We are already deep in 2022 and there are a lot of events and circumstances affecting world and as a result equity markets. Peaking inflation and thus – rate hikes, still-present supply chain problems, geopolitical tension are some among them. Therefore, we decided to present you with an update on the equity risk premium for Croatia & Slovenia.

We are already deep in 2022 and a lot of events and circumstances are affecting world and equity markets. Some of the events with the highest impact on equity markets are peaking inflation and thus – rate hikes, still-present supply chain problems, geopolitical tension and some among them. The mentioned events will undoubtedly influence (and already have) the estimates for future cashflows, growth rates and intrinsic risk associated with all assets on the equity market as a result.

We have already witnessed a few rate hikes from both FED and ECB from long-lasting low levels, a trend that is here to stay, at least for some time. Market participants are pricing in the overwhelmingly bearish sentiment and the scare of recession.

For today, we decided to present you with an update on equity risk premiums for Croatia and Slovenia. In short, the equity risk premium (ERP) can be explained as an excess return an investor would demand to invest in the average equity over the risk-free rate.

The equity risk premium can be seen as a function of:

- how risk-averse the investors are (premium increasing with risk aversion)

- how much risk is perceived in the investment (premium higher for riskier investments)

According to Damodaran, to estimate the equity risk premium for a country, one should find the premium for a mature market and add an additional country risk premium, based upon the risk of the country in question. To estimate the mature market risk premium, one has to compute the implied equity risk premium for the S&P 500 index. This is done by calculating the implied expected return on stocks which is then deducted by the risk-free rate (T. Bond rate).

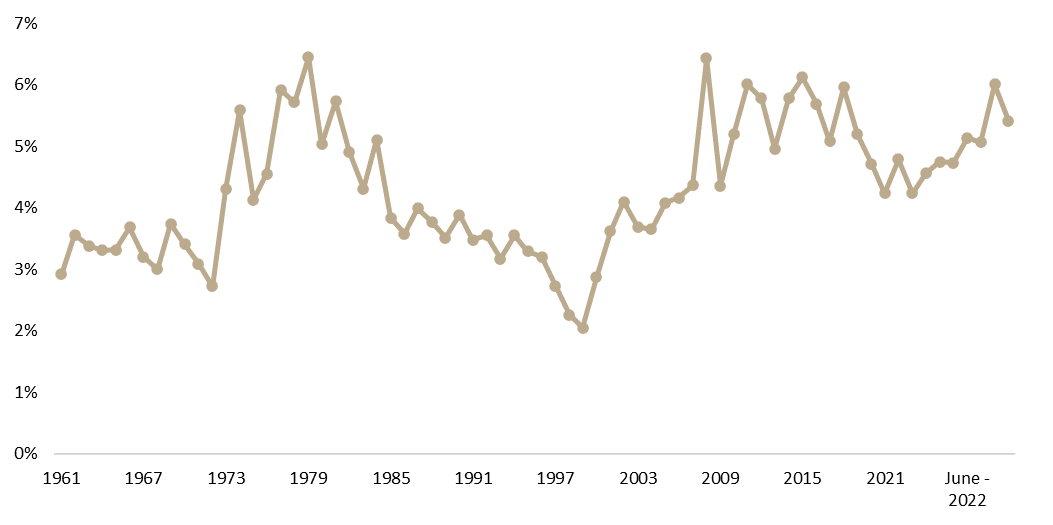

Historical ERP for Developed Markets (1961 – September 2022)

