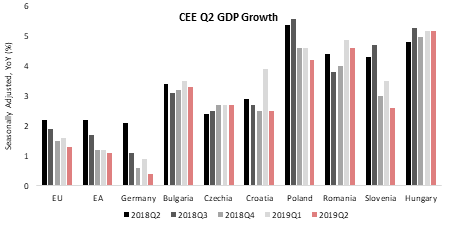

Detailed data published last week showed that CEE economies are losing steam but still rising way above Eurozone. Domestic demand keeps supporting growth while net exports contribute on the negative side as foreign demand vanishes. The question is how long domestic demand can resist pressure as these are mainly small and opened economies.

As you may already know, GDP growth in EU keeps decelerating for the last couple of quarters, i.e. since reaching its peak in the end of 2017. Slowdown continued in second quarter of 2019 with high frequency data pointing to modest recovery in the third quarter. In CEE we are also witnessing slower economic growth, however, pace is relatively strong driven by personal consumption and strong growth of investment while as expected, foreign demand pressures on the negative side. For the following quarters we expect growth to stay at Q2 levels or decelerate slightly more due to geo-political challenges and German recession on one side and loose monetary policy and tight labor market on the other. Although drivers are quite similar, its worth our while to look at each country and see some specifics.

Slovenian growth in Q2 was among biggest disappointments in CEE as it increased by ‘only’ 2.5% YoY compared to 3.3% YoY quarter before. As we wrote last week, main drag were net exports which were the main driver of Slovenian growth after the banking crisis. However, household consumption once again leads the pack while investment shows it could continue rising close to double digits. Nevertheless, net exports dragged down solid growth of domestic demand as strong rise of domestic demand seems to drive even stronger rise of imports, most likely due to growth of investment which is seen as most import – intensive.

On the other side, Czech Republic’s growth did not decelerate significantly as it was already somewhat lower compared to other countries. Namely, growth of 2.7% YoY was repeated for the third consecutive quarter supported by household and government consumption. However, labor market seems completely exhausted meaning that most of the rise came from rise of wages. A bit worrying is that investment rose by only 0.9% YoY knowing that EU funds withholding increased somewhat and that most of the increase came from the government side. To put things into perspective, in Q1 investment growth stood at 3.4%. Net exports did contribute positively due to exports rising stronger than expected which looks slightly contra intuitive as main trading partners have seen decelerating.

Romania is one of the countries that many of the analysts expect to decelerate significantly and to breach that famous Maastricht’s 3.0% fiscal deficit but somehow manages to keep things going without both. As most of the countries mentioned here, Romanian growth did decelerate but not even close to some of the analysts’ forecasts. After rising close to 7.0% YoY in 2017 and decelerating to 4.0% in the last quarter of 2018, it recovered once again and posted growth of 4.9% and 4.6% in Q1 and Q2 2019 respectively. As we still do not have detailed breakdown for Q2, we could guess that enormous growth of wages and pensions drove strong growth of consumption that keeps such a strong pace for several years now. Domestic demand comes with some negative effects also as imports surged resulting in wide current account deficit. The other deficit, fiscal one, government still somehow manages to curb into 3.0% of GDP as economy is rising strongly but we should wait for April 2020 to see whether this will repeat this year as well.

Bulgarian flash estimate showed that country’s economy increased by 3.3% YoY, that is only 0.2% slower compared to Q1. However, its breakdown showed some interesting effects in economy. Namely, final consumption slowed from 4.5% YoY in Q1 to 2.7% YoY which resulted in large drop of imports which were down by 5.5% YoY while exports increased by 3.3% contributing to overall GDP growth just to replace slower growth of consumption. Gross capital formation stayed close to the Q1 rising by 2.2% showing that rise of 2.5% in Q1 wasn’t just a blip but signaling significant slowdown compared to 2018 when investment jumped by almost 7.0%. Nevertheless, Bulgarian growth seems to be balanced, with neutral fiscal policy and small pile of public debt so seems like entering ERM II and monetary union should be a done deal without any major shocks in the European Union.

Looking at the latest data, Hungarian economic story seems far from over, rising by 5.2% in both Q1 and Q2 and is one of rare economies in EU that did not decelerate in 2019. Extremely loose monetary policy combined with ease fiscal policy and solid EU funds withdrawal support continuance of double- digit growth of investments and wages. In the second quarter of 2019 household’s consumption was up by 4.5% YoY while investments increased by ‘only’ 16.4% YoY compared to 23.4% YoY in Q1. However, as a very opened economy, its imports are mainly following local demand trajectory while rise of exports fell significantly, i.e. rising by 2.7% YoY in Q2 compared to 7.7% in Q1. In the following quarters we expect net exports to take even bigger toll due to possible recession in Germany, its biggest trading partner. On the other side, stellar growth of investments could last bit more driven by cheap financing, solid sentiment and EU funds but due to political controversies it’s possible that these funds decelerate in the next cycle.

