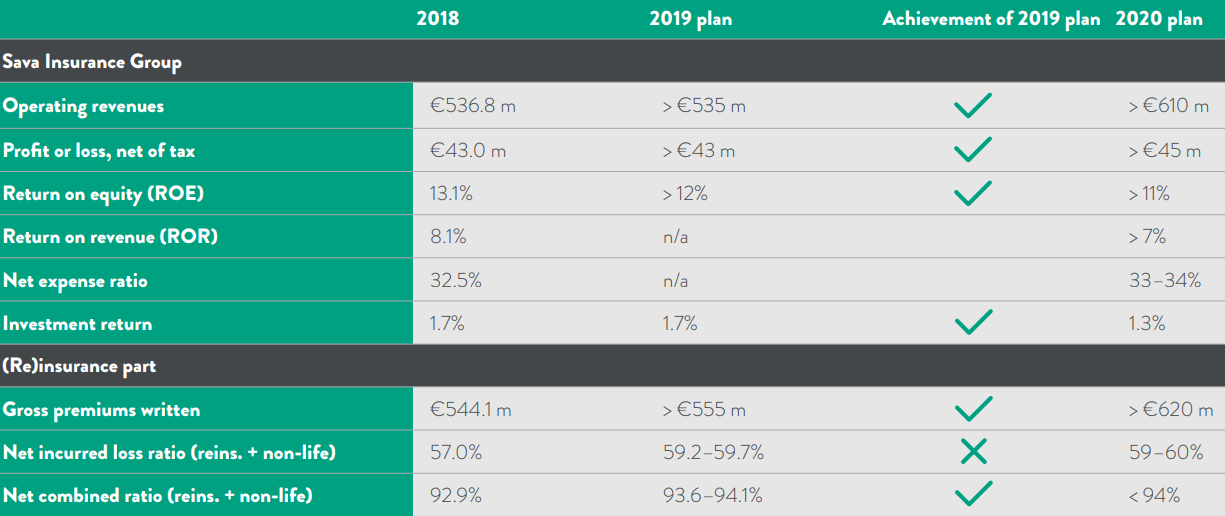

According to it, the Group’s operating revenues for 2020 are planned to exceed 4%, and the net profit for the year is planned at a minimum of EUR 45m.

Sava Re published a document on the Ljubljana Stock Exchange in which they announced their 2020 annual plan. According to it, the Group’s operating revenues for 2020 are planned to exceed 4%, and the net profit for the year is planned at a minimum of EUR 45m. Thus, the Group will aim to achieve a return on equity of at least 11%.

The key targets for 2020 are:

Growth in Slovenian non-life gross premiums written is planned at 3%, taking into account the expected slowdown in new vehicle sales.

Life insurance gross premiums written are expected to decrease by 9%, which reflects the large number of policies maturing in the Slovenian life business segment.

Outside Slovenia, the Group expects insurance business to grow organically at rates exceeding the expected growth rates of GDP. The Group’s non-life and life insurers outside Slovenia are planning their gross premiums written to grow by 6% and 15%, respectively.

In 2020, the Group’s non-life insurers will focus in particular on development and expansion of the existing sales network, diversification of their portfolios by means of new products, and strengthening of bancassurance as a sales channel. In their development of insurance products and services, the Group’s life insurers will focus in particular on reducing or abandoning guaranteed rates in 2020 in view of the low interest rates prevailing in the financial markets.

Reinsurance operations expect gross premiums written to grow by 8% in 2020. This will be achieved by growing the volume of business in new markets while maintaining portfolio diversification by both geography and partner.

The Group’s investment policy includes maintaining a high level of security of invested insurance contract assets, as well as ensuring high liquidity and risk diversification. Investment management in 2020 will be affected by the continued low interest rates, and the expected return will be 1.3%. The investment portfolio structure will also remain relatively conservative in 2020, featuring a high share of bonds and other fixed-income investments and a high credit rating profile, with the share of equity securities and infrastructure projects increasing slightly.

Source: Sava Re, InterCapital Research

For 2020–2022, the Sava Insurance Group has the following key growth and profitability targets:

the Group’s operating revenues is planned to grow on average by 4% annually throughout the 2020–2022 strategy period. In 2022, operating revenues will exceed EUR 650m, an increase of more than EUR 60m through the Group’s organic growth. The rate of return on equity is expected to exceed 11% in the strategy period.

Growth of Slovenian insurance business is expected to slow down, which reflects the expected slowdown in new vehicle sales, whereas higher premium growth rates are planned for the reinsurance business, for insurance business outside Slovenia, and for pension and asset management business.

