“Labour market is strong, rate-setters are wrong.” This verse circulated chat rooms and it even reached Twitter on Friday afternoon as sound NFP figures (payrolls and wages) crossed the wires. We beg to differ – labour market is strong, however central banks might not make a faux pas if they stop raising rates past a certain point, this point being in sight. Now let us elaborate why.

Friday’s US labour report came stronger than consensus, both in terms of aggregate payroll figure (+263k vs. +200k BBG consensus) and average hourly earnings (+5.1% YoY vs. +4.6% YoY BBG consensus). The headline NFP figure delivered a print 63k above consensus, but even more importantly October NFP figure was adjusted upwards by some 23k (from +261k to+ 284k). Remember those headlines about the tech sector layoffs (3.500 people on Twitter alone)? Well, the tech sector recorded a positive figure overall, meaning that the rumours are failing to materialize. Regarding average wage growth, the figure came at +5.1% YoY, significantly above the 3.0% YoY number recorded in late 2019/early 2020. If anybody was looking for a figure that would support the claim that the US labour market was hitting the dire straits, it became obvious that the figure was nowhere to be found.

A strong labour market report was the reason behind our amazement that Nick Timiraos published another fortune-telling article in WSJ underlining the FOMC being on track to do a 50bps hike on the December 13th-14th meeting. The article came with a caveat – they might raise rates above the 5.0% threshold in the first half of the coming year if the market demands it. This is where Pery Mehrling’s notion on the stock and flow effect of rate hikes kicks in: with PCE inflation rising to +6.0% YoY and core PCE at +5.0% YoY, it might not take more than 5.0% in FED fund target to bring inflation down; however, it might take 5.0% for longer than previously expected. Also, there’s an increasing number of consumer price components printing price declines, however, we’re still waiting for the second shoe to drop – namely, rent and housing inflation. FED officials including Mr. Powell stated that they’re not concerned about wage growth per se, but what they’re really worried about is a tight labor market feeding into higher wages and creating higher for longer scenario – Powell himself said on Wednesday: “We don’t think we’re at that point. But it can’t be that we can go on for five years at very high levels of inflation and that doesn’t work its way into the wage – and price-setting process pretty quickly”. That sounded a bit hawkish to us, but you be the judge of that.

Speaking about the central banks and monetary policy, it’s important to note that we have the possibility of transatlantic monetary policy divergence in the sense that the FED gets to the target and stays put, while the ECB continues to hike since the terminal rate in Europe is nowhere to be seen. That’s possibly the reason for the sudden strength of EURUSD; if the monetary divergence truly materializes, EURUSD might have more room to go up. At this moment in time, this looks like the most credible scenario since FED has implemented passive QT for several months now, while the ECB’s QT is still on the drawing board with several ECB top officials hoping that inflation eases before they start reducing the balance sheet. If QT caused bottlenecks in the US bond market, you could only imagine what the European version could do to periphery-to-core spreads if not properly implemented. Therefore, ECB’s focus remains on the front end of the curve, hoping that would be enough to curb inflation.

