In H1 2023, Kraš recorded revenue growth of 12.2% YoY, a slight EBITDA decrease of 1%, and a net income of EUR 3m, a 15.3% decrease YoY.

Starting off with the revenue, Kraš’s sales revenue amounted to EUR 80m, an increase of 12.2% YoY. Of this, sales on the domestic market amounted to EUR 44.2m, an increase of 17.1% YoY, while the sales revenue in the international markets amounted to EUR 33.3m, an increase of 6.9% YoY. Kraš’s sales revenue came as a result of higher prices of products, which is in line with the trends in the industry, and of course, driven by high inflation rates.

In terms of op. expenses, they increased by 12.9% YoY and amounted to EUR 76.2m. Of these, the material expenses increased the most, growing by 12.6%, and amounting to EUR 54m, while staff expenses decreased by 9% YoY, and amounted to EUR 15.4m. Kraš further notes that the expense growth was primarily driven by high commodity prices, packaging, energy, and other costs, all of which further influenced profitability development.

Kraš further noted that they continue to improve the operational processes, optimize internal resources, and continually work on mitigating cost increases across all segments. Despite this, the EBITDA amounted to EUR 8.1m, a slight decrease of 1% YoY, driven by the faster OPEX than revenue growth. This would also imply an EBITDA margin of 10.2% in H1, a decrease of 1 p.p. YoY. However, we note that Kraš improved profitability-wise during Q2, offsetting lower profitability during Q1. On Q2 basis, EBITDA margin improved from 11.1% to 12%. Finally, the company also emphasized that the announced investment cycle in modernization and automatization of production facilities continues according to the plan.

Moving on to the net financial result, it amounted to EUR -53k, (H1 2022: EUR 482k), mainly driven by lower financial revenue from lower FX gains, while the financial expenses remained roughly the same. Taken together, this led to an EBT of EUR 3.8k, a 12.3% reduction YoY. Finally, the net income of the Company amounted to EUR 3k, a 15.3% YoY decrease. This implies a net profit margin of 3.9%, a 1.3 p.p. YoY decrease.

Kraš key financials (H1 2023 vs. H1 2022, EUR ‘000)

Source: Kraš, InterCapital Research

By the end of July 2023, BET increased by as much as 6% MoM, amounting to 13,227.10 points. Looking at the latest price developments, the index noted a double-digit growth of 11.7% compared to the start of the year.

The Bucharest Stock Exchange has published the latest trading activity report, for July 2023. Looking at the highlights, the Stock Exchange notes that all of the indices were in the positive territory, with the BET-TR (total return) index reaching the new ATH, increasing by 17.5% YTD (with July 31st!), while the energy and utilities index, BET-NG, increased by 16.9%. In terms of the main index on the exchange, BET, it grew by 13.4% since the start of the year (also with July 31st). During July only, the index increased by 6%!

BVB also noted that the capital market in Romania is experiencing one of the best periods with a recorded streak of successive ATH during this year. This positive sentiment is driven by the largest IPO ever made on the BVB and the largest in Europe – already known to each one of us, which company we’re talking about. The aforementioned is supported by the fact that the largest number of investors are currently present on the Romanian stock exchange, according to FCI data, along with the fact that most transactions were made during the previous month.

In terms of equity turnover, it recorded a significant growth amounting to RON 1.22bn! If we were to compare equity turnover on a YoY basis, the story is more or less the same. Finally, during July 2023, 21 working days were recorded, which would mean that the average daily turnover amounted to RON 581.2m! Finally, the equity segment on the Regulated Market (including offers) noted a new ATH with RON 16.4bn traded value (previous ATH dates all the way back to 2007!).

