On the first trading session in February futures markets were expecting a rate cut in the US by June this year. However, as fears faded this date has been moved further into the future and now with economic conditions slightly improving, the date might be completely moved out of the 2020 calendar. Where are the pockets of value in these circumstances? Find out in this brief research piece?

Although coronavirus (2019-nCoV) pandemic doesn’t seem to abate, US equity markets have shrugged off most of the risk off sentiment and the Wall Street bull is running freely once again. A popular Wall Street rule of thumb tells us that in times of a pandemic markets usually start to turn once the number of new cases peaks, but this time around it’s been completely different because of other forces in the environment. Namely, this morning during the Asian session a news bite crossed the wires about China being prepared to halve the tariffs on 75bio USD of US imports starting from February 14th (that’s why it was dubbed “an early Valentine’s Day gift”). This is clearly sign of goodwill, possibly trying to court US administration into a similar line of action, which would curb at least part of the slowdown fears caused by quarantine in Wuhan.

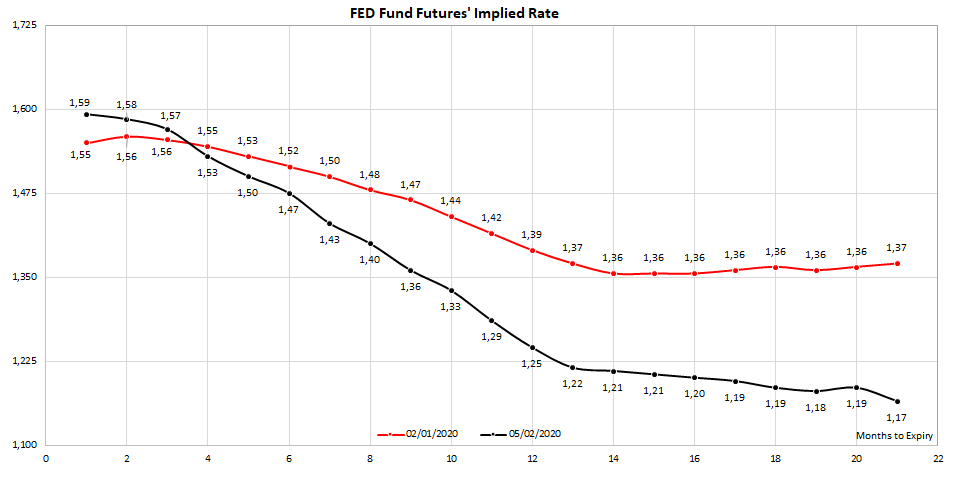

Shifting our focus on global bonds, the sentiment has changed compared to the very beginning of the year, as indicated by two charts submitted below. Looking at the FED fund futures, financial markets were expecting a rate cut in late summer of this year – believe it or not, it was completely at odds with the FOMC dots report, but then again some analysts consider the report to be misleading and backward looking altogether. By yesterday, the rate cut date has been moved to early summer, although positive news flow causes this date to move further in the future as no rate cuts would be needed to sustain the expansion of an economy that’s humming pretty good on its’ own.