Growth of non-life business in Slovenia and the Adriatic region is expected to exceed 2% and 5% annually, respectively. Regarding life business in Slovenia, gross premiums written are expected to decrease by 5%, whereas new business is expected to grow by more than 2%. When observing life business in the Adriatic region, gross premiums written are expected to grow by 10%, and new business is expected to expand by more than 7%. Reinsurance business is planned to grow by more than 3%.

In this strategy period, organic growth will continue to be secondary to our primary goal of maintaining appropriate profitability as measured by combined ratios, which are envisaged to be under 95% for the insurance and reinsurance business.

The Group’s solvency will be maintained in the 180% to 220% range in the strategy period, which represents the optimal level of capitalization based on the Group’s risk appetite. As part of its capital management policy, the Group will use part of its surplus funds for growth through acquisitions and partially for organic growth of the Group. Furthermore, Sava Re will ensure its shareholders stable growth in dividends, on average by 10% annually, with a payout ratio between 35% and 45%.

Trading statistics for December 2019 show an average daily turnover of EUR 1.1m (-26.8% YoY). Meanwhile, the major index CROBEX ended December with an increase of 1.09% ending at 2,017.43 points.

The Zagreb Stock Exchange (ZSE) published their trading statistics for December 2019, showing a total equity turnover of EUR 19.7m (HRK 146.6m). This translates to an average daily turnover of EUR 1.1m (-26.8% YoY). On a FY basis, in 2019 total equity turnover amounted to EUR 264.4m, which translates to an average daily turnover of EUR 1.47m (+27.8% YoY).

Of the total value traded in the period in December (excluding block transactions), Valamar Riviera generated 14.9%. Adris preferred comes second, accounting for 13.8%. Next come HT and Podravka with 10.8% and 8.4%, respectively. Optima Telekom follows with 6.6%. These 5 shares generated more than half of the turnover recorded by the entire (equity) market, excluding block transactions.

When observing the total equity market capitalization, it observed an increase of 11.5% YoY, amounting to HRK 147.98bn. Ina’s share is the biggest constituent of the total exchange’s equity market capitalization, accounting for about 21.6% of the total value. Next, come two Croatian banks – Zagrebačka banka and PBZ with 13.8% and 10.9%, respectively. Further, HT holds 9.9% while Adris accounts for 3.7% of the total market capitalization value.

When compared to the beginning of the month the main index CROBEX witnessed a solid 1.09% increase, ending at 2,017.43 points. CROBEX10, consisting of top 10 CROBEX shares by free float market capitalization and turnover, observed an increase of 1.24%. The highest increase of all sector indexes was realized by CROBEXindustrija – the index where its six constituents operating in industrial production have equal weights. On the flip side, CROBEXnutris recorded a decrease of 4.88%.

Average Daily Turnover on the ZSE in 2019

In 2019, the Belgrade Stock Exchange observed an average daily turnover of EUR 1.37m (+422%) or adjusted EUR 0.51m. Meanwhile BELEX15 recorded a solid increase of 5.3%, ending at 801.69 points.

In 2019, the Belgrade Stock Exchange recorded a turnover of EUR 346.2m (when observing solely equity). This would translate to an average daily turnover of EUR 1.37m representing an increase of 422%.

Such a high increase in turnover could be attributed to the Serbian state acquiring additional 34% stake in Komercijalna Banka at RSD 4350 and RSD 4508 per share (EUR 217.1m). Following the mentioned transactions, the Republic of Serbia owns 83.2% of the bank, which will enable the privatization of the Bank under the ongoing privatization process. By acquiring the mentioned shares, the state has fulfilled its obligation (put option) as part of the current sale of the bank, which was defined in 2006.

If we were to adjust for the mentioned transaction, the average daily turnover on the Belgrade Stock Exchange would amount to EUR 0.51m (+95%)

Average Daily Turnover on the BELEX

In 2019, the most traded share (excluding block transactions) was Galenika Fitofarmacija with a turnover of EUR 24.8m. Such a high turnover on Galenika could be attributed to the ownership consolidation in the company, which occurred in December. Next comes Komercijalna Banka with EUR 10.59m and NIS with EUR 7.8m.

When observing gainers of the BELEX 15 index, Komercijalna Banka recorded the highest increase of 53.32%, which came on the back of the mentioned finalization of the privatization of the bank. Jedinstvo follows with a 26% increase. Messer Tehnogas and Impol Seval come next with a 16.4% and 11.1% increase, respectively. On the flip side, AERO recorded the highest decrease of 44.7%, however one should note that this could be solely attributed to the one-off dividend payment.

Turning our attention to BELEX15, the index observed a solid increase of 5.3%, ending at 801.69 points. It is worth noting that this is the fourth year in a row that the index finished the year in green.