As central banks are expected to go in easing mode once again, yields across the globe are going only one way. German bund currently stands close to -40bps despite this week some relief came from Italian policy makers. It seems now investors can’t see scenario in which yields increase, resulting in yield hunt and depressed risk premia all over EM, especially CEE.

On its last monetary policy meeting, the Governing Council of the ECB said that it expects interest rates to remain at their current levels at least through the first half of 2020 (versus „through the end of 2019“ stated in April) with Mr Draghi at Sintra saying that “further cuts in policy interest rates and mitigating measures to contain any side effects remain part of our tools” which was pronounced as announcement of rate cuts already this year. Furthermore, Mr Draghi mentioned limits on asset purchases implying they could increase limits in case they decide to purchase more bonds in the coming period. On top of that, IMF’s Christine Lagarde who is seen as dove and is known for ease stance is most likely to be Draghi’s successor. Bearing in mind all mentioned, one shouldn’t be surprised seeing bund at -40bps while 5Y5Y inflation swaps also being at their bottom, around 1.20%. Besides inflation and growth slowing down in Eurozone, one of the drivers to ease policy was also trade wars that are weighing on general global growth.

Meanwhile, last Saturday Mr Trump stated that USA will not impose additional tariffs on Chinese goods and that they could have a deal in the near future. Without many surprises, that was the main driver for green color on most of the major equity markets in the beginning of this week, leading S&P500 equity index to the highest levels recorded. As financial stability is obviously one of the aims of FED, it will be interesting (at least to say) what will Mr Powell say on its next FOMC meeting in the end of July. Looking at the futures markets, market already priced one cut in July although few weeks ago some analysts were mentioning that even 50bps cut could be in cards. Expectation of 50bps cut was based on history when FED cut rates by 50bps when they started to ease their policy. However, both times that was just after recession kicked in while now analysts ‘only’ expect modest one to start somewhere in mid-2020.

So where are we now? Not to disrupt capital markets, FED is most likely to cut its interest rates in less than a month while Mr Draghi and his company could follow later this year. We think that at the moment one could find several reasons why Mr Powell shouldn’t ease his policy right now (strong rise of credit, solid GDP growth and inflation, unemployment at record low, equity indices at record highs etc.) while that would be a bit tougher for the ECB.

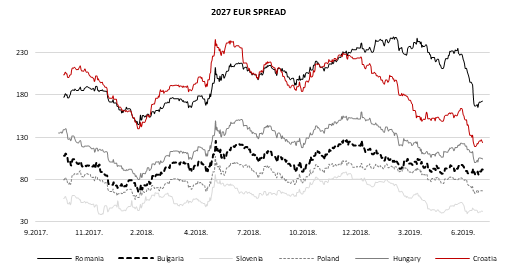

Coming closer to home, one should by now know that Croatian Eurobonds were among best performers in EU, driven by both benchmark and spread contraction due to investment grade. However, one should know that Croatia is not alone as yield hungry investors went to EM once again. On the chart submitted below you could see how risk premia fell significantly for all the countries presented, with Romania having slightly different path due to political risks.

Source: Bloomberg, InterCapital

The expected duration of the project is from Q4 2018 to Q4 2019.

Ericsson Nikola Tesla published a document in which they state that the Ministry of the Interior of the Republic of Croatia and a group of economic operators headed by Ericsson NT whose members are Securitas Hrvatska and Hidraulika Promet, have signed a supply contract with the aim to implement the project “Strengthening surveillance of the state border through the procurement of a thermovision camera on a trailer with a field vehicle”. The purpose of the project is to protect the state border, i.e. establish surveillance of the state border in accordance with Schengen standards.

The contract is worth HRK 37 million (VAT excluded) and is co-financed by the Internal Security Fund. Note that the expected duration of the project is from Q4 2018 to Q4 2019.

The mentioned company came from a merger of Imperial Rab and Hoteli Makarska, which got delisted on 1 July 2019.

The Zagreb Stock Exchange approved the listing of 365,596 shares of Imperial Riviera which starts trading today. The mentioned company came from a merger of Hoteli Makarska to Imperial Rab, who remained the main entity. Hoteli Makarska got delisted on 1 July 2019.

Imperial Riviera will continue operating under the same ticker of Imperial HIMR and ISIN: HRHIMRRA0001.

Note that Valamar Riviera together with AZ pension fund owns 91.34% of shares of Imperial Riviera.