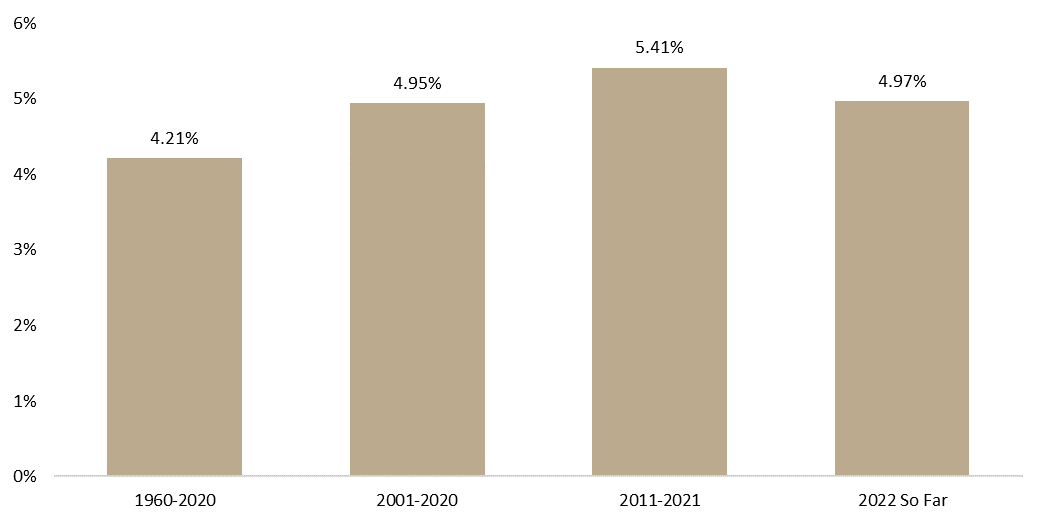

As of September 2022, the ERP for a mature equity market (such as the USA or Germany) amounts to 5.42%, representing a solid increase of 0.7 p.p. since our update in January 2021. The current ERP is somewhat higher than the historic median of 3.99% (since 1961) and is closer to the average of 4.21%. When looking at the table below, one can also indicate that the equity risk premium for the US is very much in line with the historic data based on a few different time spans.

Historical ERP for Developed Markets

In order to calculate the equity risk premium for Croatia or Slovenia, one would, according to Damodaran, have to add an additional country risk premium to the premium for the mature market. Damodaran calculates the country risk based upon the local currency sovereign rating for the country from Moody’s or with the CDS spread for the country (if one exists and/or has sufficient liquidity to be representable). Another way to estimate country risk would be by calculating the spread of the country’s EUR-denominated 10-year bond and the Bund, since Bund is deemed as default free. We believe that this is the most current metric as it reflects an up-to-date opinion of the wide investor universe over the perceived default risk of Croatia and Slovenia.

