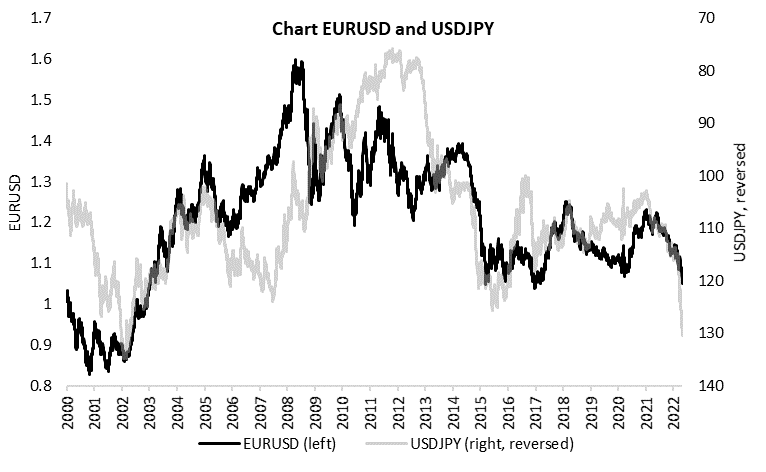

In the last few weeks, we have witnessed stubborn growth of the US Dollar versus many world currencies. DXY breached 103 level and reached the highest level since 2002 so the question is whether it could continue further. On the other side Yen is falling dramatically due to still loose monetary policy. In this article, we are looking into the details of these moves.

At the end of 2020, EURUSD reached 1.22 as Fed slashed its interest rates to zero while ECB did not have so much room to react. Sixteen months later, EURUSD stands at 1.05, level last time seen in February 2017 and there are plenty of reasons for the move, both for the strength of the USD and the weakness of the euro. The main drivers are obviously expectations that Fed will aggressively lift rates above 2.50% this year and close to 3.50% next year while ECB is still not showing signs of such a hawkish U-turn. Currently, Eurodollar futures for December 2022 stand below 97.0, reflecting expectations that a 3-month deposit that starts in December will bear a 3.0% rate while the same Euribor futures is at 99.45 (0.55%). This means that the spread between the two rates is expected to be around 2.50% versus 1.0% now. Furthermore, economic forecasts by the analysts are lower with each new edition which could benefit USD as a safe haven asset. Although there were some questions about the USD being the world’s leading reserve currency since start of the west’s embargo on Russia, decreasing its importance could take years. On the other hand, EUR’s weakness is coming from Ukraine-Russian conflict and ECB’s dilemma regarding its monetary policy. War in Ukraine will obviously have the largest impact on Ukraine, Russia, and Europe respectively, and bearing in mind European dependency on imported commodities one could not be surprised by its weakness. Talking about ECB, it is still not quite clear whether they are prepared to fight inflation without bearing in mind the health of the economy. ECB is slowly moving from QE and lifting rates is on the table, but they do not want to go full speed ahead with it but waiting for the monthly and quarterly data. As there is a real risk coming from a total embargo on commodities that would push Europe into recession this seems reasonable, but uncertainties could last for years while inflation in Europe is above 7.0% right now. In case ECB decides that it will start lifting rates in July and shows firm intentions to fight inflation despite the economic downturn we expect EURUSD to rise above the current levels but if Russian tensions intensify and ECB is still on ‘wait and see’ mode, EURUSD could go to parity quite soon.

On the other part of the globe, Japan’s currency is also witnessing a sharp weakening versus the US dollar. Namely, USDJPY reached 130, while being below 115 at the end of February, reflecting a depreciation of more than 10% in just 2 months. As stated above, Fed decided to hawk-up its game while BoJ decided that it will maintain its loose policy and will continue with yield curve control. This means that it will continue buying unlimited JGBs close to 0.25% which was once again confirmed this week. Inflation in Japan is still not showing any signs of uncontrollable growth as we see in all other parts of the world but is rising slowly. In March 2022, Japan’s CPI stood at 1.2% which was the highest level since 2018. Local investors most likely decided to sell as many JGBs as possible and transfer their funds into foreign assets bearing much larger interests, even when you look at FX-hedged basis. However, yesterday we saw Japan’s Ministry of Finance officials saying that recent FX moves warrant extreme concern meaning that one of the most dovish central banks in the world could have second thoughts soon. And then we would see what the real importance of Japan’s local investors for the global fixed income is.

EUR/USD exchange rate and USD/JPY reversed exchange rate

Source: Bloomberg, InterCapital

Ericsson NT published their Q1 2022 results yesterday, showing a strong 18% YoY increase in sales, a 38.9% YoY increase in EBITDA and a net profit of HRK 59.7m (+46.3% YoY).

In Q1 2022 Ericsson NT posted sales in the amount of HRK 526m, representing a strong 18% YoY increase. The increase in sales came on the back of realized projects both in domestic and foreign markets. Although, the company emphasized the fact that even Q1 results show a positive impact on basically all segments, war in Ukraine will impact the Company’s realized projects and new businesses that planned to be contracted in the Belarus region. All activities with Belarus’s clients are currently being put on hold and the company emphasized that new projects in Belarus were planned, which will also come in question. The impact should be seen in Q2 2022.

Sales Breakdown (HRK m)

Gross profit amounted to HRK 82.9.m, up by 31.3% YoY, due to sales growing faster than COGS which positively impacted gross profit. COGS reported lower growth due to lower transition and transformation costs and the impact of the cost-efficiency program. As a result, the gross margin grew 1.6 p.p. to 15.8%.

