OMV Petrom published their FY 2021 preliminary report. According to it, consolidated sales for 2021 amounted to RON 26bn, recording a double-digit increase of 31.9% YoY. The increase in sales is due to the higher sales of petroleum products in terms of both prices and volume.

Consolidated sales for 2021 amounted to RON 26bn, recording a double-digit increase of 31.9% YoY. The increase in sales is due to the higher sales of petroleum products in terms of both prices and volume.Sales revenues were partly offset by lower sales volumes of natural gas and electricity. Out of total consolidated sales, Downstream Oil accounted for 63%, Downstream Gas for 37% and Upstream for approximately 0.2%.

Clean CCS Operating result increased by 90% (versus FY 2020) to RON 4.4bn, mainly due to an increase in crude oil prices in the Upstream segment, much higher refining margins in the Downstream Oil segment and better performance of the power activity in the Downstream Gas segment.

Special items comprise net charges of RON -129m, mainly driven by the net temporary losses from power forward contracts in Downstream Gas. Inventory holding gains amounted to RON 122m, mainly driven by an increase in crude oil prices.

Operating profit for 2021 reported an increase of more than 2x, compared to FY 2020. This increase is mainly driven by the favorable market environment. This increase was partly offset by the lower prices as COVID-19 crisis had a negative impact on the industry, and by the net impairments triggered by the revision of price assumptions.

Net financial result was down to RON -311m (versus 2020 gain of RON 12m) mainly due to higher interest expenses in relation to the discounting of receivables and to the one-off positive effect in 2020. As a result, profit before tax for 2020 was RON 3.4bn – 2.3x higher than RON 1.48bn achieved in 2020.

OMV Petrom ended 2021 with net profit of RON 2.86bn, representing an increase of 121.8% YoY.

DIVIDEND PROPOSAL

Based on the above-stated results, the Executive Board of OMV Petrom proposed a gross dividend of RON 0.0341 per share, which represents a 10% YoY increase. The dividend translates to a yield of 7.02% at the current share price. Note that the ex-date was not stated. The Executive Board’s proposal for the distribution of dividends for the FY 2021 will be submitted for approval to the April 2022 Ordinary General Meeting of Shareholders after the approval by the Supervisory Board, following Audit Committee review.

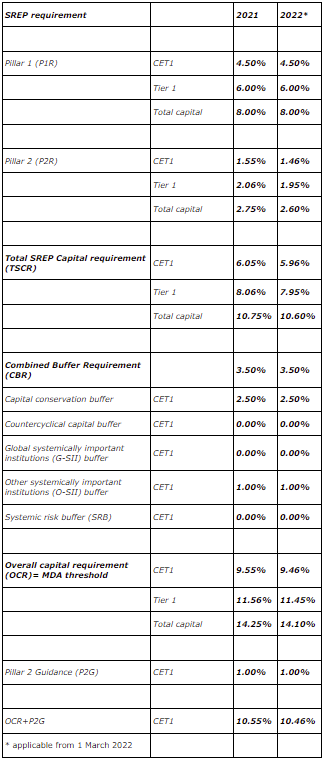

On 2 February 2022, the ECB issued a new SREP decision for NLB. Due to the new ECB SREP decision, NLB lowers Total Capital Ratio from 14.25% to 14.1% (indicating additional excess capital of EUR 19.2m).

On 2 February 2022, the ECB issued a new SREP decision for NLB under which it has reduced the Pillar 2 Requirement from 2.75% to 2.60% while Pillar 2 guidance remains at 1.00%. New SREP decision shall apply as of 1 March 2022. Following the new OCR the Group has excess capital of EUR 392.4m (9M 2021 results). NLB is as of this date required to maintain the OCR at the level of 14.10% on a consolidated basis, consisting of:

- 10.60% TSCR (8% Pillar 1 Requirement and 2.60% Pillar 2 Requirement (of which at least 56.25% must be held in CET1 capital and at least 75% must be held in Tier 1 capital)); and

- 3.5% Combined Buffer Requirement (2.5% Capital Conservation Buffer, 1% O-SII Buffer and 0% Countercyclical Buffer).

As of the end of 2021, the total loans of financial institutions amounted to HRK 280.3bn, representing an increase of 1.7% YoY or 0.1% MoM. In 2022 we expect loan growth to pick as we expect consumers to continue re-leveraging backed by relatively high consumer confidence.

At the end of 2021 financial institutions total loans amounted to HRK 280.3bn, an increase of 1.7% YoY and an increase of 0.1% MoM. Comparing it to 2021 inflation figure of 2.6%, we can says that the growth was moderate. In 2022 we expect loan growth to pick as we expect consumers to increase their leverage backed by relatively high consumer confidence. As pandemic threat subsides, further increase in consumer spending and growth of unsecured consumer loans is expected. Interest rates for secured lending are on their lowest level in the history, so consumers will continue to have incentives to increase their leverage, so housing loans are expected to growth further. This trend was already evidenced in 2021 when household loans, the largest segment of total loans increased by 3.9% YoY. Uncertainty in economic activity imposed by continuation of pandemic in 2021, has resulted in decrease of corporate loans 0.3% YoY.

Corporate and Household Loans Growth Rate (YoY, %)

In total, household loans at the end 2021 amounted to HRK 141.5bn, an increase of HRK 5.3bn in absolute terms, while corporate loans amounted to HRK 86.05bn, a decrease of HRK 235.9m. The main drivers of the increases in household loans were housing loans, which increased by HRK 5.59bn or 9% YoY to HRK 67.77bn, followed by all-purpose loans, which increased by 1.52% YoY or HRK 792.1m, reaching 53.04bn in 2021.

On the flip side, the growth was offset by credit card loans which decreased by-11.3% YoY or HRK 412.8m to HRK 3.25bn as well as overdrafts on transaction accounts, which declined by -4.4% YoY or HRK -283.2m to 6.13bn in 2021. Combined, these four categories amount to 92% of all household loans. Looking over to Other loans, they continued their decline in 2021, decreasing by -4.27% YoY (or HRK 394.4m) and ending the year at HRK 8.85bn.

Loans to households (HRK m)