The last important event before the turn of the year – the roll over of CROATE 5.375 11/29/2019 – is behind us and we can apply our complete and undivided attention to the upcoming Christmas parties. Or can we? Out of the total notional in size 1bio EUR, 53.86% was converted into new paper, leaving 461mio EUR to become due tomorrow. What happens the day after tomorrow when the HRK proceeds land on the holder’s balance sheets? Find out in this brief article.

Croatian Ministry of Finance placed a dual-tranche of government bonds last week with demand exceeding the notional planned by a wide margin. The orderbook opened last Thursday morning and by 13:00 CET the book runners issued guidance indicating that CROATE 0.25 11/27/2024 (the shorter HRK paper) has attracted a cumulative bid in size of roughly 8bio HRK (versus 2.5bio HRK planned); the longer EUR-linked one, CROATE 1 11/27/2034, ended up with an orderbook in size of 13bio HRK (versus 6.5bio HRK planned).

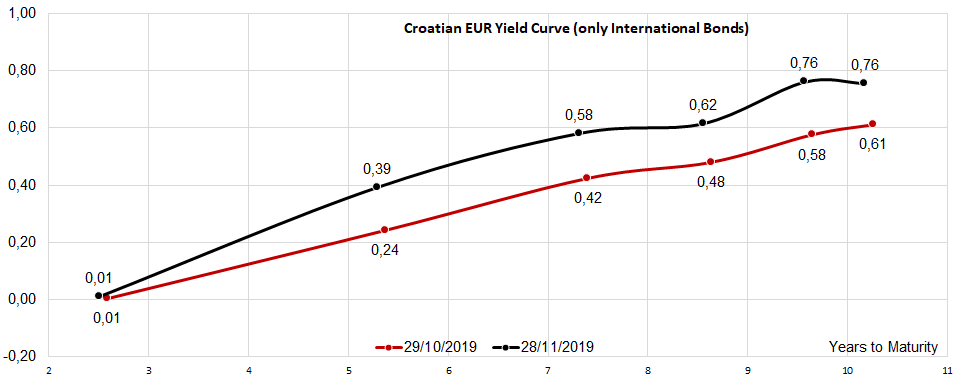

If You don’t have a calculator at hand, the total orderbook reached 21bio HRK at 13:00 CET and half an hour later the book was closed topping 23bio HRK. It’s quite reasonable to expect that the bulk of these extra 2bio HRK went straight into the shorter paper because market participants anticipated that they might get much less 24s than initially planned. Morning IPTs were 0.41%-0.44% for the HRK paper and 1.20%-1.35% for the long EUR-linked one (both IPTs in terms of YTM) and due to the overwhelming demand it’s understandable that both of the yields finished either below the target (0.36% reoffer yield for CROATE 0.25 11/27/2024) or at the very low of the range (1.20% reoffer yield for CROATE 1 11/27/2034). It’s worth mentioning that the government decided to increase the amounts to 3.5bio HRK on the shorter one due to relatively high bid-to-cover (2.28x using the 13:00 CET data). The notional on the 34s remained unchanged at 7.5bio HRK.

OK, enough with the history lessons – what happens next? Both of the new bonds were settled yesterday, CROATE 1 11/27/2034 with a base exchange rate of 7.432497 (if You have a good memory, try to memorize this number because it might come in handy in the next five years at least, i.e before Croatia enters the euro area). Looking at the shorter (HRK) paper, domestic banks took about 64% of the notional outstanding (2.24bio HRK), asset managers 19% (665mio HRK), pension funds 12% (420mio HRK), insurers 2% (70mio HRK) and the remaining 3% (105mio HRK) went to the „miscellaneous“ bracket (this piece of data was distributed by the book managers).

On the other hand, the longer EUR-linked bond became the favorite toy of pension funds (56% of the allocation, 4.2bio HRK in absolute amount) and insurers (26% of the allocation – 1.95bio HRK). Investors with ultra-long and long investment horizon typically keep these bonds in „hold to collect“ portfolios where the paper is valued at amortized cost – this basically curbs the excessive price volatility and prevents the value of their portfolios from riding the roller coaster. But don’t be too complacent about the 82% of allocation going into good old HTC – asset managers took 9% of the placement (675mio HRK), with banks taking additional 8% (600mio HRK). These positions might be valued as FVOCI or FVPL according to IFRS 9, meaning that these investors would feel the price swings on there P&L’s (sooner or later). Don’t forget that this is not a typical instrument banks would want for their ALM departments – it’s reasonable to assume that most of the 600mio HRK of the 34s went straight into trading books. This might be reasonable in terms of risk/reward since in three short months (March 05th, 2020) about 1bio EUR of CROATE 6.5 03/05/2020 would become due, a lot of it held by the same long term investors that bought the EUR-linked paper on Thursday. It’s highly unlikely that the government would be issuing another instrument tailor made for the insurers and pension funds three months from now, hence the demand is certain to reappear in March. The risky part of the deal for banks is where the benchmark is going to end up three months from today – if Bund yields/mid-swaps go higher, investors might be more inclined to go shopping on the eurobond market (especially the pension funds who are less constrained in terms of regulation – no Solvency II). That’s the reason banks are probably not betting the farm on this trade (600mio HRK aggregate is small potatoes for the banks) – after all, the liquidity might be terrible because banks are constrained by capital restrictions from taking too much of the 34s.

