One United Properties successfully completed their IPO on Friday, during which they sold130,007,085 shares, which account for 10% of all shares. The final offer price amounted to RON 2 per share which gives a market cap of RON 2.8bn. Therefore, to get you a bit more familiar with the BVB’s latest addition, today we bring you an overview of One United Properties.

In the new listing on the Bucharest Stock Exchange, we saw the Romanian developer One United Properties embark on a 10% IPO between June 22 and July 2. The company planned to sell 130,007,085 shares, which account for 10% of all shares at a price ranging between RON 1.93 and RON 2.12 per share. Note that 60% of the public offer was addressed to a tranche of institutional investors, and the remaining 40% to retail investors.

According to a statement released on the BVB on Friday, the final offer price was set at RON 2 per share, while the company’s expected capitalization is RON 2.86bn (EUR 580m). Meanwhile, according to the prospectus trading will start either on or around July 15th.

What is it all about?

Founded in 2006, One United Properties (ONE) is one of the most important players on the Romanian real estate market and the leading developer of luxury residential real estate. The Company’s activity is organized into four business lines: developing and selling residential properties, developing office properties, renting Group owned properties and investing. The main line is the residential activity, covering Bucharest and Constanta (including Mamaia).

Financial overview

The main product of the Group are the housing units (mainly apartments) in the categories “medium”, “medium-high”, “high” and “very high” prices, located in exclusive/high interest areas for residential spaces in Bucharest and Constanța (including Mamaia), the targeted customers being mainly those who purchase housing units respectively for their own use, to a significantly more reduced extent being those who purchase these units for rent or buy them as an investment. The segment posted volatile sales results in the observed years with sales ranging between RON 147m and 437m. However, there is an explanation to that. The segment’s 32.9% YoY drop in 2019 can be attributed to lower amounts recognized as income in that year, as the apartments sold were in a relatively less advanced stage of completion. Meanwhile the segment surged 196.8% in 2020, amounting to RON 437.5m, with the bulk of sales coming from three projects (One Mircea Eliade, One Herastrau Towers, Neo Mamaia) Overall, One United Propertieshave a portfolio of completed residential projects with a gross development value (GDV) of over EUR 222.6m and other projects under development/planning of EUR 939.4m. As of the date of this Prospectus, the Issuer has completed residential projects that include 687 housing units, with another 4,000 units under development, of which over 900 are under construction.

Regarding the rental & services income, rental income has been diminishing during all three observed years with 2020 posting the strongest decrease of -89% YoY to just RON 1.3m. The reason behind this is the expiration, of the main lease of One North Gate, which was the only rent-generating project at that time. Furthermore, rental income was also affected by the pandemic and switches to a work from home set up. Meanwhile revenues from services to tenants have been observing a similar trend. However, the Company intends to rely more intensely on the office rental activity from 2022, with the help of two new projects, namely One Tower and One Cotroceni Park.

Turning our attention to gains from investment property, one can notice that they have been quite volatile during the observed period. Note that this was primarily due to gains related to office buildings under development. Just like what happened to the company’s rental income, the outbreak of the COVID-19 pandemic affected the valuation of office buildings which now became more conservative.

One United Properties Operating Income (RON)

When observing the company’s expenses, administrative expenses stand out as they have soared from RON 8.8m in 2018 to RON 29.9m in 2020, mostly backed by the general increase in the company’s activity. Meanwhile commissions for brokerage real estate have been sliced in half, from RON 2.6m in 2018 to RON 1.1m in 2020. This decrease is due to the fact that these expenses through sales are recognized in the result when the apartment is completed and delivered to the final customer. Thus, the evolution of these costs is directly related to the completion of projects.

As one could have noticed by now, One United Properties have quite a volatile business and the same goes for their operating result. Namely, EBIT ranged between RON 137.9m and 217.3m in the observed period.

As a result of the above-mentioned, net profit was volatile just as the rest of the P&L.

