Europe’s auto industry has been hit hard by the outbreak of the COVID-19 pandemic and its aftermath which led many factories to temporarily shut down production. Now after the lockdown period is behind us, car and car part manufacturers in Europe are faced with a challenging new environment, weighted by a low demand side which was not that great to begin with.

Let’s start off by viewing the number of newly registered vehicles in Europe and Russia. The European automotive industry – with the exception of the recession in the early 1990s and the financial crisis in 2009 – has continuously been growing since 1980. However, it only (fully) recovered from the financial crisis in 2017. In 2019 Europe recorded a 0.9% YoY increase in the number of newly registered vehicles as the pressure of new regulations and the slowdown of the global economy took its toll. Namely, European car manufacturers were battling a slowing European economy, where the biggest market (Germany) was at risk of sliding into a recession and U.K. buyers still await the outcome of ongoing Brexit talks. Furthermore, alongside the economic fallout from trade tensions between the U.S. and China, carmakers were feeling the pinch from the shift to electric cars. Then, as if all of the abovementioned wasn’t enough, 2020 decided to throw a curveball to the industry by adding a global pandemic into the mix.

Number of New Passenger Cars (Units, T12M)

As seen on the chart, Europe recorded just one month of YoY growth in newly registered vehicles (passenger cars and LCVs) in 2020. Such a declining performance is, of course due to the COVID-19 pandemic. However, it still paints a worrying picture that the pent-up demand did not play a larger role after the lockdown had ended.

New passenger cars in EU (monthly basis) %

New passenger cars in Russia (monthly basis) %

On the other hand, when looking at the historical changes in the number of new passenger cars on the Russian market in the period from 2009 until today, one can notice that that the EU and Russia usually show inverse trends. After the slowing of sales in 2013-16 against a backdrop of general macroeconomic decline, the market began recovery in 2017. In 2018 the sales picked up by as much as 20% YoY in the first five months of 2018 to slow down later due to a worsening macroeconomic situation, with monthly growth declining to a range between 5.6%-11.0%. Average annual growth totalled 12.8% in 2018, only slightly up from 11.9% in the previous year. However, note that the strong growth was affected by several outside factors such as government incentives that remained in place under some programs and measures to increase car lending, coupled with an anticipated rise in the VAT rate and car prices in 2019, as well as fears of new economic restrictions. And just as expected, 2019 brought an economic growth slowdown, lower oil prices, the devaluation of the Russian ruble and a higher VAT which rose to 20%, all of which contributing negatively to the demand side. As a result, in 2019 the number of newly registered cars shrank by 2.3% YoY. When observing the T12M number of new passenger cars, it appears that Russia’s new vehicle market has recovered faster than the EU market. However, the prospect of further declines can never be ruled out in a market that has so frequently been impacted by geopolitics. One should also note that rising sales of cars in Russia can also indicate a fear of future ruble depreciation, thus pulling forward demand due to concerns about future price increases.

What can we expect in 2021?

A market recovery is expected; however, it remains to bee seen if it will be as strong as some surveys suggest (double-digit growth in 2021 due to the depth of 2020’s decline). Meanwhile the recovery is expected to be fuelled by low interest rates and attractive financing deals. Furthermore, Government-led infrastructure spending will also buoy sales of new commercial vehicles, which will outpace those of cars.

Regarding key trend which we can expect to see in 2021, the most obvious one is restructuring. As entire value chains have been seriously affected by the outbreak of COVID-19, automakers will have to accelerate their consolidation and restructuring plans in 2021 in order to repair their severely damaged finances. Notable mentions which can serve as an example are Honda, who will close their Swindon plant in the UK, formerly the company’s only EU car factory and Nissan who will close a large facility in Barcelona, which primarily makes electric vans and pick-ups. As a result, one can expect a negative effect on suppliers of these plants. Other key trend to watch would be the expected rise of electric vehicles boosted by the generous incentives and subsidies on offer in the EU in 2021 as governments try to fuel a green recovery.

For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation.

