This week Croatian Ministry of Finance issued EUR 1bn of EUR-pegged 8Y paper on the local market at yield of 1.39%. Bid to cover stood at 1.42 while the amount will be mostly used to finance two maturing bonds, RHMF-O-222A and RHMF-O-222E. More details on the issuance and world rates find in this brief article.

Looking at the details of the deal, the first indication on yield was a range of only 2bps, from 1.39% to 1.41% and that did not change until the very end. The final yield was set at 1.39% which compared to the bid levels of EUR Eurobond CROATI 2030 seemed a bit cheap. RHMF-O-302E (FX-pegged, payable in HRK) has a coupon of 1.25% meaning that it was issued at discount i.e., the price of 98.943 and today is its first trading day on the secondary market. However, there is still FX component of the issuance that we do not know as CNB’s EURHRK mid-level on the date of settlement will be applicable (February 4th). Going further, it is important to mention that paper which matures on Saturday, RHMF-O-222E (EUR 500m) was issued at yield of 0.685% while RHMF-O-222A (HRK 3bn) was issued at 2.29%, resulting in an aggregated cost of debt maturing at 1.39%. We must add here that out of HRK 3bn and EUR 500m maturing, Croatian National Bank holds almost HRK 1bn and 65m EUR which central bank did not reinvest in the new paper, same as it did in July 2021. To sum, EUR 900m matures with 200m being at the central bank, institutional investors increased their exposure to the government by some EUR 300m. We still do not have a detailed breakdown of holders, but the summary showed that most of the issuance went to banks (52%) and pension funds (39%) while investment funds bought took only 3% of the issuance. Knowing the local market, most of the paper will go to HTC part of the portfolios while we do not expect to see much trading of the rest. Considering EURHRK, the market longed EUR 550m this week through the paper but we did not see an increase in volatility in any direction.

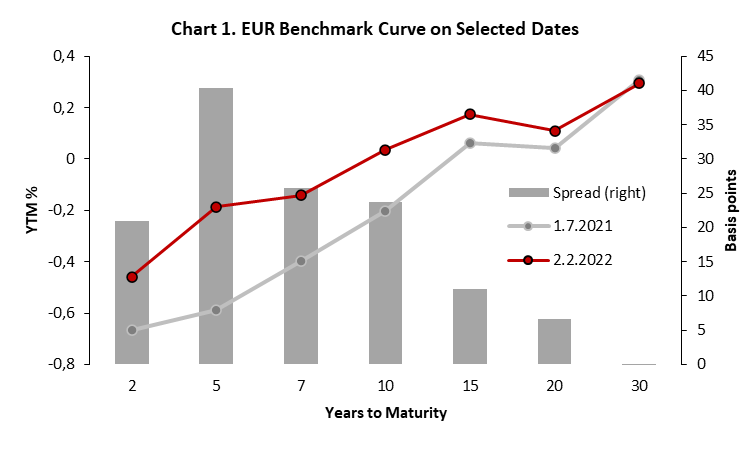

The last time the Croatian Ministry of Finance was on the market was in the summer of 2021, issuing HRK 7Y paper RHMF-O-287A to refinance maturing RHMF-O-217A. Back then, Croatia placed HRK 9bn (EUR 1.2bn) at 0.533%, with more than HRK 18bn in orderbooks. EUR 10Y paper stood at -20bp. This week, the Croatian government placed EUR 1bn of 8Y bond at 1.39% with some EUR 1.4bn in orderbooks. 10Y EUR benchmark stood at couple basis above zero. So, what happened in only half a year period?

As we are all aware, inflation is theme number one in the whole world while the second theme are central banks and their potential aggressive tightening. The story accelerated after the summer of 2021 and bonds once again have become investors’ enemy number 1 and that lasted until this day. Just look at yesterday’s EA CPI. Namely, eurozone’s headline CPI landed at 5.0% in January versus 4.4% being expected by the consensus. Core inflation stood at 2.3% YoY, which was below December’s levels but still fell less than expected. Considering strong energy complex and already very hawkish Fed, market continues increasing their forecasts on EUR interest rates and now December 2022 Euribor futures points at 25bps hikes until the end of the year. Also, to bear in mind, German 2Y paper this week increased above -50bps and reached highest levels in 6 years, while bund reached almost 5bps yesterday. Today, we will hear from ECB about its monetary policy and Lagarde will have a tough job in defending the current ECB’s view. The market is surely prepared for ECB to change its stance and start lifting already this year, but the real question is whether ECB is ready to completely change its rhetoric as Fed did last year. We find out in a few hours.

