The turn of the quarter is expected to be much more muted than usual, but a lot of things are brewing below the surface of global fixed income market. On the local front, the Ministry of Finance announced placement of a 7Y HRK bond on Wednesday and we expect a 9bn+ HRK size and a reoffer yield slightly below 0.50%. How much do you have to bid in order to get the size you want – well, you’ll just have to skim read the article in order to find out.

The turn of the quarter occasionally brings about bouts of volatility, however this time around the flows might be muted. At least looking at fixed income and money markets. On June 24th FED released details about the stress test of US G-SIBs, which basically rekindled bank dividend payouts and share buybacks. This would definitely have an impact on fixed income markets going forward and Zoltan Pozsar (Credit Suisse) pointed out that US banks at holdco level basically run 20x times leverage, meaning that for every 10bn USD wiped out from the balance sheet through dividend payouts or share buybacks, there is about 200bn USD less demand for Treasuries, MBS, and deposits. Deutsche Bank posted in a research piece that thanks to pandemic and mitigating measures introduced in the US, commercial banks’ share of government securities rose sharply from below 20% of securities outstanding to a bit above 25%. At the same time foreigners’ share of treasures has been gradually declining for a number of years and it’s quite likely that as long as US real yield stays in a negative territory, foreign institutions (excluding central banks) would continue to avoid US government debt.

Where does all of that leave us? The main question that’s still on the table is when will FED announce the tapering of asset purchase and currently the September FOMC meeting looks like a good time point. The reason for this expectation is the fact that by September we would have more clarity about the pace of labor market recovery in the United States. Market consensus has so far been that government support for the unemployed and gradual reopening have prevented US workers from flocking back on the labor market, hence two lousy NFP prints. Analyst consensus has so far bended to reflect economic reality, so on Friday markets expect a 700k print (versus 559k reported in June). If not exceeded, the event wouldn’t cause the FED to bat an eyelash and would fit perfectly into their outlook of a slow return to normal, full of headwinds and threats (delta variant being just the most prominent).

In other words, there is a lot of brewing under the surface of fixed income markets, but probably without sudden eruptions of volatility in the coming weeks. Share buybacks and dividend payouts from US banks would likely be a gradual process and won’t be frontloaded on the bond market. However they do represent a tailwind for the rising yields on US government debt and tapering of asset purchase which would probably start early next year would pull demand from the market as well.