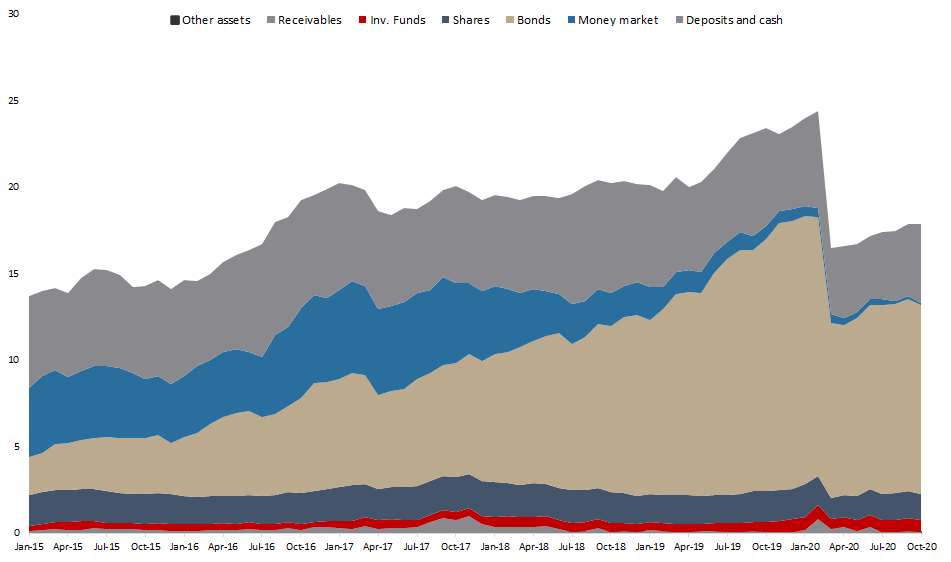

As visible from the graph below, NAV of all funds has witnessed a steady increase for each consecutive month since April, and as of end October stood at HRK 17.27bn (flat MoM). This still represents a decrease of 23.5% YTD (or HRK 5.8bn).

As a reminder, in March, UCITS funds observed a sharp decrease in their NAV of 32.2% or HRK 7.42bn. We note that most of the mentioned decrease could be attributed to the withdrawals from the funds, while a smaller portion reflects the change in value of assets in which the funds invest in. As turmoil on financial market subsided withdrawals from funds were halted.

The biggest decrease of a YTD basis was observed in bond holdings, which decreased by 29.6% or HRK 4.6bn. Meanwhile shares observed a decrease of 14.4% or HRK 256.2m.

On a MoM basis, deposits and cash observed the highest increase of HRK 402.2m or 9.7%, while all other virtually all other asset classes have observed a decrease. Bonds have observed the highest decrease of HRK 196.3m or 1.8%, while shares have recorded a decrease of 3.3% or HRK 52m (for the first time since March). Of that, domestic equity holdings are down by 1.5%. To put things into a perspective, CROBEX was down by 2.11% in October.

Asset Structure of UCITS funds (October 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not significantly changed their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to as low as 59% (April), while as of October 2020 bonds take up for 61% of the total assets. Such a decrease could mainly be attributed to the above-mentioned withdrawals from funds which (predominantly) invest in the mentioned asset class. Of the aforementioned bond holdings, domestic government bonds account for 41.1% of the total assets under management (or HRK 7.34bn) which is the single largest item of UCITS funds.

Shares have observed a gradual increase in total assets since February, and currently account for 8.6% of the total assets (or HRK 1.523bn). Note that domestic shares account for 29% (or HRK 443m) of the total equity held by Croatian UCITS funds. Domestic equity holdings are down by 26% YTD, representing a decrease of HRK 155.7m.

Total Assets of All Croatian UCITS Funds (2015 – October 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Here you can find key takes from the convocation to Petrol’s AGM which will be held on 28 December.

Petrol published the convocation to the AGM which will be held on 28 December 2020. In the convocation the Management board proposes that a claim/claims will be filed for damages to Petrol, against the President and members of the Management Board who performed these functions at the time when the individual transaction was concluded or implemented after obtaining the opinion of experts of relevant professions on the amount of damage, where it will be determined that Petrol incurred damages.

Before filing the claims, the Counsel shall be obliged to obtain the opinions of experts in the relevant fields on the amount of damages in individual transactions in which a decision has been made to file a claim for damages in the event of established damage. In transactions where, based on the opinion of experts from the relevant professions, it will prove that Petrol has incurred damages, the Counsel shall be obliged to file a claim/claims for compensation of damages within 6 months from the day of the adoption of this decision. Some of these transactions concern mBills, (purchase of a shareholding and recapitalisation), Zagorski metalac (purchase of a shareholding), Petrol (Beograd) (recapitalisation and purchases of filling stations), etc.

Besides the above mentioned, the Management Board of the Company would also require consent of the Supervisory Board for the following transactions after approval of inclusion of this change into Articles of Association of Petrol. The transactions for which approval will be needed are following:

Transactions on the basis of which the Company acquires or disposes of its own shares;

Transactions in the amount of over EUR 1m, on the basis of which the company acquires or disposes of shareholdings or shares of companies, whereby, in order to avoid doubt, transactions related to the acquisition of shareholdings or shares also include transactions related to the Company’s participation in the recapitalisation process of another company;

Transactions on the basis of which the Company establishes or terminates any company and/or business unit;

Transactions on the basis of which the Company borrows or approves a loan over EUR 2m, except for such transactions concluded between the Company and its subsidiaries and borrowing operations of the Company in amounts as included in the Company’s borrowing plan, which is approved by the Supervisory Board of the Company. For the avoidance of doubt, a series of several consecutive loans taken out by the Company from the same lender or granted by the Company to the same borrower shall be considered as a single loan, whereby affiliated companies in the sense of the provision of Article 527 of ZGD-1 shall also be considered the same lender;

Individual transactions of purchases or sales of long-term intangible, tangible fixed assets and investment property of the Company, for the amount exceeding EUR 5m. The avoidance of doubt, a set of several interconnected transactions shall also be considered as a single transaction, in particular insofar as they represent a single investment.