Source: Bloomberg, InterCapital

Yesterday, the Slovenian Parliament passed the law on loans in Swiss francs that is putting an FX Cap on the exchange rate between Swiss francs and the Euro and is overruling all court rulings on this issue, even those where it is voted in favour of the banks. Banks will file an initiative with the Constitutional Court to initiate proceedings to assess the constitutionality of the law and a proposal to suspend enforcement. The application for suspension until the review of its constitutionality will be filed, but if it is not accepted it could potentially threat Slovenian banking sector. NLB has published the announcement on LJSE where it estimates potential negative pre-tax effect of EUR 70m-75m.

Yesterday, the Slovenian Parliament passed the “Law on limitation and distribution of foreign exchange risk between creditors and borrowers concerning loan agreements in Swiss francs” that is putting a cap on the exchange rate between Swiss francs and the Euro to be set at 10% volatility (the “FX Cap”) and shall be applied from the conclusion of any of the affected loan agreements. The Law affects all loan agreements denominated in Swiss francs (regardless of whether the agreements are still in force) concluded between banks operating in Slovenia as lenders and individuals as borrowers in the period from 28 June 2004 to 31 December 2010.

Banks will file an initiative with the Constitutional Court to initiate proceedings to assess the constitutionality of the law and a proposal to suspend enforcement. The application for suspension until the review of its constitutionality will be filed by banks collectively. But if it is not accepted by the Court, the banks my have to start booking reservations as early as in Q1 2022 result. So if Constitutional Court does not accept this bank’s initiative Slovenian banking sector could collectively take a hit of few hundred millions of Euro. Banks has started to make public their exposure to the Swiss francs loans in question and they have started to estimate their potential reservations for these costs.

NLB has published yesterday the announcement on Ljubljana Stock Exchange, where it estimates a negative pre-tax effect on the operations of NLB and NLB Group between EUR 70m-75m, subject to further detailed analysis. To put things into a perspective, this accounts for brodaly speaking a quarterly EBT of the Group. Impact on NLB and NLB Group is material but very manageable given the historically limited extent to which NLB engaged in Swiss francs lending. NLB is sufficiently well capitalized so it will not threaten its capital adequacy ratio falling below required level, nor will it threaten completely its dividend pay-out but it could potentially influence its 2022 net income. We note that as of 9M 2021, the Group reported a CAR of 17.2%, indicating excess capital of EUR 373.2m.

Addiko Bank, despite being a significantly smaller player in Slovenia, seems to be more exposed to CHF loans. To be specifc, the Group noted that they assessed a negative impact caused by the implementation of the new law in the range of approximately EUR 100 to 110m , based on its own interpretation and assuming a worst-case scenario. Such negative impact would result in a net loss for the financial year 2022. Consequently, no dividends are expected to be paid out for the financial years 2021 and 2022.

The total equity turnover downward trend has been overturned, in January the turnover reached EUR 45.42m (HRK 341.8m) which is an increase of 75.84% MoM. This translates into a daily average of EUR 2.16m (HRK 16.28m), showing more than 2x increase YoY, which is the result of low liquidity in January 2020.

Out of the total value traded (excluding block transactions) in January, Podravka generated 6.79% of the total equity traded on ZSE. Valamar generated 4.99% of total turnover, followed by Atlantska Plovidba and Adris Grupa (pref.), generating 3.90% and 2.96%, respectively. HPB comes next with a 2.66% out of total turnover. The top five traded companies accounted for 21.31% of the total value traded.

The main index of ZSE, CROBEX, noted an increase of 2.56% MoM, ending the month at 2,132.61 points.

At the end of January, several blue-chip companies (5 out of 10) experienced an increase MoM. Podravka is leading the way in this metric with 8.23% MoM increase, followed by Atlantic Grupa with 7.14% increase, Ericsson Nikola Tesla (3.26%), Valamar Riviera (3.03%) and Adris grupa (pref.) with 2.17%. Končar remains on the same level, while the highest reported decrease in January was AD Plastik (-3.63%).

Share Price Performance of Croatian Blue Chips in January (%)