On its yesterday’s auction, Croatian Ministry of Finance issued three bonds worth HRK 15bn to refinance two maturing papers worth HRK 12.5bn. First time ever, Croatia issued 20Y EUR denominated paper, with yield of 1.28%. The shortest paper issued, 5y pure HRK, was issued at 0.37% while second tranche of RHMF-O-34BA yields 1.12%. In this article read more details about the auction and Croatian local bond market.

As announced last week in the media, Croatian Ministry of Finance decided to refinance two maturing bonds RHMF-O-203A and RHMF-O-203E with triple tranche on local market. Two maturing bonds were worth HRK 12.5bn in aggregate, which will be financed in full, while rest of the funds will most likely be used to fill the gap in this year’s budget balance. As papers mature on March 5th, holders of the maturing papers could choose between swapping the old paper for the new one on March 3rd or buying new ones and then receiving cash for the maturing paper two days later. The difference is in EURHRK rate, as new paper will be valued on March 3rd.

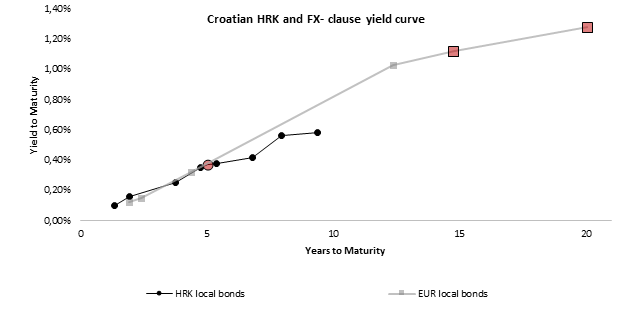

Now let’s talk about the auction and most important thing, prices. In the morning banks sent first indication of yield which stood at 0.37%-0.42% for the RHMF-O-253A, 1.12%-1.17% for existing RHMF-O-34BA and 1.28%-1.43% for 20Y RHMF-O-403E. Few hours later investors were informed that total demand for all three papers stands at HRK 16.5bn while yields were moved towards the lower bound of the first indication. In the end Ministry of Finance decided to issue HRK 5bn of RHMF-O-253A at 0.37% (coupon of 0.25% and clean price 99.406), HRK 4bn of RHMF-O-34BA at 1.12% translated in clean price of 98.374 which is mildly below market bids and EUR 800m (HRK 6bn) of RHMF-O-403E at 1.28% (coupon of 1.25% and clean price 99.472), resulting in the biggest auction recorded. Both RHMF-O-253A and RHMF-O-34BA were issued right on the curve (bid prices), without any premium left while 20Y EUR paper was issued close to its extrapolated value, reflecting solid bid for new paper. Total demand on aggregate stood at HRK 20.5bn, translated into bid to cover of 1.36, or 1.65 looking at the maturing amount.

Looking at the total demand in the past, this auction was one of the lightest in term of bid to cover but one has to bear in mind very long duration of the third paper and yields being on their bottom. On the other side, excess liquidity in banks’ balance is higher than ever (almost HRK 40bn) which stands at central bank at 0.00% while pension and investment funds are increasing their AUM every month due to wage and employment growth and no yield on deposits in banks. From market segmentation point, we could say that RHMF-O-253A was ‘made’ for banks and short-term funds, bond funds and insurances were mostly investing in RHMF-O-34BA while pensions funds poured their money in the new 20Y EUR denominated paper.

Talking about EUR denominated bonds, one should bear in mind that investors will buy new papers at EURHRK rate that will be set on Monday, March 2nd. In the last few days we saw significant volatility on EURHRK rate most likely due to auction as there are probably some investors that will leave their RHMF-O-203E to mature while not reinvesting proceeds to the new papers but instead buying single currency just to leave its balance unchanged. Just to put things into perspective, EURHRK yesterday jumped all the way to 7.4700 on bid side but then dropping to below 7.4600 as MinFin decided to issue more EUR papers (HRK 10bn) than was expected on the market.

To conclude, solid demand and current low-yield environment will benefit Croatian budget significantly. Just with the yesterday’s auction, Croatian Ministry of Finance will save HRK 600m as two bonds maturing cost us HRK 750m a year, while these three bonds will in aggregate cost us 140m a year. Assuming that Croatia will refinance its maturing CROATI 2020 in the summer at yield of 0.60% (EUR denominated 10Y Eurobond), total savings from auctions in 2020 will be around HRK 1bn. On top of all mentioned, Croatia proved that it could issue 20Y bond with no premium on the extrapolation, extending its curve and locking lower yields for longer.

