With presidential elections behind us and millions of votes still not counted, we cannot be 100% sure who the 46th US president is, but there are high chances that former Vice president Biden won. In this brief article we are looking at US vote in more details and how market feels about the outcome.

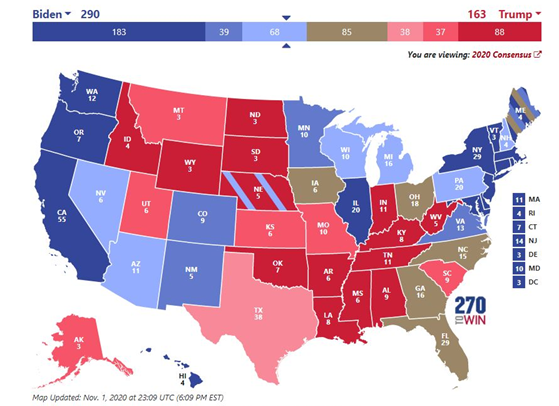

This week headline news was not about real economy, coronavirus cases or new lockdowns but clash between two candidates in US presidential elections. At the moment, it seems that democrat candidate Joe Biden will be the next US president while there are smaller chances of blue wave. Now, let us look what happened in the last three days. It is estimated that more than 100m people voted by mail before the election date, meaning that more than 60% of the Americans that voted did their ‘duty’ before the November 3rd. According to NBS news projections, around 160m Americans voted in total which marks a record high number and turnout rate in presidential election. Looking at the past presidential races, high turnout did not favor Republican candidates while before the election it was also stated that voters leaning to the left candidate preferred mail-in voting resulting in pre-election polls highly favoring Mr Biden. On Nov1st, Fivethirtyeight.com predicted Mr Biden will win 290 electors, Mr Trump 163 (with 85 electors undecided), which was way higher margin compared to 2016. Translated into odds, former vice president led by 52% versus 44% while in 2016 Clinton had margin of only 2% with 48% versus 46%.

Source: Fivethirtyeight.com, Nov 1st, two days before US presidential elections

After the polling locations were closed on Tuesday, Florida was the first swing states that Trump won. Furthermore, Obama’s swing states Michigan and Wisconsin also favored Trump in the first hours while North Carolina and Georgia were too close to call. All in all, on Wednesday morning (GMT time), it looked like Mr Donald Trump could stay another 4 years in White House, while blue wave was completely out of the picture. As expected, Mr Trump declared his victory saying that they will go to US supreme court and that he wants all voting and counting to stop as he assumed (correctly) that additional counting of mail-in votes will decrease his margins in swing states. Nevertheless, most of the swing states did continue to count mail-in votes through the day, resulting in Mr Biden flipping Wisconsin and Michigan states meaning that he only needs Nevada and Arizona (in which he is tightly winning) to count their votes in full. That would make swing states Pennsylvania, Georgia, and North Carolina unnecessary for Mr Biden to secure presidency. We are still waiting for the confirmation that votes are counted in full, but this morning it looks like Mr Biden will become the oldest president in the history of US. Blue wave could still be possible although margins will be significantly smaller than pre-election polls “predicted”. Trump reacted as expected, saying that votes in Wisconsin should be counted again while filling a lawsuit over the counting of absentee ballots in Georgia, Pennsylvania, and Michigan. If you have read just one article regarding US election, you would have known that this was predicted as the worst possible scenario for financial markets.

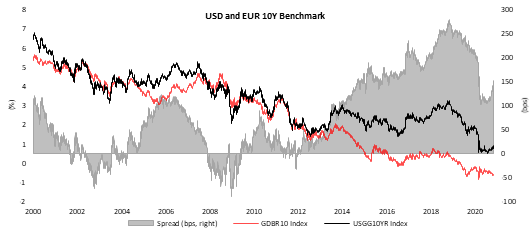

This morning, the most likely scenario is that Mr Biden won the White House while Democrats did not manage to take control over Senate. What the market has to say about this most feared outcome? It looks like investors just waited elections to pass and to buy whatever there is to buy not even bothering about who actually won the elections. US and EM equity, Treasury and EM bonds, EM currencies, you name it. USD yield curve bull flattened due to mixed Congress that will not easily approve new fiscal package worth USD trillions, as announced by some analysts. Since fiscal push is maybe even more distant than before, there were some speculations that FED could be the only safe net in case coronavirus keeps denting the economy. Just to put things into perspective, from its highs of 95bps on November 3rd, US 10Y yesterday fell close to 70bps. If Republican’s control of Senate gets confirmed (hence tougher negotiations on fiscal package), yields could fall further and US10Y-Bund spread could reach levels last seen this summer; especially if coronavirus cases continue rising, resulting in risk-off sentiment on equity markets. All in all, from financial markets’ perspective it seems we got the best from both candidates.

Source: Bloomberg, InterCapital

As all Croatian blue chips published their 9M 2020 results, we decided to look at what effect did the pandemic have on the profitability margins of each observed company.

It is important to note that comparing the margins across the selected companies is not necessarily the best way to do the comparison as many companies operate in different industries. Since both EBITDA and profit margin reflect to a great extent the industry in which the company operates in, we advise to compare it to the peer average or median. Nevertheless, it is still worth seeing which Croatian companies are more profitable and therefore have more “room” to potentially reduce the prices of their goods or services if needed, while still remaining a higher level of profitability.

