7SLO ETF increased by as much as 24.7% YTD.

For today we decided to look at the YTD share price performance of Croatian blue chips listed on ZSE. We note that only liquid shares with a market cap of more than EUR 100m and ETFs were included in the overview. Out of 15 observed securities, 8 have observed a YTD double digit increase.

As visible from the graph, the best performing security on ZSE is 7SLO, a total return ETF which tracks the performance of the SBITOPtr index. The ETF showed a stellar performance in 2021, increasing by as much 24.7% YTD. Meanwhile, we note that the ETF increased by 33.7% since its listing back in November 2021. The ETF also showed a very solid turnover of more than HRK 13m in 2021. The other ETF listed on ZSE, 7CRO, which tracks the performance of CROBEX10tr index also noted quite a strong performance, increasing by 10.6% YTD.

Podravka comes second with a a 22.5% increase, as food companies have showed resilience to the pandemic. This can be further supported by the performace of other food companies on the ZSE, Atlantic Grupa which noted a very solid increase of 11.9% and Kraš which increased by 10.3%.

On the flip side, Arena Hospitality Group noted a decrease of 4.7% as tourist companies were significantly affected by the ongoing pandemic situation. We have recently published a brief overview of a YTD performance of sectors in the region, which can be found here.

YTD Performance of Selected Securities on ZSE

For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

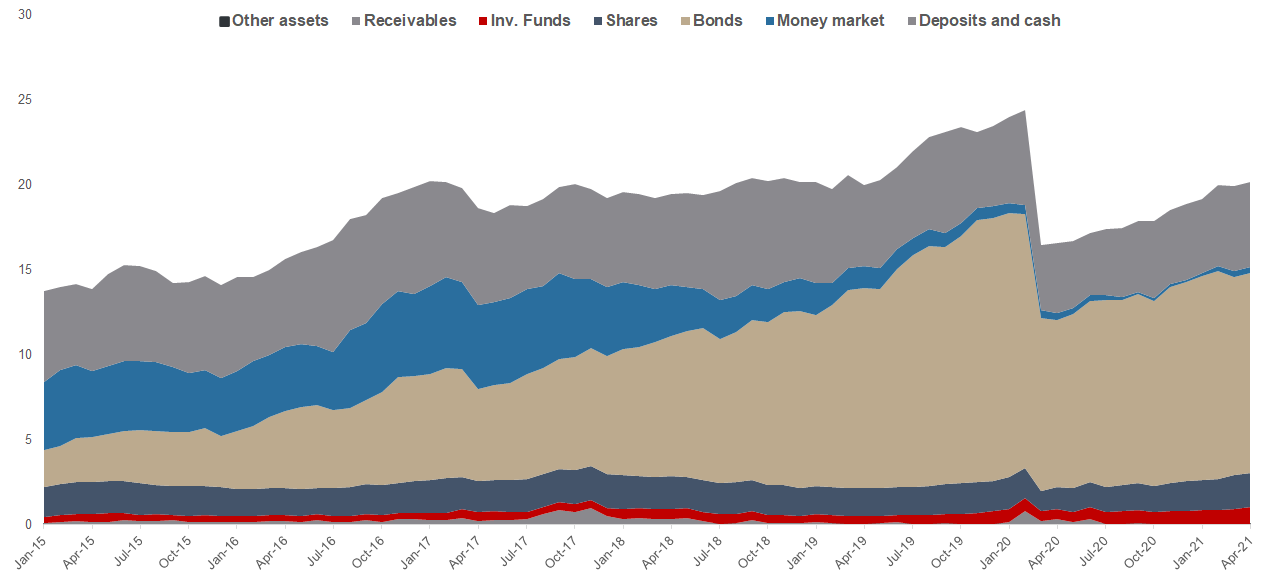

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing in 2021. As visible from the graph below, NAV of all funds has witnessed a steady increase for 13th consecutive month, and as of end April stood at HRK 19.67bn (+1.9% MoM). This represents an increase of 8% YTD, but still a decrease of 14.7% compared to the pre-pandemic highs (Feb 2020).

The biggest absolute increase on a YTD basis of AUM was observed in deposits and cash by HRK 557.5m (+13%). Shares follow with an increase by as much as HRK 299m (+17%). On a MoM basis, bonds and shares have observed the highest absolute increases by HRK 76.4m (+0.7%) and HRK 75m (+3.8%), respectively.

Looking at the asset composition of Croatian UCITS funds, shares have noted a slight increase in total AUM by 0.9 p.p. YTD and currently account for 10.1% of the total AUM. This is still below the 10y average of 12%.

We also note that domestic shares account for 27.9% of total equity holdings. Domestic equity has so far in 2021 seen a 12.6% YTD increase, while foreign equities have observed a 19% YTD increase.

Bond holdings continue to be the largest asset class of Croatian UCITS funds accounting for 58.2% of the total AUM. This does represent a decrease by as much as 4.1 p.p. YTD. We note that the shift in structure comes from the increase of other asset classes like shares, investments funds, deposits and cash. Bonds remained relatively flat YTD with its assets amounting to HRK 11.7bn (EUR 1.6bn).

Total Assets of All Croatian UCITS Funds (2015 – April 2021) (HRK bn)

At the share price a day before the proposal, dividend yield is 5.3%, while ex-date is 8 June 2021.

The shareholders of Triglav approved the initial proposal of the Management Board regarding the 2021 dividend payment. To be specific, the approved dividend is EUR 1.70 per share. The total amount of dividends of EUR 38.65m represents a payout ratio of 53%. We note that the company has been a consistent dividend payer prior to the pandemic, paying out EUR 2.5 per share for 5 consecutive years (as visible on the graph below).

At the share price a day before the proposal, dividend yield is 5.3%. However, at the current share price, dividend yield is 4.9%. Note that the ex-date is 8 June 2021.

Dividend per Share (EUR) and Dividend Yield (%) (2014 – 2021)

At the share price a day before the proposal, dividend yield is 3.6%. Ex-date is 8 June 2021.

At the yesterday’s GSM, the shareholders adopted the initial proposal of the Management and Supervisory boards to use EUR 13,173,041.60 of the profits for dividends. This translates into a dividend of EUR 0.85 per share.

Such a dividend proposal represents a payout ratio of 23.4%. We note that such a payout ratio is below the strategic plan for 2020 – 2022 (payout ratio between 35% and 45%). However, the company noted that based on the Agency’s strictest criterion, the dividend must not exceed the average dividend paid in the period 2017–2019, which is EUR 0.85 per share.

We note that the ex-date is 8 June 2021.The Group notes that the amount of the dividend is in line with the recommendations of the Insurance Supervision Agency and does not put at risk the financial position, i.e. the solvency and liquidity, of the Company or Group.

At the share price a day before the proposal, dividend yield is 3.6%. However, at the current share price, dividend yield is 3.2%.

Dividend per Share (EUR) and Dividend Yield (%) (2014 – 2021)