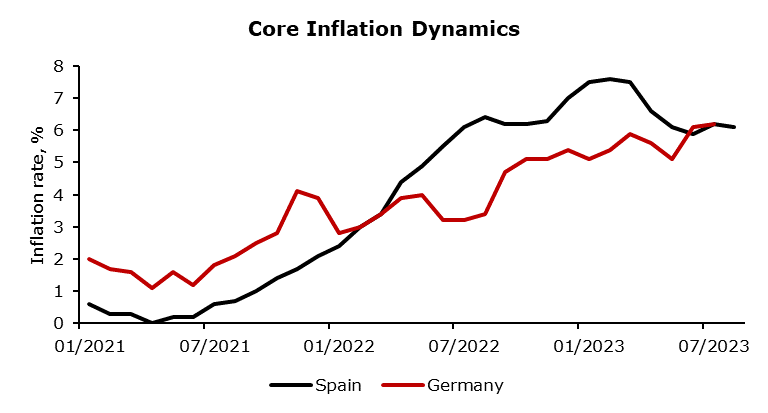

Over the past year, inflation has been dropping on a yearly basis due to a high base in 2022. As the inflation accelerated in 2021 and 2022, the sharp spikes in inflation happened due to the sudden price appreciation of mainly oil, natural gas, and other commodities in Europe. As time passed, those high levels were moving out of the calculation of yearly inflation and that is the main reason for a sharp drop in headline inflation on a yearly basis. However, core inflation remains high as the food and energy prices are excluded from the calculation.

Fear of persistent inflationary pressures is embedded in bond yields which are multiple times higher than a year or two ago. Mainly due to the central bank being hawkish as core inflation remains a bit below highs and fright of high wage growth pushing core inflation up still exists. Thus, central bankers reiterated their willingness to hold rates higher for longer as the structural changes to the economy happened post-pandemic alongside the reduction of globalization. Positive news for European inflation comes out of China as the deflationary risk rises unless China delivers significant stimulus to the economy to reboot economic growth. However, that might put downward pressure on commodity prices and consequently to inflation in Europe, but the Chinese economy losing steam is unpleasant news for the world economy as it is one of the largest world economies with almost a fifth of the world population and huge export capabilities upon which the whole developed worlds depends. High hopes of the Chinese government delivering enormous stimulus for the economy might push commodities back up and push headline inflation in Europe significantly higher. The first signs of inflation rising in Europe are in Spain which recorded 1.9% on a yearly basis in June and now it is already at 2.6%. By the end of the year, it should accelerate further as the average monthly change of inflation in Spain in the first eight months of the year is at 0.4% which should prop up the inflation on a yearly basis notably higher than current 2.6%. However, core inflation is still at 6.1% on a yearly basis in Spain, while the month-over-month average rate of change is at 0.4% which indicates that the core inflation should stay much higher than 2% in 2023. In Germany, the average monthly rate of core inflation in 2023 is at 0.5% which indicates that price pressures persist and times of low-interest regime as it was in 2010 seem to be behind us.

Core inflation should remain remarkably above 2%, thus restraining the European Central Bank from lowering interest rates to prevent a wage-price spiral. Across Europe, unions demanding higher wages were particularly successful and the European Central Bank cannot do much to lower interest rates as inflation remains high even though core countries of the Eurozone are recording negative GDP growth. Mostly it is due to the significance of the manufacturing sector in the economies of the core countries of the Eurozone as opposed to Spain and Croatia whose services sector drive growth and whose economies prove resilient to the rate hikes by the European Central Bank. Currently, there is no reason for the ECB to turn its back to higher for longer policy as the core inflation is notably above the targeted rate and the wage inflation should keep the core inflation high.

In conclusion, the complex interplay of factors has led to a complex inflation landscape in Europe. While headline inflation has seen a sharp drop due to the high base effect, core inflation remains elevated. Bond yields reflect concerns over persistent inflation, spurred by the central bank’s cautious stance amidst fears of rising wage pressures. China’s role as an economic powerhouse adds further uncertainty, as potential stimulus efforts could impact global commodity prices and European inflation. As core inflation remains stubbornly high and wage-price dynamics evolve, the European Central Bank’s commitment to a vigilant approach seems warranted, even amid varied growth trajectories across Eurozone nations.

