Investing in the biggest U.S. equity index since 2019 would’ve made a positive impact on your portfolio, even with equity market being dragged down by a few negative circumstances like yield curve flattening, QE tightening, boiling inflation, war, etc. Yet, positive sentiment fights pretty hard in financial markets. The region still offers a solid dividend yield which should be attractive for an investor with SBITOP’s expected dividend yield of 6.3%.

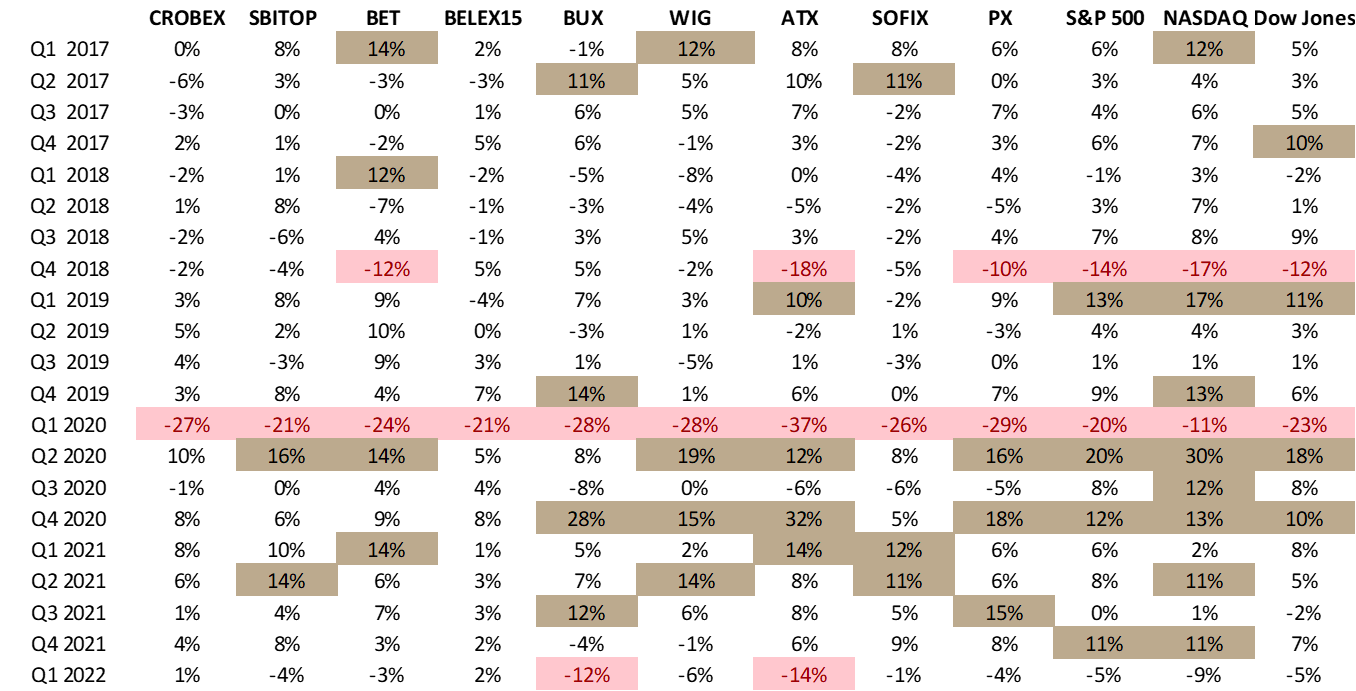

A very challenging quarter ended last week with major global and regional equity indices showing their worst performance in two years. The unease that has plagued equity markets was driven by inflation surging to the highest levels in the last few decades, upending of already stretched supply chains caused by Russia’s invasion of Ukraine and anticipation of rate-increase plan through economies that is influencing discount rates and resulting in flight from equity. 1Q 2022 decrease in value of equity markets is still on average five times lower than the drop induced by the corona crises in 1Q of 2020 when an average decrease of 25% was evidenced. Compared to the end of 2019, equity indices that we are looking at are on average 20% up, while some markets did better than others.

The biggest winners are equity indices in the U.S. (S&P 500, NASDAQ and Dow Jones) and in case you were investing in those markets since 2019 you fared pretty well and could have realized returns in the period ranging from 21.5% (DJIA 2019-1Q 2022) to 70% (NASDAQ 2019-1Q 2022).

