50 Cent is back! But this time, he’s touring the FED fund target band instead of concert halls. After yesterday’s FOMC which delivered a 50bps (i.e. 50 cent) rate hike, two more 50 cent hikes are expected June 15th and July 27th. What’s our take on yesterday’s FOMC? Find out in this brief research piece.

FED Chairman Jerome Powell managed to tickle the global financial markets with a 50bps FED fund hike (new target set at 0.75%-1.00%), just as LIBOR and FED futures were expecting. The dovish surprise came from Powell’s remarks on 75bps hike not even being considered in closed door meetings, instead favoring 50bps hikes on the following two meetings at least. That gets us to 2.00%-2.25% by the end of July. A slower than expected pace caused a minor euphoria on global markets, regardless of the asset class. US blue chips, mainly FANGs (if anybody uses this acronym anymore), rallied by roughly 3.0%-5.0% and US 2Y dropped from 2.80% to 2.60%.

The only dovish thing we heard today is basically that a 75bps rate hike is currently off the table. FOMC is highly attentive to Chinese lockdowns and Ukraine invasion as potential inflation tailwinds, but the Washington based institution remains tight lipped on that, possibly because inflation woes are more important than recession travails. Additionally, QT is scheduled to unwind at a pace of 30bn USD for Treasuries and 17.5bn USD for MBS in the coming three months, accelerating to 60bn USD and 35bn USD thereafter, respectively.

What really caught our attention yesterday was FED’s fuzzy idea of a neutral rate. First and foremost, Powell expressed his skepticism aimed at estimating the neutral rate, saying that there’s a lot of “false precision“ in the calculation. On the other hand, he also said FED will move expeditiously toward neutral. This comes just weeks after one ECB paper expressed reservations about its own staff projections of inflation (FT subsequently called it the mea culpa report). It seems FED is humming to the same tune as the ECB: staff projections based on backward looking data might not be as good at predicting the trajectory and pace of economic variables in historically unique situations such as post-pandemic recovery. What Powell essentially said is that staff forecasts were once used the same way the ancient mariners were using stars – for navigation. In post-Covid world, staff projections look more like astrology than real science. Hopefully, that will change in the future. For the time being, in forecasting the pace of rate hikes, it’s more useful to look at the developments in the real economy (i.e. inflation and unemployment) than the movements of celestial bodies (such as forecasted medium term inflation).

So what happens next? We switch our attention to Friday’s NFP (380k expected by BBG consensus versus 431k a month ago) and especially the May 09th Victory Day in Russia. The latter is certainly going to weigh more influence on CEE spreads than the former. Speaking about Victory Day, a lot of analysts expect a possible escalation of conflict, but we believe the grim expectations are overblown. Kremlin’s spokesman Dmitri Peskow also downplayed fears of escalating conflict, but nobody took his word for it because by now we all figured out on our own who really calls the shots in Kremlin. Nevertheless, it’s still worth keeping an eye on the rhetoric coming from Moscow on this important day.