One United Properties EBIT (RON) & Margin (%)

One United Properties Net Profit (RON) & Margin (%)

Balance Sheet

On the balance sheet, the company operates with a very low level of indebtedness with the net debt/EBITDA ratio amounting to 0.98x. This is also visible when comparing the company’s interest-bearing debt to assets which has only increased slightly, from 19.3% in 2018 to 22.6% in 2020.

One United Properties Capital structure in %

Dividend Policy

In their prospectus, the company also announced a dividend policy that envisages a payout ratio of 35% of the company’s distributable net profit.

Peer Analysis

When compared to some peer companies, One United Properties seems somewhat overvalued. However, this could partially be explained by the high profitability of the company, coupled by the optimistic outlook of the local market.

| wdt_ID | Company | EV/EBITDA | P/E |

|---|---|---|---|

| 1 | Deutsche Wohnen | 10,23 | 11,52 |

| 2 | Polski holding Nieruchomosci | 15,85 | 15,78 |

| 3 | Nexity | 6,45 | 20,05 |

| 4 | Median | 10,23 | 15,78 |

| 5 | One United Properties | 14,57 | 16,96 |

Index performance wise, H1 2021 could be characterized as a very solid period for all regional markets. How does this performance compare to the previous years?

In H1 2021 almost all regional markets recorded a double-digit increase of their respective main index, which can be seen in the graph below. The Slovenian market observed the largest index increase of 24.9%, the Austrian index followed closely with an increase of 22.4%. The Serbian market index BELEX15 has seen the smallest increase of 4.1%. Meanwhile, CROBEX noted a very solid increase of 13.9%.