9M results include the aftermath of Croatia’s tourist season which both directly and indirectly influences many Croatian blue chips.

9M 2020 EBITDA margin of Selected Companies (%)

As of 9M, two Telecoms and a Hospitality company lead the list with the highest EBITDA margins. To be specific HT and Maistra recorded the highest EBITDA margin of 41.4% and 33.3%, respectively. For HT this notes a slight increase in the margin of 0.6 p.p., as this is one of the sectors who was among the least impacted by the pandemic on profitability level. Telecom sector was, in majority, influenced on the revenue side. HT as the leader felt strong impact on lost visitor revenue and handset revenue as consumer consumption decreased and tourist arrivals in 9M 2020 dropped by 62%. On the other hand the company showed in Q3 48% YoY surge in ICT revenue, which is a segment growing due to pandemic. Therefore, HT’s revenue decreased 3.9% YoY in 9M 2020. Meanwhile, Maistra’s EBITDA margin dropped by as much as 11.1 p.p. YoY as operating revenue dropped by 54.5% YoY. However, the company managed to retain still a relatively high margin as operating expenses decreased by 44% on the back of cost rationalization measures and state support. Optima Telekom comes next, with a EBITDA margin of 31.7%, showing an improvement by 4.3 p.p. YoY.

The highest drop YoY in EBITDA margin was witnessed by Valamar Riviera (-16.5 p.p.) due to strong decrease in revenue (-68% YoY) caused by coronavirus pandemic. Closed properties from March to the end of May and early termination of the summer season (as governments’ issued travel warnings to its citizens in Austria, Slovenia and Italy that came into force in mid-August) resulted in drop in number of accommodation units sold of 65% YoY. Company’s ADR decreased by 12.8% , as camps, who have lower ADRs, witnessed an increase in their share in revenues to 45% in 9M 2020.

Change in EBITDA & Profit margin (9M 2020 vs 9M 2019) (p.p.)

Turning our attention to the profit margins, HT once again leads the list with 8.6%, while its margin decreased by 1.8 p.p. YoY. Atlantic Grupa and Podravka follow with a profit margin of 7.9% and 6.5%, respectively.

On the filp side, three of the observed companies recorded a negative profit margin (net loss). Besides above mentioned tourist companies Optima Telekom also recorded a net loss in 9M. Of the companies, which recorded a net profit, AD Plastik observed the highest drop in profit margin of 3 p.p. YoY.

If you wish to compare EBITDA and net profit margins of these companies to their regional sector peers, you can do so by looking at our daily trading multiples which can be found here,

9M 2020 Profit margin of Selected Companies (%)

In 9M of 2020, the company noted a decrease in sales of 3.8% YoY, a decrease in EBITDA of 0.8% and a decrease in net profit of 6.5%.

In the first nine months of 2019, Telekom Slovenije noted net sales revenue of EUR 440m, representing a decrease of 3.8% YoY. If we were to exclude IPKO and Planet TV the Group generated EUR 450.5m in operating revenues, or a decrease of 2% YoY. However, we note that the company has announced earlier this week that the Group stopped the sales procedure of Kosovo based IPKO, which will remain a part of the Telekom Slovenije Group. To read more about it click here.

Coming back to sales revenue, revenues from the mobile segment of the end-user market is down by 3.4%, primarily due to the impact of the Covid-19, which resulted in lower revenues from roaming services abroad. Besides that, sales were impacted by the optimisation of subscribers whose basic subscription fee includes an increasing number of services, which is driving down revenues from services not included in the subscription fee. Furthermore, revenues from the fixed segment of the end-user market is down (-1.2%) primarily due to lower revenues from traditional telephony, while revenues on the wholesale market is down 9% due to reduced international voice traffic and lower revenues from roaming by non-residents.

Moving on to operating expenses, they amounted to EUR 410.35m, representing a decrease of 3% YoY. Of that, the largest item was cost of services which stood at EUR 157.1m (-7% YoY). Such a decrease could be attributed to the to the reduced volume of international traffic and roaming as and lower costs of multimedia content.

As a result of all of the above EBITDA amounted to EUR 144.6m, representing a slight decrease of 0.8% YoY. Meanwhile EBITDA margin showed an improvement of 1 p.p. and stood at 32.9%. As a reminder, according to the Group’s key objectives for 2020, EBITDA is estimated at EUR 210.6m. However, the Group assesses that the pandemic and measures adopted at the national level due to the two waves of the declared epidemic will have an adverse impact on the Group’s EBITDA of around 4% relative to planned EBITDA for 2020.

Operating profit amounted to EUR 40.12m, which is an increase of EUR 2.97m or 7.5% YoY.

Going further down the P&L, net profit from continuing operations stood at 36.85m, which marks an increase of EUR 5.6m or 18.2% YoY. However, the company reported a decrease in net profit of 6.5% to EUR 27.44m. Such a decrease could be attributed to the loss from discontinued operations of EUR 9.4m. Of that, Loss from the sale (recognized upon the measurement of fair value) of Planet TV amounted to EUR -5.6m, while loss of the period for Planet TV amounted to EUR -3.58m.

As a reminder, in July of 2020 Telekom Slovenije and the Hungarian company TV2 signed an agreement on the sale of all of the Company’s participating interests in Planet TV for the value of EUR 5m.

We note that the above stated results could be seen as positive given the Covid-19 situation, which we find supportive for the share price.