Such a pricing implies an equity value of EUR 144.9m for a 100% stake.

Sunce Hoteli published recently a statement that Eagle Hills has signed a SPA with Lucidus and Sunce Ulaganja for the purchase of 4,151,092 of shares, which represents 69.71% of the share capital. Eagle Hills, the new owner of the shares has announced that it is obliged to publish a takeover bid for the remaining shares after passing the respective threshold of 25% according to the Croatian Takeover Act. The Croatian SPV is acting in concert with Eagle Hills, Abu Dhabi, Jaona Investments, Dubai and Mr. Mohamed Ali Rashed Alabbar, Dubai, United Arab Emirates. Mr. Alabbar is managing Eagle Hills Group that is developing real-estate projects of mixed use in total value above EUR 50bn.

Following the announcement, Sunce Hoteli yesterday published another announcement on the Zagreb Stock Exchange where pricing of the transaction is revealed. It stated that LUCIDUS, which holds 1,146,420 shares of Sunce Hoteli representing 19.25% of the share capital, is selling them for price of EUR 27.89m. Such a pricing implies an equity value of EUR 144.9m for a 100% stake, or HRK 183 per share (a premium of 4% compared to the current market price). We note that the price puts the transaction multiple at EV/EBITDA of 15.9x. However, the aforementioned multiple does not accurately represents the acquisition given that the company does not consolidate their JV (Jadran Hotel Tučepi) and land for a development project on Brač island.

As a reminder, back in September of 2017, the company concluded a cap hike at HRK 155 per share.

In the table below you can find takeover multiples of some Croatian tourists in the recent history.

Croatian Tourists – Takeover Multiples

Source: InterCapital Research

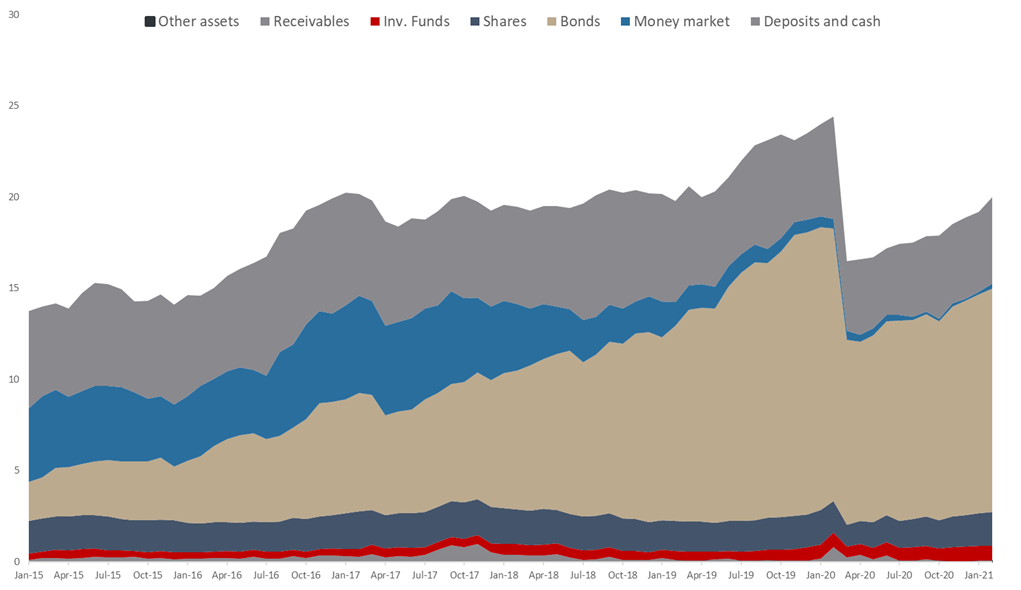

For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing since the outbreak of the pandemic. As visible from the graph below, NAV of all funds has witnessed a steady increase for 11th consecutive month, and as of end February stood at HRK 18.9bn (+2% MoM). This still represents a decrease of 18 YoY (or HRK 4.15bn).

As a reminder, in March, UCITS funds observed a sharp decrease in their NAV of 32.2% or HRK 7.42bn. We note that most of the mentioned decrease could be attributed to the withdrawals from the funds, while a smaller portion reflects the change in value of assets in which the funds invest in. As turmoil on financial market subsided withdrawals from funds were halted.

The biggest decrease of a YoY basis was observed in bond holdings, which decreased by 18% or HRK 2.7bn. Meanwhile shares observed an increase of 8% or HRK 135.7m.

On a MoM basis, bonds have observed the solid increase in nominal terms of HRK 236.5m or 2%. Looking at domestic equity holdings, they are up by 2.7% MoM, while foreign equity holdings increased by as much as 4.9% (or HRK 61m).

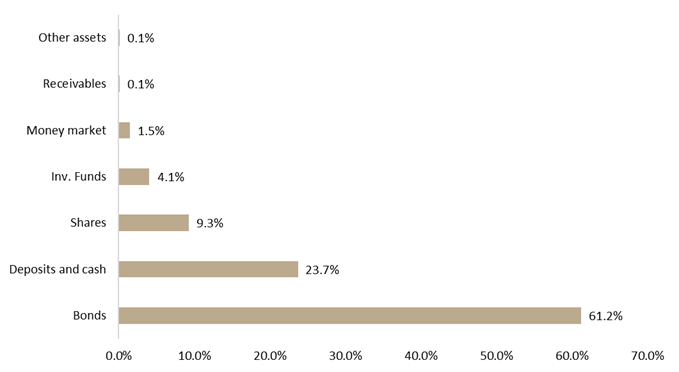

Asset Structure of UCITS funds (February 2021)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not significantly changed their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in February 2020 to as low as 59% (April), while as of February 2021 bonds take up for 61.2% of the total assets. Such a decrease could mainly be attributed to the above-mentioned withdrawals from funds which (predominantly) invest in the mentioned asset class.

Shares have observed a gradual increase in total assets since February, and currently account for 9.3% of the total assets (or HRK 1.86bn). Note that domestic shares account for 29.1% (or HRK 541.6m) of the total equity held by Croatian UCITS funds.

Total Assets of All Croatian UCITS Funds (2015 – February 2021) (HRK bn)