They did it again – Romania issued 3.0bio EUR of international debt to finance the budget hole in 2019. With Croatia getting back into the investment grade bracket, it’s worth taking a look at how the auction went by for clues about the possible Croatian Eurobond issuance in the middle of the year.

About half a year ago the market backdrop was quite different than the one today – in early October 2018 the markets were still trying to make sense of a wild fixed income meltdown in which the US 10-year yield reached 3.26%, the level not seen since 2011. At that point in time inflation fears were as real as they get – US labor market was getting tighter and tighter, growing wages exerted pressure on inflation expectations, and on top of that in early October Amazon announced that it would raise the minimum wage for it’s 350k+ strong US workforce (globally, the company employed about 650k people). In this awkward and adverse times Romania decided to tap the financial markets for a 10Y/20Y dual tranche.

When the books opened on October 04th, the leads sent IPTs of about +265bps and +350bps above Germany, respectively; the orderbook was getting filled and at the end of the day the combined books stood at 2.8bio EUR (1.6 bid-to-cover since the total amount issued ended up at 1.15bio EUR for the 10Y and 600m EUR for the 20Y). Due to the high demand, the spread naturally contracted to +250bps above Germany (for a 10Y issuance) and +337bps above Germany (for a 20Y paper), which was not bad considering that Europe was holding up much better in the face of a fixed income sell off compared to the US.

Now fast forward six months and here we are – the macroeconomic backdrop has changed, economic growth cooled down, global insecurity is holding off investment and the central banks have turned dovish towards the prospects of interest rate hikes. Naturally, with the specter of recession circling around the globe, the yields made another remarkable turnaround compared to October and went into the opposite direction from multi-year highs to multi-year lows. And Romania once again came to the markets to finance it’s growing public deficit.

The auction itself took place last week. Since the financial conditions were more favorable, this time the country decided to do a triple tranche (7Y/15Y/30Y) and to raise some 3bio EUR (1.15bio/0.50bio/1.35bio EUR, respectively). This time the spreads to benchmark were actually a bit wider in spite of the bull market on global bonds – when the orderbook closed, the spreads ended up at +248.1bps above Germany for the 7Y, +346.9bps above Germany for the 15Y, and +411.4bps above Germany for the 30Y paper. A quick interpolation between 15Y and 30Y would give a 20Y spread of +368.41bps, 31bps above the October issuance.

The book size was still ample with 2.7bio EUR for the 7Y (2.35 bid to cover), 1.5bio EUR for the 15Y (3.00 bid to cover), and finally 3.0bio EUR for the 30Y (2.22 bid to cover). Just a quick glance on the numbers can tell You that investors were mostly interested in the mid and short part of the curve; its also worth remembering that this is the part of the curve that continental Europe was looking for. As a matter of fact, US investors took 29% of the 30Y paper, while UK accounted for additional 32% of notional, meaning that “real money” was not particularly hot for the longer paper.

We could say that in the times of rock bottom yields investors are going for a yield hunt down the rating ladder and further away on the yield curve, but not both at the same time.

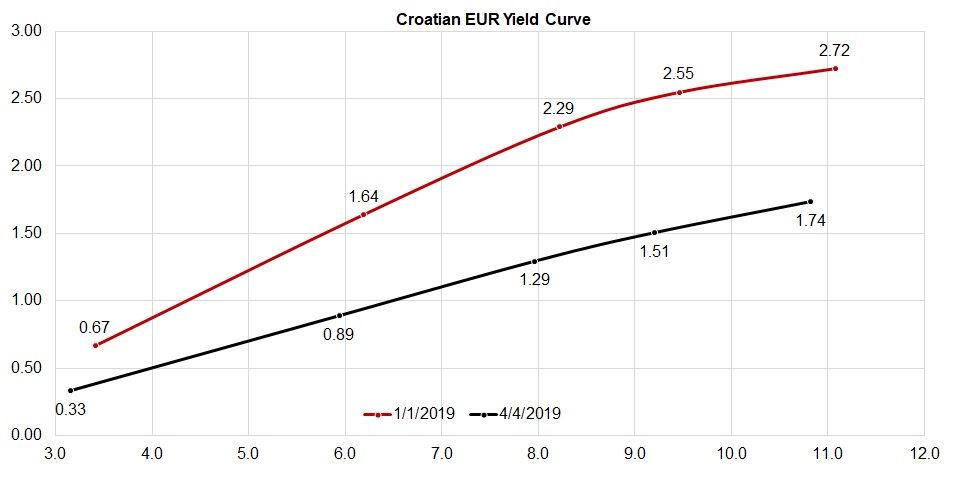

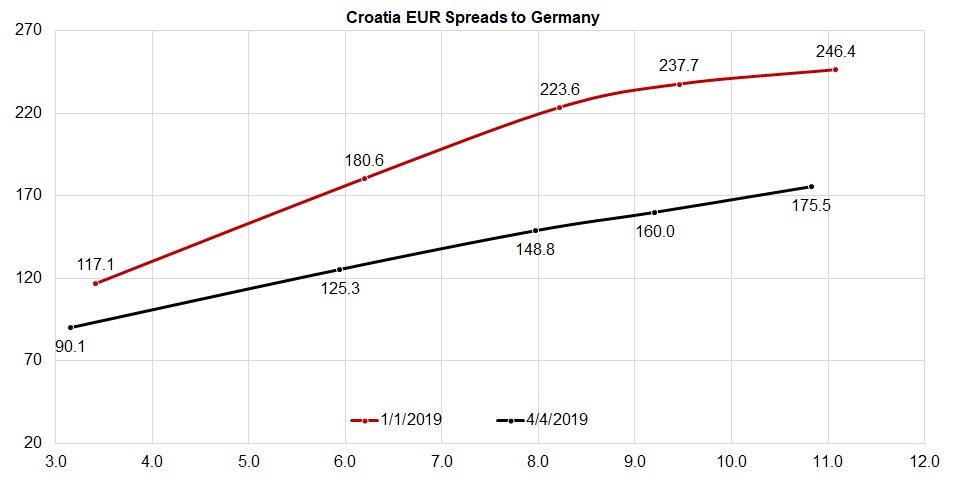

In the coming months our focus will nevertheless be on the CROATI € curve – the spreads have tightened considerably compared to the beginning of the year as the country got back into the investment grade bracket. Just a couple of days ago news came from the Ministry of Finance that the government is monitoring the financial markets for a possible international bond issuance in late spring/early summer (according to Bloomberg). After the rating upgrade, the new BBB- corresponds to the ratings given to Romania and Russia, but since Croatia is only steps away from submitting a letter of intent for joining the ERM II mechanism, don’t be too surprised if the country gets much tighter spread than the comparables.

HPB has announced finalization of take-over of Jadranska Bank and showed condolidated 2018 results.

Consolidation of Croatian banking sector is underway and HPB has held press conference to annnounce that it has finalized takeover of Jadranska Bank. HPB is Croatian 6th largest bank by assets and conoslidated results of the group for 2018 show that it had EUR 3.1b of assets which grew 15.1% in 2018. By acquisition the HPB has increased its presence in the area of Central Dalmatia where it was originally not that strong and it has in total acquired 40 ths new clients.

The read on our oveview of Croatian Banking sector in 2018 see link.