When looking at regional markets only Slovenia showed a resemblance with returns to the US by returning 30% in the period from the end of 2019 to 1Q 2022. The drop in Q1 2022 was at 4%, similar to the drop of S&P 500 (-5%) and DJIA (-5%). Slovenia’s equity market has companies with strong fundamentals and since it is a member of EMU, its returns are evidenced in the global currency of Euro. This lack of exchange rate risk gives Slovenia a strong upside compared to for instance Romanian or Polish markets which in the period from the end of 2019 to 1Q 2022 returned 27% and 12%, respectively. In the same period, both currencies depreciated 3.2% and 1.6%, respectively which is not significant in relative terms. So, both markets gave pretty good returns in the period.

Brief regional FY 2021 and Q1 2022 overview

FY 2021 proved to be a very good year for both Croatian and Slovenian Blue Chips. But the market faced another aggravating circumstance, on top of a few one’s market is already bearing (well-known yield curve flattening/inverting, quantitative tightening by central banks more aggressive than expected, still present corona, etc.) due to the Russia – Ukraine situation. Nevertheless, regional blue-chips published their FY 2021 results during March, bearing mostly positive news, among already few mentioned negative ones, still holding up to the positive sentiment.

In Croatia, most blue chips reported both top and bottom-line increases. Croatian tourist’s nights reached as much as 77% of 2019 which was a record year, leading to a triple-digit top-line increase of Croatian tourists. Food companies also reported a good year with inflation pressures starting to impact in Q4. Končar reported robust growth on FY basis. Only AD Plastik reported a drop in both sales and EBITDA levels due to the still-present semiconductor shortage and on top of that, AD Plastik marked the highest negative impact from the Russian invasion of Ukraine due to 27% of revenues being generated from Russia. CROBEX’s movement reported slightly lower changes in price, both on the upside and the downside.

In Slovenia, 2021 proved to be a very good year for Slovenian blue-chips also, as all of them reported YoY top-line growth – clearly representing a more positive sentiment during 2021. This translated into growth in the bottom line for most blue chips. Generally, financials showed a very strong year, yet still having a positive sentiment as the higher expected bond yields would relatively favor financials. Aside from financials, Krka, as SBITOP’s largest constituent, noted a slight increase in sales. Petrol’s acquisition of Crodux boosted their FY and Q4 results. Overall, SBITOP’s expected dividend yield in 2022 is 6.33%, mostly driven by Krka with a dividend yield of 6% and 31% weight in SBITOP. Triglav with 10.4% in SBITOP a few days ago proposed a dividend per share of EUR 3.8, representing a dividend yield of 9.5% at the closing price of the day before, which you can read here.

Corona pandemic market downturn was quite short and severe, and it was followed by a huge amount of government stimulus that has supported the growth of stocks on global and regional markets. But after this market downturn, times of decreasing stimulus and higher marching interest rates are ahead of us. This coupled with oil and energy prices at highly elevated levels shows that this downturn is markedly different from the crash in 2020. The outlook of many multiasset investment officers is that they are not very optimistic about stocks over the next year, while it is not easy to judge by the past as economies were never in a similar position. But it remains to be seen how quickly will assets purchase programs dissolve and how long will global trade bottlenecks be in place. The position of global energy flows are shifting because of Russia-Ukraine war while an abundance of liquidity is not drying up that fast. Companies with exposure to Russia and neighbouring markets are quickly adjusting to new environment in hope that financial markets will not lose their interest. If you throw a good dividend on top of it, demand should be there.

At the share price before the announcement, DY amounted to 2.8% for both the regular and preferred shares. The ex-date is yet to be announced.

Končar D&ST published a document on the Zagreb Stock Exchange in which the Company proposed the distribution of profit for the year 2021. Of the net profit of HRK 88.4m, 53.1m will be held as statutory reserves, while the remaining amount, HRK 35.4m will be paid out as dividends. This represents a payout ratio of 40%.

At the share price before the announcement, the dividend yield amounted to 2.8% for both the regular and preferred shares. The dividend is subject to approval at the GSM, and the ex-date is yet to be announced.

As a reminder, Končar D&ST is a member of Končar elektroindustrija Group (KOEI) and is consolidated in Group results. Končar has 67.9% shareholding in this company.

In the graphs below, we are giving you an overview of the historic movement of the Company’s dividend per share and dividend yield.

Dividend Per Share (2015 – 2022) (HRK) Dividend Yield (2015 – 2022) (%)

In Q4 2021, revenue from internet access services amounted to HRK 1.3bn, an increase of 7% YoY.