Source: Bloomberg, InterCapital

NLB acquired the 83.23% stake in Komercijalna Banka for EUR 387m, which puts the transaction multiple at P/B 0.77. Find out more about the acquisition in this brief article.

NLB published a document on the Ljubljana Stock Exchange announcing that they have acquired the entered into a share purchase agreement with the Republic of Serbia for the acquisition of an 83.23% ordinary shareholding in Komercijalna Banka.

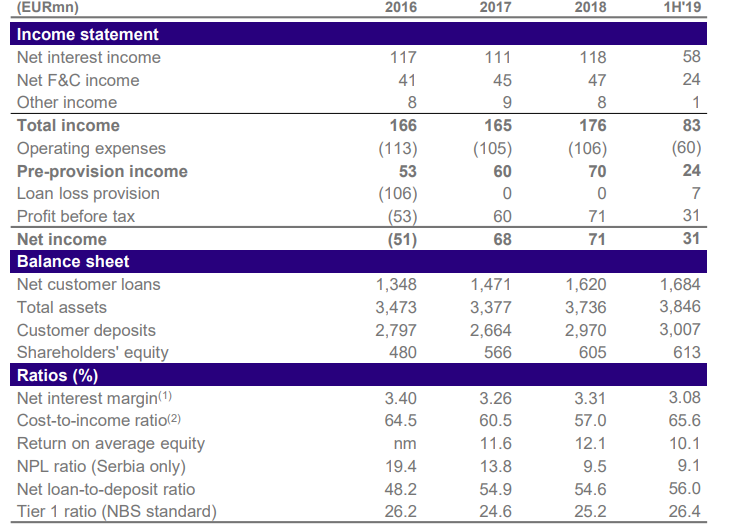

NLB acquired the 83.23% shareholding for the amount of EUR387m, which will be payable in cash on completion. Such a price puts the transaction multiple at P/B 0.77 and P/E 6, while it implies a valuation of EUR 465m for the 100% stake in Komercijalna Banka. Note that in accordance with Serbian bank privatisation regulations, NLB is not required to launch a mandatory tender offer for minorities’ shareholdings in Komercijalna Banka.

The closing of the transaction is expected in Q4 2020 and is subject to mandatory regulatory approvals from, amongst others, the European Central Bank, Bank of Slovenia and the National Bank of Serbia.

Following the completion of the acquisition, Serbia would become NLB’s second largest market accounting for roughly 24% of the Group’s asses (compared to current 4%). Meanwhile, the Group’s assets in core foreign markets would increase from 34% to roughly 49%.

The Purchase Price will be subject to a 2% annual interest rate between 1 January 2020 and closing.

It is important to note that subject to National Bank of Serbia approval, declared but unpaid dividends and employee benefits for prior financial years will be paid before closing. Komercijalna Banka’s existing shareholders will also receive a dividend equating to 50% of 2019 net income up to a maximum of EUR 38m before closing.

Capital Adequacy & 2019 Dividend

NLB notes that they will at all times exceed the Overall Capital Requirement and Pillar 2 Guidance of 14.25%. To deliver on this objective we will use capital instruments already issued and not yet accounted for (EUR240m of Tier 2 instruments) and anticipated capital accretion stemming from retained earnings and/or ongoing RWA optimization measures, potential AT1 issuance and non-controlling interest inclusion.

NLB is striving to maintain a material dividend payment for 2019, however timing will be synchronised with the regulatory approval process and the implementation of capital optimisation measures. NLB is upholding its dividend policy which, subject to meeting its target capital ratio, envisages a dividend payout ratio of approximately 70%. If the company were to carry out such a payout ratio, this would imply a dividend of EUR 6.77 per share (DY roughly 11% at the current share price).

About Komercijalna Banka

Komercijalna Banka is the 4th largest bank in Serbia by total assets, which is the the largest market in the SEE region in terms of bankable population. Komercijalna Banka will add more than 770,000 active retail clients and the largest branch network in the country with 203 branches to NLB’s existing operations in Serbia.

Komercijalna Banka Key Financials

Source: NLB Group

To read more about Komercijalna Banka click here.

To read our brief overview of the Serbian Banking sector click here.

Synergies

NLB notes that there are significant opportunities for value creation as a result of the mentioned acquisition. The company notes that they could achieve roughly EUR 16m in realization of materials cost and funding run-rate pre-tax synergies achieved in 2023.

