Over the past week, bond markets have lived through a rollercoaster. Since the start of February, the US 10-year yield has risen by 15 basis points due to huge non-farm payroll numbers exceeding the market’s expectations. As the central bankers are getting forward with dovish statements, this might be a good entry point for steepening of the yield curve trades or increasing the duration of the bond portfolio.

Since the start of 2024, the market partially reversed the rally on the bond market that started at the end of October. Macroeconomic data and the PMIs are proving that the US economy is not slowing down as expected. Nonfarm payrolls revisions added approximately 27 thousand payrolls per month in the second half of 2023 which implies a stronger labor market than previously thought. However, as Mr. Powell pointed out at the latest Fed meeting on Wednesday the 31st of January, a strong labor market and strong growth with current disinflationary dynamics is the ideal scenario for the Fed. Also, he pointed out that current strong services inflation is compensated with lower goods inflation which is in line with their 2% inflation target. Furthermore, bond volatility is elevated as market participants are not convinced that the inflation is completely contained, even as most inflation data in the recent months came below expectations proving that the disinflation forces are stronger than expected. Energy markets, especially the natural gas and oil market are helping central bankers in containing inflation as the WTI price stabilized between 70$ and 80$ per barrel.

Following the NFP data on Friday, the US Treasury 2-year yield rose sharply by almost 20 basis points as the market is discarding rate cuts that were priced in before. More than one rate cut was discarded out of overnight index swaps in 2024 with cuts being moved forward in time from March to May Fed meetings. As long as the energy markets are contained, there are not many reasons to believe in a second inflationary cycle. Wage growth on Friday was well above expectations, however, the number of hours worked dropped, especially in manufacturing sectors which is a clear sign of a momentum slowdown in the economy. Another disinflationary force is China whose problems are rolling over without the light at the end of the tunnel in sight without a huge stimulus that was widely expected a few months ago. All of the arguments mentioned above point to using this NFP data point as the entry point for buying bonds, both on the front and the long end. As long as the Fed keeps its rate-cutting narrative, there is no reason to fight it, rather than follow it. Also, it should be much easier than last year when the tightening cycle was in place and shorting bonds is clearly a risky position to have due to heavy losses in case of bank failures or other tail events.

The recent NFP data has sparked significant movements in the bond market, with the US 10-year yield rising by 15 basis points. Despite the rollercoaster, the market partially reversed the rally that began in October 2023, fueled by strong macroeconomic data and PMIs indicating continued economic strength. Federal Reserve Chair Powell emphasized the ideal scenario of a strong labor market and growth with current disinflationary dynamics. Bond volatility remains elevated, reflecting uncertainty about contained inflation. The rise in the US Treasury 2-year yield post-NFP suggests a shift away from previously priced rate cuts. The prevailing narrative favors buying bonds, particularly amid Fed’s rate-cutting stance and global economic factors restraining inflationary pressures.

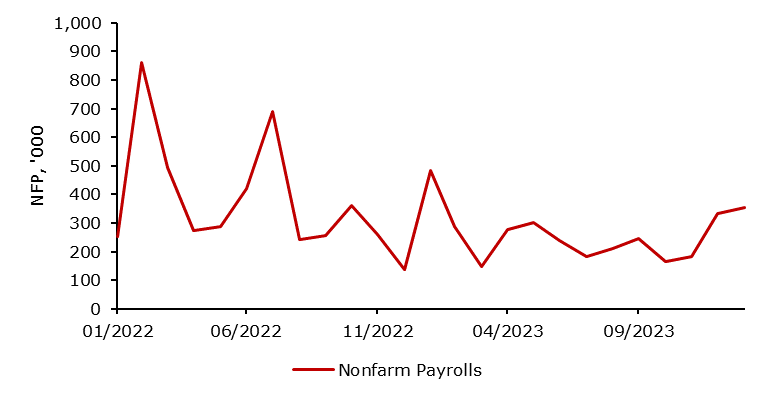

Nonfarm Payrolls

Source: Bloomberg, InterCapital

Today, we decided to present you with a brief overview of CROBEX constituents’ free float as the FY reporting season is soon to come.

In our analysis we considered free float to equal all individual shareholdings lower than 5%, while pension funds and UCITS funds were considered as free float regardless of their shareholding percentage.

Source: ZSE, InterCapital Research

Just more than half of CROBEX constituents have free float higher than 50% indicating that 50%+ of CROBEX constituents are still held by a small group of majority shareholders. Of the constituents, only Ingra and Adris (pref.) has a free float of over 90%.

On the other hand, ZABA and Kutjevo have less than 10% of free float. ZABA has a free float of 3.8% and is almost completely owned by Unicredit with 96.2% ownership. ZABA is followed by Plava Laguna, Brodogradilište Viktor Lenac, and HPB with a free float of 15.8%, 18%, and 25.4%, respectively.

We note that the only significant recent change occurred in Podravka’s shareholder structure, where Braća Pivac acquired >5% of the total shares outstanding, partially lowering Podravka’s free float on ZSE.

The prime market is the most demanding market on the Zagreb Stock Exchange regarding the requirements set before the issuer. It is worth noting that it requires the issuer to have a free float of at least 35%. If we were to compare CROBEX to that parameter, a few of the constituents would not meet the criteria (ZABA, Kutjevo, Brodogradilište Viktor Lenac, and Jadroplov).

If we were to calculate the free float of CROBEX constituents while excluding pension funds, the results would be slightly different for some, but significantly different for the majority of companies. Namely, Croatian pension funds held EUR 2.7bn of the current total market capitalization of ZSE. This amounts to 11.6% of the current market cap of ZSE equity which amounts to EUR 22.9n.