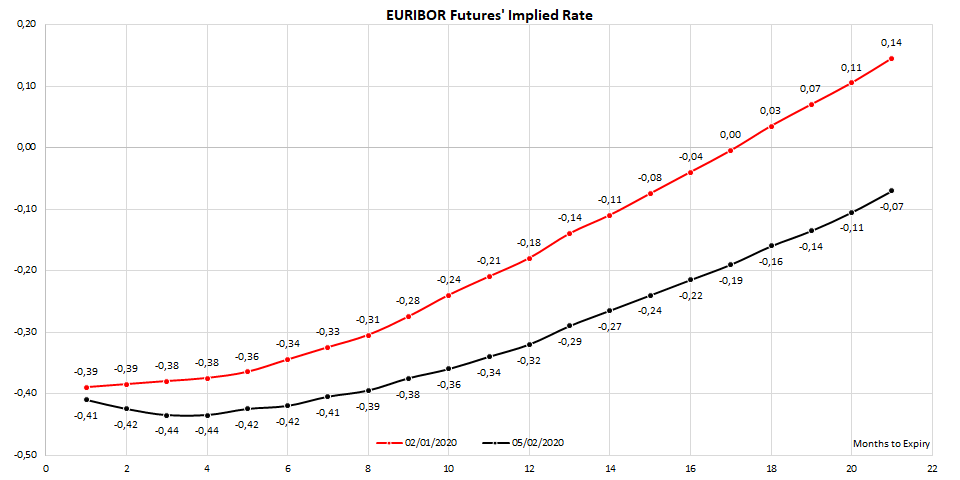

Speaking about economic indicators in the US, composite January PMI has been revised slightly higher to 53.3 (from 53.1 in a flash estimate), benefited mostly from a revision in Services PMI. The wording of the report painted a bleak picture – PMI growth was fostered by a low base in autumn (a point when trade wars reached it’s high noon) and we are in the election year which is often marked by lower spending; coronavirus outbreak doesn’t help either. Eurozone PMIs were also revised higher (to 51.3 from 50.9), but this was thanks to higher manufacturing PMIs (services ticked slightly lower). On the other hand, German factory orders released this morning dropped to -8.7% YoY (versus analyst consensus at -6.7% YoY), meaning that the worst might not be over for manufacturers in the largest European economy. Interestingly, the EURIBOR futures curve implies that no rate cuts under way in Europe, which is completely in line with economic theory since short term interest rates as low as they are now can’t do much to spur economic growth.

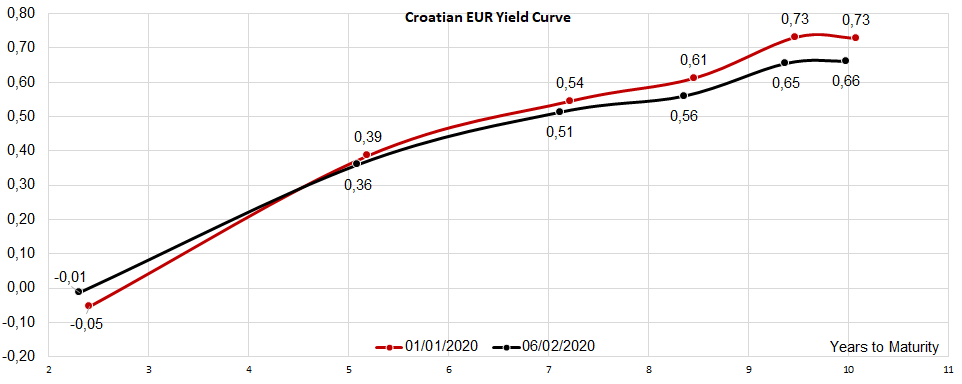

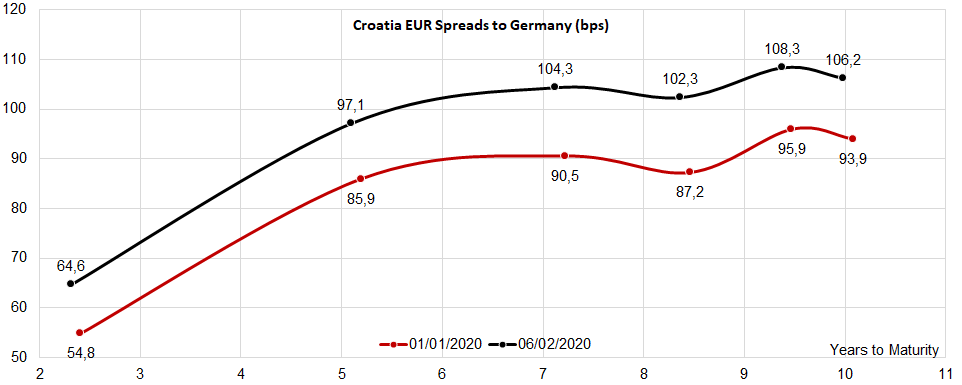

How are Croatian international bonds faring? Looking at the EUR-denominated ones, the drop in yields has not been congruent to the drop in German yields, meaning that the risk premium has widened (as indicated on one of the charts submitted below). For instance, CROATIA 2029 EUR is currently traded at 104.30 (0.65% YTM, Germany+108.3bps), meaning that the risk premium is in the 50th percentile in the three month time horizon – i.e. nothing exceptional.