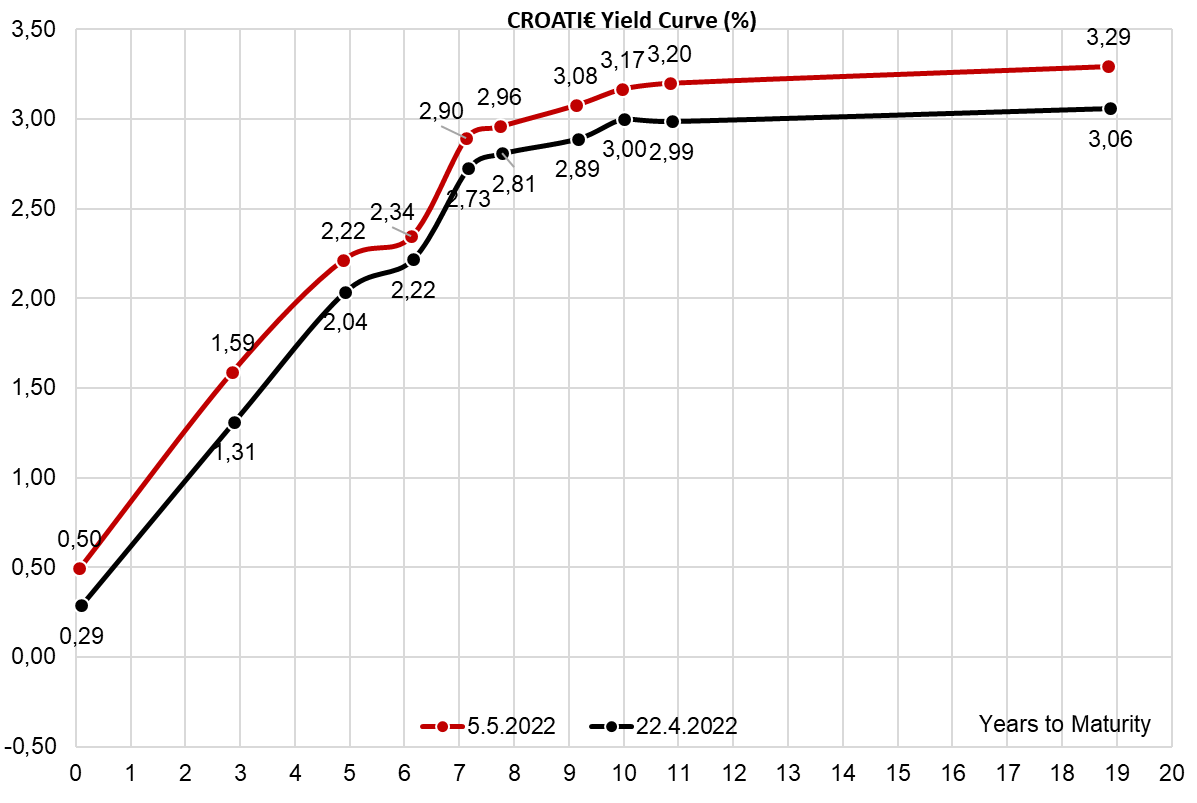

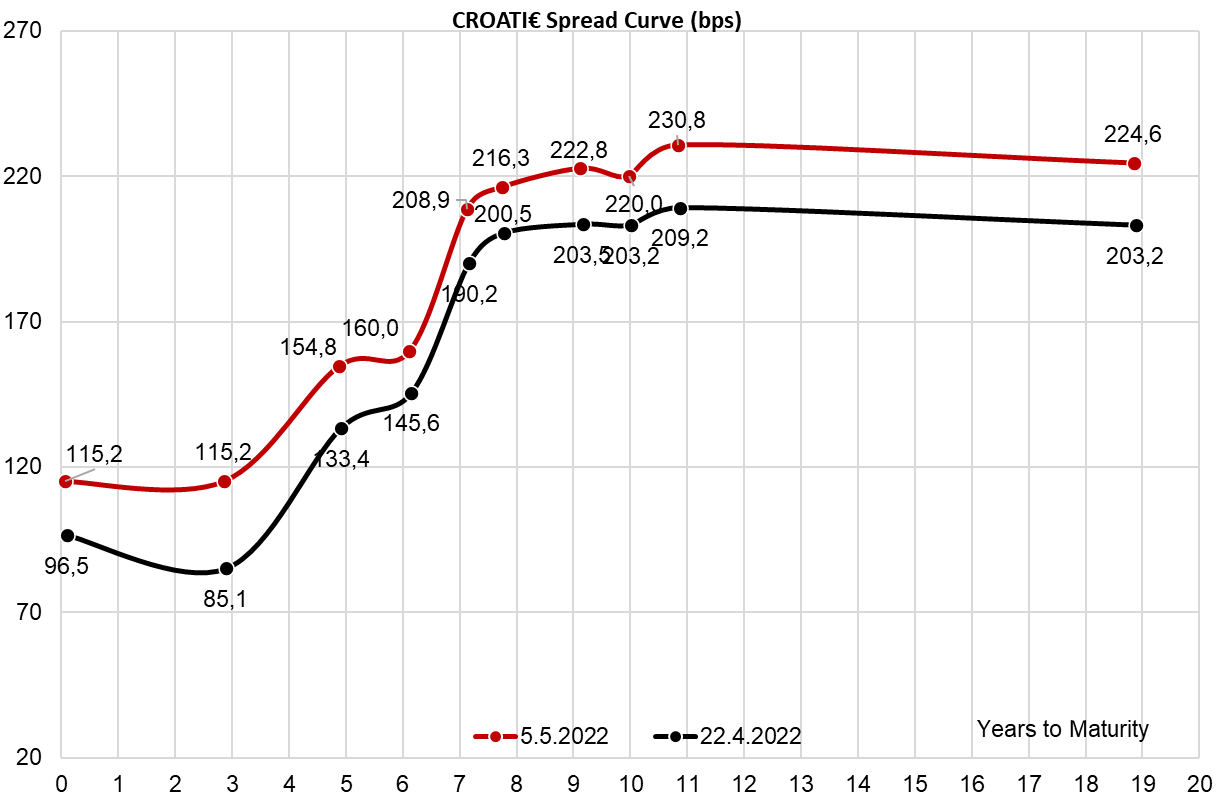

What’s going on with Croatia? Risk off sentiment that was broken yesterday with 50 Cent Powell also reversed the BTP-Germany spread widening that was knocking on heaven’s door of 200bps pre-FOMC (for more info, check out .ITLGER10 on Bloomberg or take a look at the chart above this paragraph). The spread was often seen as a proxy for spread between Croatia and Germany, so you can see that between April 22nd and yesterday Croatian risk premia widened as well (second chart below). There is a silver lining in all of this: CROATI 2.875 04/22/2032€ big seller is out, perhaps because he managed to offload, so the bond should appear less heavy going forward. We are under the impression that at least some of the maturing RHMF-T-218F (the 1.2bn EUR pure FX heavyweight that banks love so much) spilled over into new eurobond, hence providing domestic support. From our talks with insurers, we got a feeling that big money LDIs are currently hoarding cash and avoiding any unnecessary CEE investment before the coast is clear on Ukraine-Russia conflict. We aren’t really sure when the fog of war will clear, but we have a feeling that when that eventually does happen, there will be plenty of buyers and only a handful of sellers. Business as usual.

At the share price before the announcement, this would amount to a DY of 3.14%. Ex-date is set for 23 June 2022.

Atlantic Grupa has released an invitation to the General Assembly of Shareholders, to be held on 15 June 2022. In it, they also published MB and SB proposals, out of which one refers to the dividend payment. According to the report, a dividend of HRK 50 DPS shall be paid in 2022, out of the retained earnings the Company realized in the 2020 business year.

At the share price before the announcement, this would amount to a DY of 3.14%. It was also proposed that the net profit from 2021 shall remain undistributed. The ex-date is set for 23 June 2022, while the payment date is set for 5 July 2022. The said proposal is subject to approval by the GSM.

Also, the proposal to split Atlantic’s shares 4-for-1 was made. By distributing shares the company wants to increase its liquidity and attract new investors. A share split is to be approved, just like a proposed dividend of HRK 50 DPS, at the General Assembly of Shareholders that will be held on 15 June 2022.

