Following statements from FOMC members, bond prices have risen sharply since the start of the week both on the long and short end of the curve. The move was stronger at the short end of the curve as more cuts were priced in the market which led to the steepening of the yield curve.

As the recessionary narrative and falling inflation narrative influenced the market over the past month, the week opened with a sharp drop in yields. On Tuesday, one of the FOMC members Chris Waller delivered dovish statements and propped the bond market. The statements were about falling inflation that should be followed by lowering policy rates as there is no reason to hold rates at peak if inflation drops closely to the target level. On the other hand, another FOMC member Michelle Bowman stated that hiking rates should be in place in case of disinflation stalling. However, the market shrugged off her statement even though she is a permanent voter like Waller. Due to the positioning of the market, Waller’s dovish statements were recognized as a trigger for skyrocketing bond prices. Shorting bonds seems to have been the pain trade as the trade became crowded and mild moves in the other direction triggered massive moves. Also, the market is quite sensitive to turning the narrative to the recessionary one as we are probably at peak policy rates in Europe and in the US and the whole market expects that rate cuts are somewhere around the corner, but still not sure when the cutting cycle is going to start. Growth data in Europe is weak, in the US growth is slowing, but not as weak as in Europe yet, however, inflation is closer to the target level than at any point in the last two years and Chris Waller made a great point that there is no reason to hold rates at such restrictive levels and risk crashing the economy if the inflation drops to reasonable levels.

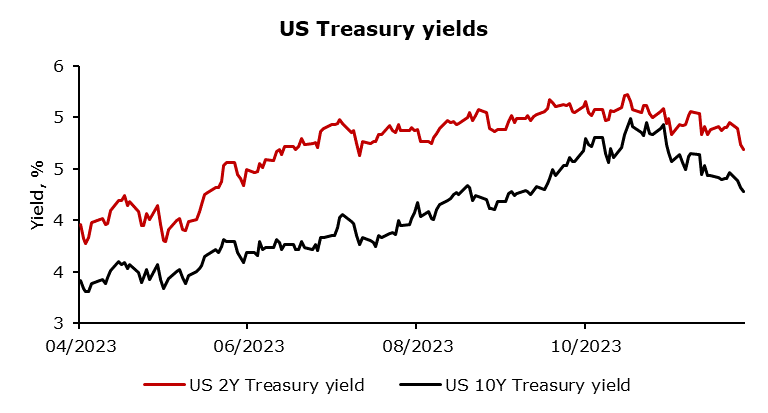

According to the OIS in the US, markets are pricing almost four rate cuts by the start of November of 2024 which is exactly what Chris Waller communicated this week. By the end of the week, more FOMC members will deliver statements as well as Chair Powell which should steer markets to the last FOMC meeting on 13th December. In Europe, the situation is similar and the market prices almost four rate cuts in Europe by October of 2024. This would imply cuts at the same time in the US as in Europe as the inflationary problems should subdue at the same time both in Europe and the US which is quite odd due to the major inflationary spike in Europe as a consequence of rising energy costs (cost–push inflation). In the US, demand–pull inflation is a major issue with heavy wage increases agreed upon this year which should be harder to bring back down implying later cuts. 10Y Treasury yield reached 5.00% in mid-October after a sharp rise in yields over the summer. 10Y Treasury yield is at 4.30% which is a 70bps drop within a month and a half. 2Y Treasury yield reached 5.25% at the same time as 10Y and retraced 55bps since then.

In conclusion, the recent surge in bond prices, particularly at the short end of the yield curve, reflects a market responding to dovish signals from FOMC member Chris Waller regarding the potential need for rate cuts amid falling inflation. This contrasts with the stance of other members like Michelle Bowman, indicating a divergence in views within the committee. The market’s sensitivity to recessionary narratives, coupled with differing inflation dynamics in the US and Europe, has led to significant volatility. As markets await further statements from FOMC members and Chair Powell, the divergence in inflation source between the US and Europe adds complexity to the global economic outlook.

