Index performance wise, H1 2020 could be characterized as a quite challenging period for all regional markets. How does this performance compare to the previous years?

In H1 2020, almost all regional markets recorded a double-digit decrease of their respective main index, which can be seen in the graph below. Slovenian market observed the lowest index decease of 8.24%, which could be attributed to a very solid share price performance of Krka, which takes up almost a third of the index.

Performance of Regional Indices in H1 2020

The performance of regional indices raises a couple of questions such as:

- Was such a performance of regional indices an outlier?

- How often did the indices observe similar performance?

To answer these questions, we decided to present you with a graphical overview of the index performance throughout time. The following graphs show H1 return of each index on a spectrum from >-20% to >+20%. Note that the higher placement of a certain period on a graph represents a better or worse index performance in the respective period.

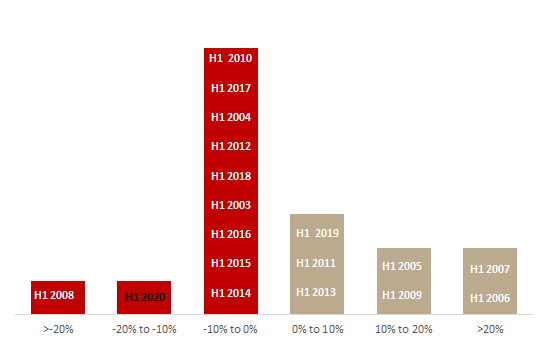

CROBEX (H1 2003 – H1 2020)

Source: Bloomberg, InterCapital Research

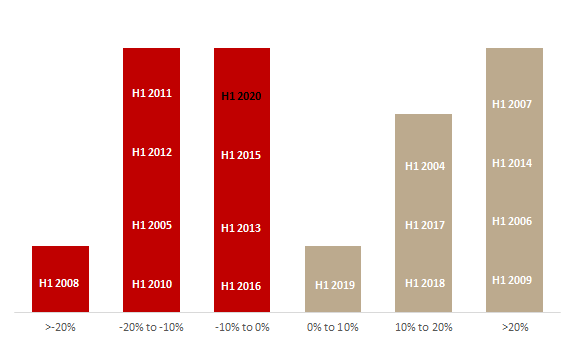

SBITOP (H1 2004 – H1 2020)

Source: Bloomberg, InterCapital Research

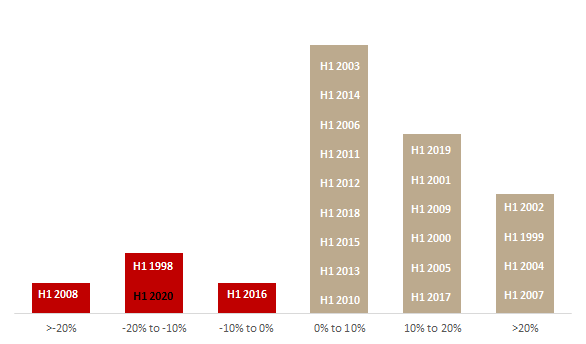

BET (H1 1998 – H1 2020)

Source: Bloomberg, InterCapital Research

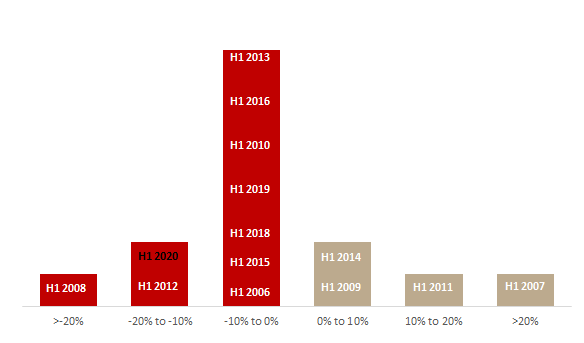

BELEX15 (H1 2007 – H1 2020)

Source: Bloomberg, InterCapital Research

Trading statistics for June show an average daily turnover of EUR 0.86m (-21% YoY). Meanwhile, the major index CROBEX ended June with a slight decrease of 0.85% ending at 1,621.55 points.

After witnessing a “green” month in April and May, the Zagreb Stock Exchange (ZSE) CROBEX observed a slight decrease of 0.85% MoM, ending the month at 1,621.55 points. It is worth noting that CROBEX ended H1 with a decrease of 19.6% YTD.

ZSE observed a relatively low turnover in June of EUR 17.1m, which translates into an average daily turnover of EUR 0.86m (-21% YoY). Such turnover is quite below the average turnover seen in 2019 and so far this year. It is also worth noting that not a single block transaction was concluded in June.

Of the total value traded in the period in June, Valamar Riviera generated 20.4%. HT comes second, accounting for 12.1%. Next come Atlantska Plovidba and Arena Hospitality Group with 7.8% and 6.4%, respectively. Dalekovod follows with 5.6%. These five shares generated more than half of the turnover recorded by the entire (equity) market.

Share Price Performance of Croatian Blue Chips in June (%)

As visible in the graph, of the observed Croatian blue chips, Valamar Riviera observed the highest share price decrease ending the month at HRK 25.8 per share (-6.5%). Such a decrease could be attributed to the skepticism regarding the development of the touristic season, as new Covid-19 cases emerged.

When observing the total equity market capitalization, it observed a slight decrease of 0.9% MoM, amounting to HRK 132.40bn (EUR 17.5bn). Ina’s share is the biggest constituent of the total exchange’s equity market capitalization, accounting for about 22.1% of the total value. Next, come two Croatian banks – PBZ and ZABA with 12.6% and 12.2%, respectively. Further, HT holds 11%.

It is worth noting that of the sector indices, CROBEXkonstrukt observed a solid monthly increase of 10.32%. On the flip side CROBEXindustrija recorded the highest decrease of 3.52%.

Following the risk mitigation, RWAs of NLB on consolidated level will be reduced by EUR 303.1m (3.3% of total RWAs).

NLB published an announcement stating that they have entered into contracts on mitigation of the risk of expropriation of mandatory reserves held by NLB Group banking members with their local central banks. The contracts were entered into on 30 June 2020, with the aim of capital optimization for each individual banking member of NLB Group, while the risk mitigation will become effective as of 31 July 2020.

Consequently, the risk weighted assets of NLB on consolidated level will be reduced by EUR 303.1m as of 31 July 2020. To put things into a perspective this accounts for 3.3% of the total RWAs.

The maximum value allocated to the Program is RON 88.5m.

MedLife announced to its shareholders that the Board of Directors of the Company adopted on 30 June the share buy-back program of the Company that will be initiate as of 7 July 2020.

The approved buy-back of a maximum number of 1.77m own shares will last for a maximum period of 18 months from the date of publication of the decision and shall not exceed the 10% threshold of the share capital of the Company.

The purchase price of shares under the Program will be between RON 10 and RON 50, subject to the applicable legal provisions and restrictions. Note that the maximum value allocated to the Program is RON 88.5m (calculated as the maximum number of 1,770,000 own shares at a price per share of RON 50).

The own shares acquired under the Program will be offered to former or current members of management or former or current employees of some of the subsidiaries of the Company in exchange for the shares held by them in the respective subsidiaries of the Company.