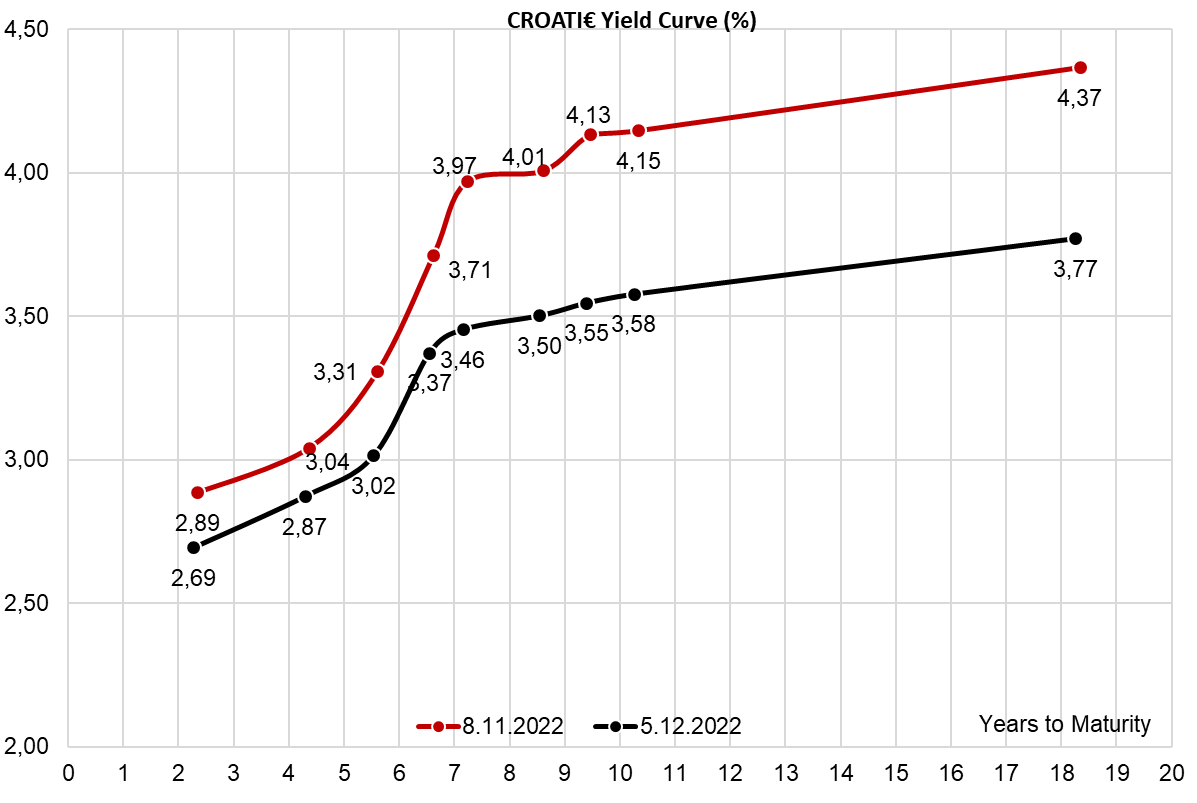

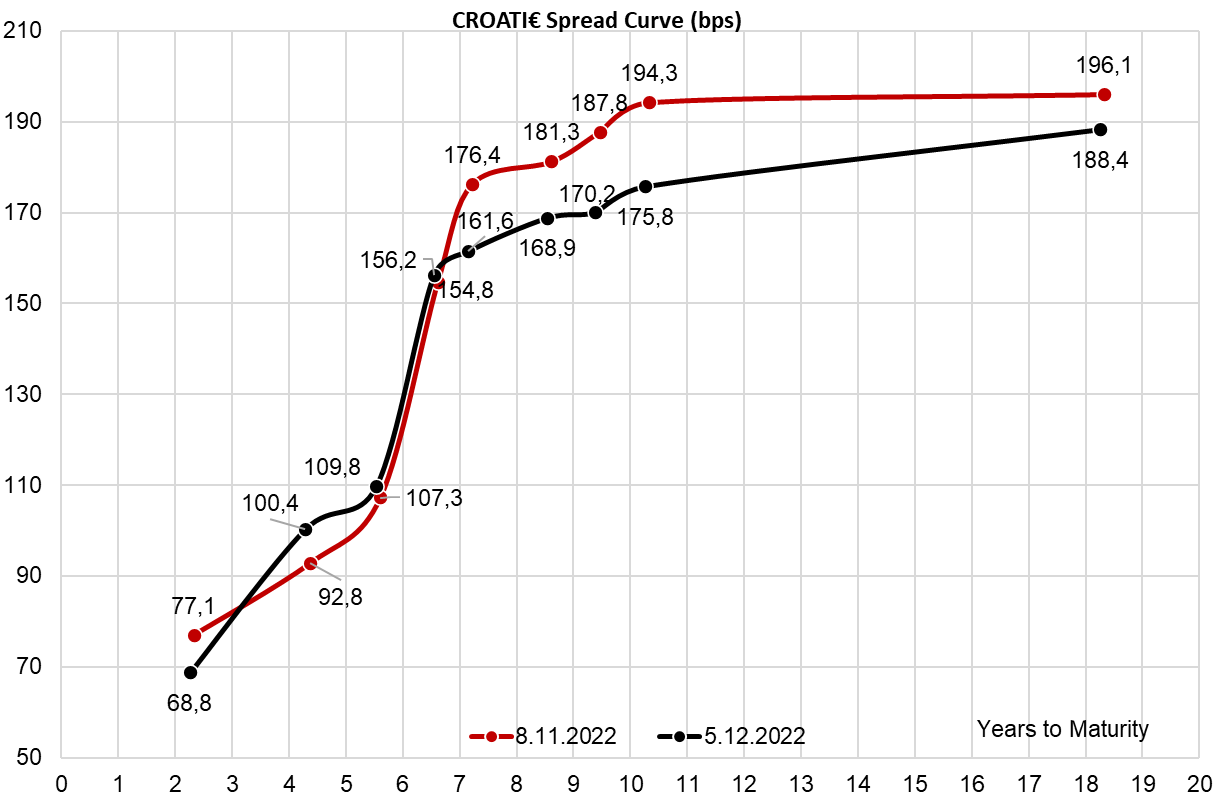

Source: Bloomberg

Probably the best thing about NFP was the subsequent rise in yields that might present opportunities to go long on cash bonds in case you’re underinvested into year-end. Lack of collateral is the pain here: only two bonds available in decent sizes are CROATI 2.875 04/22/2032€ (95.50 worked this morning in 5mm EUR, 3.44% YTM, B+161bps) and CROATI 1.125 03/04/2033€ (80.00, 3.48% YTM, B+167bps). We would like to point out that the lack of collateral on the international bond market revitalized local market trading and the trend will probably persist in days to come. RHMF-O-34BA could be sourced in decent sizes (25mm HRK++), as well as RHMF-O-327E – both papers being traded at roughly Eurobond yields (i.e. at zero liquidity premium). They say that beggars can’t choose, however cash rich asset managers with longer liabilities are not used to being beggars, meaning they might take some time to make sure the Eurobond market is pretty dry before deciding to lift any liquid offer on longer bonds.

Source: Bloomberg

Since 1 January 2022 up to date, none of CROBEX10 constituents outperformed the index more than 50% of the time.

For today, we decided to look at how often did each CROBEX10 constituent outperform/underperform the index. The figures relate from 1 January 2022 to date.