Source: Bloomberg, Intercapital

This morning, NLB announced that it has entered into a share and purchase agreement to acquire 100% shareholding in SLS HOLDCO, holdinška družba, d.o.o., the parent company of Summit Leasing Slovenia d.o.o. and its subsidiaries, from funds managed by affiliates of Apollo Global Management Inc. (Apollo Funds), and the European Bank for Reconstruction and Development (EBRD). The acquisition is expected to increase NLB’s RWAs by app. EUR 700m, within its EUR 4bn capacity for M&As.

According to NLB, Summit Leasing is a leading provider of auto finance in Slovenia. As of 30 September 2023, it had consolidated gross receivables of app. EUR 890m, which includes EUR 635m related to the used and new vehicle segments in Slovenia, and through its wholly-owned subsidiary Mobil Leasing d.o.o., gross lease receivables of app. EUR 120m in Croatia. Summit Leasing is also a leading provider of point-to-sale consumer finance in Slovenia, recording app. EUR 95m gross receivables as of 30 September 2023.

Summit Leasing has a vast network of over 750 dealers in Slovenia and Croatia, as well as over 550 points-of-sale in consumer finance in Slovenia. By the end of 2022, Summit Leasing managed app. 140k outstanding financing contracts with over 110k customers.

NLB further notes that the consideration for the transaction represents a modest premium to the book value of Summit Leasing. Subject to the development of the business up until completion, the acquisition is expected to increase NLB’s risk-weighted assets (RWAs) by app. EUR 700m, which is within the EUR 4bn that NLB has been targeting in its M&A capacity. Cost and funding synergies are expected to ensure that the transaction is earnings accretive from the first full year of acquisition, with the full realization of cost synergies targeted within the period of app. 18 months from completion.

Completion of the transaction is subject to regulatory and anti-trust approvals and is planned for the second half of 2024. NLB’s CEO, Blaž Brodnjak, had the following to say about the transaction: ” That the time has come for the further growth of the NLB Group, albeit inorganic, should come as no surprise to anyone who has closely followed our development over the past few years. We have namely repeatedly emphasized that we are constantly monitoring market conditions and analysing potential opportunities for tactical mergers and acquisitions, that could open new opportunities for potentially even new markets to us, but above all increase added value for our stakeholders and provide our clients with additional services and solutions”.

NLB’s CEO further noted that “Leasing is one of the strategic activities of the NLB Group, so it is not surprising that we have gradually expanded this activity from the Slovenian market also to the North Macedonian and Serbian markets. We believe that leasing will become a significant part of the group. It is planned that in its mature phase, it will contribute more than EUR 1bn to the total assets of the Group, with the newest acquisition significantly accelerating this ambition. Our goal is for our leasing companies to become the leaders in the field of movables across our region and to play an important role in the mobility in the markets of our presence.”

Of course, as NLB noted in many of its results conference calls, an acquisition was just a matter of time. Summit Leasing was the obvious choice, as it was split from Nova KBM group when OTP purchased Nova KBM, due to OTP already having leasing operations in Slovenia which would lead to it having a practical monopoly. As such, it was long speculated that Summit Leasing would be the choice for the bank. Furthermore, NLB also stated its desire to enter the Croatian market in one way or another, and this presents a perfect opportunity for NLB.

Lastly, NLB was advised on the transaction by Deloitte UK Corporate Finance as the financial adviser, Deloitte CE South as the due diligence adviser, Kavčič, Bračun & Partner as a legal adviser, and Kinstellar, also as a legal adviser. The entire press release can be read here.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 37 | 30.11.2023 | CICG | Cinkarna Celje Q3 2022 Results, Business Plan for 2024 and business assessment of 2023 | Slovenia |

| 38 | 30.11.2023 | CICG | Cinkarna Celje 2024 Financial Calendar | Slovenia |

| 39 | 30.11.2023 | ZVTG | Triglav Q3 2023 Results | Slovenia |

| 40 | 30.11.2023 | UKIG | Unior Q3 2023 Results | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).