Below we provide you with a historical overview of the Company’s dividends per share and dividend yields.

Atlantic Grupa Dividend per Share (HRK) and Dividend Yields (%) (2013 – 2022)

In Q1 2022, TNG recorded an increase in sales of 57.6%, an EBITDA increase of 194.2%, and a net loss of HRK 1.5m (compared to net loss of HRK 9.5m in Q1 2021).

In Q1 2022, TNG recorded an increase in sales of 57.6% (or HRK 28.8m) and amounted to HRK 78.8 m. This increase can be attributed to higher exposure to spot market results during first quarter – especially when compared to much lower spot market prices in Q1 2021. To amplify positive change, sales reported higher numbers due to the absence of drydocking days in this quarter. At the same time, commissions and voyage-related costs amounted to HRK 29.9m, an increase of 84.6% YoY. This increase is also attributed to the higher exposure to the spot market in 2022, compared to 2021. In total, operating expenses amounted to HRK 69.6m, an increase of 25.6% YoY, mostly driven by the aforementioned increases in commission and voyage-related costs.

The Company also notes that during the year, the average TCE (Time Charter Equivalent) net daily rate amounted to USD 13,549, an increase of 15.2% YoY, mostly due to the higher amount of time the tankers were employed on time charter contracts. At the same time, the daily vessel operating expenses decreased slightly to USD 6,828, a decrease of 1% YoY. Meanwhile, fleet utilization increased as well, growing by 4.3 p.p. to 99.9% in 2021.

The EBITDA increased almost threefold (+194.2% YoY) and amounted to HRK 22.4m. This increase can mostly be attributed to the higher sales due to the aforementioned utilization rate and Time Charter Equivalent rates. EBITDA margin in Q1 2022 amounted to 28.5%, an increase of 13.2 p.p. YoY.

Net interest expenses amounted to HRK 4.2m, while net FX losses amounted to HRK 6.5m.

The Company recorded a net loss of HRK 1.5m, a lower net loss than the year before when net loss amounted HRK 9.5m. This result can be attributed to several factors: aforementioned higher exposure to spot market, absence of drydocking days, higher average TCE (Time Charter Equivalent) and increase in fleet utilization.

TNG Financials (Q1 2022 vs. Q1 2021, HRKm)