Mon Perin gets listed on the Zagreb Stock Exchange, under the ticker MONP. Trading starts today, 30 March 2022.

Mon Perin, a tourism & hospitality company, which was founded on a basis of developing „social entrepreneurship“, that is, having a specific ownership structure and investment strategy for the local community, has taken the next step and listed on the Zagreb Stock Exchange. The Company, which has been the cornerstone of development in the Bale – Valle county in Istria (contributing between 20% – 40% directly or indirectly to the county’s budget), currently has over 900 stakeholders.

The Company has done various projects over the years, including the latest EUR 100k in financing archeological research, two new projects, the „ Mon Perin Castrum“ and „Mon Perin Wind“, among others. Thus far, the Company’s total investments amounted to HRK 200m in the tourism sector, with a planned HRK 300m in the future, out of which, HRK 56m is already being invested in preparation for the 2022 summer season.

Before the listing, the Company did a capital increase in the amount of HRK 35.5m. In total, the Company’s share capital amounts to HRK 106.73m, divided into 10,670,000 shares. The trading of Mon Perin starts today, 30 March 2022, under the ticker MONP. In 2021 the company had HRK 54m sales and HRK 15m net income. majority shareholder with 35% is a legal entity owned by the Cucurin family.

Source: Insertion Prospectus of Mon Perin d.d.

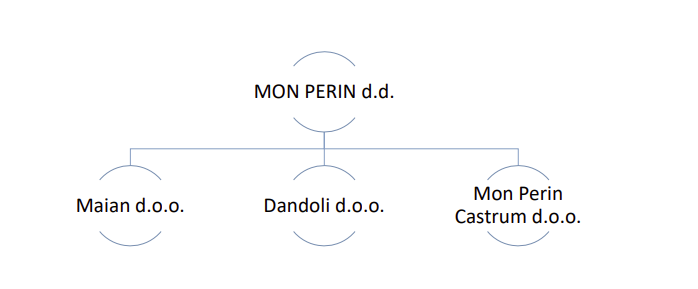

Maian was established in 2013 to manage the Issuer’s secondary activities, i.e. managing agricultural land located next to the Mon Perin camp, organizing parking for daily camp visitors and transporting tourists with tourist train for guests and camp visitors.

The company Dandoli d.o.o was founded in 2017 for the purpose of managing catering facilities in the Mon Perin camp and performing wholesale services for other catering facilities in the Municipality of Bale.

Mon Perin Castrum d.o.o. was founded in 2014 to separate the activities of the planned diffused hotel into a new company.

The company has a plan to make in Bali hotel located in a single town, consisting of many buildings close to one another, with unified management that can provide standard services to all guests. The objective is to offer a more friendly, authentic and sustainable form of tourism hospitality.

In the period from 22 Feb 2021 till 27 Mar 2022 the value of taxable invoices increased by 24.6% YoY amounting to HRK 227.5bn. The spending amount is 7.7% higher than spending in a comparable period in 2019/2020, yet again indicating positive sentiment. The value of last week’s taxable invoices is up 22.3% YoY, while compared to the same week in 2020, a strong increase of more than 2x is reported. Last week’s Value of Taxable Invoices compared to the week before was down 5.6%.

By looking at the latest announcements from the Tax Administration of the Republic of Croatia, in the period from 22 Feb 2021 till 27 Mar 2022, the value of taxable invoices increased by 24.6% YoY amounting to 227.5bn. This growth in taxable invoices represents positive sentiment in consumption, especially taking into consideration that consumption is yet again, 7.7% higher than in the 2019/2020 comparable period (25 Feb 2019 – 29 Mar 2020). Taxable invoices in wholesale and retail trade in the period from 22 Feb 2021 till 27 Mar 2022 grew by HRK 20.3bn YoY (an increase of 15.3%) and it is also 8.7% above the value of spending level in this segment in the same period in 2019/2020.

The value of taxable invoices in all segments in the week from 21 Mar to 27 Mar 2022 witnessed double-digit growth of 22.3% YoY. Compared to the same week in 2020 consumption more than doubled, clearly beating pandemic spending. This growth, which amounted to HRK 2bn, was driven by an increase in spending in wholesale and retail trade, which reported an increase of HRK 1.1bn and amounted to HRK 2.6bn (84.4% YoY). Meanwhile, it is important to note that the value of taxable invoices in accommodation and food in a given week also reported a strong growth – an increase from HRK 20m to HRK 308m, when compared to the same week in 2021 – a clear sign of a more positive market outlook. Compared to the same week in 2020, which is considered a pre-pandemic period, taxable invoices in accommodation and food also reported a slight increase of 6.1%.

The value of taxable invoices in all segments in the week from 21 Mar to 27 Mar 2022, compared to the week before (14 Mar 2022 to 20 Mar 2022) was down 5.6%, mostly driven by the value in wholesale and retail in the same period which decreased by HRK 193.3m and amounted to 68% of the value of all taxable invoices. When looking at the value of taxable invoices in accommodation and food service, it increased slightly by 6.1% compared to the week before.

At the closing price before the announcement, this would amount to a DY of 9.92%. The proposed ex-date is set for 5 July 2022.

After the Board of Directors meeting held on 28 March 2022, Romgaz announced the distribution of profit & retained earnings from 2021. This would mean that in fact, 2 dividends would be paid, one from the 2021 profit distribution and the other from the retained earnings distribution.

The profit distribution would be in the amount of RON 1.395bn, which would equate to a DPS of RON 3.62 per share. The retained earnings distribution would amount to RON 69.4m, which would equal a DPS of RON 0.18 per share.

Combined, this would amount to a gross dividend of RON 3.80 per share. At the closing price before the announcement, this would amount to a DY of 9.92%. The proposed ex-date is set for 5 July 2022, the record date is set for 6 July 2022, and the payment date is set for 27 July 2022. The decision is subject to approval and change at the OGMS (Ordinary General Meeting of Shareholders), which is to be held on 28 April 2022.

Romgaz Dividend Per Share (RON) and Dividend Yield (%) (2015 – 2022)

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 45 | 28.3.2022 | TTS | TTS 2021 dividend proposal | Romania |

| 46 | 29.3.2022 | ATGR | Atlantic Grupa 2021 Annual Report | Croatia |

| 56 | 31.3.2022 | ZVTG | Triglav Audited annual report for 2021 | Slovenia |

Given the current Covid-19 situation, some of these events might be subject to change (postponed or cancelled).