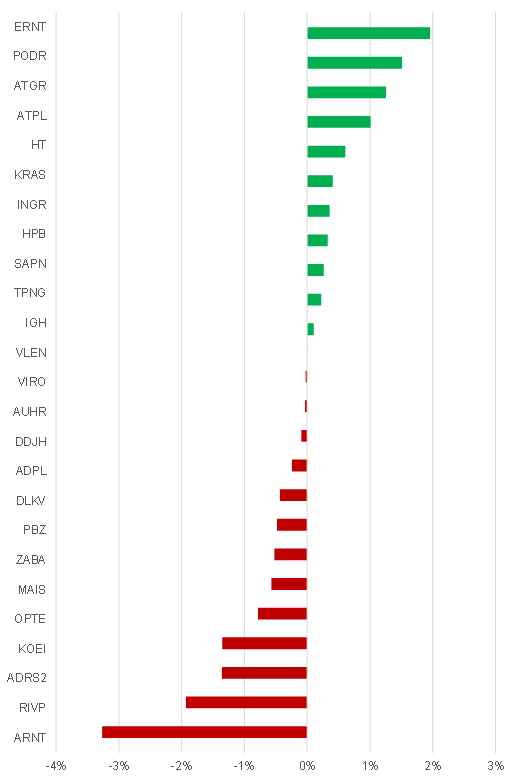

Although CROBEX is still below its value witnessed at the beginning of 2020 (-2.9%), some of its components have had a stellar performance both in terms of operating results and in terms of share price development during the same period. Therefore, we decided to see which components had the biggest impact on CROBEX’s movement since the beginning of 2020, or better yet since the outbreak of the COVID-19 pandemic.

The best performance among CROBEX components was evidenced by Ericsson NT whose share price surged 21% since the beginning of 2020. Their resilience to the pandemic was due to the sector they operate in, since the ICT sector was one of the least hurt by the pandemic. The company has a business model where work from home was introduced from the start of the pandemic, so ICT solutions produced by its human capital and their implementation was almost not affected by the pandemic. The company continued its contract with major telecom operator and extended its operations to all Croatian telecom operators. Its sales grew on all its markets and its margins increased as sales grew on higher margin businesses. On the same token, Hrvatski Telekom had a solid performance since the beginning of 2020 and its share price increased from the beginning of 2020 by 8%. HT’s business was influenced by decreased consumer spending due to lock-down and drop in inflow of tourists. But since 4Q 2020 this trend was reversed, and sales have picked-up. On the other hand, on the level of 2021 the decrease in sales is expected as the Group sold its investment in Optima Telekom which will not be consolidated anymore. Still, EBITDA margin is expected to be flat as savings in processes and other expenses were introduced. Due to higher depreciation and write-offs due to Optima on the level of 2021 19% lower net income is expected. But due to strong cash position and operations of HT Inc., dividend per share is expected at least on the same level as in this year, while company is stepping up its share buyback program to app. HRK 130m.

Consumer non-discretionary producers, Podravka and Atlantic Group, as expected did well since the beginning of 2020. From the start of the pandemic the results were boosted by the stockpiling effect while later consumers stuck with the purchase of their favorite brands which can now after the end of recession grow even further. Both companies also used the time of the pandemic to leverage on some savings and improved their business models, so their operating profitability was up. These both stocks put in a solid performance during pandemic, so Podravka’s share price surged from the beginning of 2020 by 21% and Atlantic Grupa’s by 16%.

Expectedly, hospitality companies Valamar and Arena, negatively influenced CROBEX, by 1.9% and 3.3% respectively. Their shares are down from the beginning of 2020 by 25% and 18%, respectively as their financials are still in the red. Third quarter is expected to show strong results for both companies, while 2022 is expected to bring further normalisation towards operations of pre-pandemic levels. So, we expect stocks that were the strongest prior to the pandemic to show leadership most likely after a full reopening.

Individual Impact of Shares on CROBEX Movement Since the Beginning of 2020

Source: Bloomberg, InterCapital Research

Note: Closing price as at 25 Aug 2021

In the first 7 months of 2021, GWPs increased by 11.2% YoY. GWPs in non-life insurances grew 11.7% YoY, while life insurance increased by 9.7% YoY.

According to Croatian Insurance Bureau on GWP development in July 2021, in the first 7 months of 2021, GWP’s observed a significant growth of 11.2% YoY (or HRK 754m). This indicates a continuation of a very strong year.

The total amount of collected GWPs was HRK 7.47bn (includes insurers located in Croatia and insurers operating in Croatia but based in another EU country). Earlier mentioned increase came back strong on both, life and non-life insurances.