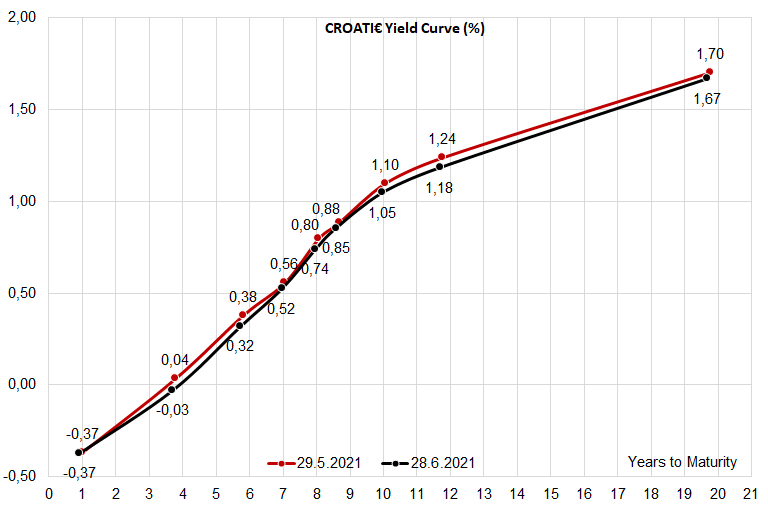

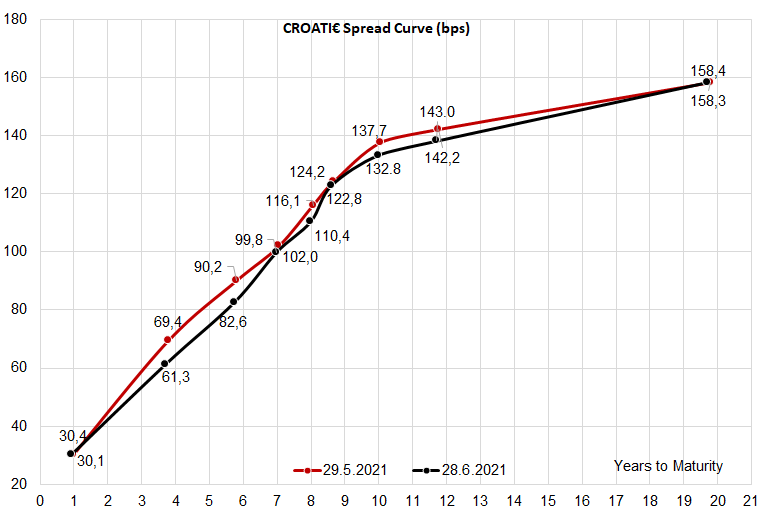

Speaking about the Croatian fixed income market, this morning Croatian Ministry of Finance announced a local currency bond being placed this Wednesday (June 30th). The purpose of the placement is to collect the funding for maturing 6bn HRK CROATE 2.75 07/08/2021 and finance the deficit spending. With regard to size of the auction, it’s quite likely that it might reach or even exceed 9bn HRK (3bn HRK net issuance) since last year the Ministry of Finance learned valuable lessons about the volatility of tourist revenues and it’s implications for the government budget. With that in mind and yields at 7Y point on the curve slightly below 0.50%, it would be quite prudent to place a bit more than the current expenditures command in order to have a clear head into September. It’s quite likely that Croatian banks would demonstrate significant demand although the 7Y duration goes two years above their ALM’s preferred target. In other words, market’s thirst for LCY assets would imply demand by far exceeding the 9bn HRK of the expected placement, so get prepared for concessions and being allocated significantly below your placed bid quantities.

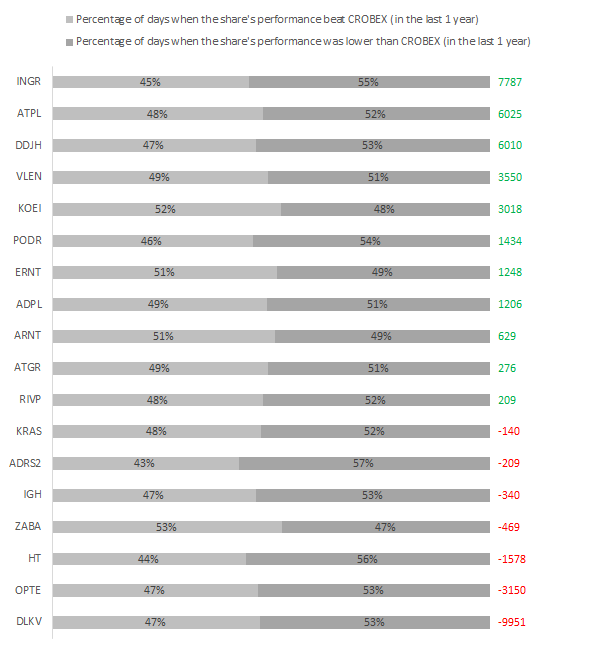

Today we bring you an overview of how often current CROBEX components managed to beat the index by yield in a period of one year.

For this, we calculated the percentage of times (out of 252 trading days) in which an individual share recorded higher yield than the index. As visible on the chart, eleven out of eighteen shares mostly performed better than the index on a daily basis. However, note that we listed them according to the amount of basis points by which the company outperformed CROBEX in the last year. Therefore, one can notice that Ingra whose yield outperformed CROBEX by 7787bps during the last year was able to beat the index on just 45% of trading days. Meanwhile, Zagrebacka bank was able to outperform the CROBEX on 53% of days, the most out of all constituents. However, due to the stronger negative effect on the remaining days, the bank still underperformed the index by 469bps. Leading the laggards, Dalekovod had a lower yield than CROBEX 47% of the times performing lower by 9951bps.

Percentage of Days CROBEX Components Outperform the Index