Sources of value creation, according to NLB would be:

- Optimization – Head office functions in Belgrade, as well as operations in BiH and Montenegro; Harmonisation of information technology platforms

- Funding synergies – Leveraging Komercijalna Banka’s local currency deposit funding base; Integration of deposits and current accounts

- Revenue synergies – Increase share of active clients; Increase penetration and cross-sell cards, cash loans and mortgages

- Restructuring charges- Total restructuring charge of EUR 21m in the first two years of the transaction; 75% of charges phased in 2021 and the remaining in 2022

The tankers will be chartered out at approximately USD 17,100 and USD 16,850 per day under regular market terms.

Tankerska Next Generation (TNG) published an announcement on the Zagreb Stock Exchange stating that the company has secured two-year employment for one of its conventional ice-class product tankers, the contracted employment is due to commence in March 2020.

The company notes that the tanker will be chartered out to a prominent charterer at approximately USD 15,250 per day under standard market terms and conditions. The charterer has an option to extend the deal, in direct continuation, for the third year at approximately USD 15,750.

Furthermore, TNG has ensured additional time charter coverage for its ECO tanker at USD 16,850 per day for three to six months, with immediate effect.

The mentioned employment of both tankers is above the 2019 average. As a reminder, daily TCE net rates per operating vessel in 2019 were USD 14,794 on average, representing an increase of 12.1% YoY. Meanwhile fleet utilization remained a 100%. The rise in TCEs was caused by improved market conditions witnessed in 2019.

This week TNG published their FY 2019 report. To read more about the FY results click here.

At the current share price, this translates to a dividend yield of 4.5%, while the ex-date would be on 24 April 2020.

Imperial Riviera published a document on the Zagreb Stock Exchange announcing that the Supervisory board of the company has proposed a dividend of HRK 34.92 per share. When we would compare it to last years dividends in Imperial and Hoteli Makarska it would be an increase of 59%.

At the current share price, this translates to a dividend yield of 4.5%. The company notes that the ex-date would be on 24 April 2020, while the payment date would occur on 19 May 2020.

As a reminder, Valamar together with AZ pension fund own 89.86% of class A of shares of Imperial Riviera that in total amount to 1,001,401. In December 2019 Valamar together with AZ pension fund and Allianz further increased capital for 488,012 shares of class B which are not listed on Zagreb Stock Exchange. In order to read more on shareholding structure of these share please clique here. After capital increase Valamar Riviera is the biggest sole shareholder and it owns 43.68% of share capital of Imperial Riviera, while AZ mandatory pension fund owns 47.02% of share capital.

The company also published a call to the GSM where they announced that net income for 2019 amounts to HRK 59.1m, while dividend would be paid from previous years’ retained earnings.

In 2019, the company recorded an increase in sales of 11.7% YoY, increase in EBITDA of 9.4% and an increase in net profit of 31.7%.

Nuclearelectrica published their preliminary 2019 results on the Bucharest Stock Exchange. According to the report, the company recorded an increase in sales of electricity of 11.7% YoY, amounting to RON 2.37bn. Of that, sales of electricity on free market accounts for 89%, while Nuclearelectrica also recorded RON 259.3m of sales of electricity on the regulated market which was not present in 2018. Meanwhile, total revenues amounted to RON 2.38bn, representing an increase of 11.7%.

When observing operating expenses, they amounted to RON 1.78bn, noting an increase of 8.4%. Such an increase came mostly on the back of higher other operating expenses by 19.6% or RON 84.66m. To be specific, most of the increase of other operating expenses could be attributed to Expenses on the ANRE contribution of RON 42.5m. Besides that, operating expenses were affected by higher personnel expenses by 9.5% or RON 37.77m.

As a result of the above mentioned, EBITDA amounted to RON 1.19bn, representing an increase of 9.4%. Such a result puts the EBITDA margin at 49.3% (-0.7 p.p. YoY).

Going further down the P&L, operating profit stood at RON 636.5m, representing a solid increase of 18.6% YoY. Meanwhile, operating profit margin stood at 26.3% (+1.7% YoY).

In 2019, Nuclearelectrica recorded a net financial gain of RON 1.84m, comparing to RON 36.08m in 2018. The lower gain could be mainly attributed to a decrease in foreign exchange gains.

Net profit for 2019 amounted to 540.9m, representing an increase of 31.7%. Such a result puts the net profit margin at 22.4% (+3.5 p.p. YoY).