Domestic equity holdings of Croatian UCITS funds are down by 15.4% in 2020, representing a decrease of HRK 92.19m.

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing in 2020. As visible from the graph below, NAV of all funds has witnessed a steady increase for each consecutive month since April, and as of end 2020 stood at HRK 18.22bn (+2.6% MoM). This still represents a decrease of 19.3% YoY (or HRK 4.36bn).

As a reminder, in March, UCITS funds observed a sharp decrease in their NAV of 32.2% or HRK 7.42bn. We note that most of the mentioned decrease could be attributed to the withdrawals from the funds, while a smaller portion reflects the change in value of assets in which the funds invest in. As turmoil on financial market subsided withdrawals from funds were halted. According to HANFA, as of end 2020, natural persons held HRK 11.04bn of the total NAV, representing a decrease of HRK 3.56bn (or 24.4%). Meanwhile, legal entities accounted for HRK 6.23bn, representing a decrease of HRK 1.75bn (or 22%).

The biggest decrease on a YoY basis was observed in bond holdings, which decreased by 24.2% or HRK 3.75bn. Meanwhile shares observed a slight decrease of 2.3% or HRK 41.46m. November (and December) were particularly positive months for equities as they were given additional tailwind by the positive vaccine development. As a result, total equity holdings increased by HRK 214.76m. We also note that HANFA added that equity funds mostly recorded a negative return in 2020, with an average return of -2.32%. Meanwhile, the returns of equity funds ranged from -18.13% to +20.88%.

Asset Structure of UCITS funds (December 2020)

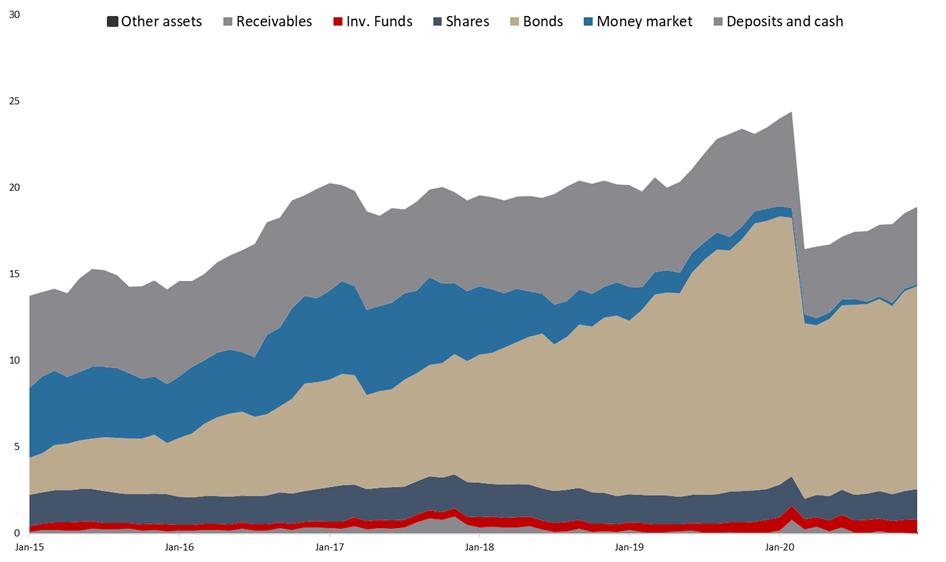

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not significantly changed their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to as low as 59% (April), while as of end 2020 bonds take up for 62.2% of the total assets. Such a decrease could mainly be attributed to the above-mentioned withdrawals from funds which (predominantly) invest in the mentioned asset class. Of the aforementioned bond holdings, domestic government bonds account for 40.2% of the total assets under management (or HRK 7.59bn) which is the single largest item of UCITS funds.

Shares have observed a gradual increase in total assets since February, and currently account for 9.2% of the total assets (or HRK 1.74bn). Note that domestic shares account for 29.1% (or HRK 506.9m) of the total equity held by Croatian UCITS funds. Domestic equity holdings are down by 15.4% YoY, representing a decrease of HRK 92.19m.

Total Assets of All Croatian UCITS Funds (2015 – 2020) (HRK bn)

By looking at the latest announcement from the Tax Administration of the Republic of Croatia, being tracked for Covid-19 pandemic purposes, in the period from 24 Feb till 24 Jan 2021 the value of taxable invoices decreased by 15.96% YoY.

A higher frequency data is compiled by Croatian Tax Administration, a department of the Ministry of Finance, who stated that the value of taxable invoices dropped by 15.96% YoY (or HRK 29.5bn) in the period from 24 February till 24 January. Meanwhile total taxable invoices in the mentioned period amounted to HRK 155.2bn.

Drop in taxable invoices in wholesale and retail trade in the same period was at 7.75% (or HRK 9.39bn) while drop in accommodation and food services reached 48.3% (or HRK 12.87bn).

The value of taxable invoices in the 3rd week of January 2021, observed a single digit decrease for the second consecutive time this month. To be specific in the 3rd week of November taxable invoices decreased by 5.62% YoY to HRK 167.3bn. Drop in taxable invoices in the wholesale and retail trade was relatively low at -2.18% YoY, while drop in accommodation and food services was at -71.53% YoY. This does not surprise us given the imposed restrictions in Croatia and throughout Europe with efforts to tackle the spread of the virus. There has not been an official announcement regarding the relaxation of the measures, however according to media, we might expect slightly looser restrictions starting February.

If we were to compare it on a WoW basis, the value of invoices has slightly decreased by 3.82% or HRK 111.77m.