EBITDA increased 39% and amounted to HRK 82.8m. During the year, the Company employed 204 new employees (end of period Q1 2021 vs. end of Q1 2022), increase of 6.2% YoY. At the same time, the average monthly gross salaries increased from HRK 21,589 to HRK 22,338, growing by 3.47%. Selling expenses were down 5.1% YoY while administrative expenses were up 7.1% YoY, amounting together to HRK 22.1m. Depreaciation was down 7.7% to HRK 13.3m YoY. All this had a strong influence on the increase of EBIT, which grew by 53.7% YoY (or HRK 82m), amounting to HRK 69.6m.

EBIT amounted to HRK 69.6m marking a 53.7% YoY increase due to an improved gross profit. Meanwhile, selling and administrative expenses decreased by 5.1% YoY due to increased presales activities related to 5G radio access and core networks, and broadband network implementation projects.

Below the operating line, the net financial result more than halved, amounting to HRK 1.5m (-53.6%%) because of lower positive FX movement. Finally, net profit amounted to HRK 59.7m representing a 46.1% YoY increase.

Ericsson Key Financials (HRKm)

Cash and cash equivalents, at the end of Q1 2022, amounted to HRK 407.5m. This cash amount composes 33% of total assets, which is a decrease compared to year end 2021 when cash position stood at HRK 477m. This creates a strong financial cushion for the Company for any developments. Cash flow from operations was negative at -56m due to changes in working capital which amounted to HRK -140m.

At the share price before the announcement, this would be a DY of 1.4%. The ex-date is yet to be announced.

Končar published the convocation to the General Assembly in which the Management and Supervisory Board proposed the distribution of net profit for the year 2021. To be specific, the company proposed a dividend amounting to HRK 13 per share. This indicates a dividend yield of 1.4%.

The proposed profit distribution is subject to approval at the GSM which will be held on 10 June 2022.

In the graphs below, we are bringing you a historic overview of the company’s dividend per share and dividend yield.

Dividend per Share (HRK) and Dividend Yield (%) (2015 – 2022)

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 30 | 28.4.2022 | KOEI | Končar 2021 Annual Report, Q1 2022 Results | Croatia |

| 31 | 28.4.2022 | HT | HT Q1 2022 Results, Investor & Analyst Conference Call | Croatia |

| 32 | 28.4.2022 | ERNT | Ericsson NT Q1 2022 Results | Croatia |

| 33 | 28.4.2022 | ADPL | Annual Report 2021, Q1 2022 Results Presentation | Croatia |

| 34 | 28.4.2022 | SNG | Romgaz Annual General Meeting | Romania |

| 35 | 28.4.2022 | TLV | Banca Transilvania General Shareholders Meeting | Romania |

| 36 | 28.4.2022 | BRD | BRD: Annual Genaral Assembly of Shareholders | Romania |

| 37 | 28.4.2022 | BRD | BRD: Annual Report 2021 - financial results | Romania |

| 38 | 28.4.2022 | TGN | Transgaz General Meeting: Approval of 2021 results | Romania |

| 39 | 28.4.2022 | TEL | Transelectrica General Assembly Meeting: Approval of 2021 annual financial results | Romania |

| 40 | 28.4.2022 | SNN | Nuclearelectrica General Meeting | Romania |

| 41 | 28.4.2022 | ATGR | Atlantic Grupa Q1 2022 results | Croatia |

| 42 | 28.4.2022 | TRP | Teraplast Annual General Meeting | Romania |

| 43 | 28.4.2022 | TRP | Teraplast 2021 Annual Report | Romania |

| 44 | 28.4.2022 | COTE | Conpet Annual General Meeting | Romania |

| 45 | 28.4.2022 | ATPL | Atlantska Plovidba Board of Directors Meeting | Croatia |

| 46 | 28.4.2022 | ARNT | Arena Hospitality Group Q1 2022 Results | Croatia |

| 47 | 28.4.2022 | WINE | Purcari Annual General Meeting of Shareholders 2022 | Romania |

| 48 | 29.4.2022 | SNN | Nuclearelectrica Annual Report for 2021 | Romania |

| 49 | 29.4.2022 | TLV | Banca Transilvania Annual Report for 2021 | Romania |

| 50 | 29.4.2022 | SNG | Romgaz 2021 Annual Report | Romania |

| 51 | 29.4.2022 | TTS | TTS Annual General Meeting, Annual Report for 2021 | Romania |

| 52 | 29.4.2022 | TGN | Transgaz Annual Report for 2021 | Romania |

| 53 | 29.4.2022 | TEL | Transelectrica Annual Report for 2021 | Romania |

| 54 | 29.4.2022 | WINE | Purcari Annual Report for 2021 | Romania |

| 55 | 29.4.2022 | PODR | Podravka Q1 2022 Results | Croatia |

| 56 | 29.4.2022 | SNP | OMV Petrom Q1 2022 Results | Romania |

| 57 | 29.4.2022 | SNP | OMV Petrom conference call - Q1 2022 results | Romania |

| 58 | 29.4.2022 | COTE | Conpet 2021 Annual Report | Romania |

| 59 | 29.4.2022 | ATPL | Atlantska Plovidba Q1 2022 results | Croatia |

| 60 | 29.4.2022 | RIVP | Valamar Riviera Q1 2022 Results | Croatia |

Given the current Covid-19 situation, some of these events might be subject to change (postponed or cancelled).