As of end October, total financial institution’s loans amounted to HRK 272bn, which represents a 6.5% increase YoY.

Croatian National Bank (HNB) published their monthly statistical report on loans placement of other monetary financial institutions. According to the monthly statistical report as of end October, total financial institution’s loans amounted to HRK 272.03bn, which represents a 6.5% increase YoY and an increase of 0.2% MoM.

Its biggest categories household loans and corporate loans evidenced growth of 3.5% YoY and 4.2% YoY, respectively. In April corporate loans observed a monthly increase of 4.3% which arguably came on the back of higher demand for working capital loans and revolving loans. However, since then corporate loans have been observing a negative trend, recording MoM decreases. As of end October, corporate loans amount to HRK 84.45bn, representing a slight decrease of 0.09% MoM.

It is also worth adding that loans to central government witnessed sharp increase of 23% YoY to HRK 42.86bn, which was mostly evidenced with the beginning of the pandemic. To be specific, this relates to a HRK 6bn loan to the state (for Covid-19 support) which occurred in parallel to HNB reducing the required reserves for banks freed additional funds. Meanwhile, loans to local government amounted to HRK 5.56bn, representing an increase of 21%.

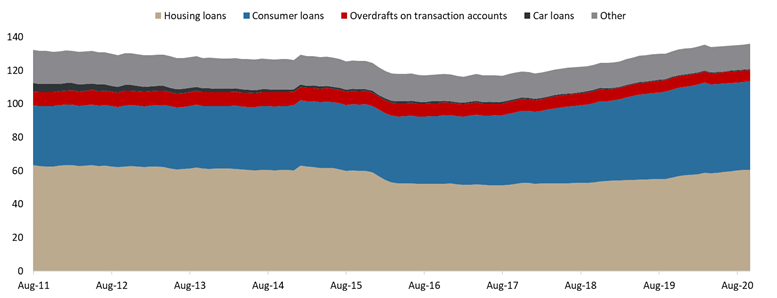

Total loans issued to households amounted to HRK 136.04bn, representing an increase of 3.5% YoY (or HRK 4.59bn). Such an increase was almost entirely driven by a rise in housing loans (+10.1% YoY or HRK 5.55bn) and somewhat consumer loans (+2.1% YoY or HRK 1.09bn). We note that these two items account for 83.47% of the total loans to households. The mentioned increase was partially offset by a decrease in almost all other loan segments (besides mortgage loans). Furthermore, car loans observed a sharp drop of 24.8% or HRK 142.5m, which is the highest drop of all segments. This does not come as a surprise, given the low car sale trend which has been observed throughout this year.

Loans to Households (HRK bn)

Source: Croatian National Bank, InterCapital Research

If we were to compare total loans issued to households since the beginning of the pandemic, one can notice a slight increase of 0.5% or HRK 664.6m. Such an increase could mostly be attributed to a still solid performance of housing loans by 3.2% or HRK 1.87bn, which was partially offset by a 2.1% decrease in consumer loans (or HRK 1.14bn). Meanwhile. the majority of other loan segments also recorded a decrease in the observed period. It is worth noting that we expect consumer loans to further decrease by the end of the year, given the shaken consumer confidence caused by the Covid-19 crisis. This has been a steady trend since the outbreak of the pandemic (when observing MoM development). However, we note that the decrease has seen a steady slowdown in these months, while in October, consumer loans even withessed a slight increase of 0.1% MoM.

On the flip side, housing loans continue recording MoM increases, with the exception of April (lockdown period), when housing loans observed a 0.6% decrease.

Structure of Loans to Households (October 2020)

The EBA revised Guidelines, which will apply until 31 March 2021, include additional safeguards against the risk of an undue increase in unrecognised losses on banks’ balance sheet.

The European Banking Authority (EBA) has decided to reactivate its Guidelines on legislative and non-legislative moratoria. Such a decision was brought after closely monitoring the developments of the COVID-19 pandemic and, in particular, the impact of the second COVID-19 wave and the related government restrictions taken in many EU countries. As a reminder, the guidelines were previously in place until 30 September.

EBA notes that this reactivation will ensure that loans, which had previously not benefitted from payment moratoria, can now also benefit from them. The role of banks to ensure the continued flow of lending to clients remains of utmost importance and with the reactivation of these Guidelines, the EBA recognises the exceptional circumstances of the second COVID-19 wave.

The EBA revised Guidelines, which will apply until 31 March 2021, include additional safeguards against the risk of an undue increase in unrecognised losses on banks’ balance sheet. EBA further adds that with the continued unfolding of the COVID-19 pandemic, it is crucial that banks continue to provide lending to the real economy while recognising any solvency issues in order to ensure that problematic loans are well reflected in their balance sheets.

Thus, as part of the re-activation of its Guidelines on legislative and non-legislative moratoria, the EBA has introduced two new constraints to ensure that the support provided by moratoria is limited to bridging liquidity shortages triggered by the new lockdowns and that there are no operational restraints on the continued availability of credit.

The following constraints apply:

- Only loans that are suspended, postponed or reduced under general payment moratoria not more than 9 months in total, including previously granted payment holidays, can benefit from the application of the Guidelines.

- Credit institutions are requested to document to their supervisor their plans for assessing that the exposures subject to general payment moratoria do not become unlikely to pay. This requirement will allow supervisors to take any appropriate action.