In the last two weeks both Fed and ECB had their monetary policy meetings but both events passed without major surprises. Ms Lagarde managed to answer all questions related to PEPP without giving any meaningful direction while on the other side of the Atlantic, Mr Powell stated that „it is not the time to start talking about tapering“ highlighting his stance that there is still large gap in the economy which needs their extra loose policies. In this article we are analyzing central banks’ current stance and what to expect in the following months.

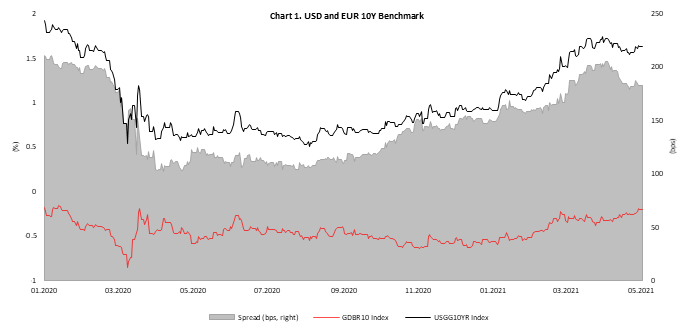

In February and March this year, we witnessed large increase in US Treasury yields with US 10Y skyrocketing from 1.0% to 1.75%. As correlation between EUR and USD yields being significantly positive, EUR yield curves increased also and 10Y rose from -60bps to -20bps. Due to negative spillovers from US in terms of financial conditions, i.e. tightening, on March 11th ECB stated that “the GC expects purchases under the PEPP over the next quarter to be conduced at a significantly higher pace than during the first months of the year”. Back then EUR 10y benchmark stood at -32bps. One and a half months forward, yield on 10y bund breached level of -20bps although ECB did increase their PEPP purchases. In the period of January – March 15th, average PEPP net purchases stood at EUR 14bn a week while after the statement average weekly purchases stood at 18bn, reflecting increase by almost 30%. With close to EUR 1.000bn already spent under the envelope, at the current pace of EUR 18bn a week ECB could buy at this “significantly increased” for the next 10 months and still have some change in the end of March 2022. Nevertheless, market has their own expectations which could be seen looking at the single currency which gained more than 3.0% versus USD last month while UST-bund 10Y spread tightened from 200 towards 180bps. This means markets started to price European recovery and started to think about reflation trade in Europe which (once again markets think) should force ECB to slower bond buying programs. Nevertheless, Ms Lagarde and her team of governors have few words to say on the matter. At their last monetary policy meeting ECB left their statement unchanged while Ms Lagarde did not provide any new information beside saying that they will continue with their increased PEPP purchases.

On the other side of the Atlantic Fed’s monetary policy meeting was another non-event which did not give us much surprise either. Namely, statement was almost unchanged with only few words pointing on a stronger recovery. Fed expects GDP to reach 2019 levels this year and still expects inflation to be only transitory. The words transitory became the mantra for all the bond holders hoping that jump of inflation will be only transitory and will not push central banks behind the curve. Going back to Fed, Mr Powell last week firmly stated that Fed is not ready to taper asset purchases, kicking the can down the road until inflation slows down as they expect it or becomes too stubborn to ignore it. On this matter, only time can tell as it seems Fed will take action driven only by real data. As inflation will almost surely peak in April and May, it will be crucial to observe it after, i.e. in Q3 and Q4. Furthermore, labor market is the data to watch with Fed giving it great importance.

In the following months and quarters, inflation will certainly be under the radar and will keep bond holders awake. However, any underperformance of price growth, any deviation on labor market, or increase of corona cases will call bond buyers. Although many market participants were selling bonds for the last two months, market could turn fast and we could once again look towards Japan and their 30 year fight with low inflation. In another scenario, central banks could find themselves behind the curve which could drive another panic sell and some tough calls among central bankers but we do not expect the latter to occur.

Source: Bloomberg, InterCapital

Dividend yield is 1.6%, while ex-date is 28 July 2021.

Podravka held the sessions of the Management Board and Supervisory Board in which a profit distribution was proposed. To be specific, a dividend of HRK 9 per share is proposed, which translates into a dividend yield of 1.6%.

We note that the ex-dividend date is 28 July 2021, while payment date is 27 August 2021.

The mentioned proposal is subject to approval at the GSM.

In the graph below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (HRK) and Dividend Yield (%) (2016 – 2021)

Pan-Slovenian Shareholders’ Association counterproposed a dividend payment of EUR 3.5 per share.

Triglav has received a counterproposal by the shareholder Zavod VZMD (Pan-Slovenian Shareholders’ Association) regarding the profit distribution.

Zavod VZMD counterproposed a dividend in the amount of EUR 3.5 per share (EUR 79.6m), which translates into a dividend yield of 10.5%. As a reminder, the Both the Management Board and the Supervisory Board proposed a dividend of EUR 1.70 per share (EUR 38.65m).

VZMD believes that after not paying any dividends last year it is appropriate and necessary that the Company allocates the majority of accumulated profit for dividend payments to its shareholders. As the submitting shareholder, VZMD believes that the Company is capable of paying such a dividend to its shareholders without adversely affecting or obstructing the Company’s plans. According to VZMD, the higher dividend payment will strengthen the confidence of existing and potential investors in the Company’s shares.

Triglav’s Management Board opposes the counterproposal. The Management’s proposal is based on the Company’s dividend policy, which is outlined as attractive for the shareholders while being sustainable in terms of the Triglav Group’s financial stability, growth and development. Both aspects were taken into consideration in a balanced manner, and due to the current situation, the precautionary aspect was additionally taken into account in the formulation of the proposal in accordance with the request of the Insurance Supervision Agency. The Management Board and the Supervisory Board propose that 53% of consolidated net profit be allocated for the payment of dividends, thus exceeding the 50% threshold set by the dividend policy.