At the current share price, dividend yield is 5.3%

The Management Board and the Supervisory Board of Triglav will propose to this year’s GSM that part of accumulated profit be distributed for dividend payment, unless the Insurance Supervision Agency opposes this proposal by the time the GSM is convened.

As a reminder, the regulator recently announced that due to the uncertain situation regarding the spread of the COVID-19 pandemic and the consequent unclear impacts on the economy and the insurance industry, the Agency expects that until 30 September 2021 insurance, reinsurance and pension companies (supervised entities) suspend dividend payments and undertake no irrevocable commitments to pay out dividends. The Agency exceptionally allows any of the supervised entities not to comply with this recommendation. You can read more about it here.

Both the Management Board and the Supervisory Board assess that the bases for the dividend payment are appropriate and thus, in accordance with the Company’s dividend policy, propose a dividend of EUR 1.70 gross per share. The total amount of dividends of EUR 38.65m will represent 53% of the Company’s consolidated net profit for 2020 and. We note that the company has been a consistent dividend payer prior to the pandemic, paying out EUR 2.5 per share for 5 consecutive years (as visible on the graph below).

At the current share price, dividend yield is 5.3%.

The dividend is subject to approval at the GSM, which should take place on 25 May 2021.

Dividend per Share (EUR) and Dividend Yield (%) (2014 – 2021)

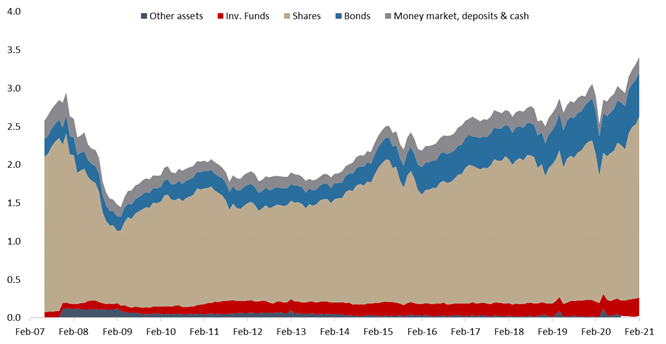

As of February 2021, Slovenian mutual funds manage EUR 3.4bn, representing an increase of 2.4% MoM.

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their asset structure during COVID-19 crisis.

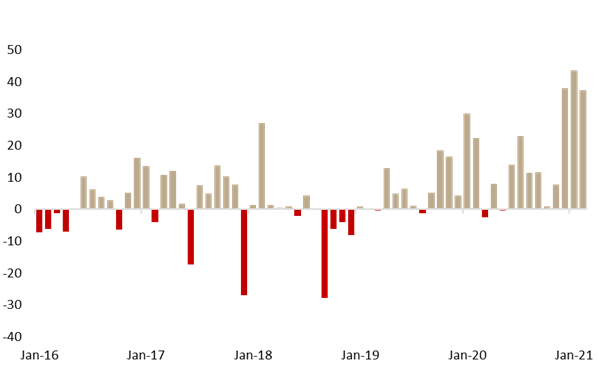

As of February 2021, Slovenian mutual funds manage EUR 3.4bn, recording an increase for the 4th consecutive month (+2.4% MoM). It is worth noting that net contributions to the funds amounted to EUR 37.2m, representing one of the highest inflows since December of 2007. As a reminder, the funds already observed a very solid inflow of EUR 43.4m in January.

It is also worth noting that mutual funds experienced a full recovery after a considerable loss in March 2020 due to the crisis caused by the Covid-19 pandemic. As a reminder, after witnessing a 12.4% MoM decrease in March of 2020, Slovenian Mutual funds have fully recovered and are currently up by 16% compared to beginning of the pandemic. It is also important to add that we have not seen an outflow of funds in 2020 with only 2 months seeing negative contributions.

Net contribution in the Slovenian mutual funds (EUR m)

Turning our attention to the asset structure, as of February 2021, shares account for 69.5% of the total assets (or EUR 2.36bn). Shares observed an increase of 3.6% MoM. We note that the vast majority (97.5%) of equity holdings of Slovenian mutual funds come from the foreign market. Domestic equity holdings, which amount to EUR 58.8m have witnessed a slight decrease of 0.6% MoM.

Since the beginning of 2020, Slovenian mutual funds have observed a decrease in domestic equity holdings by 17.3%, while the current EUR 58.7m represents the one of the lowest positions in domestic equity since the inception of Regulator’s statistics.

Total Assets of All Slovenian UCITS Funds (Feb 2007 – Feb 2021) (EUR bn)