HAKOM has recently published its ICT market data for Q4 2021 in Croatia. According to the report, total revenue from fixed public communication networks amounted to HRK 263.1m, a decrease of -4.7% YoY. Of that, revenue from retail amounted to HRK 236.4m, decreasing by -2.9% YoY, while wholesale revenue amounted to HRK 26.7m, a decrease of app. -18% YoY. Meanwhile, the total number of subscribers amounted to 1.2m, a decrease of -2.2%. Of that, HT currently holds the largest market share of 50.5%, remaining at the same level YoY, while other participants on the market hold the remaining 49.5%.

Total revenue from telephone services in mobile public communications in Q4 2021 declined to HRK 974.9m, a decrease of -8.7% YoY. Such a decrease came both on the back of decreases in retail revenue, which decreased by-5.25% and amounted to HRK 826.7m, and the wholesale revenue, which decreased by -24.1% and amounted to 148.2m. In the retail segment, revenue from residential users, which constitutes 75% of the retail revenue, decreased by -6.24% and amounted to HRK 622.4m, while at the same time, revenue from business users decreased by -2.1% and amounted to HRK 204.3m. Meanwhile, the total number of mobile active subscribers amounted to 4,402,213, a slight increase of 0.61% YoY.

Looking at the market share by subscribers, we can see that the situation remains mostly unchanged for the last couple of quarters, with HT maintaining the highest market share at 45.5% (an increase of 0.6 p.p. QoQ but a decrease of -0.2 p.p. YoY), followed by A1, which currently holds 35.4% market share, an increase of 0.1 p.p. QoQ and 0.7 p.p. YoY. Lastly, we have Telemach, which holds 19.2% of the current mobile market share, a decrease of -0.6 p.p. QoQ, -0.4 p.p. YoY.

Mobile Subscribers Market Share, Q4 2019 – Q4 2021 (%)

Total revenue from internet access services amounted to HRK 1.3bn, an increase of 7% YoY. The increase came solely on the back of mobile internet revenue increase, which increased by 11.3% and amounted to HRK 842.1m. Fixed internet revenue remained roughly the same (-0.04% YoY). The total number of internet subscriptions also increased, growing by 2.4% and amounting to 5,765,220.

Total revenue from television services increased by 4.3% to HRK 216.7m, with the total number of pay-TV subscribers amounting to 873k, an increase of 2.6%. IPTV users were up 1.1% and amounted to 449k, while at the same time, satellite TV users decreased by -3.5% and amounted to 140k.

So, with all this data in mind, how did the two largest telecom companies in Croatia, Hrvatski Telekom and A1 perform during 2021?

Hrvatski Telekom

The trends seen in the whole market are also quite reflective of the largest telecom company in Croatia. During the year, HT recorded revenue of HRK 7.39bn, a decrease of -0.9% YoY due to deconsolidation and sale sof Optima in H2 2021. When adjusting revenue for Optima contribution in H2 2020, it can be concluded that in 2021, HT Group organic revenue increased by 1.1% YoY, driven by strong mobile and core fixed business despite the shift in System Solutions revenue due to a focus on high margin deals. Looking at the segments, revenues in mobile, broadband & TV & data, and fixed wholesale all increased, growing by 8.3%, 5%, and 21.2% YoY. At the same time, fixed voice revenue, other fixed revenue, and system solutions revenue experienced a decrease, declining by -4.4%, -39.4%, and 24.1%, respectively. It should be noted that the decrease in other fixed revenue is mostly due to a part of that revenue being reported under broadband & TV & data revenue, increasing one and decreasing the other. EBITDA before exceptional items AL (after leases) increased by 5.3%, driven by strong commercial momentum and positive impact of transformation measures, amounting to 2.88bn. EBITDA AL adjusted for Optima contribution increased by 7.9% YoY, with the fifth consecutive quarter of EBITDA AL growth demonstrating continuation of strong positive commercial momentum and positive impact of transformation measures. Finally, net profit increased 4.5% YoY, amounting to HRK 615m, on the back of mobile revenue growth combined with lower OPEX growth.

A1

Meanwhile, the 2nd largest telecom company in the Croatian market, A1, recorded revenue of HRK 3.42bn, an increase of 5.6% YoY. Services revenue grew by 5.7% and amounted to HRK 2.87bn. Out of that, mobile service grew by 8.7%, while fixed-line service revenue remained roughly the same. The growth was supported by the redesigned mobile portfolio with 5G propositions, attractive hardware, and higher subsidy levels. EBITDA AL amounted to HRK 1.07bn, an increase of 9.8% YoY, driven by the increase in sales and operational costs decline. Capital expenditures in Croatia amounted to HRK 727.4m, an increase of 94% YoY. Considering A1 Hrvatska is part of A1 Telekom Austria, the net profit is consolidated on the Company’s entire level, and thus cannot be taken as a separate for the Croatian market only.