After analyzing dozens of takeover offers since 2014, we have concluded that in the vast majority of cases, it is more advantageous for shareholders to accept takeover offers than it is to maintain their positions. In this analysis, we’ll review the data and show our arguments for why.

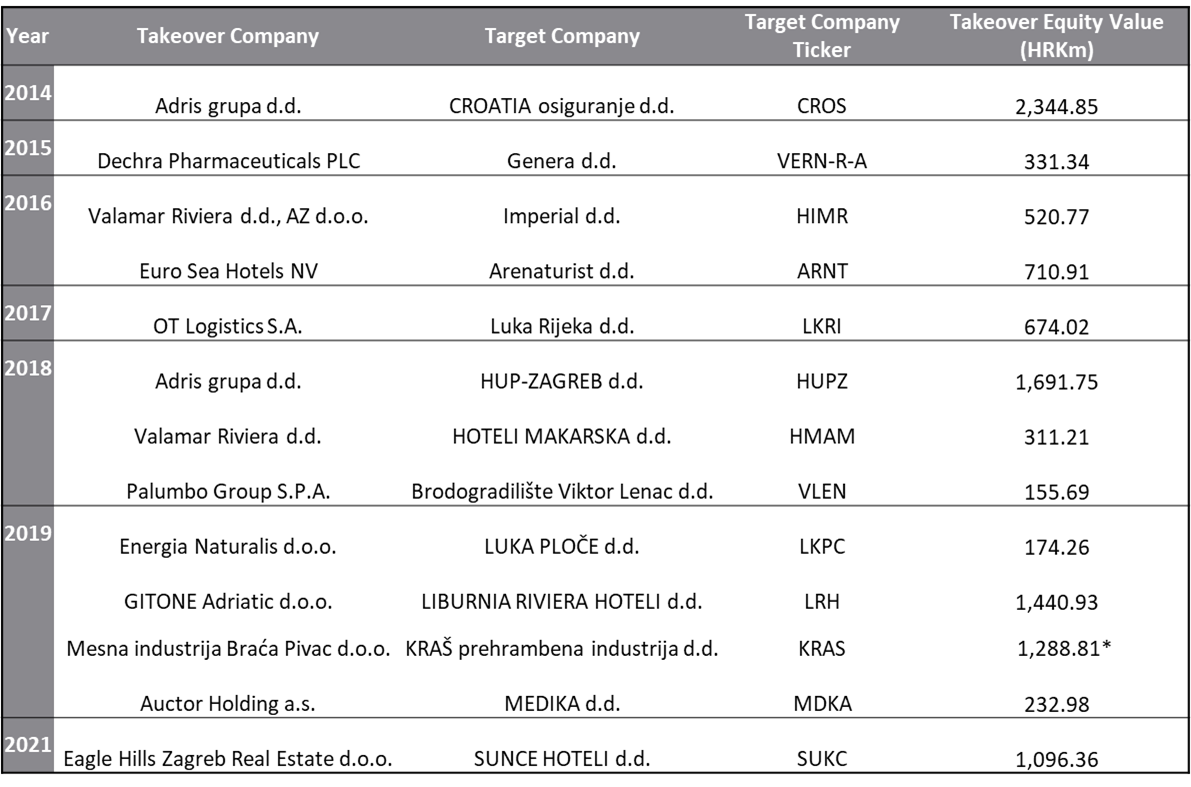

HANFA records a total of 43 takeover offers in Croatia since 2014, with our analysis focused on 13 viable offers. Excluded offers were deemed too small in market cap, lacked market liquidity, were delisted, or were involved in pre-bankruptcy settlements. The complete list of all the takeovers is available here (Croatian only).

Select takeover offers list in Croatia since 2014

Source: HANFA, InterCapital Research

*Based on the HRK 860 realized takeover offer price

The companies under analysis were categorized based on their liquidity, enabling us to gauge the implications of the takeover on the market. The 3-month VWAP prior to the takeover requirement date was utilized as a reference point in line with the Croatia takeover legislation, with the first comparison made between this value and the takeover price. Furthermore, the 1-year and current prices of target companies were evaluated to determine whether the decision to tender the shares in the takeover offer was viable in the short and long term. The target companies’ tickers were used to represent the overall takeover offers.

Select takeover offers sorted by takeover price premium over the 3m VWAP (%)

Source: HANFA, InterCapital Research

From the first analysis, we can conclude several things:

- The median takeover price premium over the 3-month VWAP amounted to a mere 0.69%.

- Out of the 13 observed takeovers, 5 offered no takeover premium whatsoever.

- The median takeover price premium of companies that offered one amounted to 18.7% over the 3-month VWAP.

1-year share price vs. takeover price (left), current price vs. takeover price (right)*, %

Source: HANFA, ZSE, InterCapital Research

*Companies that were delisted show the current share price as 0

**In the 1-year share price comparison, the last available share prices were used for delisted companies

Next up, the second analysis can tell us the following:

- 10 out of the 13 companies 1 year after the takeover traded at a lower price compared to the takeover offer, with an average drop of 10.8%.

- 3 out of 13 companies were above the takeover price – Arenaturist, Kraš, and Medika.

- Within 1 year of the takeover, 3 out of 13 observed companies got delisted.

A quick comment on the 1 year after “winners”:

Arenaturist (now Arena Hospitality Group) – 1 year after the takeover process, the share price was 56.6% higher than the takeover price. After the takeover, Arenaturist experienced a capital increase, as well as an SPO, leading to this price growth. In the meantime, however, the share price decreased significantly, leading to the current share price which is 16.7% lower than the takeover offer price. If you timed the market, congrats!

Kraš – At the time when Kraš was in play, with an offered premium of 0.69% to 3-month VWAP, a new buyer emerged with KAPPA STAR LIMITED actively buying shares during and after the process. In theory, it was a competing bid and thus the takeover price was not really a valid reference point. Furthermore, during this period, KRAŠ-ESOP, the owner of an 18.45% stake in Kraš, sold their stake for HRK 860, and at one point, the share price on the market reached HRK 1,050, making the takeover offer even less relevant. However, that price did not last long, and using the HRK 860 as a reference, Kraš is currently trading at a 30% discount.

Medika – 1 year after the takeover offer, the share price was 103% higher. Currently, it stands at 337% higher than the takeover offer price. However, not much has happened with the share price in the last 7 years.

In short, our analysis reveals that as a rule shareholders are better off tendering their shares. In 23% of the takeovers, the shares got delisted, often at a lower price. Meanwhile, in 77% of the cases, the share price was lower 1 year after the takeover. Even if you held the shares up until today, you are still in the red 50% of the cases. And finally, let’s not forget – the vast majority of the observed names are illiquid and in our opinion shouldn’t even be considered true “publically listed companies”.