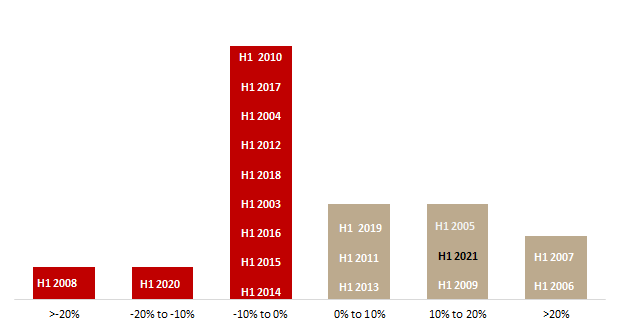

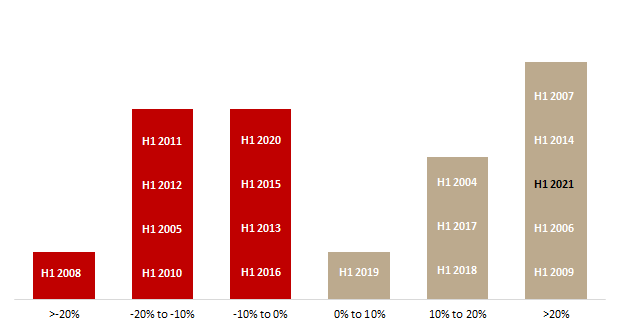

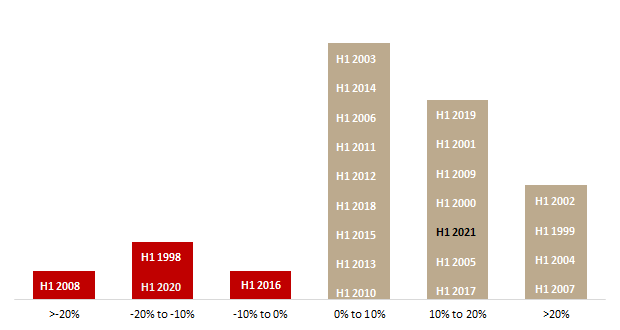

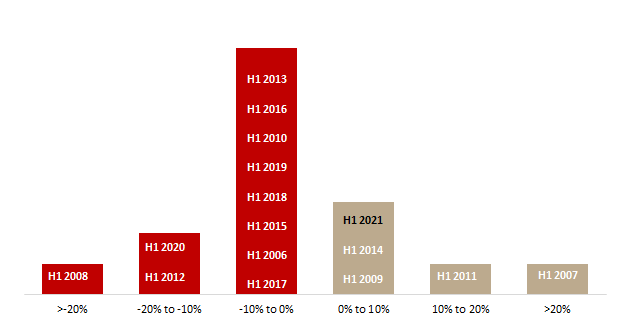

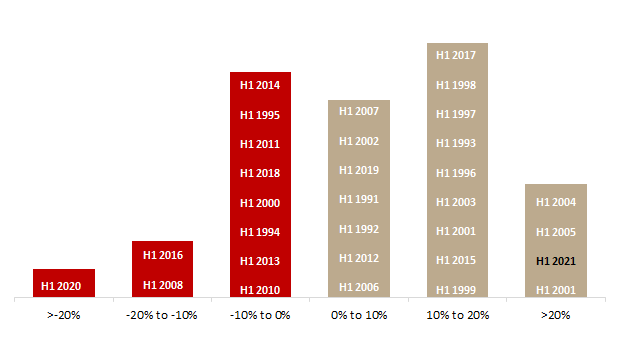

For today we decided to present you with a graphical overview of the index performance throughout time. The following graphs show H1 return of each index on a spectrum from >-20% to >+20%. Note that the higher placement of a certain period on a graph represents a better or worse index performance in the respective period.

CROBEX (H1 2003 – H1 2021)

Source: Bloomberg, InterCapital Research

SBITOP (H1 2004 – H1 2021)

Source: Bloomberg, InterCapital Research

BET (H1 1998 – H1 2021)

Source: Bloomberg, InterCapital Research

BELEX15 (H1 2007 – H1 2021)

Source: Bloomberg, InterCapital Research

ATX (H1 1991 – H1 2021)

Source: Bloomberg, InterCapital Research

In June CROBEX increased by 2.47%, ending the month at 1,980.49.

The total equity turnover has seen another increase in the past month, in June the turnover reached EUR 38.3m (HRK 287.5m) which is an increase of 35% MoM. This translates into a daily average of EUR 1.9m (HRK 14.4m), showing an increase of 122% YoY.

Out the total value traded (excluding block transactions) in June, Atlantska Plovidba generated 13% of the total equity traded on ZSE. HT, Valamar Riviera and Adris grupa generated 12%, 11% and 10%, respectively, followed by Maistra with 7%. The top five traded companies accounted for 53% of total value traded.

We also note that large block trades of HT occurred in June, generating EUR 17.2m (HRK 129.2m) of turnover.

Among CROBEX constituents, Atlantska Plovidba performed at best level, with a share increase of 19.3%. Končar also noted a solid increase of 7%.

On the other side Dalekovod noted the highest share price decrease of 15.6%. To read more on the reasons behind the plunge, click here. Optima Telekom, trading in the official market, noted a share price decrease of 12.3%.

The main index of ZSE, CROBEX continued its positive sentiment from last month, ending June at 1,980.49 points (+2.47%).

BELEX15 index recorded an increase of 1.42% and ended the month at 779.45 points.

In June, the Belgrade Stock Exchange observed a turnover of EUR 6.2m (when observing solely equity), which would translate to a relatively low average daily turnover of EUR 280k. As of end June, BELEX is up by 4.12% YTD.

The most traded share was ALTA Banka with EUR 4.3m, the only share that recorded turnover higher than EUR 1m. When observing the BELEX15 constituents, the most traded share was Messer Tehnogas with EUR 189.2k, followed by NIS with EUR 186.8k and Komercijalna banka with EUR 183.7k.

Turning our attention to the gainers of the BELEX15 index, Jedinstvo recorded the highest increase of 9.81%, next comes Komercijalna banka with 5.71%. On the flip side Messer Tehnogas noted a decrease of 0.28%, while NIS reminded flat.