Source: Bloomberg, InterCapital

At the end of July 2023, the total NAV of Croatian mutual funds amounted to EUR 2.07bn, representing a decrease of 7.7% YoY, and an increase of 2.0% MoM. Compared to its pre-pandemic all-time high, this is a reduction of 33.2%.

Recently, The Croatian Financial Services Supervisory Agency, HANFA, published its latest monthly report on the changes and developments recorded by the Croatian capital markets, including the data for the Croatian mutual funds. According to the report, the NAV of the Croatian mutual funds at the end of July 2023 amounted to EUR 2.07bn, which is an increase of 2.0% MoM, but a decrease of 7% YoY.

Taking a closer look at the asset holdings of the funds, on a yearly basis, we have a pretty mixed bag, with both increases and decreases recorded, depending on the category. The largest absolute increase was recorded by shares, which grew by EUR 66.8m, or 24.3%, followed by bonds, with an increase of EUR 15.4m, or 1.2%. On the other hand, the largest by far decrease was recorded by deposits and cash, which declined by EUR 292.9m, or 58.2% YoY, followed by money market holdings, which decreased by EUR 11m, or 29.5% YoY. Here we can see the effect of a less restrictive (as compared to the pension funds) investment policy, but also the perceived improvement in the market conditions and sentiment. As such, a switch from lower yielding but also lower risk holdings (deposits & cash, money market) to higher risk, but also higher return assets such as bonds (relatively) but especially shares, is to be expected.

Turning our attention to the monthly data, the largest absolute increase was recorded by bonds, which grew by EUR 48.2m, or 3.9% YoY, followed by shares at EUR 13m, or 4%, while other assets which yielded positive returns remained roughly the same. On the flip side, deposits, and cash recorded a decrease on the MoM basis as well, declining by EUR 19m, or 8.3% MoM, followed by receivables, which decreased by EUR 7.3m, or 38%.

Total assets of Croatian mutual funds (2015 – July 2023, EURm)

Source: HANFA, InterCapital Research

Of course, besides the changes in the inherent value of the underlying assets of these funds, contributions and redemptions can also influence the NAV. In July, the net contributions to the funds amounted to EUR 24.7m. However, this was primarily due to the net contributions of the Other funds’ category, which grew by EUR 47.3m, followed by equity funds at EUR 4.5m. On the other hand, bond funds recorded redemptions in the amount of EUR 47.3m, while balanced funds also recorded redemptions, albeit at the lower EUR 3.9m.

In terms of securities and deposits, in total they amounted to EUR 2.01bn in July 2023, representing a MoM increase of EUR 57m, (or 2.9%), and a YoY increase of EUR 48.2m (or 2.5%). Breaking this down further, domestic securities and deposits amounted to EUR 826.3m, and recorded a MoM decrease of 0.1%, or EUR 815k, and a YoY decrease of 30.6%, or EUR 363.8m. On the other hand, foreign securities and deposits amounted to EUR 1.19bn and recorded a MoM increase of 5.1%, or EUR 57.9m, and a YoY increase of 53.2%, or EUR 412m.

Finally, taking a look at the current asset structure of the funds, we can see that bond holdings are still the preferred investment class, accounting for 61.5% of the total assets, an increase of 1.3 p.p. MoM, and 6.3 p.p. YoY. Following them we have shareholdings at 16.4% of the total, an increase of 0.4 p.p. MoM, and 4.4 p.p. YoY, as well as investment funds, which hold 10.1% of the total, and have recorded a 0.1 p.p. decrease MoM, but a 1.2 p.p. increase YoY. On the other hand, deposits and cash recorded a MoM decrease of 1.1 p.p., and a YoY decrease of 11.8 p.p., accounting for 10.1% of the total assets at the end of July 2023.

Current AUM of Croatian mutual funds (July 2023, % of the total)

Source: HANFA, InterCapital Research

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 34 | 30.8.2023 | EL | Electrica Q2 2023 Results Conference Call | Romania |

| 35 | 30.8.2023 | ONE | One United Properties Q2 2023 Results Conference Call | Romania |

| 38 | 31.8.2023 | CICG | Cinkarna Celje Q2 2023 Results | Slovenia |

| 39 | 31.8.2023 | FP | Fondul Proprietatea Q2 2023 Results, Conference Call | Romania |

| 40 | 31.8.2023 | LKPG | Luka Koper Dividend Payment date | Slovenia |

| 41 | 31.8.2023 | ZVTG | Triglav Q2 2023 Results | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).