It’s worth mentioning that CROATE 2⅜ 07/09/29 (the HRK-denominated 2029 maturity) could be purchased at 116.60 (0.56%) on the stock exchange, which is 10bps less off in terms of yield, but allows the investors to increase HRK exposure. Going long on HRK might not be such a bad idea because the EURHRK exchange rate might have entered doldrums in the midst of the pending Supreme Court decision on the conversion of CHF loans. The decision should be made by March 11th (90 days after the Court in Pazin requested legal opinion) and would involve the overpaid interest on former CHF-loans. If the fears of market participants turn to be overblown, the seasonal appreciation of HRK might offer attractive returns on an unhedged CROATE 2⅜ 07/09/29 because in the end, it’s the total return that the investors are after.

As NLB held a FY 2019 pre-publication call, we are bringing you some key takes from it. Note that the company will publish their FY results on 20 February 2020.

On Wednesday, NLB Group held a pre-publication call, in which the CEO and the CFO of the bank presented the Group’s operations in FY 2019 and expectations for the following period.

| wdt_ID | Performance Indicators | Mid-term target |

|---|---|---|

| 1 | Net interest margin | >2,7% |

| 2 | L/D ratio | less than 95% |

| 3 | CAR | ~16,25% |

| 4 | CIR | ~50% |

| 5 | Cost of risk (bps) | less than 90 |

| 6 | NPE ratio | less than 4% |

| 7 | ROE | >12% |

Q4 & FY Results

The management has stated that from a revenue point of view, Q4 has been a standard quarter for NLB, meaning that no one-offs were recorded. Cost wise, Q4 will show somewhat higher costs, as the last quarter is seasonally the quarter with highest costs (the company gets going with their investment program). However, cost dynamics will be positive compared to the previous year.

The management also stated that we should expect slightly higher employee costs (low single digit growth), as the markets in which the company operates are experiencing wage inflation of 3.5% – 4%. Besides that, NLB experienced normalization of remuneration of the management which slightly affected the employee costs.

In line with the company’s expectations, the head-count is decreasing as the bank is replacing some processes with digital responsibilities which they see as a positive trend that will continue in the next year. As a result, new provisions for redundancies will appear (mostly in the Slovenian market), which will affect the company’s profitability to a certain extent, though, the management deems that it is necessary for cost discipline and future efficiency improvement.

In Q4, NLB observed normalization of cost of risk, unlike in Q3 when cost of risk amounted to -31bps, which further boosted the bottom line. This does not come as a surprise as it is not plausible to observe negative cost of risk going forward.

Regarding cross-boarder lending, NLB expects solid growth (especially in Serbia), where they see solid prospects for the bank, as they have intensified cross-border lending. As a reminder, due to the EC commitments, NLB was not allowed to provide cross-border lending until the Slovenian State reduced their share in the company down to 25% + 1 share. Besides that, the company’s introduction of leasing services is still pending and the company is hoping to launch it in Q1 or Q2 of 2020.

Turning our attention to the balance sheet, NLB recorded solid loan growth in 2019, however also a further increase of deposits, which does come at a certain burden. As of 9M 2019, the Group operated with a relatively low L/D ratio of 67.9%, showing room for further loan growth.

Potential Impact on the Consumer and Housing Loan Restriction

Starting of November 2019, the Bank of Slovenia changed the recommendation into a binding one in the area of consumer lending, placing caps on the maturity of consumer loans, and the ratio of the annual debt servicing costs to the borrower’s net income. To read about the mentioned restrictions in detail, click here. The Group deems that these restrictions are an overshoot, as they believe that restricting access to credit for retail clients is not healthy. The Group will continue to argue against the mentioned restrictions and has filed a constitutional assessment of the mentioned restrictions.