Now on to the shorter part of the curve – this Friday CROATE 5.375 11/29/2019 matures (1bio EUR notional) and the government allowed holders of this paper to pay for the new paper by delivering the old one. About 539mio EUR worth of notional was converted to the new paper, meaning that about 461mio EUR of the 19s would become due tomorrow (i.e. this share was not converted).

What happens with these proceeds? This is where things get really interesting – when a EUR-pegged bond becomes due, the holder receives the proceeds paid directly in kuna and converted using the central banks mid exchange rate. All of that happens on the last day of November (end-of-month), which is always important for the valuation purposes. Effectively, the remaining holders of the 19s would sell a total of 461mio EURHRK – quite a chunk. At least some of them and probably most of them would like to stay long EURHRK on the day after tomorrow and the supply of EUR-pegged instruments on domestic market is rather dry. There are almost no EUR-pegged bonds or TBs to purchase (that’s hardly a news), but as of lately, banks in general have been reluctant to take EUR deposits. At least part of the explanation lies in the legal concerns considering that the interest rate charged by a Croatian bank cannot go into negative, and once the bank receives the EUR deposit it still has to invest it somewhere in the euro universe, making loss on the process. The only way out for the banks is to restrict EUR-denominated deposits altogether. With this in mind the situation gets more puzzling and in the coming days it will certainly be interesting to watch what do these holders do with the proceeds of the CROATE 5.375 11/29/2019.

Clearly the situation is not so grave as it might look at first. OK, the market will go short EURHRK by 461mio EUR tomorrow at about 7.43 EURHRK exchange rate (this is a lucky guess, the exact exchange rate will be published by the central bank in the afternoon) – so what? This is no problem for the clients who can leave the FX exposure unhedged; as a matter of fact, for some of them this might have been an opportunity to extend their short EURHRK exposure ahead of the seasonal drop. But some of these holders do need to stay hedged and do need long EUR exposure the day after tomorrow – it seems that we’ll just have to wait and see what happens.

Yesterday, the Croatian Bureau of Statistics published its first estimates on GDP for Q3 2019 showing that Croatian economy expanded by 2.9% YoY, accelerating from Q2 when GDP increased by 2.4% YoY.

Final consumption continues to be the main contributor to GDP which kept its pace and increased by 3.1% YoY, 10bps higher looking at Q2 growth. The largest part of final consumption, household expenditure increased by a robust 3.3% YoY, while general government’s expenditure decelerated and increased by 2.9%.

Gross fixed capital formation rose by 5.0% YoY, reflecting significant slowdown compared to the first two quarters of the year when investment expanded by 11.5% and 8.2%, respectively. However, looking at the first three quarters, growth of investments still stands above 6.0% that will add about 1% point growth to overall GDP.

The main surprise came from both exports and imports. Namely, exports of goods and services accelerated and increased by 4.7% YoY due to skyrocketing exports of goods (7.1% YoY). On the other hand, imports of goods and services increased by only 1.1% with imports of goods being at 0.9% YoY compared to growth of 4.6% and 9.7% in Q1 and Q2. Deceleration of imports of goods and services growth to 1.1% YoY is a positive sign and shows that domestic industry was producing more for increased spending during high summer season.

Croatian GDP, Real Growth Rates (%, YoY)*

*Quarterly Gross Domestic Product, seasonally adjusted real growth rates

With the mentioned sale HT continues with the strategy of restructuring non-core parts of its business operations. Note that the sale was concluded for an undisclosed amount.

HT published an announcement on the Zagreb Stock Exchange announcing that they concluded the transfer and sale of the share in the company E-tours, one of the leading national travel agencies for foreign and corporate travel. The deal was concluded with Uniline, one of the leading tourism companies in Croatia. HT states that with the mentioned sale they continue with the strategy of restructuring non-core parts of its business operations. The transaction enables HT to reduce the complexity of managing over the non-core part of its business operations.

Note that the sale was concluded for an undisclosed amount, while the of the transaction is expected to close on 31 December 2019.

The bid was extended to 16 December 2019 due to the complexity of the process.

The Ministry of Finance of the Republic of Serbia published an announcement on their website stating that the deadline for submitting the binding bids for Komercijalna Banka have been extended to 16 December 2019.

The mentioned deadline has been extended at the request of participants in the tender procedure due to the complexity of the process, while at the same time taking into account the intention to get the best possible offer.

As a reminder, the initial deadline for submitting the bid was 2 December 2019. Also, earlier this week, Serbian state acquired additional 34% stake in the Bank from EBRD and IFC. Following this transaction the Republic of Serbia will own 83.2% of the bank, which will enable the privatization of the Bank under the ongoing privatization process. To read more about it, click here.

The mentioned act should take place in 2020.

The Chamber of Deputies, the decision-making chamber, adopted the law on alternative investment funds (AIF) yesterday, which repeals the normative act by which investors are capped by a 5% ownership threshold in all 5 listed SIFs.

After the mentioned vote, the law goes for promulgation to the president, and the legislator gives a period of 6 months to Fondul Proprietatea and SIFs to submit the documentation related to the qualification under one of the categories of alternative investment funds. Therefore, the mentioned act should take place in 2020.

Such news had a positive reaction on the SIFs share price, as they increased by 4-5% during yesterdays trading session.