InterCapital remains dedicated to making investments into the region more attractive by supporting transparency and liquidity, and we thank our partners for supporting us in achieving this goal.

We are proud to announce that Krka and Triglav have renewed their Market Making agreements with InterCapital Securities.

Being a market maker means that InterCapital will continuously put both bid (buy) and ask (sell) orders on KRKG and ZVTG shares at a pre-defined spread. The idea is to enable investors to buy or sell the shares (up to a certain size) at any time within a reasonable volatility range.

In 2019, InterCapital reignited market making in Slovenia after 10 years, and currently provides the mentioned services to 5 Slovenian blue chips: Krka, Triglav, Petrol, Telekom Slovenije and Sava Re.

Besides that, InterCapital is already an established market maker in Croatia, covering 8 blue-chip companies, all part of the CROBEX index and 2 ETFs. According to our experience, the service accounts for a significant portion of the shares’ total turnover. We are proud of having earned the trust of both companies and will do our best to continue providing the best service possible.

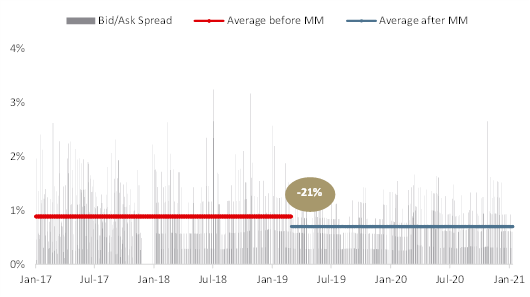

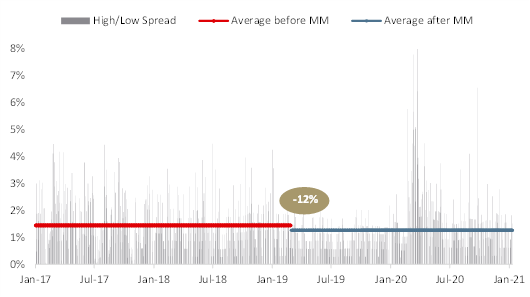

The importance of market making can be witnessed in the graphs below, which show a reduction of the bid/ask spread and intraday volatility of one Slovenian blue chip since the engagement of InterCapital as a market maker. As visible from the graph, InterCapital successfully reduced both of the above-mentioned parameters, despite the selloff in 2020 caused by the outbreak of the pandemic.

To read more about the importance of market making click here.

Effects of Market Making – Reduction of Bid/Ask Spread on a Slovenian Blue Chip

Effects of Market Making – Reduction of Intraday Volatility on a Slovenian Blue Chip

Since 1 January 2020 up to date, half of CROBEX10 constituents outperformed the index more than 50% of the times.

The Croatian Equity market in 2020 could be described as a roller coaster, in which we have seen unprecedented volatility. For today, we decided to look at how often did each CROBEX10 constituent outperform/underperform the index. The figures relate to from 1 January 2020 to date.

In the mentioned period, the CROBEX10 has observed a decrease of 6.4%, while it has increased by 33.1% since its March 2020 bottom. Looking at the index constituents, one can notice that AD Plastik and HT have outperformed the index more than other constituents, that being 51.5% of the time each. AD Plastik has also outperformed the index by 3.6 p.p. in the observed period, while compared to the 2020 bottom it observed the highest increase of 86.2%. HT outperformed the index by as much as 11.6 p.p. which is the second best result among constituents.

How much did individual constituents out/under perform compared to the index? (p.p.)

Arena Hospitality Group and Ericsson Nikola Tesla follow, outperforming the index 51.1% of the time. Arena Hospitality has underperformed the index by 9.8% in the observed period, as the tourism sector was one of the most affected in the crisis. However, compared to the March 2020 bottom, the share is up by as much as 64%.

On the flip side, half of the CROBEX10 constituents underperformed the index most of the observed times. Of those Adris (pref.) leads the list, underperforming the index 56.4% of the times, followed by Valamar Riviera (54.9%).

How often do CROBEX10 Constituents Outperform the Index? (%)

At the current share price dividend yield is 4.3%. Ex-date is 22 March 2021.

AD Plastik published a document on the Zagreb Stock Exchange announcing that the company’s Supervisory board has confirmed the proposal of the Management Board regarding the dividend payment in the amount of HRK 8 per share. The mentioned dividend should be paid from retained earnings for 2019. At the current share price, dividend yield is 4.3%.

The mentioned news was positively accepted by the investors, as AD Plastik’s share price jumped by 5.1% yesterday, closing at HRK 185.5 per share.

Ex-date is 22 March 2021, while the dividend would be paid on 26 March. The dividend payment is subject to approval at the AGM which should be held on 16 March.

In the graphs below, we are bringing you a historical overview of the company’s dividends per share and dividend yield.

Dividend per Share (2013 – 2021) (HRK)

Dividend Yield (2013 – 2021) (%)