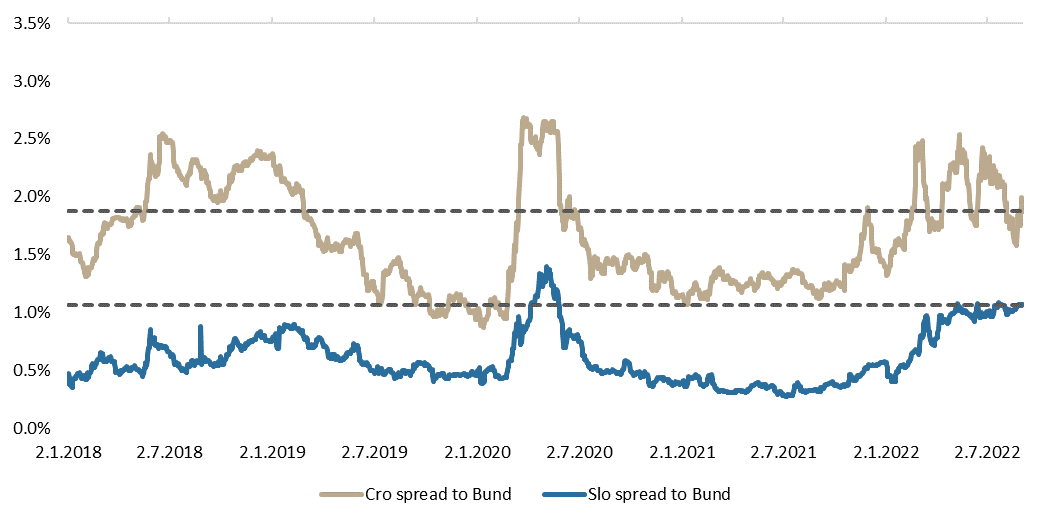

Spread Between 10Y Croatian/Slovenian Government bonds vs. Bund

Source: Bloomberg, InterCapital Research

As visible from the graph above the spread between Croatian 10Y EUR denominated bond and Bund currently stands at 1.9%, while the Slovenian one is at 1.1%. This is somewhat lower than the median of 1.7% and 0.55%, respectively. Meanwhile, during the outbreak of the pandemic, the spread reached as much as 2.68% and 1.4%, respectively, which was tamed by an unprecedented monetary stimulus in the EU. According to Damodaran, to compute the country risk premium it makes sense to adjust the above-mentioned default spread by the relative equity market volatility for that market. The multiplier amounts to 1.1 according to Damodaran.

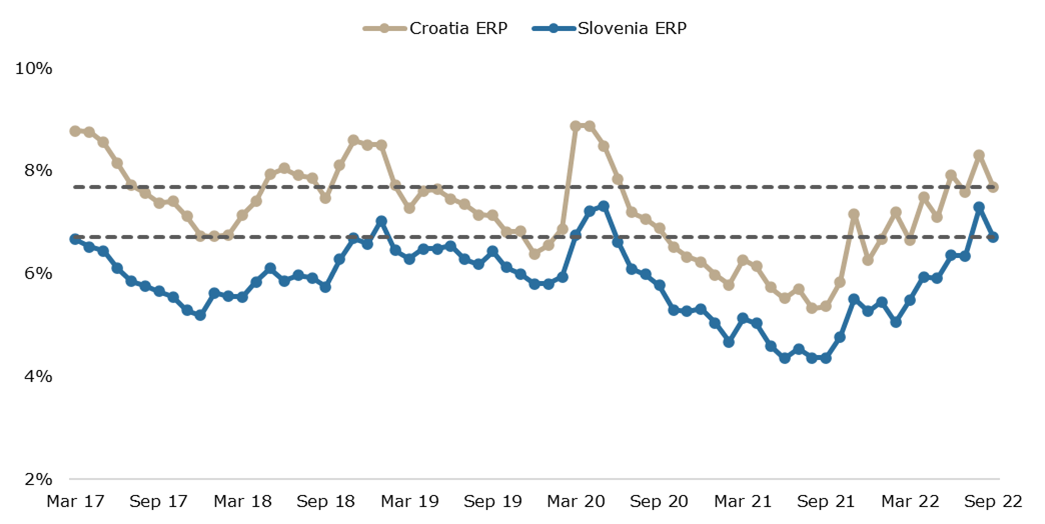

Finally, we reach the ERP for Croatia which, as of September 2022, stands at 7.67%. Meanwhile, Slovenia’s ERP stands at 6.70%. This represents a decrease of more than 1 p.p. and 0.51 p.p., respectively, compared to April 2020, when they reached their peak. Nevertheless, we can see a clear increasing ERP trend for both Croatia & Slovenia during the last year, which shouldn’t come as a surprise.

In the graph below you can find the ERP for Croatia and Slovenia since 2018. As visible from the graph both ERP’s noted a relatively high increase compared to one of the lowest levels reported during 2021. To be specific, Croatia’s ERP is higher by 0.5 p.p. compared to the median of the period, while Slovenia’s ERP is higher by 0.8 p.p.