Performance of BET constituents in July 2023 (MoM, %)

Source: Bloomberg, InterCapital Research

In terms of the performance of the BET constituents, development during July was mostly positive on the BVB. The largest increase during July on an MoM basis was recorded by Aquila, whose share grew by as much as 30.3%, followed by Transport Trade Services with also double-digit growth of 17.9%. BVB is to follow at 16.8% growth, Sphera Franchise Group at 14.1%, Banca Transilvania at 12.1%, BRD at 11.2%, and Purcari Wineries at 10.5%. On the flip side, the largest decrease was recorded by Romgaz, which lost 8.2% of its value, followed by Teraplast at a 3.5% MoM decline. Overall, the majority of BET constituents noted a positive development on the stock exchange during July.

YTD performance of BET constituents in 2023 (%)

Source: Bloomberg, InterCapital Research

On a YTD basis, the story is even more positive. Looking at the latest available prices, a good number of BET constituents noted a strong double-digit growth. The largest increase was recorded by Transport Trade Services, whose share increased by 68%, followed by Aquila at 62.7%, BVB at 48.4%, Sphera Franchise Group at 45% and Purcari at 38.3%. In total, almost half of the index constituents recorded >10% returns in this period, while the biggest recorded decline was recorded for Teraplast with a 17% share price decline.

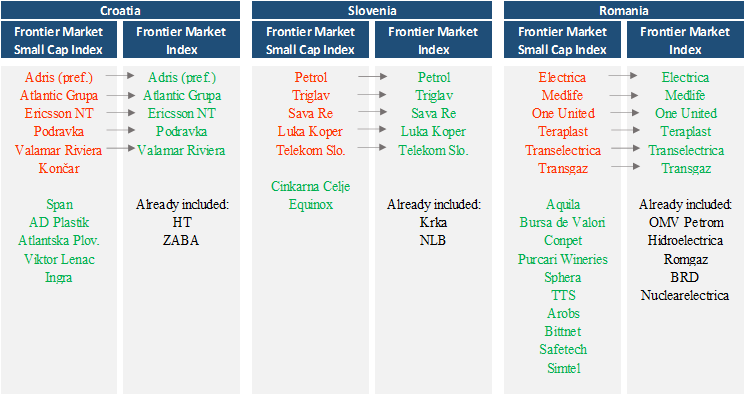

Finally, we note that MSCI, the best known for its series of stock indices that provide a benchmark for many ETFs and mutual funds, has recently published its regular revision. The revision is favoring our region regarding its visibility for Croatia, Slovenian and Romania in the form of new representatives in MSCI’s Frontier Index.

In short, MSCI divides frontier market into two main categories that enter the Frontier Market Index: Frontier Small Cap Index and Frontier Market Index, which is composed of companies with even higher market capitalization compared to Small Cap.

With that said, if a company is on any of these lists, it makes it „investable“ in the eyes of asset managers and investors. Additionally, special attention is paid to the companies listed on Frontier Market Index (read: not in Small Cap index). Companies like the aforementioned might be included in passive ETFs that track MSCI Frontier Market as its constituent. However, we note that this will also act as a catalyst for easier passing of investor’s screening when looking at region! The changes took place as of the close of 31 August 2023.

Which companies are being included?

Romania will have 16 investable companies (+10!), while 6 companies will enter the Frontier index.

In conclusion, MSCI’s recognition of Croatia, Slovenia and Romania through more companies being included in MSCI’S Small Cap and Frontier index implies increasing economic prominence. We are eager to witness the unlocking of value that this deserved recognition of the region may bring!

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 34 | 30.8.2023 | EL | Electrica Q2 2023 Results Conference Call | Romania |

| 35 | 30.8.2023 | ONE | One United Properties Q2 2023 Results Conference Call | Romania |

| 38 | 31.8.2023 | CICG | Cinkarna Celje Q2 2023 Results | Slovenia |

| 39 | 31.8.2023 | FP | Fondul Proprietatea Q2 2023 Results, Conference Call | Romania |

| 40 | 31.8.2023 | LKPG | Luka Koper Dividend Payment date | Slovenia |

| 41 | 31.8.2023 | ZVTG | Triglav Q2 2023 Results | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).