In the third quarter of 2020, Croatian GDP fell by 10.0% compared to Q3 2019, resulting in fall of 8.8% in the first nine months of 2020. Considering partial lockdown that was imposed last week, positive surprises are unlikely this year, but at least 2021 prospects look brighter. In this article we are looking into details regarding Q3 2020 GDP and what could we expect in the following period.

According to the latest data provided by Croatian statistical office, Croatian GDP fell by 10.0% in the third quarter of 2020. That was the second biggest GDP fall ever recorded, right after 15.4% YoY plunge in the quarter before. In the first nine months of this year Croatian economy is down by 8.8% and it is expected to end the whole year at around -7.5% YoY.

Double-digit decrease of GDP in terms of YoY was widely expected bearing in mind all the challenges in the last few months. However, looking at the data there were some positive surprises which capped fall to ‘just’ 10.0%. The biggest surprise came from changes of inventories which contributed to the overall result by more than 10.0%. This means that if inventories stood at the same level as they were in Q3 2019, real GDP would be lower as much as 20.0% in Q3. Off course, that is hard to imagine since companies did not build their inventories months before as they were not expecting touristic season to happen at all. Another positive surprise came from investment that decreased by only 3.0%, most likely driven by continued growth in construction sector, and from government consumption that rose by 1.5% YoY.

On the other side household consumption was down by 7.3% YoY and was great drag for the overall result. Also, exports of goods and services decreased unpleasantly by 32.3% YoY with exports of goods decreasing by only 3.0% while service sector volume was lower by 45.3%. Considering situation regarding coronavirus in early summer and media coverage after the tennis tournament on Croatian coast, tourism sector proved to be much more resilient that some were thinking. At the same time, imports of both goods and services fell by ‘mere’ 14.1%. As fall of exports overshadowed fall of imports, next export was positive by only HRK 10.989bn compared to HRK 31.364bn in penultimate quarter of 2019, meaning that fall of net exports in the third quarter of 2020 shaved almost 5.0% of Croatian GDP, hence presenting once again the enormous significance of touristic sector for the economy.

To sum up, last two quarters were the worst quarters on the record for Croatia but also for most of the European and global economies. Looking at the data for Q3 in Europe, most of the countries started recovering but seems there will be a long way before we reach 2019 GDP levels again.

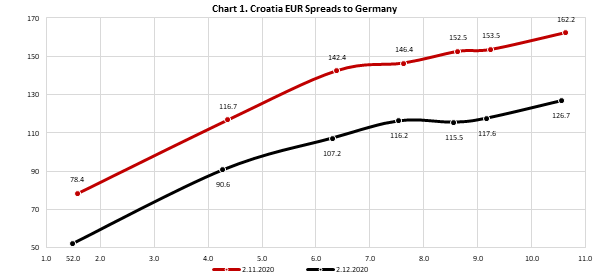

What investor had to say on the Croatian Q3 GDP data? Well, Croatian 10Y EUR Eurobond CROATI 2031 trades at the highest levels on the record, i.e. its YTM reached all time lows of 75bps. However, it looks like there is more room for tightening if you bear in mind that in the February CROATI 2030 stood at 55bps versus some -35bps on German Bund implicating spread of around 90bps. Looking at the Croatian equity index Crobex, it seems like investors are becoming more bullish due to vaccine hopes and new instruments on Croatian market.

Source: Bloomberg, InterCapital

Yesterday, CROBEX noted a 2% increase, ending the trading day at 1,749.58 points.

Yesterday, the UK became the first western country to approve a Covid-19 vaccine, with its regulator clearing Pfizer and BioNTech SE’s vaccine. Thus, hospitals are preparing to administer the vaccine and 800,000 doses ready to be delivered from Belgium. The vaccine should be available in Britain starting next week. Although we did not see a reaction from major European equity markets yesterday, Croatian equity seemed to have reacted positively to such news as virtually all traded stocks ended the day in green.

CROBEX noted a 2% increase yesterday, ending the day at 1,749.58 points. At the current level, the index is still down by 13.3%.

On the prime market, AD Plastik leads the daily gainers with an increase of 5.26%, closing at HRK 160 per share. At the current share price, the company is traded at EV/EBITDA of 6. Next come, Arena Hospitality Group (+3.7%) and Valamar Riviera (+2.14%), marking the continuation of the positive sentiment on tourist companies which started in November. Outside the prime market, Atlantska Plovidba recorded a solid increase of 6.35%, while Končar went up by 3.51%.

Turnover on the ZSE amounted to HRK 15.4m (including ETF turnover). Meanwhile, the highest traded security yesterday was 7CRO (CROBEX10tr ETF) with a turnover of HRK 2.3m.

Trading statistics for November show an average daily turnover of EUR 1.58m (-5.7% YoY). Meanwhile, CROBEX ended November with a sharp increase of 8.1%.

November marked what can arguably be considered the most significant event on the ZSE this year, which was the first listing of ETF’s in Croatia. To be specific, on 17 November, InterCapital Asset Management listed two ETF’s – InterCapital CROBEX10tr UCITS ETF (ticker: 7CRO) which replicates CROBEX10tr index, while InterCapital SBI TOP ETF (ticker: 7SLO) replicates SBITOP index. The listings were welcomed with a very solid interest on the market, as the turnover of both ETF’s amounted to HRK 11.8m in first two weeks of its trading. To put things into a perspective, 7CRO was the 8th most traded security on ZSE in November (excluding block transactions).

Trading report for November shows a total equity turnover amounted to EUR 33.08m (or HRK 250m). This translates into an average daily turnover of EUR 1.58m, representing a decrease of 5.7%. Of the total value traded in the period in November block transactions of 2 companies (3 shares) account for 26.3%. Precisely, Adris reg. (HRK 31.5m), Adris pref. (HRK 13m) and HT (HRK 21.24m) were traded through block transactions.

If we were to exclude block transactions (and include ETFs), Adris pref. generated HRK 33.3m or 17%, while Valamar Riviera generated HRK 24.3m. HT comes third, accounting for 8.6% (or HRK 16.8m). Next come Ericsson NT and PBZ with HRK 15.1m and HRK 13.3m respectively. As a reminder, in early November, PBZ has announced its delisting from ZSE.

Share Price Performance of Croatian Blue Chips in November (%)

The Croatian equity market, as well as most European markets, noted a very solid performance in November, which could be attributed to the positive vaccine development. To be specific, CROBEX observed the best monthly performance in 2020, increasing by as much as 8.1% and ending the month at 1,702.37 points. We note that such a high monthly increase of the index was last time observed in January of 2013 when CROBEX increased by 8.5%.

As visible in the graph, Tourism companies by far lead the list of gainers as the vaccine news brought positive sentiment in regard to the 2021 summer season. Therefore, Valamar Riviera increased by 21.3% closing November at HRK 27.9 per share. As of end November, Valamar’s share price is still down 28.5% YTD. Next comes Arena Hospitality Group which noted an increase of 15.04%, surpassing the HRK 300 mark. Atlantic Grupa follows with an increase of 11.48%. As of end November, Atlantic is up by 4.6% YTD.