Croatia’s and Slovenia’s ERP (2018 – Sep 2022)

Source: InterCapital Research

We once again note that when calculating the cost of equity for Croatian or Slovenian blue chips, the same (above state) ERP should not always apply based on the country of incorporation. Many of these companies have a significant portion of their operations outside of the country of their incorporation and the risk of operating there should be reflected in the ERP. This can be done by weighting the ERP based on revenues (or another key performance indicator) it makes in each country it operates. By doing so, we believe that we estimate a more accurate ERP, without over/underestimating the risk premium with regard to operations in foreign markets. Intuitively, if a company operates in markets that are perceived to have a higher country risk premium than the one of incorporation, its ERP will be higher. For example, Slovenian financials operate in almost all Ex-Yugoslavian countries which all have a higher perceived country risk premium than Slovenia. Therefore, the ERP for these companies should be higher than the one above stated.

At the end of July 2022, the total loan growth continued its growth, increasing by 7.1% YoY, 1.2% MoM, and amounting to HRK 299.8bn.

The Croatian National Bank (HNB) has recently published its monthly report on the developments and changes that were evidenced by the Croatian financial institutions. In the report, the total loans of Croatian financial institutions increased by 7.1% YoY, 1.2% MoM, and amounted to HRK 299.8bn, almost breaching the HRK 300bn mark. This is also the highest level that has ever been recorded, and this shows that the growth in loans in Croatia continues despite the current macroeconomic and inflationary situation, showing the strength and resilience of the banking system. In fact, if we were to look at the data since the beginning of the year, after the slowdown in February and March, the loan growth accelerated significantly, outpacing the growth in 2021. This would mean that on a YTD basis, the growth in loans amounted to 7%.

Breaking this down further, household loans (which are the largest segment of the total loans) increased by 5.2% YoY (or HRK 7.24bn), and 0.77% (or HRK 1.13bn) MoM. The real growth this month, however, was recorded by the corporate loans, which increased by 15.3% YoY (HRK 13bn), 2.62% MoM (or HRK 2.51bn), and amounted to HRK 98.3bn.

Corporate and household loans growth rate (YoY,%)

The corporate loans growth in particular is interesting. If we were to break down this into its components, then we can see that companies are still maintaining high levels of investments (app. 41% of the total corporate loans, or HRK 40.5bn), which grew by 16% YoY, but the main driver is the working capital loans, i.e. loans that the companies take to maintain normal business operations and liquidity. This category of loans has a lower 35% of the total (or HRK 34.1bn), but it grew faster, at 22% YoY, and also increased its share in the total by 2 p.p. YoY. What this can tell us is two things: On the one hand, companies are increasing their levels of investments, as loans are only a part of the investment (usually a combination of loans and capital), but at the same time, they are taking out more loans to finance their operations, which is also to be expected. This is due to the high operating expenses growth due to rising energy, electricity, material, and staff costs that have been recorded for a year now, but that significantly accelerated since the start of the year, and especially since the start of the war in Ukraine. Overall, the increase in corporate loans is quite positive news, following the recent announcement of a solid GDP expansion, which shows that despite the situation, the situation in Croatia is not as dire as in some other countries.

Moving back to the household loans, the main driver of the increase in this category remains the housing loans (the largest category of household loans at 48.99%), which increased by 9.4% YoY (or HRK 6.21bn), and 1.33% MoM (or HRK 946.5m). This would also mean that housing loans increased by 1.9 p.p. YoY. Next up, we have consumer loans, which accounted for 36.85% of the total household loans, representing a decrease of -0.84% YoY. Even so, the consumer loans increased by 2.8% (or HRK 1.48bn) YoY, and 0.39% (or HRK 213.5m) MoM. This would mean that even though these loans increased, they increased slower than the overall loan growth. The 3rd largest category of household loans, other loans (at 6.15% of the total), increased by 0.04% YoY (or HRK 40m), while on an MoM basis, they decreased by 0.59%, (or HRK -53.6m).

Composition of Croatian loans to households (HRKm)

Overall, the situation in the Croatian financial system, when it comes to loans, is currently positive, despite the geopolitical, macroeconomic, inflation, and cost pressures. Given that the current gas situation in Europe is extremely volatile, this could possibly change. However, it should also be noted that as Croatia is poised to enter the euro-zone in January 2023, this does currently put it in a relatively good position, especially financially.