It is important to note that the restrictions will create a temporary dip, while the Group will adjust to it as soon as possible. However, since the measure was introduced in November, the effect will not as visible in the FY results, rather Q1 will show to which extent is the consumer lending affected.

Potential Acquisition of Komercijalna Banka

The management discussed the potential acquisition of the Komercijalna Banka, the third largest bank in Serbia by total assets. As a reminder, 83.2% of the total shares of Komercijalna Banka, which are owned by the Republic of Serbia, are up for sale.

NLB is currently discussing the sale with Serbian Government, and the Finance Minister of Serbia, Siniša Mali has stated that he expects the completion of negotiations to occur within 2 – 4 weeks.

The management of the NLB Group has previously stressed that their position in Serbia is sub-scale and would like to grow there, but in any potential M&A they would consider following conditions: that they consider the pricing to be fair, that the acquisition would be of the benefit to the shareholders and that it does not affect the company’s dividend policy, and management strives to pay a substantial dividend even in a transition year.

Furthermore, if the potential acquisition goes through, there is a possibility of a one lower dividend payment compared to the management target (70% payout ratio from 2019 – 2023), however the management notes that the company would still pay a substantial dividend. Besides that, in the following years, the potential acquisition would not hinder the managements dividend policy.

Sale of NLB Vita

In December, Sava Re and NLB a signed a sale, purchase and transfer agreement regarding 100% of the share capital in NLB Vita. To read about why NLB sold Vita, click here. The management could not give much comments on the mentioned sale but noted that the impact of the sale is positive. The mentioned sale is in line with the company’s policy of the wind-down of the non-core segment. It is important to add that the one-off effect of the sale will be visible in the 2020 financials.

The no-confidence vote was passed in the parliament with 261 votes, well above the required 233-vote majority.

Romanian Prime Minister Ludovic Orban’s minority government has been toppled after losing a no-confidence vote with 261 votes (well above the 233 threshold required) brought by the left leaning opposition. The no-confidence motion was yesterday put forward by the opposition Social Democrats (PSD), who were themselves overthrown by parliament in October with 238 votes. To read more about it click here.

What seems to follow is snap elections and according to the Romanian law, early elections can be triggered if two government proposals are rejected by the Parliament within the next 60 days. It is worth mentioning that according to Romanian media, early elections are likely to be called by June at the latest. The interim Government will have limited power in the meanwhile. Currently, PSD and the UDMR hold 228 seats in parliament, which indicates that a number of lawmakers voted against a government that they initially supported in November.

Note that if the vote had failed, the current Government, headed by Mr. Orban, would have had a green light to reintroduce electing local officials in two rounds of voting instead of the current first-past-the-post system introduced in 2012. Both PSD and the UDMR would have stood to lose a high number of local positions if local officials will again be elected in two rounds.

The charterer of the conventional product tanker declared the previously agreed option of USD 15,500 per day for 8 months starting mid-March.

Tankerska Next Generation (TNG) published a document on the Zagreb Stock Exchange announcing that the time charter for the ECO product tanker “Pag” has expired after a period of 8 months, out of a maximum of 12, and in accordance with the contractual terms, the vessel was redelivered from the charterer with whom it successfully operated during the specified period.

According to the fleet employment strategy, the Company will secure new employment for the vessel on the spot market in order to fully utilize the commercial and operational potential of the vessel within current market terms. Furthermore, the charterer of the conventional product tanker declared the previously agreed option of USD 15,500 per day for 8 months starting mid-March.

Our view on the new charter

We are happy to see another vessel contracted at a favorable rate. A quick calculation based on 2018 results (so assuming daily opex of USD 6,755 per ship, G&A of USD 903k, D&A slightly below USD 8m and interest expense slightly below USD 4m) makes us conclude the following:

- TNG records EBITDA breakeven at average TCE of roughly USD 7,200;

- TNG records net income breakeven at average TCE of roughly USD 12,600 per day;

- An average TCE of 14,500 a day could earn EBITDA of USD 16m and net profit of USD 4m (HRK 3.1 EPS).