Earlier this month, InterCapital signed a market making agreement with Telekom Slovenije, which represents our 5th market making mandate in the Slovenian market. Since we take pride in being the only market maker in Slovenia, we decided to present you with a brief article on the importance and effects of market making on a share.

In 2019, InterCapital reignited market making in Slovenia after 10 years, and currently provides the mentioned services to following Slovenian blue chips: Telekom Slovenije (as of February), Krka, Triglav, Petrol and Sava Re. Besides being the only provider of market making services in Slovenia, InterCapital provides the same service in Croatia for 8 blue-chip companies (9 securities), all part of the CROBEX and CROBEX10 index.

Since we take pride in being an established market maker in the mentioned markets, we decided to present you with the importance and effects of a share having a market maker. For our analysis we decided to look at Krka, the most liquid share on the LJSE.

The introduction of market making affects the secondary market of a share in three key ways:

- Reduction in bid / ask spread

- Increase in liquidity

- Reduction in intraday volatility

Reducing Bid/Ask Spread

Being a market maker means that the market maker will continuously put both bid (buy) and ask (sell) orders on a certain share at a pre-defined spread. By quoting bids and offers for a given stock within a narrow price range, a market maker provides needed liquidity to the market that might not be present on its own, satisfies supply and demand of the financial markets and keeps securities changing hands from sellers to buyers. This is especially important in the case of less liquid shares as illiquidity discourages investors, especially institutional ones, because the time for taking a position and the price paid for the acquisition of shares is often unacceptably high.

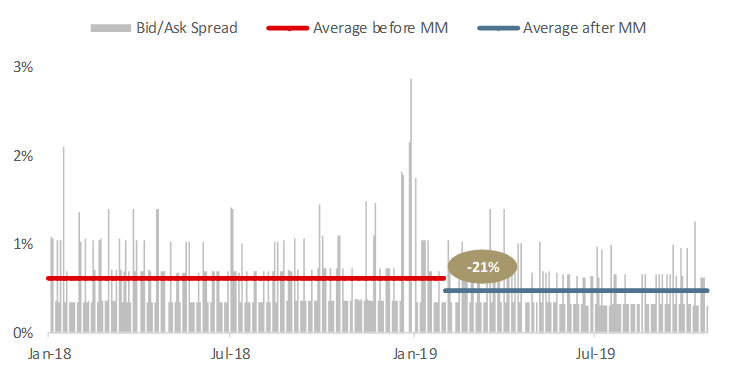

The idea of market making is to create a reasonable bid/ask spread, thereby forcing other market participants to put quotes within that range, further reducing the spread. For example, as visible on the graph below, after the engagement of InterCapital, bid/ask spread on the share of Krka has been successfully reduced by 21%. It is noteworthy that the less liquid the share, the reduction of the bid/ask spread tends to be larger.

Impact of Market Making Services on Bid/Ask Spread (Krka)

Source: Bloomberg, InterCapital Research

Increase in Liquidity

Another benefit of having a market maker is that it usually leads to an increase in the stock’s liquidity. Investors, both retail and institutional, prefer stocks that have a liquid market and market makers, as it indicates they might more easily get in and out of positions and that the share price will not be defined by small orders (thus reducing price volatility).

According to our experience, once the market making service is established, it accounts for a significant portion of the shares’ total turnover, indicating a positive impact on the share’s liquidity. Since the reignition of market making in Slovenia, the market maker has accounted for double-digit share in traded volume of all 5 stocks. More specifically, market making has accounted, on average, for roughly 14% of the total traded volume on Slovenian stocks since its introduction.

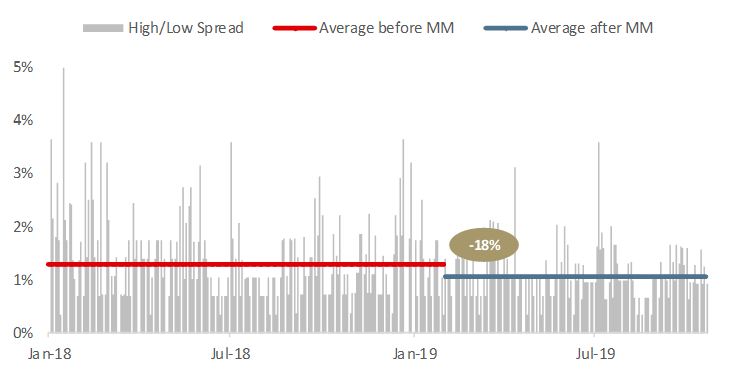

Reduction in Intraday Volatility

Intraday volatility of a share can be defined as the percentage change between the highest and lowest price traded within a day. Through the activities of a market maker of continuously putting both bid and ask orders on a certain share at a pre-defined spread, market making leads to a significant reduction of the mentioned volatility. To put things into a perspective, Krka’s share has witnessed a solid decrease in intraday volatility of 18% since the inauguration of market making. This is important, especially to retail investors, as they can both buy or sell shares within the “reasonable” market price, usually without a high volatility risk.

It is also worth noting that besides financial metrics, institutional investors see market making as a positive add-on in terms of corporate governance and focus on creating shareholder value.

Impact of Market Making Services on Intraday Volatility (Krka)

Source: Bloomberg, InterCapital Research