Poland is also one of the stars of CEE as its economy rises way above EU although there are some signs of deceleration. Polish GDP increased by 4.2% compared with 4.6% in the Q1 due to neutral contribution from net exports (contribution of 0.7% in Q1). However, bigger investment growth cushioned some of the fall from exports, increasing by 7.5% YoY compared to 3.2% quarter before. As it’s the case in Hungary, we expect net exports to drag on GDP growth even more while domestic demand could decelerate due to exhausted labor market and slower EU funds.

Croatian economic growth recorded in Q2 was one of two disappointments in CEE. Sure, most of analysts saw first quarter (3.9% YoY) as noise rather than signal of higher gear however seeing such a strong growth in Q1, it was expected some of the momentum could stay. Households consumption seems like losing some steam while investment did decelerate but still grew by stellar 8.2% YoY. Exports of goods and services rose at very modest pace of 1.3% YoY while imports of goods and services decelerated slightly but still grew at robust 6.7% resulting in negative contribution from net exports as it was the case with all the countries beside Bulgaria and Czech Republic.

Source: Eurostat, National Statistical Offices, InterCapital

The Warsaw Stock Exchange released a statement yesterday in which they announced the formation of a new equity index which will include the largest and most liquid stocks listed on the exchanges of the Visegrad Group countries, Croatia, Romania and Slovenia.

The index portfolio will include more than 100 of the most liquid stocks of companies listed on Central and Eastern European exchanges in Bratislava, Bucharest, Budapest, Ljubljana, Prague, Warsaw and Zagreb. Stocks participating in the index have to meet the liquidity criterion: average value of trading per session of at least EUR 90,000 in six months period. The participation of stocks in the index will depend on their free float and will be capped according to the 5/10/40 rule (i.e. participation of the biggest stock is capped at 10%, aggregate participation of stocks weighing more than 5% is capped at 40%). The participation of stocks from any single country in the index portfolio will be capped at 50% (in practice, the cap applies only to stocks listed on GPW).

Note that two Croatian and four Slovenian companies have been included in the index thus far. The Croatian representatives are HT and Valamar, while Slovenian companies include Krka, NLB, Petrol and Triglav. To view all the remaining index constituents please click here.

Fondul Proprietatea announces Shareholders Meeting to approve a new buy-back program worth RON 1.6bn.

Fondul Proprietatea released an invitation to the shareholders meeting which will be held on November 15th, 2019 during which the Fund’s shareholders will put a new buy-back program to a vote. According to the release the new buy-back program aims at acquiring 800,000 shares at a minimum price of RON 0.2 per share and a maximum price of RON 2 per share. The duration of the program will be from January 1st, 2020 until December 31st, 2020.

As a reminder, when it comes to buy-back programs, Foundul is one of the most active companies on the Romanian market with the Fund completing their tenth buy-back program in August. Through the program the Fund successfully bought back a total of 150,000,000 own shares (1.65% of the Fund’s capital).

Sojaprotein announced yesterday that the Victoria Group, the company’s largest shareholder, acquired an additional 1.3% of Sojaprotein’s shares at RSD 180 per share through their latest takeover bid.

In a statement released yesterday on the Belgrade stock exchange Sojaprotein announced the end of the latest takeover bid made by the Victoria Group for the remaining 10.9% stake in the company. As a result of the takeover bid, the Victoria Group was able to acquire a total of 177,931 shares representing a 1.29% share in the company, thus lifting their stake in the company to 90.4%. Note that this wasn’t the first attempt made by the Victoria Group to acquire all of Sojaprotein’s shares. At the beginning of March Victoria Group issued a takeover bid for the remaining shares of Sojaprotein, however they were only able to acquire 2.6% of the company’s share. Afterwards the Group went on to purchase an additional 18% Sojaprotein’s shares on the open market at RSD 180 per share.

As a reminder, Sojaprotein is the largest soybean processing factory in Serbia. Last year, MK Group took over Victoria, after buying out its debts from the banks. After this event, the obligation to announce a takeover bid for its subsidiaries Veterinarski Zavod and Sojaprotein occurred.