The life segment has shown significant growth of 9.7% YoY (or HRK 160m) to 1.8bn, albeit slower than in 1H 2021 when 11.9% YoY growth was evidenced. The Croatian largest insurance company has almost 17% market share in life segment, with the strong GWP growth of 6.4% YoY (to HRK 297m). Among the biggest Croatian insurers, the highest growth in Life, 27.5% was evidenced by Allianz Croatia to HRK 289m of GWPs. The fourth biggest Croatian insurer, Wiener osiguranje grew by 18% HRK 428m, making it the biggest insurance company in Life segment.

The dominant share of collected GWP’s in Croatia lie with the Non-life segment amounting to 76%. This segment grew by 11.7% (or HRK 594m) and total GWPs sold amounted to 5.7bn. Croatia osiguranje has the biggest market share of 29.3%. Triglav osiguranje has noted strong growth in the first 7 months of 2021. The performance in this category grew by 27.3%, which is the highest growth rate in non-life insurance among Croatian top insurers.

In non-life segment, the highest share has insurance against civil liability in respect of the use of motor vehicles (which accounts for 24% of GWPs), also recorded a high absolute increase of HRK 246m or 16%. The second largest segment is vehicle insurance (casco policy) which accounts for 12% of total GWPs. Due to frequent and strong earthquakes in Croatia the two related insurance policies have grown: fire and elemental insurance (+12.8% YoY) and other property insurance (+14.3%).

On the other hand, the highest decrease was in insurance for legal support, which fell by 27.1%, while the highest nominal decrease was in accident insurance by HRK 3.6m.

In 1H of 2021, Intereuropa recorded an increase in sales of 15%, increase in EBITDA of 10% and an increase in net profit of 71%.

In the 1H of 2021, Intereuropa Group recorded EUR 84.7 million in sales revenue, noting an increase of 15% YoY. The intercontinental transport segment achieved strong results overshooting the planned figures by 21%, increasing the most relative to the same period last year. The highest growth in the land transport segment was recorded in domestic transport and customs services. In the land transport segment, EUR 42.9 million was generated, which accounts for 51% of the Group’s sales, and was up by 15% relative to the same period last year and 8% higher than planned. Intercontinental transport and Logistic solutions follow, accounting for 28% and 18% of the company’s revenues, respectively.

When observing the sales structure by country, the company has recorded the vast majority of their revenues in Slovenia (68%) and Croatia (16%). Bosnia and Herzegovina and Serbia follow with 5% and 3%, respectively.

Operating expenses witnessed increased slightly higher than sales by 16%, amounting to EUR 77.7m. The increase could mostly be attributed to a rise in cost of goods materials and services (+18% YoY).

EBITDA amounted to EUR 7.0m, which is an increase of 10% YoY and 18% higher than planned. This result puts the EBITDA margin at 8.3% (-0.3 p.p. YoY). The main reason for higher-than-planned EBITDA was the positive impact of higher sales revenue in the context of successful cost management. Labour costs were up by 2%, primarily due to growth in average labour costs per employee and the increased number of employees. Material costs were also higher due to a rise in energy prices. Meanwhile, operating profit amounted to EUR 3.7m, representing a surge of 41% or EUR 1.1m.

Going further down the P&L, Intereuropa recorded a net financial loss of EUR -0.28m, which represents a decrease in loss of EUR 0.4m. Such an improvement came mostly from revenues from participating interests in Group companies, which were not recorded during the same period in 2020..

In 1H of 2021, the company recorded a net profit of EUR 2.8m, showing a 71% increase.

Turning our attention to indebtedness, Intereuropa reduced their net debt by EUR 3m in 2021, to EUR 41.4m. On 31 January 2020, the Company successfully completed the refinancing of several loans arranged under the financial restructuring agreement concluded in 2012. The Group has taken an EUR 54.8m loan from syndicate of banks led by NLB d.d. The loan was concluded in two tranches, one with a maturity of seven years and the other with a maturity of four years. An annex to the loan agreement entered into force on 27 May 2020 as preparation for the expected deterioration in the Company’s liquidity position due to the outbreak of the coronavirus crisis. A one-year deferral of the payment of principal and interest, from 1 April 2020 to 31 March 2021 was agreed. The Group began repaying principal and interest on 1 April 2021 and has no overdue unpaid liabilities under loan agreements as at the reporting date.

When looking at investment in 1H 2021, the Group invested EUR 1.3m in fixed assets, which makes an increase of 113% YoY. Of that amount, EUR 0.7m was invested in property, while EUR 0.6m was invested in equipment and intangible assets. This puts the company at of 15% of the entire investment plan achieved as the Group plans to invest EUR 8.4m in 2021. The COVID-19 epidemic has had a significant impact, resulting in the postponement and delay of investments.