In the mentioned period, the CROBEX10 has observed a decrease of 11.2%, while 4 of the constituents outperformed the index. Of that, Atlantska Plovidba is the only constituent to actually report an increase in its share price, amounting to 4% YTD increase. Podravka, HT and Končar are to follow, decreasing in share price by “only” 0.3%, 6.2% and 8.3%, respectively. On the flip side, AD Plastik noted the biggest decrease of 51.2% due to semiconductor shortage in the EU market and the Russian geopolitical situation, where most car producers have stopped their production. This material impact has already been seen in AD Plastik’s H1 financial statements with the same trend continuing in 9M 2022 period, with net loss amounting to HRK 87m, due to lower sales revenue and higher costs, which also lowered operating profitability.

How much did individual constituents out/underperform the index? (YTD) (p.p.)

Source: Bloomberg, InterCapital Research

Among the CROBEX 10 constituents, each of them underperformed the index more than 50% of the time. To be specific, Adris (pref.) underperformed the index 50.2% of the time leading the way on top of the list. Adris is followed by HT with 51.1% of the time.

On the flip side, we note the CROBEX10 constituents that underperformed the index most of the observed times. Of those, Arena Hospitality leads the list, underperforming the index 54.9% of the time. Also, we note that Arena Hospitality underperformed CROBEX10 by 12.8 p.p. YTD with only AD Plastik noting worse YTD performance.

How often do CROBEX10 Constituents Outperform the Index? (%)

Source: Bloomberg, InterCapital Research